Welcome to another installment of our CEF Market Weekly Review, where we discuss closed-end fund (“CEF”) market activity from both the bottom-up – highlighting individual fund news and events – as well as the top-down – providing an overview of the broader market. We also try to provide some historical context as well as the relevant themes that look to be driving markets or that investors ought to be mindful of.

This update covers the period through the first week of September. Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the preferreds/baby bond markets for perspectives across the broader income space.

Market Action

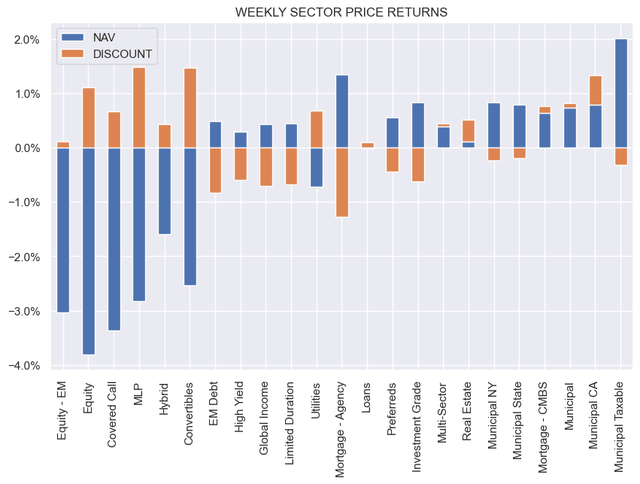

CEF sectors were mixed on the week, with equity-linked sectors seeing drops in the NAV due to the broader weakness in equities. Fixed-income CEF sectors mostly held up, particularly Muni funds.

Systematic Income

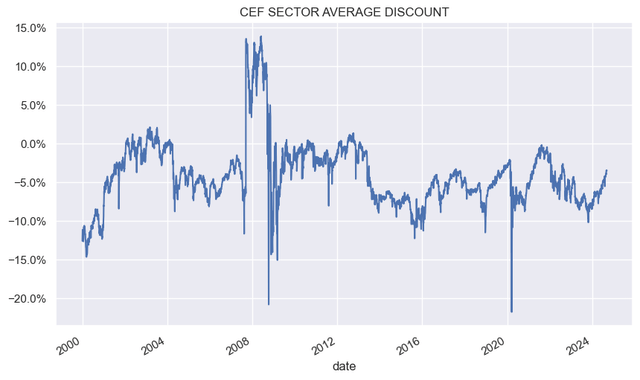

The average CEF sector discount remains on the expensive side of fair-value, particularly in the context of the past decade.

Systematic Income

Market Themes

Tortoise plans to merge two of its MLP funds – NTG into TYG. To sweeten the offer for shareholders, the board of TYG approved a 40% increase in distributions, which will be paid monthly rather than quarterly. That NTG is getting merged into TYG rather than vice versa is not a surprise. Despite the rally in MLPs over the last couple of years, the 5Y total NAV return of NTG is -10% per annum – the worst of the remaining Tortoise CEFs – which is quite something. It makes sense to try to get this out of the market consciousness. We have seen the same theme in BDCs, where poorly performing BDCs such as FCRD and BKCC were merged into other BDCs. This is also something to keep in mind when analyzing historic returns of the BDC sector, as they can be significantly affected by survivorship bias.

Separately, the company will be conducting a strategic review of its TEAF CEF. Tortoise said that it’s disappointed with the fund’s performance and its wide discount. The performance angle applies to both price and NAV. Since inception in 2019, total price CAGR is -1% annualized and total NAV CAGR is +1.2%.

The fund is somewhat unusual in combining both private and public assets in the portfolio, and this strategy will be reviewed. Private assets are not, in themselves, the cause of the wide discount – loan CEFs AIF and AFT held a third of their portfolio in private assets and traded at premiums prior to their merger into MFIC.

The way to get the discount to move would be to 1) improve performance, 2) halve the extremely high management fee of 1.35%, 3) say that the fund will 100% terminate on its 2031 term date. Alternatively, the fund can ditch its private assets and transition to an open-end fund. Recall that this is what is happening to three other Tortoise CEFs: TPZ, TTP, NDP.

Market Commentary

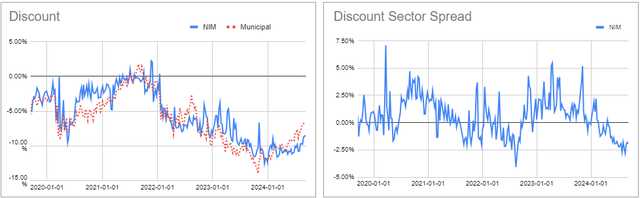

The start of the month brought CEF distribution news. Nuveen continues to boost distributions on their unleveraged Muni funds e.g., NUV, NUW, NMI, NXN, NNY. Interestingly, NIM did not get a boost this time around. It remains fairly attractive due to the wide discount and, like other unleveraged CEFs, very efficient net income generation.

Systematic Income CEF Tool

There are no leverage costs to eat into the returns and the discount, in effect, offsets the management fee, allowing investors to hold an actively managed portfolio for free.

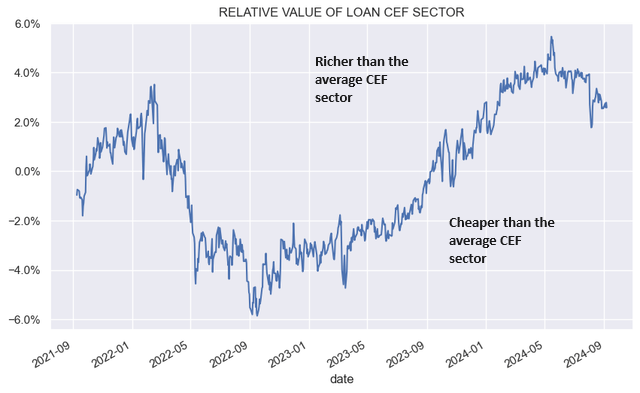

Elsewhere, Invesco bumped the distribution of its bond fund VBF by 3%. BlackRock made tiny adjustments to their equity funds e.g., BMEZ, BSTZ, BIGZ, BCAT, ECAT. Eaton Vance cut the distributions for two loan CEFs EFR and EFT and EVF. These are the second cuts in a row, and it certainly looks like the loan CEF hikes investors enjoyed previously are getting unwound. This is going to impact directly on their relative valuations, as shown in the recent article. The loan CEF sector remains more expensive than the average CEF sector; however, it has been getting cheaper over the last couple of months. We expect this trend to continue. We have exited loan CEFs prior to the recent relative valuation downtrend.

Systematic Income

Read the full article here