Ameriprise Financial (NYSE:AMP) has an interesting profile in the financial services sector, focusing its growth strategy in the advisory & wealth management segment. This has supported its recent growth, but this seems to be already reflected in its valuation.

Ameriprise Business Profile

Ameriprise Financial is a financial services company offering several products within the industry, including mutual funds, savings, and annuities, insurance, beyond others. It operates under a multi-brand approach, which includes Ameriprise Financial, Columbia Threadneedle Investments and RiverSource.

The company has a long history, but has been a standalone entity only since 2005, when it was spun-off from American Express (AXP). Its current market value is about $44 billion, and its shares trade on the New York Stock Exchange.

Its core business is wealth management and investment advisory, operating mainly as a financial planning and services company. The product suite is designed to meet its customers’ needs across the investment life-cycle, including cash and liquidity solutions, asset accumulation, income, protection, and wealth management. It also owns a bank, providing traditional banking services to its wealth management customers.

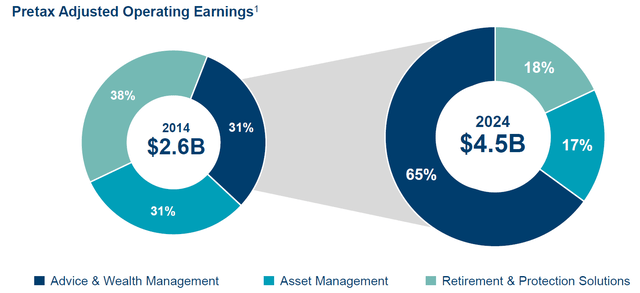

At the end of last March, it had about $1.4 trillion of assets under management (‘AUM’) and administration, being by this measure one of the largest companies in the financial services industry in the U.S. About 86% of Ameriprise’s revenues are generated from wealth management, while asset management is responsible for the rest. Its business is spread across three major units, namely Advice & Wealth Management, which is the largest one and accounts for about half of the company’s revenues, followed by Retirement & Protection Solutions, and Asset Management.

Over the past few years, the company’s growth strategy has been focused mainly in the wealth management business, explaining why this segment has increased significantly its weight within the group.

Business mix (Ameriprise)

Given that wealth management has a more recurring profile than other activities, this bodes well for a less cyclical business and better predictability of its earnings and profitability level over the long term. This segment is mainly fee-based, accounting for some 80% of revenues generated in this segment, which is a positive profile for the sustainability of its business model in the long haul.

In this segment, it has more than $960 billion in client assets under management or administration, and has an advisor network of more than 10,000 financial advisors, which build long-term customer relationships with individuals with $100,000 or more of investible assets.

Compared to other companies in the financial services industry which I’ve covered in the past, such as T. Rowe Price (TROW) or Invesco (IVZ), I think Ameriprise has a better business profile because it’s less dependent on investment performance and has a more recurring revenue and earnings profile than its peers over the long term.

While the wealth & asset management industry is quite competitive and Ameriprise does not have any specific competitive advantage over its larger or smaller peers, its relatively large exposure to advisory & wealth management gives it an interest profile and good growth prospects ahead.

Additionally, compared to its previous business mix in which Ameriprise was much more exposed to insurance-related activities, its current business mix also requires less capital and has lower earnings volatility, offering therefore a much more attractive investment proposition to shareholders than compared to some years ago.

Going forward, Ameriprise’s growth strategy is not expected to change much, being highly focused on growing its wealth management business on an organic basis, targeting affluent, high net-worth individuals, and institutional investors. Its primary target is individuals with investible assets between $0.5-5 million and a responsible mindset, a segment that has good growth prospects and allows Ameriprise to focus on a specific customer type where it may face less competition from larger players in the wealth management industry.

This means, Ameriprise tries to distinguish itself from other players by providing a more dedicated service for a market segment that other players may neglect, which seems a sensible strategy for the long-term sustainability and growth of its business.

Customers (Ameriprise)

This strategy has been quite successful, considering that Ameriprise’s growth in the wealth management segment is quite strong over the past three years, growing client assets by 26% during this period and reporting positive flows during a tough period for the capital markets, which is a very good outcome considering the fierce competition it faces in the industry.

Ameriprise Financial Overview

Regarding its financial performance, Ameriprise has reported a positive track record, delivering revenue and earnings growth in recent years, showing that its business is less related to capital markets than some of its wealth & asset management peers.

In 2023, Ameriprise’s revenues increased by 8% YoY to $15.5 billion, supported by higher AUM, especially in the wealth management segment, and by a strong increase in net investment income related to higher interest rates. Indeed, in Ameriprise Bank it holds securities for liquidity purposes and in the insurance segment it also has an investment portfolio, thus the rising interest rate environment was positive for its net investment income, which increased to $3.2 billion in 2023 (vs. $1.4 billion in the previous year).

Regarding operating expenses, despite the inflationary environment, Ameriprise shown good cost control with general and administrative expenses increasing by 4% YoY to $3.8 billion, but there were other expenses hurting its operating profit. The company reported an expense of $608 million related to the market impact on non-traditional long-duration products plus higher costs of claims and settlements, which penalized its reported operating results and led to a drop of 18% YoY to $3.2 billion.

However, adjusted for market movements and other one-off effect, the company’s adjusted operating income increased by 8% YoY to $3.1 billion, which is a better indication of its underlying earnings power in the future. By segment, advisory & wealth management was the major driver of earnings growth given that its adjusted operating earnings in this segment increased to more than $2.8 billion in 2023 (vs. $2.1 billion in 2022), while other business segments reported lower adjusted operating earnings, impacted by lower revenues (asset management) and higher claims costs (insurance) during the last year.

During the first quarter of 2024, Ameriprise maintained a positive operating momentum, reporting revenues of $4.15 billion, up by 11% YoY supported by higher management fees and net investment income, and an annual decline of 10% in total expenses. This combination of higher revenues and lower costs led to a net income of $990 million in the quarter, almost the double from Q1 2023, and its return on equity (excluding Accumulated Other Comprehensive Income – AOCI) was 48.1%, an improvement of 290 basis points compared to Q1 2023.

By segment, advisory & wealth management remained its major growth engine, reporting an adjusted operating profit of more than $2.5 billion in the last quarter (up by 13% YoY), while other segments also reported some growth but at much more modest rates.

Regarding its balance sheet, Ameriprise had a very comfortable position at the end of last quarter, given that its excess capital was about $1.5 billion and had more than $1.9 billion in liquidity at the holding level. Considering that its business is nowadays more exposed to recurring advisory and wealth management operations, this means it doesn’t need to retain much of its earnings and can therefore distribute a large part of its organic cash flow to shareholders.

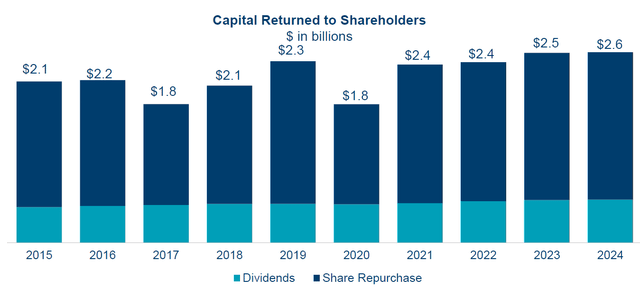

Indeed, its capital return strategy has been to perform share buybacks and deliver a growing dividend to shareholders, returning about $22 billion of capital over the past decade.

Capital returns (Ameriprise)

As shown in the previous graph, the majority of capital returns has been made through stock buybacks, while its dividend represents a much smaller part of cash outflows.

Its current quarterly dividend is $1.48 per share, or $5.92 annually, which at its current share price leads to a forward dividend yield of about 1.4%. This is a relatively low yield compared to other alternatives in the financial services sector, thus Ameriprise’s income appeal is not great. Nevertheless, its dividend payout ratio is only around 18%, which is quite low, thus its dividend is clearly sustainable and should continue on a growing path in the coming years.

In addition to dividends, over the past twelve months, the company has also repurchased about $2 billion of its own shares, which means its total payout was about 80% of its earnings, a capital return strategy that is likely to be maintained in the next few years.

Valuation & Risks

Regarding its valuation, Ameriprise is currently trading at more than 12x forward earnings, at a premium to its historical valuation over the past five years (10.2x), which may be a sign of overvaluation.

Compared to its closest peers, Ameriprise is also trading at a slight premium, considering that a relatively large peer group of asset & wealth management companies trade at around 11.7x earnings. Looking into peers with a stronger concentration of their operations in the wealth management segment, such as Julius Baer (OTCPK:JBAXY) or Stifel Financial Corp (SF), its shares also look slightly overvalued, given that Julius Baer is trading at only 10x earnings and Stifel at 11x.

Considering that Ameriprise’s growth prospects and profitability aren’t much different from its peers, this means its shares aren’t particularly cheap right now.

Regarding risks, one important factor is competition in the industry and potential further concentration through mergers & acquisitions, which may create larger players that may eventually compete on pricing and lead to some margin pressure ahead across the industry.

Another potential risk is declining interest rates in the coming quarters, which may negatively impact its revenue growth. Ameriprise’s net investment income has increased significantly in recent quarters, but this may change if the Federal Reserve decides to start cutting rates in the near future, representing a potential headwind for revenue and earnings growth in the next few quarters.

Conclusion

Ameriprise’s strategy to gradually shift its business towards advisory & wealth management has been successful and gives it relatively good long-term growth prospects. However, competition in this segment is strong and Ameriprise doesn’t seem to have any specific competitive advantage in the industry, and thus growth may slow down in the coming years. Its valuation isn’t also particularly cheap right now, thus Ameriprise doesn’t seem to offer much value for long-term investors right now.

Read the full article here