Topline

Video streaming service Roku announced Wednesday it will slash its workforce by 10% and undergo several other cost-cutting measures, sending the embattled pandemic darling stock soaring to near its highest level in over a year.

Key Facts

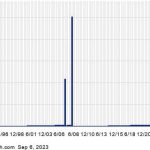

Roku shares rallied 10% in early trading to above $92, just shy of its 52-week high briefly achieved early last month.

The company also said Wednesday it will close certain office space and remove a significant amount of produced content from its streaming platform.

Roku said it will incur a $45 to $65 million loss related to the layoffs, a $160 million to $200 million loss for the office consolidation and a $55 million to $65 million loss for the streaming cutback.

The company also announced stronger guidance for the current financial period, sharing it expects to lose between $20 million and $40 million this quarter, a narrower loss than the $50 million previously projected by the company.

The significant cost-cutting moves are a result of “new CFO Dan Jedda taking steps to help improve prospects for Roku hitting its [earnings] target,” Rosenblatt analyst Barton Crockett explained in a note to clients.

Key Background

Roku, which had about 3,600 employees at the end of 2022, announced separate rounds of 200 layoffs apiece in November and March. Its stock is up more than 100% year-to-date, far outperforming the tech-heavy Nasdaq’s 35% gain. But Roku shares are still down more than 80% from its 2021 peak as the company failed to translate investor optimism into profits. The company lost $662 million over the most recent 12-month period.

Chief Critic

Though many believe Roku’s efforts will help improve the company’s bottom line, Roku will “need to invest [more] to remain competitive in this crowded marketplace,” according to MoffeettNathanson analyst Michael Nathanson. The firm has a sell rating for Roku, setting a $55 price target which implies 40% downside.

Tangent

Roku’s largest shareholder is Ark Invest, the asset manager helmed by the polarizing stock-picker Cathy Wood. Ark owns 9.7% of Roku, a stake worth more than $1 billion. Roku stock’s poor performance over the past two years has contributed strongly to the laggard return from Ark’s flagship Innovation ETF.

Read the full article here