I have long argued that a myopic focus on Spotify’s (NYSE:SPOT) royalty payments and relatively low gross profit margins has caused investors to underestimate the company’s ability to create and capture value. As Spotify is maturing, it’s now beginning to pull more of the value levers that it has always had access to.

Spotify’s share price has increased steadily over the past 18 months, with investors finally beginning to buy into the company’s narrative. Much of this appears to be driven by the company’s foray into audiobooks and recent improvements in profitability. Product development and growth are expected to persist in 2024, but Spotify’s focus is now shifting to monetization and efficiency.

The last time I wrote about Spotify, I suggested it was undervalued as its product expansion efforts provided upside with little risk and that its subscription revenue made it relatively immune to macro volatility. This has proven to be the case so far, with the stock up almost 150% since then.

Further improvements in profitability with consistent growth should support Spotify’s share price, but future gains may be more muted. Spotify’s revenue multiple is now above average historical levels, and reasonably aggressive assumptions have to be made about growth and profitability to justify the company’s valuation.

Music Streaming

Spotify’s music streaming business is now fairly mature, and while there’s still significant room to grow users internationally, value creation is largely dependent on Spotify’s ability to attract subscribers and increase pricing.

Spotify began to pull the pricing lever toward the end of 2023, and so far, this doesn’t appear to be impacting subscriber numbers. Spotify also plans on increasing subscription prices by 1-2 USD per month in the UK, Australia and Pakistan, with a price increase also expected in the US later in the year. Spotify also is likely to introduce more subscription tiers as the platform’s functionality increases.

Price increases are supported by Spotify’s efforts to increase its value proposition through new features. For example, Spotify is reportedly working on DJ-like features which would enable subscribers to mix tracks, change playback speed, etc. The company hopes that this will deepen engagement and support a premium subscription tier. A premium plan would also likely offer high-fidelity audio.

Spotify also plans on introducing full length music videos for subscribers. This move is widely considered to bring Spotify into closer competition with YouTube, but I don’t believe this is an important dynamic given how different the core use cases of the two platforms are.

Marketplace products are an important component of Spotify’s plan to improve music margins. Spotify also controls discovery and hence can charge fees to increase listens. For example, Spotify for Artists drives discovery and in return takes a commission on royalties. Margin gains as a result of these factors are happening under the surface, but this hasn’t really been apparent so far as expansion efforts (international growth, podcasts, audiobooks) are currently low margin / unprofitable.

New Ventures

Spotify already has introduced podcasting, audiobooks and a marketplace. New verticals that are likely to be introduced in coming years include:

- Live music and events

- News

- Education

I question whether there’s any real user benefit in combining multiple audio offerings into the one app. This may not really matter though, as Spotify has enormous distribution that virtually guarantees it some degree of success.

Spotify’s podcasting business was reportedly close to break even in Q4, and engagement continues to grow. Much of the improvement in profitability appears to have been driven by cost cutting initiatives. Spotify has made large changes in its podcast business to get it to this point, including:

- Management changes

- Combined Gimlet and Parcast

- Layoffs

- Closed Spotify Live

- Abandoned its exclusivity strategy

Exclusives vs. non-exclusives is a question of prioritizing subscribers vs. advertising. Broadening distribution supports advertising growth and better aligns Spotify with creators. Spotify has invested heavily in content, but the long-term outcome of this is not clear yet. The company is shifting investment to parts of the podcasting business, which are working, which indicates that returns have not been satisfactory so far. This includes a shift away from original content.

Audiobooks could drive the next leg of Spotify’s growth, and this is likely an important contributor to the stock’s recent run. Books are currently a 140 billion USD market, with audiobooks having a 6%-7% market share globally. In the most penetrated markets, this figure is closer to 50% though, leading Spotify to believe audiobooks could be close to a $70 billion opportunity.

Spotify has stated that it’s happy with the performance of its audiobooks business, with the company’s entry into the market reportedly accelerating overall market growth. Spotify is now the No. 2 provider of audiobooks behind Audible.

Amazon has a dominant position in both e-readers and audiobooks, with Kindle representing more than 80% of all e-reader sales in the US and Audible’s audiobook market share in excess of 60%. While Spotify’s distribution will make it a strong competitor in this market, integrating e-reading and audiobooks is likely a stronger value proposition than an all-purpose audio platform.

Spotify has been offering subscribers up to 15 hours of audiobook listening per month to try and drive adoption. This reduces friction in users sampling books before purchasing them, although is likely weighing on margins at the moment. Apple’s App Store policies are currently restricting the audiobook business, though. Apple would require a 30% cut of any book purchase in the mobile app, which would likely result in a loss for Spotify. As a result, Spotify doesn’t allow audiobooks to be purchased in the mobile app.

This is an issue that extends beyond just audiobooks though, with Spotify wanting to introduce a range of new products to improve monetization. While the Digital Markets Act could open up new opportunities for Spotify, Apple’s actions mean that some of Spotify’s desired initiatives still won’t be profitable. Unless regulators try and force Apple to comply with the spirit of the DMA, the status quo is likely to persist.

Growth

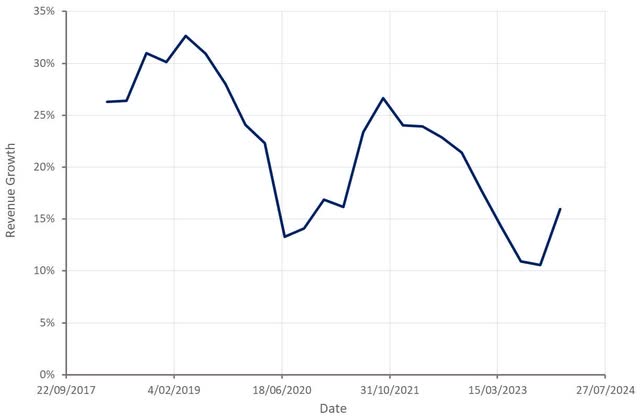

Spotify’s revenue increased 16% YoY in the fourth quarter to 3.7 billion Euro, with growth supported by pricing. Ad revenue growth was relatively weak though, offsetting some of the subscription strength.

Figure 1: Spotify Revenue Growth (source: Created by author using data from Spotify)

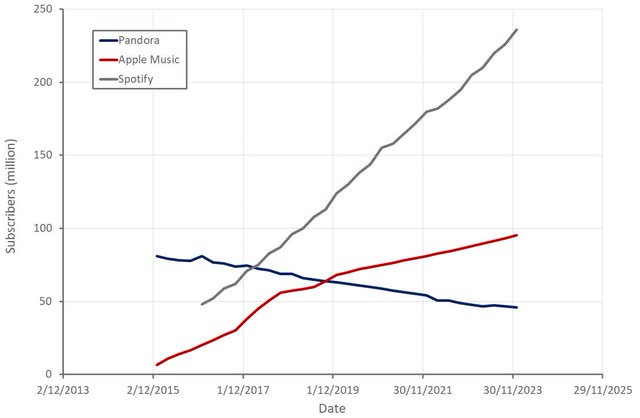

Spotify added 28 million monthly active users and 10 million subscribers in the fourth quarter, and now has a user base of 602 million. Spotify’s subscriber growth remains extremely consistent, which is somewhat surprising given price increases. Audiobooks could be assisting subscriber growth though, offsetting the impact of recent price increases.

Figure 2: Spotify Subscribers (source: Created by author using data from Spotify)

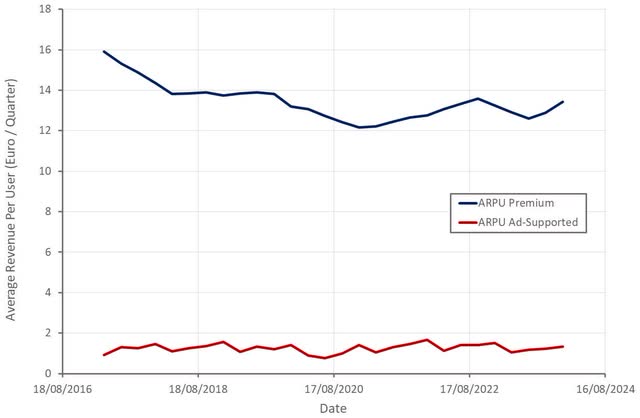

Spotify’s average revenue per user continues to fluctuate in a fairly tight range for both subscribers and ad-supported users. This is somewhat deceptive though, as international expansion is masking improvements in more mature markets. Subscriber ARPU is likely to begin moving up in coming quarters anyway due to price increases.

Figure 3: Spotify Average Revenue per User (source: Created by author using data from Spotify)

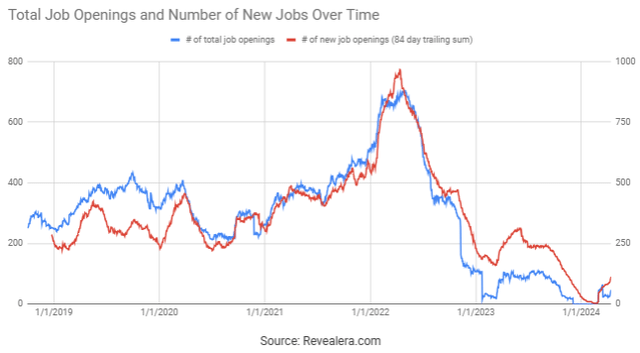

Recent layoffs and a lack of job openings would seem to suggest that growth will be weak going forward. It should be kept in mind that Spotify over hired in 2021 and 2022 and is still trying to correct for this.

Figure 4: Spotify Job Openings (source: Revealera.com)

Future growth levers include:

- Users

- New businesses

- Pricing

While Spotify is reportedly more focused on profits than growth, many of these growth levers will pressure margins in the near-term.

Profitability

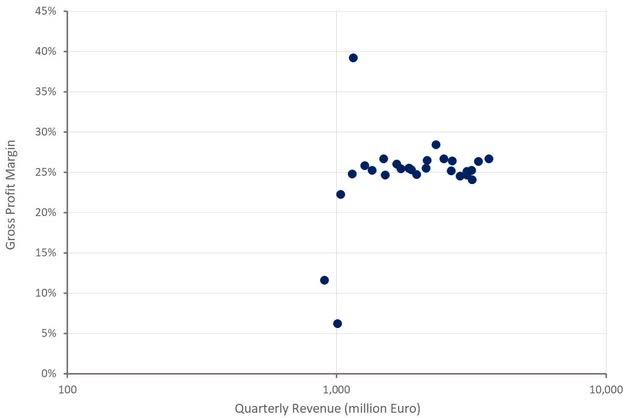

Spotify’s gross profit margin was 26.7% in the fourth quarter, benefiting from reduced podcast losses. The company also is trying to drive greater efficiency in areas like cloud costs and streaming delivery. Given royalty payments, price increases may not have much of an impact on gross profit margins.

Figure 5: Spotify Gross Profit Margin (source: Created by author using data from Spotify)

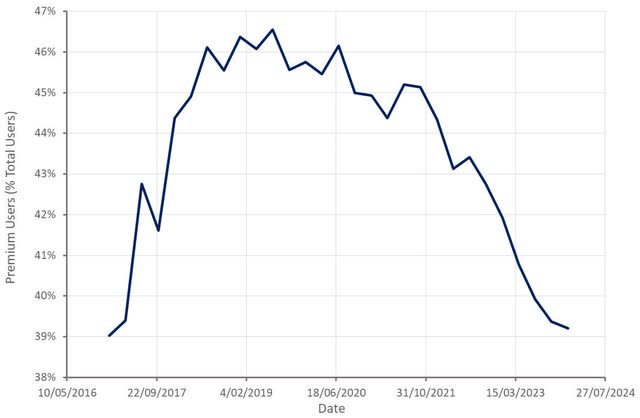

Gross profit margins are another area where progress is being hidden by growth initiatives. Podcasts and audiobooks are a drag on margins at the moment. So is international expansion, where Spotify currently has less subscribers as a percentage of total users. The company expects this to change as these businesses mature, but it will make progress difficult in the near term.

Figure 6: Spotify Premium Users (source: Created by author using data from Spotify)

Operating profitability was aided by reduced marketing spend and lower personnel costs in Q4. Spotify incurred 143 million Euro of charges related to cost cutting measures announced in December. Absent this, Spotify would have recorded another quarter of improved profitability and a second straight quarter of positive GAAP operating profits. Free cash flow was 396 million Euro in Q4, although some of this strength was timing related.

Spotify has a 20% operating profit margin target, which could be overly optimistic. This will ultimately depend on how much success Spotify has in areas like audiobooks. Based on its performance so far, I estimate that operating profit margins are likely to end up somewhere around 15% at maturity.

Conclusion

Spotify is forecasting 618 million users and 239 million subscribers for the end of the first quarter. While this guidance is likely conservative, it would be one of Spotify’s weakest quarterly subscriber adds. Given recent price increases, I think there‘s an elevated risk of churn in the near term. The company also guided to a currency-neutral revenue growth rate of in excess of 20% YoY, consistent with the fourth quarter. Margins are expected to improve throughout the year, with podcasting achieving gross profitability.

I’m not sure that this guidance justifies Spotify’s current valuation. The only time the company has traded above current revenue multiples was immediately after the company went public and during the pandemic bubble. Spotify will need to achieve consistent growth and improvements in profitability to maintain its current valuation, with any missteps potentially being punished by the market.

Figure 7: Spotify EV/S Ratio (source: Seeking Alpha)

Read the full article here