After a difficult multi-year period, Roku, Inc.’s (NASDAQ:ROKU) growth and profitability are beginning to bounce back. It’s difficult to get excited about the company’s immediate prospects though as Roku is currently spending a lot to grow a little. Some of this has been the result of a post-pandemic hangover, but the competitive environment also appears to be tough.

I previously suggested that Roku’s low valuation and improving fundamentals should help the stock move higher in the coming quarters. I also felt that competition concerns and ad market weakness would probably limit gains. The stock is down nearly 30% since then on the back of soft Q4 results.

Roku’s revenue multiple remains near all-time lows despite the company’s platform now dominating revenue and supporting long-term growth and profitability. The stock is likely to re-rate significantly higher when Roku returns to profitability and consistently robust growth, but this could still be several years away.

Market Conditions

Video advertising reportedly rebounded in the fourth quarter, helping to offset weak M&E spend. This strength is expected to persist into the first quarter. CPG, health and wellness, and telecom have been areas of strength, while categories like financial services and insurance are still relatively weak. This appears to be a fairly broad-based improvement, with Magnite, Inc. (MGNI) and PubMatic, Inc. (PUBM) both expecting higher CTV growth going forward.

The number of ad-supported streaming services is increasing, Which Roku believes will accelerate the shift of ad dollars from linear TV to streaming. Roku can capitalize on this by helping streaming services to grow engagement. In the near term, however, this will likely lead to continued pressure on CPMs.

A combination of soft advertiser demand and solid supply growth has pressured pricing in recent years. Supply growth is coming from a combination of new streaming services, more ad-supported tiers, and an increased number of ads per hour. The launch of ads on Prime Video also will likely impact pricing in 2024 as it has 115 million monthly users in the US. Pricing headwinds should begin to abate in 2025 though as inventory growth begins to normalize and ad spend continues to shift to CTV.

Approximately 60% of viewing hours are now on streaming and yet only around 30% of ad spend is on CTV. This is a large gap which will likely eventually close, but advertisers need to change spending habits and ad tech companies need to demonstrate ROAS. This shift continues unabated as well. Traditional TV hours declined 16% YoY in Q4 while streaming hours on the Roku platform were up 21%.

The market has also recently been shaken up by Walmart Inc.’s (WMT) planned 2.3 billion USD acquisition of VIZIO Holding Corp. (VZIO). Vizio is somewhat of a fringe player in the market, with only around 18 million active accounts, but it has strategic value to Walmart. The acquisition should support the company’s advertising business, which is reportedly generating around $3 billion in sales and growing at a double-digit pace. While this development certainly isn’t positive for Roku, as it could impact hardware sales and user acquisition, the company’s position in the market may be strong enough that it isn’t overly impacted. The deal also still needs regulatory approval and will likely receive close scrutiny given Walmart’s size. It’s difficult to see a solid reason why the deal should be blocked from a competition perspective, though.

Roku is the dominant player in the US market, accounting for nearly 40% of CTV ad impressions, with competitors fairly even at much lower market shares. Amazon.com, Inc. (AMZN), Samsung Electronics Co., Ltd. (OTCPK:SSNLF) and Alphabet Inc. (GOOG) (GOOGL) also are important players in the market, and each has strategic interests beyond just the CTV market.

Roku Business Updates

There haven’t been any major updates to Roku’s business in recent quarters, which is probably a positive after a series of strategy changes in recent years. Roku’s focus is shifting from cost-cutting to growth, which is somewhat odd given that the company’s losses remain elevated in large part due to growth investments.

Product innovation could be targeted at improving monetization of Roku’s control over the home screen for 80 million active accounts globally. The volume of streaming content continues to increase, and Roku believes that it can help its users navigate this content. Roku also can help companies build new experiences that are entertaining and engage viewers, helping them to decide which app to run. While there’s potential to add value for both users and publishers, Roku is facing M&E spending headwinds in the near term.

Roku recently expanded its TV lineup by introducing the Roku Pro Series, which is targeted at the high-end of the market. The Pro Series offers advanced features, like a 4K QLED display and enhanced audio technology.

Roku is also expanding the distribution of its Roku-branded TVs, from Best Buy to Costco and Amazon, which could create channel conflicts. Roku-branded TVs are still considered complementary to existing programs, though. Roku TVs are being positioned as a way for Roku to innovate in both hardware and software and share improvements with licensing partners. Given the competition Roku faces from companies like Samsung and the threat of competing operating systems undermining its partnerships, there’s also likely a defensive element to the move.

Despite the launch of Roku-branded TVs and smart home devices, Roku’s device sales remain relatively soft. I view this business as a loss leader designed to help the company acquire platform users, so this only really matters to the extent that it impacts account growth.

Financial Analysis

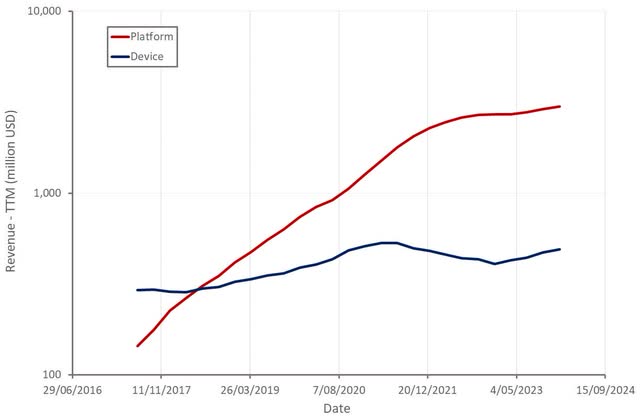

Roku’s revenue was 984 million USD in the fourth quarter, up 14% YoY. Platform revenue increased 13% to 829 million USD, driven by both streaming services distribution and video advertising activities, offset by M&E. Streaming services distribution activities outpaced platform growth, benefiting from increased subscription sign-ups and SVOD price increases. Devices revenue increased 15% YoY in the fourth quarter, driven by Roku branded TVs.

Roku expects 850 million USD in revenue in the first quarter, which would represent roughly a 15% increase YoY. While this is a solid growth rate, Roku’s platform business is still facing M&E headwinds. Political advertising should be a tailwind in 2024, but it is a relatively small contributor to Roku’s business.

Figure 1: Roku Revenue (Source: Created by author using data from Roku)

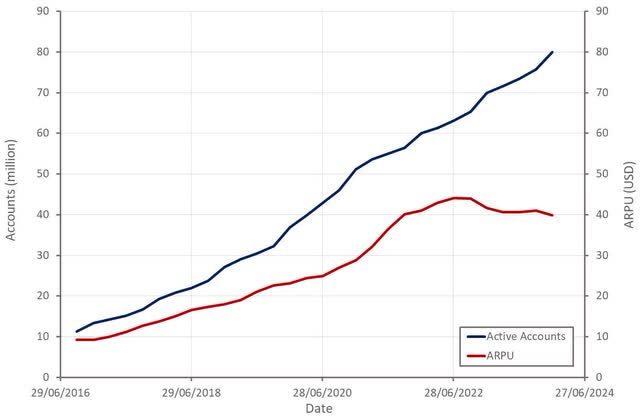

Full-year net active account growth was around 10 million, above 2019 levels and similar to 2022. Roku attributed this to its Roku TV program in the US and international expansion. Account growth came despite overall TV unit sales in the US declining YoY in Q4, which was attributed to higher LCD panel prices to higher prices for consumers.

Engagement also continues to increase with average streaming hours per active account up roughly 8% YoY. Average hours per account per day is still only 4.1 though, significantly trailing the 7.5 hours per day of traditional TV viewing time in the US.

Roku’s average revenue per user is being pressured by rapid international account growth, with ARPU in the US still generally increasing. Counterintuitively, I believe that declining ARPU is a positive, provided that it’s coupled with strong account growth, as this is indicative of solid international expansion.

Figure 2: Roku Active Accounts (Source: Created by author using data from Roku)

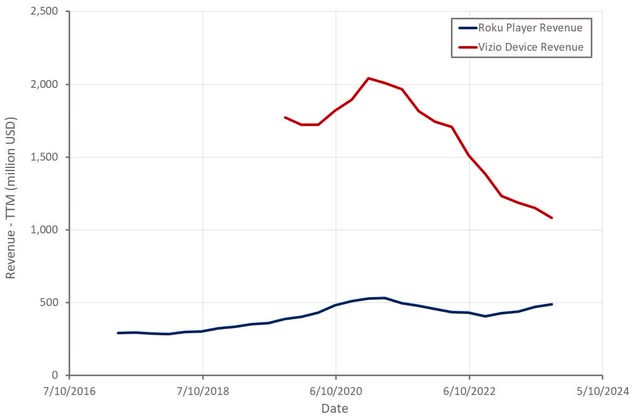

While the performance of Roku’s player business has been soft, it actually looks quite strong in comparison to Vizio’s business. It should be noted that device sales are being boosted by the launch of Roku-branded TVs and smart home devices.

Figure 3: Roku Player Revenue (Source: Created by author using data from company reports)

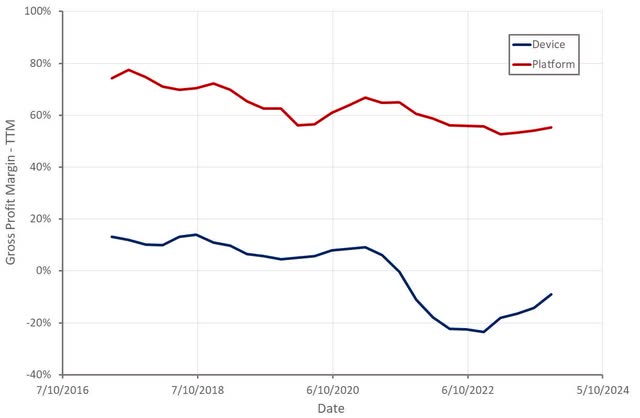

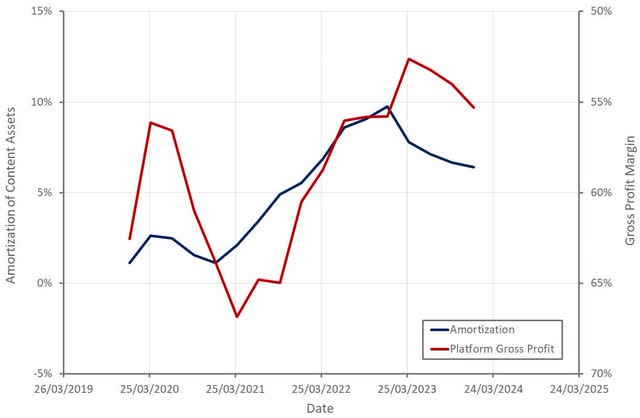

Roku’s gross profit margins remain depressed although have begun to bounce back in recent quarters. While device margins have been impacted by supply chain issues, recent headwinds have likely been driven by discounting.

Platform margins are being impacted by a combination of:

- Less high margin M&E revenue.

- International expansion.

- Lower CPMs.

Overall gross profit margin is being supported by the growth of the platform business relative to device sales, though.

Figure 4: Roku Gross Profit Margins (Source: Created by author using data from Roku) Figure 5: Roku Platform Gross Profit Margin (Source: Created by author using data from Roku)

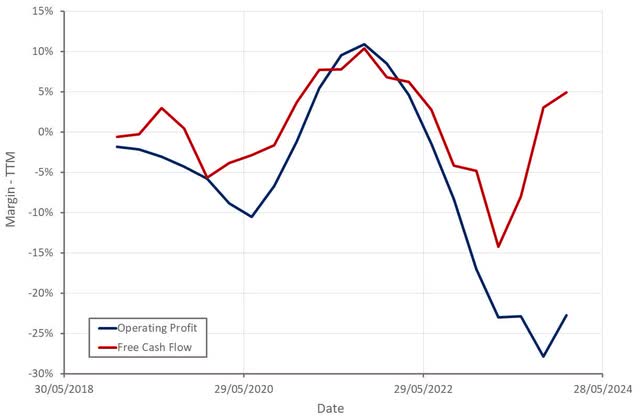

Roku’s margins and cash flows have been improving on the back of cost-cutting efforts and platform revenue growth, with the company achieving positive adjusted EBITDA and free cash flow in 2023.

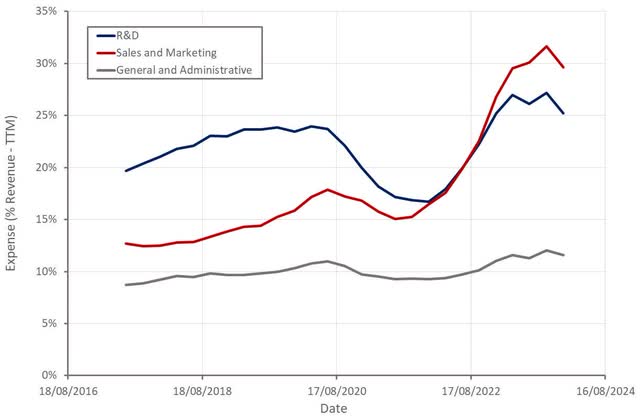

GAAP operating losses are still elevated, although Roku incurred a 42 million USD one-time charge in Q4, primarily related to lease impairments and workforce reductions. Operating expenses are expected to decline by a low to mid-teen percentage YoY in Q1. Sales and marketing expenses are particularly concerning given the company’s weak growth.

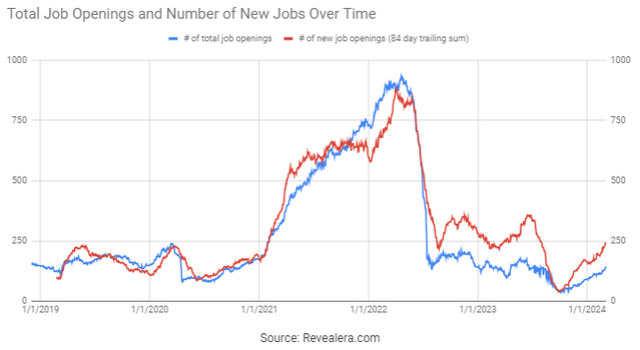

Figure 6: Roku Free Cash Flow (Source: Created by author using data from Roku) Figure 7: Roku Operating Expenses (Source: Created by author using data from Roku) Figure 8: Roku Job Openings (Source: Revealera.com)

Conclusion

Roku’s valuation remains near all-time lows, which, I believe, is hard to justify based on fundamentals. While growth is currently soft and the company still isn’t profitable, this situation doesn’t reflect Roku’s transition from commodity hardware to an advertising platform and media business. Growth and margins should improve in the coming quarters, particularly if CPMs stabilize. Roku’s revenue multiple is likely to expand meaningfully at some point, but the company may need to achieve GAAP profitability first, and this could still be several years away.

Competition remains an issue though, particularly internationally, where Roku is a relatively late mover. Roku’s business is also fairly inefficient at the moment, with the company investing a large amount in R&D, sales, and marketing, and product discounts and having little to show for it.

Figure 9: Roku EV/S Multiple (Source: Seeking Alpha)

Read the full article here