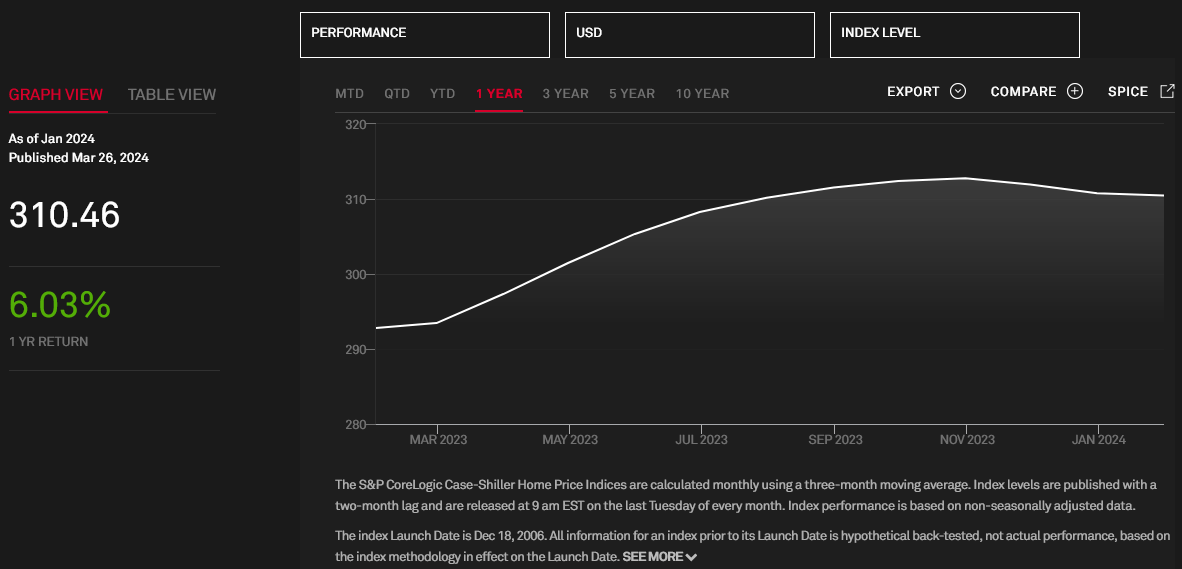

Last May, I published an article on tiny home builder Legacy Housing Corp.(NASDAQ:LEGH) wherein I pointed out that the company and the housing industry in general were in the throes of a housing downturn, which appeared to impact even the lower-end of the housing market. Since then, I have not revisited my Hold position on LEGH although I have been keeping an eye on the company’s quarterly reports as well as critical aspects of the industry including interest rates, mortgage rates, inflation rates, housing starts etc. Housing affordability in the U.S. continues to deteriorate, with large numbers of potential homebuyers priced out of the traditional housing market. Legacy Housing products and financing solutions are tailored to serve 50% of U.S. households that make less than $75,000 a year. Home prices have, however, started moderating.

S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index

S&P Dow Jones Indices

LEGH shares rallied nearly 20% since I made that call until around mid-March; unfortunately, lately, they have dropped precipitously after the company’s latest financial report that earned it a couple of Wall Street downgrades. To wit, on March 22, B.Riley analyst Alex Rygiel lowered LEGH price target to $22.00 from $24.00 (current share price at $202.9) while maintaining a Neutral rating, in large part due to ‘‘…a larger-than-expected seasonal impact in the quarter and the continuation of overall softness in the manufacturing housing industry.’’

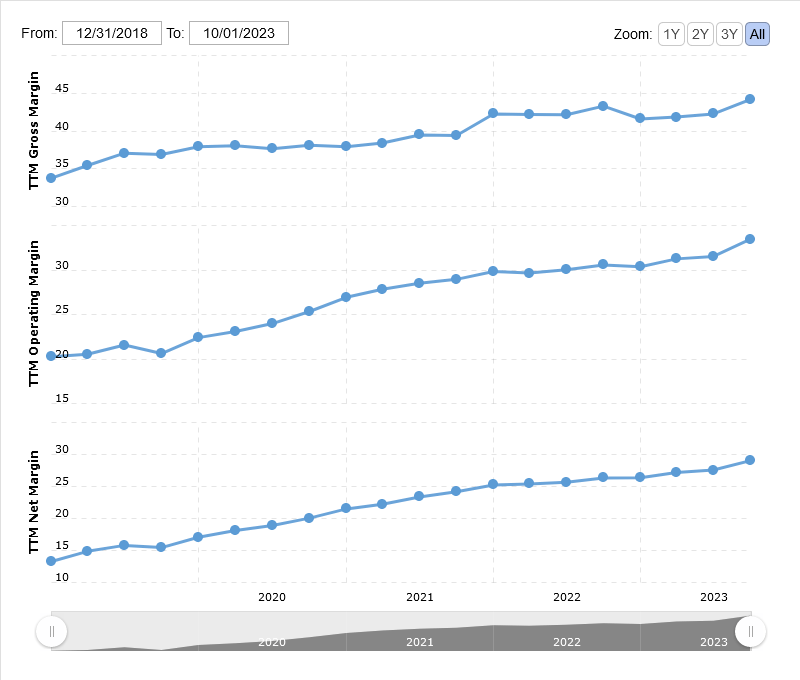

Legacy Housing reported fourth quarter and FY 2023 results on March 18, highlighting a significant decline in product sales but also noting areas of financial growth and strategic plans for expansion. The company’s FY GAAP EPS of $2.23 missed by $0.61; revenue of $189.1M (-26.4% Y/Y) missed by $48.62M while net income fell by 19.6% to $54.5 million. The company recorded a rather worrying 34.7% Y/Y drop in product sales in 2023, partly due to a 10.4% decrease in net revenue per unit sold to $59,600 and partly due to a decrease in unit volumes. However, in the company’s transcript, management explained that dealer and community customers purchased smaller, less option homes but insisted that the decrease was not driven by price concessions. That’s a good sign of pricing power as I explained in my previous article, and a reason why the company’s margins have remained healthy even during the downturn. The company has continued to cut costs, with Selling, General and Administrative expenses decreasing $3.3 million or 11.9% in 2023 as compared to 2022.

Meanwhile, Legacy Housing ended the year with a book value of $436.7 million, good for a 14.3% Y/Y increase while book value per share increased 14.2% to $17.91.

MacroTrends

Thankfully, Legacy Housing’s loan portfolio continues to be in the pink of health. The company lends to both the consumers and to community operators through MHP notes. Legacy Housing posted a 31% increase in consumer MHP and dealer loans interest income to $37.4 million. This increase was driven by increased balances in the MHP and consumer loan portfolio. The company’s consumer loan portfolio increased by $17.5 million while its MHP loan portfolio increased by $39.2 million, both net of principal payments and loan loss reserves. Per the company’s 10-Q, the average contractual interest rate per loan was approximately 13.3%. Consumer loans receivable have maturities that range from 2 to 30 years. The rate on the notes is, however, closer to 8%. So far delinquencies remain low, quite remarkable considering how high those interest rates are. In comparison, 30-year mortgage rates have been gradually creeping up and are now approaching 7%. In the September quarter, Legacy Housing’s consumer and MHP loan interest clocked in at $8.8 million, or 17.6% of total revenue, indicating just how important the segment has become for the company’s top-and bottom-lines.

Inventory Headwinds

Legacy Housing struggled with high inventory issues for much of 2023 thanks to the after-effects of the pandemic. During the pandemic, labor became hard to source, along with supply chain snags that reduced available inventory for buyers. Consequently, community managers overcompensated by increasing their purchase levels above average leading to high growth for companies like Legacy Housing. Unfortunately, this was, inevitably, going to lead to a slowdown period for builders as managers went through their large inventories. Thankfully, it appears that order flows are getting back to normal with Legacy Housing management saying the company intends to maintain its current production levels and build a backlog of homes in preparation for future sales.

The retail or dealer side of our business continues to show signs of life. We just worked through the seasonally slower period but foot traffic is still up from mid-2023 and dealers are selling homes. We believe that most of the destocking issues from early 2023 are behind us. Right now, interest from new dealers and Legacy’s products and financing solutions is high. Legacy has signed up more new dealers this month than any other month since I started. Second, our heritage stores are on track for the best sales month in the last 12 months’’ CEO Bates said during the earnings call. Bates joined the company two years ago.

Legacy Housing is also expanding company-owned stores and adding financing products. The company revealed it sells only about 10% of its production through its company-owned stores compared to almost 50% by some of its competitors. I managed to glean some useful insights about the company’s expansion plans from River Oaks Capital H2 2023 Report. Legacy Housing is the fund’s tenth largest position. Here’s an excerpt from that report:

The next area where Curt and Kenny’s industry expertise should flourish is at the one thousand acres of land they own in Austin, Dallas, and San Antonio. Manufactured Housing Parks – subdivisions with tens to hundreds of manufactured homes – have attracted the attention of many investment funds. Curt, Kenny, and the Legacy team are in the process of finding a creative way to use their one thousand acres of land to capitalize on this new Manufactured Housing Park wave. If history repeats itself, Legacy Housing will find a way to remain one step ahead of the market and use their acreage to creatively grow both their manufactured homes sales and lending.’’

Curt Hodgson and Kenny Shipley are Legacy Housing’s co-founders.

Takeaway

The majority of Legacy Housing’s profit and valuation metrics remain healthy. The company talked about a notable increase in traffic and interest in its products from dealers. Expanding the fleet of company-owned stores seems like a great idea and should help the company capture a bigger chunk of the retail margin. However, the big sales drop and profit contraction in the past couple of quarters suggest the industry downturn was quite severe, and could take a few more quarters before Legacy Housing is out of the woods.

Further, I’m concerned about Legacy Housing’s ongoing sell off. LEGH currently lies in the middle of a wide and falling trend that could see it fall as low as $16.50 in the next three months. However, the current 14-day RSI reading of 32.6 suggests LEGH is close to oversold, implying the shares are due for a rebound. I would advise investors to keep an eye on LEGH and buy if it crosses $22.00. I reiterate my Hold rating for now.

Read the full article here