Q1 highlights

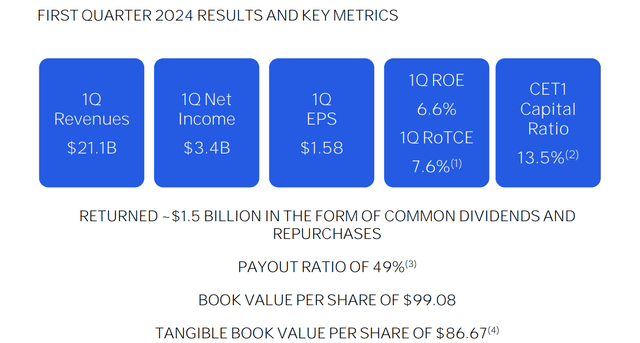

Citigroup Inc. (NYSE:C) reported its 2024 Q1 earnings on Friday morning, April 12. The results are quite strong, in my view, beating market expectations on both lines. To wit, its GAAP EPS dialed in at $1.58, beating market expectations by $0.41. Its revenue came in at $21.1B, beating market expectations by $700M.

Digging into the report’s future, I think a few more items are of more interest besides the top and bottom line numbers. And it’s the goal of this article to dissect these items in more detail. These items are summarized in the chart below. In the remainder of this article, I will elaborate on the following aspects and argue why C presents a compelling buy thesis.

- The implications of its CET1 ratio of 13.5%.

- The implication of a tangible book value (“TBV”) per share of $86.67 on its valuation.

- The implication of a $1.5B of dividends and share repurchases for total shareholder return.

- The potential impacts of its credit losses.

C 2024 Q1 ER

Financial strength and growth prospects

Despite some increases in credit losses, C’s credit and financial measures are quite strong. As just mentioned, its CET1 ratio was reported to be 13.5% in the earnings report. To better contextualize things, the regulatory minimum requirement is 4.5% for the CET1 capital ratio. Among the major banks, my estimate of the midpoint is around 10.5%. Thus, C’s financial strength is far above the minimum requirement and also is noticeably above the median of major banks. Moreover, its common equity Tier-1 capital ratio has been on an improving trajectory. The ratio used to be around 13.03% in 2022 and around 13.30% in 2023.

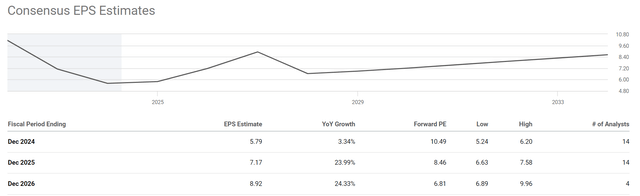

Looking ahead, consensus estimates show strong optimism for C’s future earnings growth. As seen in the chart below, the average analyst estimate for C’s FY 2025 EPS is $7.17, which represents growth of 23.99% from the estimated FY 2024 EPS of $5.79. The pace was growth was projected to continue into FY 2026 and its EPS would reach $8.92 at this rate. The implied P/E would only be 6.8x by then. Given C’s strong financial position and unique strengths. I see good reasons for consensus optimism. Citigroup boasts a strong international presence, particularly in emerging markets, which some competitors might lack. The combination of its strength in wealth management with its presence in emerging markets forms a unique growth area. Thanks to its reputation and strong financial strength, I see Citigroup well poised to attract new high net worth clients with its wealth management products and services.

Seeking Alpha

Valuation

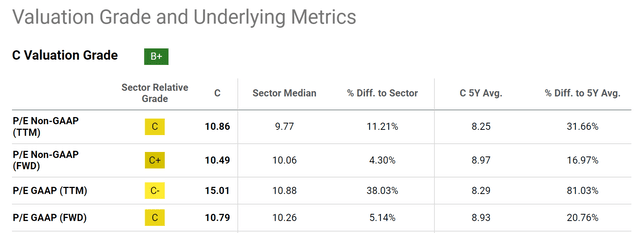

Despite strong financial strength and growth prospects, C is trading at very reasonable valuations. The first chart below summarizes C’s valuation ratios in comparison to the sector median and its own five-year averages. As seen, C’s valuation ratios are admittedly above average relative to both its sector and its own historical track record. For example, its FWD P/E on a Non-GAAP basis currently is 10.49x, compared to the sector median of 10.06x and its five-year average of 8.97.

However, I won’t overly worry about such a premium for a bunch of reasons. To start off, the premium is very slight, nothing out of the ordinary in my view. Second, given its above-average strength and scale, I think it’s totally justifiable that it trades at a premium compared to the sector median. Third, as mentioned in the section above, its P/E would very quickly shrink to the single digits with the growth projected. Finally and more importantly, I think P/TBV (tangible book value) is a much better metric for banks and this metric shows C is attractively valued both in absolute terms and relative terms (see the second chart below). In absolute terms, the stock is currently trading below TBV. As aforementioned, it just reported a tangible book value per share of $86.67, and it is currently trading at only ~$60 per share as of this writing. In relative terms, its P/TBV ratio is currently far below its average ratio over the last five years (0.758x).

Seeking Alpha Seeking Alpha

Other risks and final thoughts

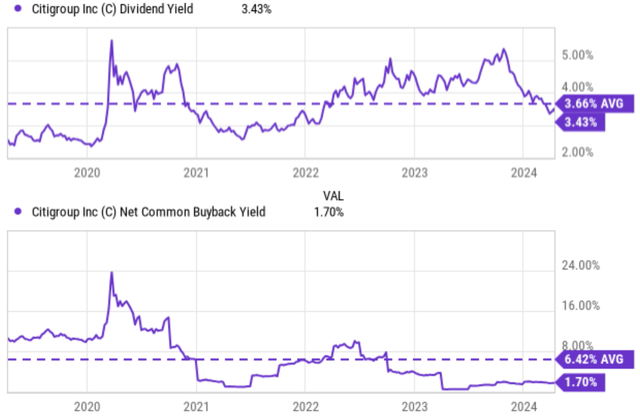

Before closing, there are two more items that I’ve gathered from the ER that are worth mentioning. The first item represents an upside risk and involves shareholder returns. As aforementioned, the company returned a total of $1.5B in the last quarter, both in dividends and share repurchases, to shareholders. To better contextualize things, the next chart shows its dividends and buybacks in the past five years. As seen, C’s current dividend yield of 3.43% is quite close to its historical average of 3.66% (serving as another sign of its reasonable valuation). A 3.43% yield is quite attractive for income investors and could provide some downside protection in the case of a market downturn.

And the share repurchase makes the picture even more enticing. As seen in the bottom panel, C has been a consistent and also aggressive buyer of its own shares in the past. In the past five years, C’s net common buyback yield has been averaging around 6.42%. In other words, the bank has returned far more capital to its shareholders this way (the more tax-efficient way – I might add) than cash dividends.

Seeking Alpha

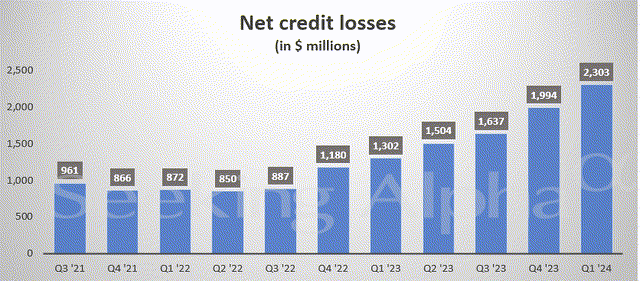

The second item represents a downside risk and involves credit losses. In the earnings report, C reported an increase of 16% in net credit losses, as shown in the chart below. As seen, its net credit losses hit a minimum level of $850 million in Q3’21 and have since been continuously increasing to the current level of $2,303 million in Q1’24.

As a response, the bank has been increasing its provision for credit losses (i.e., funds set aside in anticipation of defaults) in tandem. In the last year alone, the provision has nearly doubled to $9.2 billion. C’s net profit was around $9B in 2023 and most likely will be around $10B in 2024. Thus, the losses could cause noticeable pressure on its margins. We do not expect these issues to go away quickly. I see the issue of loan delinquencies or defaults persisting or even worsening in the near future. Our arguments were detailed in this recent article, and the gist is that we see things are becoming pretty ugly under the current combination of high borrowing rates and inflation rates. We expect this combination to cause more affordability issues among consumers and consequently delinquencies/default issues.

All told, my overall conclusion is that the risks are well compensated for by the upside potential. C presents a compelling combination of value and growth and thus offers an asymmetric return/risk profile. To recap, the key upside catalysts are reasonable valuations (especially in terms of P/TBV ratio), generous capital returns, healthy financial strength, and growth potential.

Seeking Alpha

Read the full article here