Investment thesis

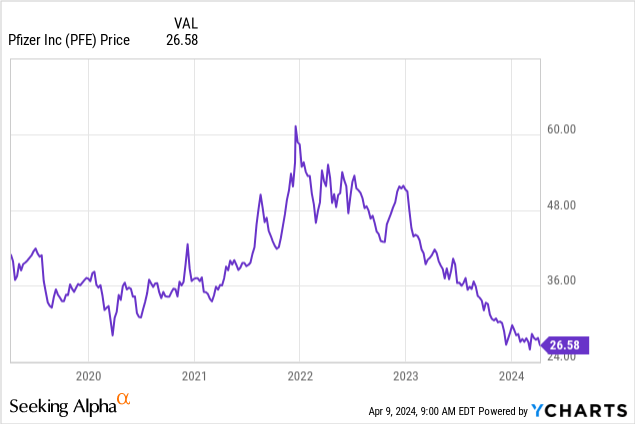

My previous bullish thesis about Pfizer Inc. (NYSE:PFE) from October 2023 did not age well, as the stock delivered a -10% total return over the last half-year, substantially lagging behind the broader market. Despite it, today I want to reiterate my bullish thesis because recent developments suggest that the business continues moving in line with its innovative approach and commitment to create value for shareholders. The market seems to be wrong by overreacting to 2023 revenue and EPS decline, which happened due to sky-high 2022 comparatives [due to the mass COVID-19 vaccination across the world] and not due to any secular issues with Pfizer’s business. Furthermore, according to my valuation analysis, the stock is deeply undervalued and currently offers an attractive 6.3% dividend yield.

The current share price of $26.58 is substantially lower than February 2020 levels. All in all, I reiterate my “Strong buy” rating for PFE.

Recent developments

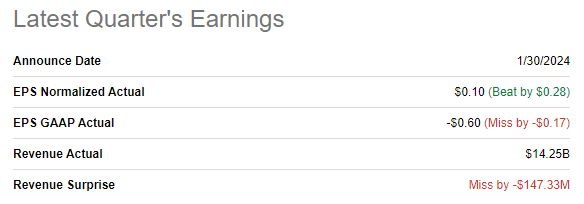

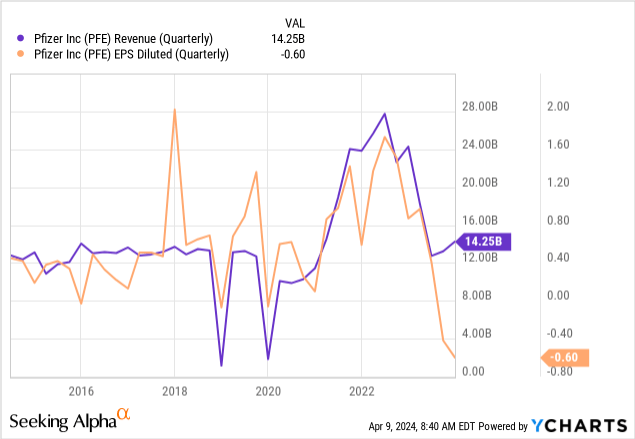

The latest quarterly earnings were released on January 30, when PFE slightly missed revenue consensus estimates and notably missed EPS estimates. Revenue demonstrated a big, over 40% YoY revenue decline for the third straight quarter, which is due to a massive decline in demand for vaccines against COVID-19.

Seeking Alpha

I do not consider a big revenue decline as a secular threat because what happened in 2023 is that the top line just moderated to pre-COVID levels since the pandemic and mass vaccination highly likely was a once-in-a-century. The same applies to the adjusted EPS. Recent quarters were not an anomaly and aligned with pre-pandemic levels. The only outlier is the latest quarter, and I want to pay readers’ attention here. According to the earnings press release, in Q4, two substantial one-off non-cash accounting entries were recorded. These two one-off transactions cumulatively decreased the diluted EPS by $1.9.

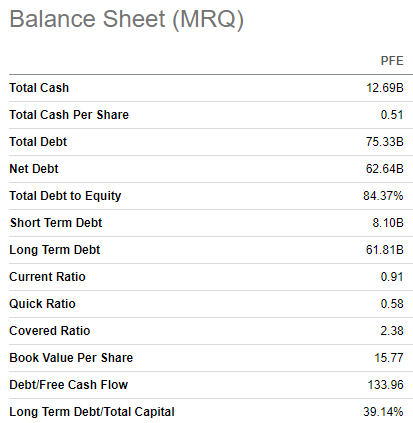

Therefore, I would not recommend panicking due to sharp YoY decreases in revenue and EPS. Pfizer just returned to its normal financial performance, and it is reasonable because the massive COVID-19 vaccination of almost the whole world’s population apparently was a one-off event. Moreover, the company’s balance sheet currently looks more solid than before the pandemic. Pfizer had a $12.7 billion cash pile as of December 31. Its $62.6 billion net debt position might seem higher than before the pandemic levels. However, almost half of the current net debt position is explained by a $31 billion debt raised to acquire Seagen.

Seeking Alpha

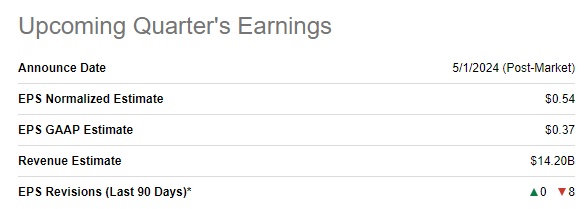

The upcoming earnings release is scheduled for May 1. Consensus estimates forecast quarterly revenue of $14.2 billion, which is 22% lower than the same quarter last year. The adjusted EPS is expected to follow the top line and decline from $1.23 to $0.54. I expect Q1 to be the last quarter to demonstrate such a massive YoY drop because Q2 FY 2023 already excluded the major portion of COVID-related revenues. This adds optimism to me that Pfizer will likely start demonstrating positive earnings dynamics starting from Q2, which will help to improve the sentiment around the stock.

Seeking Alpha

If we look at the longer-term perspective, the company continues investing heavily in developing new products. According to the drug development pipeline, there are more than 100 hundred new drugs at different phases of clinical trials and more than one-third of them are either at Phase 3 or already pending registration. Therefore, I am highly confident in Pfizer’s ability to sustain a strong portfolio of patents, which is a vital criterion for a biopharmaceutical company’s financial success.

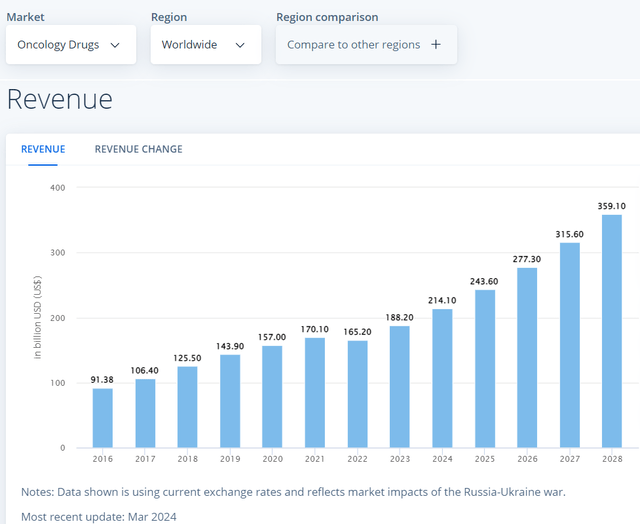

Among products which are at advanced stages of potential FDA approvals, a notable portion belongs to oncology medicine. Apart from the fact that oncology is a big issue due to high mortality rates, I am also emphasizing it because the oncology drugs market is expected to double between 2023 and 2028, according to Statista. Therefore, I consider Pfizer’s focus on expanding its presence in oncology medicine to be a sound move, given solid industry tailwinds.

Statista

I also want to emphasize that, according to the pipeline, Pfizer has a drug against Duchenne Muscular Dystrophy [DMD] in Phase 3 of clinical trials. This looks promising because the DMD drugs market is expected to compound at a staggering 33% CAGR over the next decade. Pfizer’s closest mega-cap rivals have not yet secured FDA approval for any DMD treatment. According to drugs.com, most of the DMD treatments FDA approvals were granted to products from Sarepta Therapeutics, Inc. (SRPT). However, Sarepta’s scale is much smaller, and it has much less financial resources than Pfizer. To me, this indicates that Pfizer has a good chance to build strong positioning here should its new potential anti-DMD product succeed.

Last but not least, Morgan Stanley (MS) analysts recently shared their opinion that stocks of the largest biotech companies are likely to be the major beneficiaries of the expected June 2024 first Fed rate cuts. This appears sound to me because the success of the biotech industry heavily depends on the ability of key players to innovate and create new products, which is impossible without heavy investments in R&D. And the cheaper the raising of finance is, the more financial flexibility companies possess to finance their activities.

Valuation update

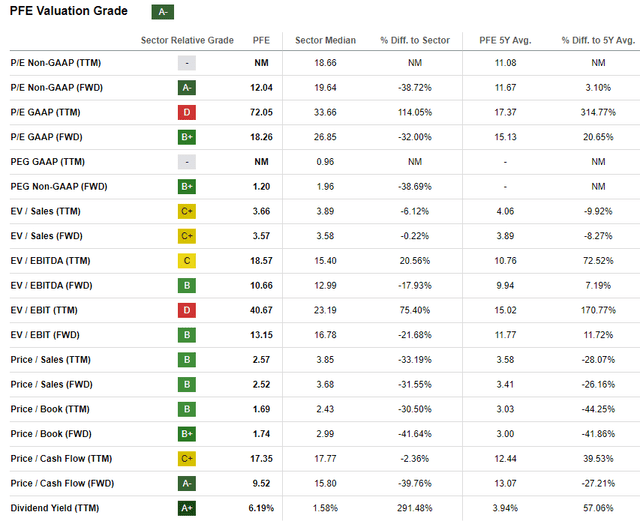

PFE tanked by 36% over the last 12 months and experienced a tough 2024 with a 7.7% YTD price decline. The stock looks substantially undervalued from the perspective of most key valuation ratios. The current dividend yield is significantly higher than PFE’s historical average, which also underlines the stock’s undervaluation.

Seeking Alpha

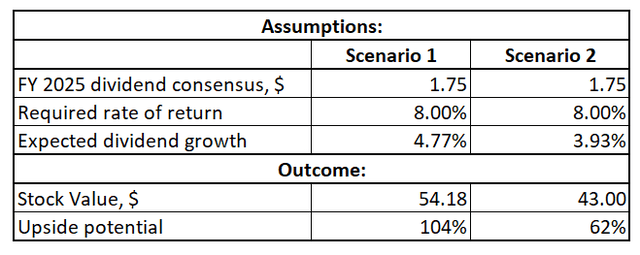

I also want to update my dividend discount model [DDM] in line with the evolving environment. I updated the current year’s dividend with an FY2025 consensus estimate to forecast a target price for the next 12 months. Furthermore, I use a softer 8% required rate of return, which aligns with the Fed’s plans to start cutting rates this year and the recommended range by valueinvesting.io. To reflect the weak sentiment around the stock, I use more conservative dividend growth estimates this time. I simulated two scenarios with 4.77% and 3.93% growth rates. These are the last five- and three- years dividend CAGR, respectively.

Author’s calculations

According to both scenarios, PFE is substantially undervalued. Even with a relatively slow projected dividend growth, the stock is around 62% undervalued, based on DDM. I know that in my previous thesis, DDM also suggested substantial undervaluation.

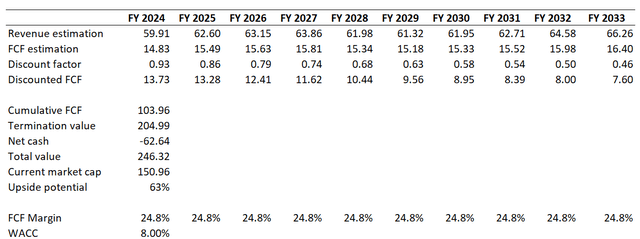

Therefore, I want to get more conviction and want to simulate the discounted cash flow [DCF] model, with the same 8% discount rate. I use consensus revenue growth estimates, which project a mere 1% CAGR for the next decade. For a company with a vibrant success history like Pfizer, I think that this revenue CAGR is a superconservative assumption. I am using a flat 24.75% FCF margin for the whole decade, this refers to the last five years’ PFE’s average.

Author’s calculations

As we can see above, the DCF model also suggests that the stock is 63% undervalued even under extremely conservative revenue growth assumptions. Therefore, I believe that a $43 target price estimation suggested by the second scenario of my DDM looks reasonable.

Risks to consider

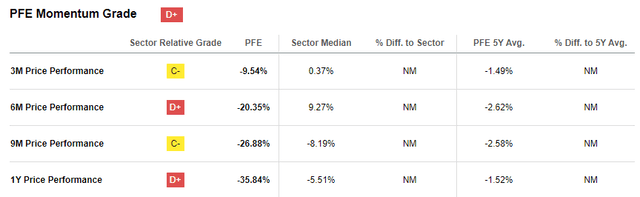

The sentiment around the stock is extremely weak, which I see from the low Seeking Alpha Quant momentum grade. The share price has fallen across all the highlighted timeframes within the last twelve months.

Seeking Alpha

To some extent, the weak sentiment is due to the rapid decline in financial performance as a result of much lower sales of COVID-19 vaccines, but there is a notable secular issue. Patents of some of the company’s most successful products of recent years are expected to expire within the next couple of years, which means losing exclusivity rights. In FY 2023, PFE generated more than $20 billion from products with patent expiration years approaching. I think that that is the major reason why investors are very cautious about PFE. And expiring patents are indeed quite a risk for any company.

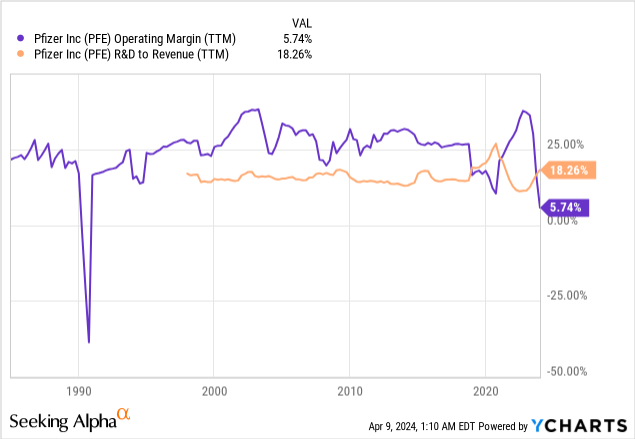

However, I want to emphasize that PFE has been in business since the nineteenth century. The company has faced numerous patent expirations over the last decades and every time it came out with new bestsellers and continued delivering value to shareholders consistently with a stellar operating margin. The company’s culture of firm commitment to innovation is the big factor that makes me positive about PFE’s ability to replace revenue from products with expiring patents. As long as PFE reinvests around 20% of its sales back into innovation, I am confident in the company’s ability to deliver new, stellar products.

Bottom line

To conclude, PFE is still a “Strong Buy”. The market overreacts to 2023 revenue and EPS notable YoY declines during several consecutive quarters because the decline is explained solely by the cooling-off effect of temporary COVID-related tailwinds. The stock offers a robust 6.3% dividend yield and there is a massive upside potential, according to my valuation analysis.

Read the full article here