Tiger Woods did it for pro golf. Serena and Venus Williams did it for women’s tennis. Michael Jordan did it for the NBA.

The WNBA, still emerging entering its 28th season, hopes Caitlin Clark can achieve what those athletes did and turn the league into a cultural phenomenon.

“I remember times when people were making fun of this league. Not anymore,” said Boris Lelchitski, an agent who has represented WNBA stars like Candace Parker and Jonquel Jones. “This is a turning point.”

Clark, who is expected to be drafted by the Indiana Fever with the first pick in this month’s WNBA draft, shattered the NCAA scoring record, was named the AP Player of the Year, and her University of Iowa games set attendance and viewership records. Also well-equipped to lift the WNBA will be Angel Reese, the Louisiana State University star who beat Clark in last year’s NCAA championship. Reese has 2.8 million followers on Instagram, more than double Clark’s following.

“I see it as a Tiger Woods entering the PGA Tour moment,” WNBA marketing chief Phil Cook recently said.

See college basketball star’s announcement after tumultuous year

But there’s no guarantee.

The league is still small financially, bringing in a reported $200 million in revenue — compared to the NBA’s more than $10 billion. More fans last year tuned in to watch the women’s NCAA tournament final, 9.9 million, than the WNBA Finals — an average of 728,000 viewers a game.

The WNBA has experienced challenges gaining attention in the traditionally male-dominated world of pro sports.

Coverage of women’s pro basketball significantly trails the men’s game. Nielsen found that ESPN’s SportsCenter provided 91 seconds of coverage for the average WNBA game, compared to 266 seconds for the average NBA game.

WNBA players’ salaries also lag behind. The highest-paid WNBA player makes $242,000, while the league minimum in the NBA is over a million dollars. The highest paid NBA player makes $52 million, according to Spotrac, a sports data website.

WNBA players often to go overseas in the winter offseason to supplement their incomes, and some of the best players get left off WNBA rosters because there are only 144 total spots among the 12 teams in the league.

“Caitlin Clark will bring a lot of eyeballs to the Indiana Fever. Will that expand itself into interest in the WNBA in general?” That’s the big question mark,” said Noah Henderson, who teaches sports management at Loyola University in Chicago.

Clark is already having an impact on the WNBA. Ticket prices to watch the Indiana Fever have more than doubled, going from $60 to $140, and tickets to the WNBA Draft sold out in 15 minutes.

She is entering the WNBA at a pivotal time for the league. WNBA commissioner Cathy Engelbert told CNN that next few years of the WNBA will set the league up for the next 30-40 years.

“We’ve never been really that successful bringing the college fan into the W,” she said. The league has been running its first-ever commercials during the tournament to attract fans and plans a marketing blitz to target alumni of schools like Iowa and LSU.

The WNBA, its broadcast partners, and corporate sponsors must invest heavily in marketing, technology and other areas to convert people who will be tuning into games for the first time to watch Clark or Reese into dedicated women’s pro basketball fans, said Jessica Gelman, the CEO of Kraft Analytics Group and founder of the MIT Sloan Sports Analytics Conference.

“The need by WNBA teams to invest in fan acquisition and fan engagement is really critical to maximize this moment,” she said. “This is the tipping point if the investment is there.”

Clark has the same potential to impact the WNBA as Woods did for pro golf, but the WNBA and broadcast partners must be more accessible for fans to watch, Gelman said. Almost a fifth of US fans say that live women’s sports aren’t easily accessible at home, according to Nielsen. Brands like Gatorade and State Farm, which have sponsored Clark in college, also have to keep up advertising with her and WNBA stars during other sporting events to build interest.

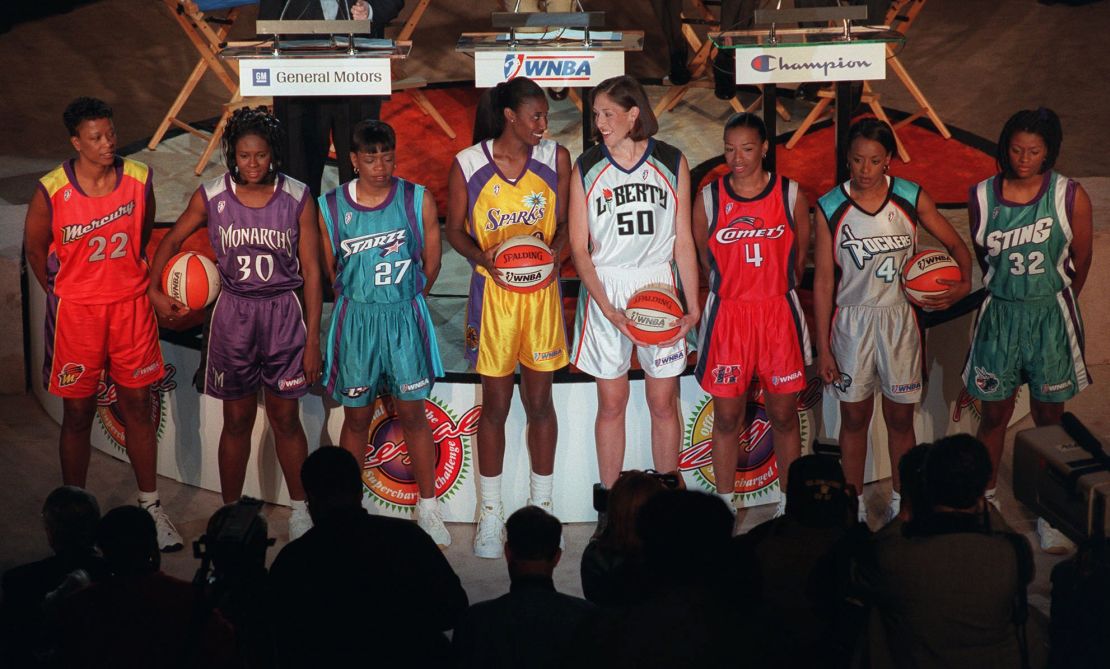

The WNBA launched in 1997, spearheaded by longtime former NBA commissioner David Stern, who believed creating a women’s league would grow the game overall.

At the time, women’s basketball was at a high point. The 1996 USA women’s national team, led by Lisa Leslie, Sheryl Swoopes and Rebecca Lobo, won the gold medal at the Olympics in Atlanta.

The league was financially connected to the NBA, and each of the first eight WNBA teams was linked to an NBA franchise.

“When the WNBA started, there was no real plan for its start, its growth and its sustainability,” said Terri Jackson, executive director of the Women’s National Basketball Players Association.

The league’s success has not gone in a straight line.

In the WNBA’s inaugural season, average attendance was around 10,000 for the eight teams. The league grew to 16 teams by 2000, but teams folded in subsequent years, leaving 12 by 2009.

By 2023, average attendance for the 12 teams remaining was under 7,000 fans per game.

“There were challenges. It was a time when there was a question of whether it was a viable business,” Donna Orender, the WNBA commissioner from 2005 to 2011, told CNN. When Orender entered the league, attendance had been dropping and sponsorship interest was waning.

“There was a cultural pushback,” she said. “At the time, people weren’t as ready to accept the fact that building businesses around strong women, especially strong women athletes, was going to be sustainable.”

Clark’s arrival in the WNBA comes after a strong few years for the WNBA and interest in women’s sports more broadly. Women’s elite sports will generate more than $1 billion in revenue for the first time in 2024, Deloitte projects.

In 2022, the WNBA raised $75 million, its largest-ever capital raise, to support marketing and growth efforts. The WNBA is coming off its most-watched regular season in 21 years. Attendance at games last season hit its highest level in 13 years. The league is adding a new franchise in San Francisco beginning in 2025 and has plans to expand to other cities.

And a lucrative new media rights deal is expected to bring in millions of dollars of additional revenue and increased visibility for star players and teams. The new deal could increase player salaries and improve their travel accommodations.

The WNBA’s current media deals are worth about $60 million annually and expire in 2025. The WNBA reportedly hopes to receive up to $100 million a season from broadcast partners in its new deals.

“This media rights deal will be very important,” Engelbert said.

Terri Jackson, head of the players union, wants player leadership to be at discussions with potential broadcast partners.

Growing interest from fans and sponsors, league expansion and a strong media deal— combined with Clark, Angel Reese and other college stars like Cameron Brink now entering the league — “really have the potential to massively accelerate the growth of the WNBA,” said Gelman from the Kraft Analytics Group. “It’s pouring fuel on something that’s already been lit.”

Attention on Clark and her sponsorship deals can help raise other WNBA stars’ deals, lifting the entire league, said Boris Lelchitski, the agent.

“Clark is the top of the pyramid in terms of bringing in her fan base. They’re going to follow her,” former WNBA commissioner Donna Orender said.

“There’s so much talent in the WNBA. That talent is going to get exposed in a much broader way that’s going to elevate all the levers that create a successful league.”

Read the full article here