Corteva, Inc. (NYSE:CTVA), spun off from the massive company, DowDuPont, has successfully realized the benefits of such reorganization to date outperforming S&P 500 Index in the past five years. However, there is still a notable gap between the value of Corteva today and the value of its peers such as Monsanto and Syngenta before privatization. Given its solid business fundamentals as well as a tremendous number of intellectual properties, Corteva remains as an attractive investment for investors to achieve excellent long-term return.

2019 Reorganization

In 2015, two of the largest chemical companies in the world, Dow Chemical and DuPont, announced plans to merge, which was completed in 2017 forming a massive company, DowDuPont.

Dow Chemical and DuPont didn’t plan to stay merged as one giant company. Instead, the idea was to combine their assets and then split into three separate, more focused companies as below:

- Dow focuses on plastics and materials science products.

- DuPont focuses specialized products in electronics, transportation, construction, water solutions, and nutrition & biosciences.

- Corteva focuses on agriculture including seeds, crop protection chemicals, and digital agriculture solutions.

The intended benefits of this reorganization was:

- to allow each company to be valued properly by the stock market realizing their hidden worth.

- to allow each company to focus on its specific industry, streamline its operations and drive growth.

Introduction

Corteva has two business segments: seeds and crop protection. Within the seeds segment, Corteva supplies commercial seeds (mainly soybean and corn) combining advanced germplasm and traits that produce optimum results for farms around the world.

Each of Corteva’s seed products can take 10-20 years to commercialize from initial research stage. As a result, to reward companies like Corteva for its innovation, similar to other seed companies, Corteva’s seeds are to be planted for one season only and farmers are not allowed to harvest and replant seeds. Corteva counts on farmers around the world to re-order its seeds every year. Due to seasonality, Corteva generates about 65% of its sales in the first half of each calendar year from farms in the northern hemisphere and generates 35% of its sales in the second half of the calendar year from farms in the southern hemisphere.

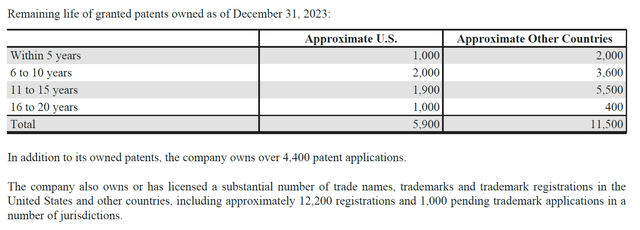

An aggressive IP strategy is crucial for Corteva’s operations. Its IP strategy protects those genetic traits (drought resistance, pest resistance, higher yield), unique combination of genetic traits, breeding processes, brands, plant varieties and agricultural chemical products.

investors.corteva.com/

The above table paints a picture of tremendous number of IP assets intertwined to protect Corteva’s future revenue.

Undoubtedly, Corteva’s business is prone to litigations including some from its legacy businesses prior to the reorganization. On its 2023 annual report, there are about 10 pages out of 176 pages disclosing various on-going litigations.

Corteva manufactures its offerings through a mix of owned production facilities and third-party growers. As of December 31, 2023, Corteva has 99 owned production facilities around the world.

Corteva focuses on seed production close to the customers so that the seeds sold to the customers are suitable for that region and its weed, insect and disease challenges, weather, soil and other conditions. As a result, Corteva uses many third party growers close to its customers that can support the production of high-quality seeds. This strategy provides increased flexibility and scalability at minimal cost.

In terms of distribution, Corteva supplies its products through four distinct sales channels:

- direct sales to farmers, which allow for close relationships and tailored solutions;

- distribution through large agribusiness retailers, expanding its reach;

- partnerships with smaller, independent agricultural retailers, ensuring local market penetration;

- online platforms, which cater to the digital transformation trends in agriculture.

In addition to supplying seeds and crop protection products, Corteva enters into licensing arrangements with customers under which it licenses its intellectual property.

Overall, in the span of 5 years, Corteva has delivered good results to its shareholders realizing the benefits of the 2019 Reorganization.

Since the 2019 Reorganization, from June 1, 2019 to March 28, 2024, Vanguard S&P 500 ETF (VOO) generated a return of 90.12% while Corteva outperformed with a return of 113.83% in the same period.

ca.finance.yahoo.com

While Corteva has remained a publicly traded company, Monsanto and Syngenta have both gone private in recent years. While Monsanto was acquired by German firm, Bayer, Syngenta was acquired by China National Chemical Corporation (ChemChina).

As a result, the three largest seed companies that matter to the world’s population in terms of food security are with the United States, Germany and China. While anti-trust scrutiny is on-going for Corteva, it seems unlikely that the United States would try to weaken Corteva’s ability to compete with Syngenta and Monsanto backed by ChemChina and Bayer in the short term.

2023 Financial Review

In 2023, Corteva generated $17.22 billion in revenue, declined 1% compared to 2022 with growth in North America and EMEA and decline in Latin America and Asia Pacific.

Corteva’s seed segment’s revenue grew by 5% from $9 billion to $9.5 billion primarily driven by price increase due to higher demand around the world, partially offset by decrease in volume due to Corteva’s exit from Russia.

Corteva’s crop protection segment’s revenue declined by 9% primarily due to inventory re-alignment, customers’ delayed purchases to weather economic uncertainties and lower demand of chemical based crop protection products

While income from continuing operations decreased by 23% from $1.4 billion to $1.09 billion in 2023, EBITDA for 2023 actually improved by 5% to $3.38 billion from $3.22 billion. This is primarily because of increased interest expense in 2023 as well as costs related to Corteva’s pension plan.

Corteva generated $1.8 billion cash from continuing operations in 2023 compared to $0.9 billion in 2022 and $1.2 billion in free cash flow.

Corteva’s working capital remained relatively unchanged as of December 31, 2023. Total current assets were $16.3 billion compared to $16.8 billion on Dec 31, 2022 and the total current liabilities were $10.4 billion on December 31, 2023 compared to $10.7 in prior year.

Through the claim of U.S. research and development credit as well as tax changes in Switzerland, Corteva enjoyed an effective income tax rate of only 13.9% in 2023, much lower than U.S. domestic corporations (about 26%). It demonstrated an effective tax strategy deployed by Corteva so far.

Overall, Corteva delivered very positive results in 2023 despite a slight decline in total revenue. As a result, Corteva’s stock price popped on February 1, 2024 from $45.5 per share on January 31, 2024 to $54.06 on February 1, a whopping 18.8% jump. However, the gap in terms of valuation for Corteva still exists for investors to capitalize.

Valuation

When Monsanto was acquired by Bayer, Bayer valued Monsanto at about $66 billion in an all-cash deal. To put it in perspective, Monsanto only reported $14.6 billion revenue in 2017 right before the Bayer transaction, which implies a valuation of $77 billion for Corteva at $17.2 billion revenue.

Even at a mere 2% annual inflation, $77 billion value would equal to $86 billion today.

However, Corteva’s market capitalization as of March 28, 2024 was only $40.3 billion while generating $17.2 billion in revenue.

Syngenta, similarly, was acquired by ChemChina for $43 billion in 2017. Syngenta’s 2017 revenue was just $12.6 billion, which implies a valuation of $58 billion for Corteva at $17.2 billion revenue. Assuming 2% annual inflation, $58 billion would equal to $65 billion today.

Syngenta is expected to go public again in late 2024 despite some failed effort due to market volatility, which can help the market realize the hidden worth of Corteva. Several days ago, Syngenta’s intended IPO would have valued it at $60 billion.

Corteva’s valuation does appear expensive if just looking at PE ratio (44 as of March 28, 2024) and other earnings related ratios. However, Corteva’s business value derives from its IP assets and are more long-lasting than traditional businesses, especially given that Corteva can stack patents on its core technologies to extend the 20-year term of a given patent. Such comprehensive IP strategy is common among seed companies. For example, Monsanto is estimated to hold about 11,000 patents worldwide as of 2017. On this metric, Corteva holds far more patents than its peers.

Considering the relative business size in terms of revenue and total patent count compared to Monsanto and Syngenta, Corteva’s valuation should fall somewhere between $60 billion and $85 billion indicating significant upside from today’s market capitalization.

Risk Factors

Despite strong EBITDA, Corteva’s crop protection business is shrinking (organically by 12%). While it is partially due to Corteva’s strategic exit in some product lines, customers have increasingly been aware of sustainable practices resulting either delayed or reduced purchases. Interestingly, Corteva has already foreseen this and has acquired Stoller Group, Inc. (“Stoller”). Stollers among other things specializes in biological agricultural products, which include natural solutions for pest control, plant health, and nutrient management.

While crop protection products derived from chemicals are facing decline and increased litigation risk, biological products and technology are the new bright star to lead Corteva’s pivot and growth. However, whether Corteva can successfully navigate this pivot remains uncertain in the near term.

While Corteva generated $1.8 billion cash from continuing operations in 2023, it spent it almost entirely on the Stoller acquisition. To help support its stock price and continue paying dividend, Corteva took on another $1 billion debt in 2023, which is not sustainable in the long run.

Of course, the results for the various on-going litigations remain to be seen and legal fees are mounting.

Conclusion

Corteva has demonstrated a robust performance since the strategic reorganization in 2019 of DowDuPont, outperforming the S&P 500 Index. Despite this success, there’s an observable valuation gap when compared to its former peers, Monsanto and Syngenta indicating an opportunity for investors. With Corteva’s solid business fundamentals, underscored by an extensive portfolio of intellectual properties and a diversified approach to production and sales, the company is destined for sustained long-term growth. As Corteva continues to navigate the evolving agricultural landscape with strategic acquisitions like Stoller, and expands into biological agricultural products, it remains an enticing prospect for investors seeking to capitalize on the agricultural sector’s future.

Read the full article here