I expressed my bullish view on IBM in my previous article published in December 2023, and since then, their stock price has surged by 17%. I highlighted their strength in hybrid platform & solutions after Kyndryl (KD) Spun-off. I am optimistic about their recurring revenue growth from software and consulting in the near future. I estimate their stock price is significantly undervalued and I upgrade the rating to ‘Strong Buy’ with a fair value of $247 per share.

Software and Consulting Drives Recurring Growth

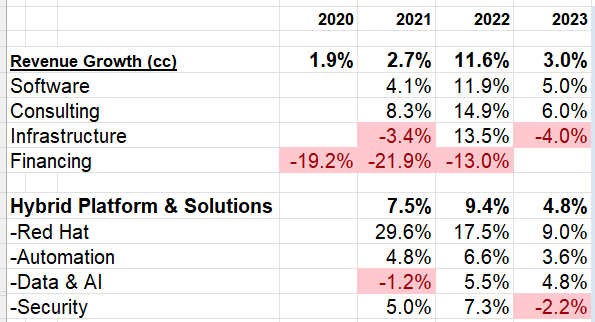

After the spin-off of Kyndryl, IBM has shifted their business focus on software, consulting and infrastructure businesses. In FY23, their software grew by 5% at constant currency, and consulting was up 6% year-over-year, as summarized in the table below. Software and consulting account for around 75% of group revenue, making IBM’s revenue stream more stable and recurring than before.

IBM 10Ks

I favor their business focus on software and consulting for the following reasons:

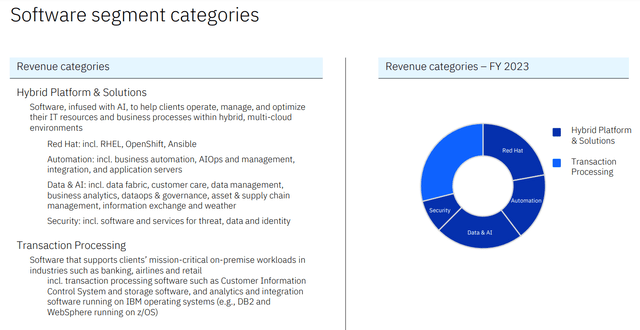

Their software business comprises a group of portfolio of Red Hat, automation platform, data & AI and security software, as depicted in the slide below. Red Hat’s platform offers Red Hat Enterprise Linux, OpenShift and Ansible Automation platform. The combination of operating system, container, and automation drives their business growth alongside the rapid expansion of data center infrastructure.

IBM Investor Presentation

As disclosed over their Q4 FY23 earnings call, Red Hat annual bookings were up 17% year-over-year, including double-digit booking growth across the three main offerings: Red Hat Enterprise Linux, OpenShift and Ansible Automation. As evidenced by Red Hat’s recent performance, IBM has made the right decision to acquire this open-source company, in my view.

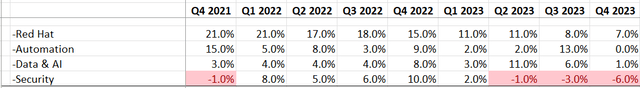

As illustrated in the table below, IBM has been delivering solid revenue growth across their software offerings, except some weakness in their security business. I will discuss the Security business in the risk section.

IBM Quarterly Results

For the consulting business, IBM has been capitalizing on the growing need for digital transformation and AI deployments. IBM has partnered with AWS, Azure and other platform service providers, and as disclosed over the call, their strategic partnership now makes up 40% of their consulting revenue, and these partnerships have delivered double-digit revenue growth for FY23. According to GlobeNewswire, the global digitalization transformation consulting is projected to grow at a CAGR of 13.31% from 2022 to 2028. IBM’s holistic offering, including both infrastructure and software/solutions, could help their consulting business win more digital transactions deals, in my opinion.

Strengthen AI and Hybrid Cloud via Acquisition

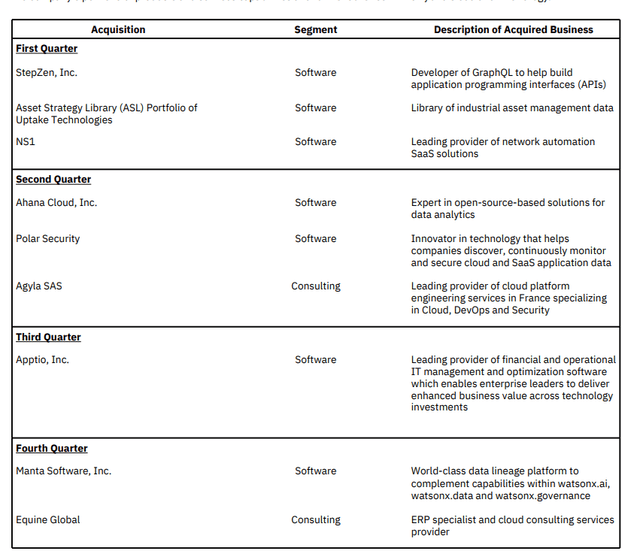

In FY23, IBM allocated $5 billion towards acquisitions, and they completed nine deals, as detailed in the table below.

IBM FY23 10K

Their acquisitions are focused on software and consulting businesses, aiming at strengthening their cloud offerings and AI technologies.

Among these deals, I want to highlight their acquisition of Apptio for $4.6 billion in August 2023. Apptio is a leader in financial and operational IT management and optimization software. The acquisition strengthens IBM’s IT automation capabilities, and the combined technology between IBM and Apptio could help enterprise customers automate their workflows in finance and back office. Additionally, Apptio is a SaaS provider, and the deal would enhance IBM’s recurring business mix. Apptio could leverage IBM’s existing technology in the hybrid cloud and infrastructures platform; consequently, I think IBM should be able to achieve tremendous revenue synergies from this acquisition.

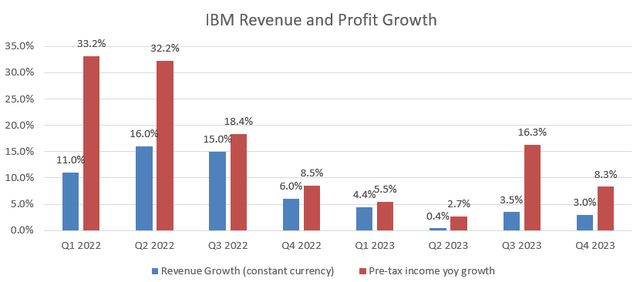

Recent Result and MSD Business Growth in FY25

IBM released their Q4 FY23 result on January 24, delivering 3% revenue growth and 8.3% pre-tax income growth year-over-year. For the full year, they generated $12.6 billion in free cash flow, paid out $6 billion in dividends and repurchased $402 million of own shares. The company expects MSD growth in revenue and $12 billion of FCF in FY24.

IBM Quarterly Results

For FY24’s growth outlook, I am considering the followings factors:

-Software: they have delivered an average of 7% revenue growth at constant currency over the past 3 years. I don’t anticipate any significant changes in the macro environment. As discussed previously, IBM’s acquisition strategy is focused on software deals. Consequently, I expect 6% organic revenue growth and 1% acquisition growth for IBM’s software. Considering the increasing AI demands for data center IT spending, the Enterprise Linux, OpenShift and Ansible Automation would continue to drive IBM’s software growth in the near future, in my view.

-Consulting: As IBM’s management indicated, the overall consulting market is projected to grow at 4%-6% annually, driven by AI, digitalization, and cloud computing. IBM’s consulting offers business transformation, technology consulting and application operations. In my view, it is a quite conservative assumption to project IBM to grow along with the market growth.

-Infrastructure: IBM offers infrastructure solutions across AI, data-intensive, and regulated mission-critical workloads. Historically, IBM’s infrastructure business has been growing at an average of 2%. Going forward, I expect their hybrid infrastructure continues growing, while the infrastructure support business would face some challenges as more workloads have been moving to clouds.

Putting everything together, I forecast IBM growing at 6%-7% in revenue at constant currency.

Model Updates

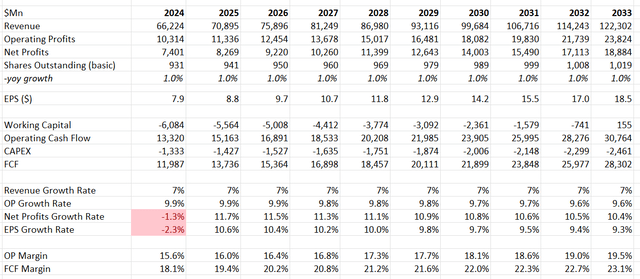

As discussed above, I assume 5% organic revenue growth in the model, reflecting mid-to-high single digit growth in software and consulting growth and LSD growth in infrastructure. Additionally, acquisition is expected to contribute 2% to the topline growth aligning with their historical average.

The margin expansion will be driven by gross margin improvement as well as SG&A spending. As IBM’s software is expected to grow faster than the group revenue growth, the shift towards more software could benefit IBM’s margin expansion. IBM’s software business delivered a pre-tax income margin of 25%, much higher than the group level of 18.2%. IBM allocated 30.7% of total revenue to SG&A in FY23, a big improvement from FY20’s level of 37.3%. Consequently, I forecast a 20bps margin expansion from gross margin and 20bps from S&G leverage.

IBM DCF – Author’s Calculation

The WACC is calculated to be 6.8% in the model, with the following assumptions:

-Risk free rate: 4.25%. 10-Year gov bond yield

-market risk premium: 7%; cost of debt: 7%

-beta: 0.65. SA’s 24-month data ((note: IBM is a very low beta stock))

-Equity: $22 billion; Debt: $56 billion

After discounting all the free cash flow, the enterprise value is calculated to be $274 billion. Adjusting the debt and cash balance, the fair value of IBM’s stock is estimated to be $247 per share, as per my estimate.

Key Risks

IBM offers security software including threat management, data security, and identity and access management. Precedence Research predicts that security market will grow at a CAGR of 8.3% from 2023 to 2032. It is quite obvious that IBM’s security business has been underperforming in the past few quarters, with security revenue declining by 6% in Q4 FY23. Several leading players, including CrowdStrike (CRWD), Palo Alto (PANW), have been delivering quite solid revenue growth in the past few years. I believe IBM’s security products are not well designed to meet the rapid demand for cloud security. In the future, IBM needs to take some transformational actions, such as acquisitions, to enhance their security software offerings.

Another uncertainty lies in their Consulting business. Accenture announced their Q2 FY24 result on March 21 and provided a weak outlook for their consulting business caused by the tightening enterprise budgets. For the consulting business, certain projects are quite discretionary, and enterprises may choose to cut back during periods of economic weakness. IBM’s growth in the consulting business could also be vulnerable.

Verdict

I believe IBM’s recent business growth has proved that they are on the right track to deliver stable and recurring revenue stream. Their M&A has been focusing on enhancing their software and consulting capabilities. I estimate their stock price is significantly undervalued and I upgrade the rating to ‘Strong Buy’ with a fair value of $247 per share.

Read the full article here