Mapping SITE’s Business

SiteOne Landscape Supply (NYSE:SITE) focuses on its commercial and operational initiatives that leverage the scale and resources as one of the US’s largest wholesale distributors in the landscape supply industry. It has a broad product portfolio, a balanced end-market mix, and comprehensive geographic coverage. It plans to fill the U.S. and Canada nursery, hardscapes, and landscape product lines. It has a robust acquisition strategy, and sales from the acquired companies added significantly to its sales.

However, the company’s pricing of products does not seem to offer any upside. Lower pricing can lead to a decline in its organic daily sales in 2H 2023. However, better cost management can keep its operating margin steady. SITE’s cash flows improved handsomely, while its balance sheet remained strong in the middle of 2023. The stock is reasonably valued versus its peers. I suggest investors “hold” the stock for a relatively improved medium-term return.

Deciphering The Strategy

SITE has a policy of growing the small customer base higher than the average through promoting private label brands. It estimates it has increased its partner program members significantly (by 50%) in 2023, where the new members are typically small-to-midsized customers. It plans to improve the cost structure by lowering inbound freight costs through a better transportation management system.

SITE aims to fill in its product lines in the U.S. and Canada. It has a robust acquisition strategy, which supplements its product portfolio and geographic expansion. It aims to grow primarily in the nursery, hardscapes, and landscape supplies categories. It primarily generates its business from maintenance, repair & upgrade, raising 65% of its revenues from here. New residential construction is the second largest contributor, accounting for 21% of its sales. The company is estimated to have a 16% share of the wholesale landscaping products distribution market worth ~$25 billion.

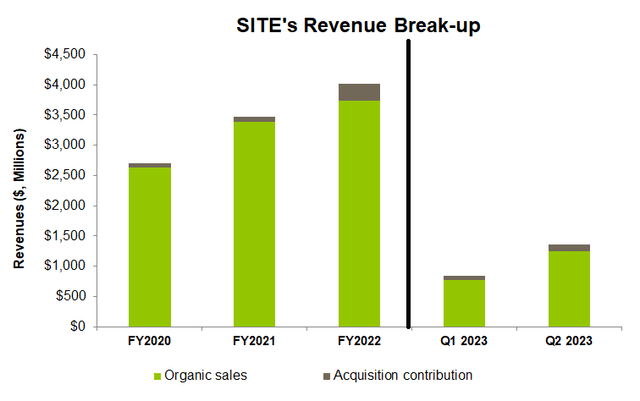

The Acquisition Boost

SITE’s Filings

Looking closely at the acquisition strategy reveals that the company completed 85 acquisitions since 2014. These companies have added $1.5 billion in trailing 12-month sales. In 2022 alone, it acquired 16 companies. From May to July 2023, it acquired three companies (Adams Wholesale Supply, Link Outdoor Lighting, and Hickory Hill Farm & Garden).

These acquisitions complemented its sales in various locations in Texas, Florida, and Tennessee with supplies for lighting and landscaping products. It will continue to add and integrate new companies to support growth. Because the industry remains fragmented and no company has a significant market share, it will likely provide an opportunity to continue growing through the inorganic route for a long time.

Pricing Trend

Prices have climbed considerably in the fertilizer, grass seed, and PVC pipe categories, particularly in June. In Q2, the category saw a 1% price hike versus 6% in Q1 and 19% a year ago. In 2H 2023, prices may decrease by “low single digits,” which would translate to similar price inflation in FY2023 compared to the previous year.

Investors may note that a year earlier, during Q2 2022, SITE had witnessed a sharp price hike. Although it lacked such a push this time around, the Hardscapes and Landscape Supplies acquisitions partially mitigated the loss. The company plans to manage the challenges of commodity-related deflation through better cost management. In 2H 2023, its gross margin will likely remain unchanged due to lower freight costs.

End Market And Outlook

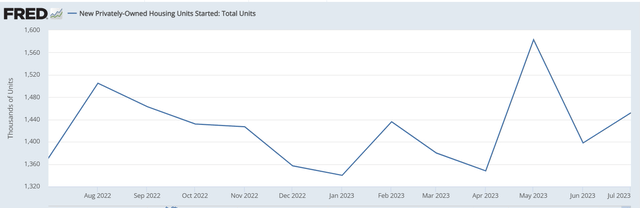

FRED

The permits of new privately owned housing units have grown by 6% in the past year until July. However, in 2023, the housing market has weakened compared to the second half of 2022. The company estimates that new residential construction accounts for 21% of its sales. This end market will remain dormant in 2H 2023. However, the management believes that the builders’ outlook has turned bullish. If the housing market turns around sharply in early 2024, it can lead to robust sales growth for landscaping products.

New commercial construction, on the other hand, remained resilient. This end market represented 14% of its Q2 sales. The sector is poised to do well in 2023 with steady customer activity and backlog. However, the repair and upgrade market will likely remain flat in 2H 2023. The maintenance category has the highest revenue contribution and can see modest growth. So, led by lower pricing, SITE’s organic daily sales can decline marginally in 2H 2023. Year-over-year, the company’s gross and adjusted EBITDA margin can vary between unchanged and slightly declined in 2H 2023. In 2024, the margins can start expanding.

Analyzing Q2 Drivers

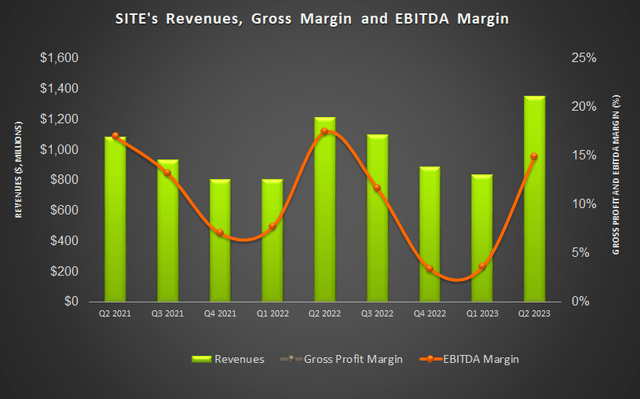

Seeking Alpha

In Q2, SITE’s organic daily sales growth increased by 4% (year-over-year), while sales addition from acquisitions added another 7% to its growth hike. The organic sales growth was more balanced across its product lines and regions in Q2.

From Q2 2022 to Q2 2023, the company’s selling days remained unchanged. Gross profit increased by 6%. Gross margin, however, contracted by 170 basis points in Q2. Despite the gains from various cost control initiatives, the company’s adjusted EBITDA margin contracted by 260 basis points in Q2.

Cash Flows and Balance Sheet

SiteOne Landscape’s cash flow from operations improved sharply and turned positive in 1H 2023 compared to negative cash flow a year ago. Higher revenues and lower inventory led to a steep rise in cash flow. Its free cash flow also turned positive in 1H 2023 compared to a negative FCF a year ago.

SITE’s debt-to-equity ratio (0.26x) is much lower than its peers’ (BECN, POOL, MSM) average of 0.7x. As of June 30, 2023, its liquidity was $524 million. So, robust liquidity ensures little financial risks. On July 12, it increased liquidity by enhancing the ABL borrowing facility.

Relative Valuation And Rating

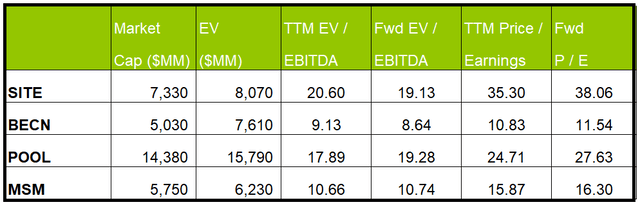

Author Created And Seeking Alpha

SITE’s current EV/EBITDA is expected to contract versus the forward EV/EBITDA multiple. The rate of contraction is steeper than some of its peers. This typically results in a higher EV/EBITDA multiple. The company’s EV/EBITDA multiple (20.6x) is much higher than its peers’ (BECN, POOL, and MSM) average (12.6x). So, the stock appears reasonably valued, with a negative bias, compared to its peers.

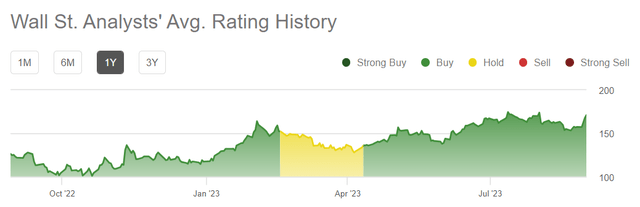

Seeking Alpha

In the past 90 days, six sell-side analysts rated SITE a “buy” (including “Strong buy.”) Three of the analysts rated it a “hold,” while one rated it a “sell.” The consensus target price is $166.7, suggesting a 1% downside at the current price.

What’s The Take On SITE?

Seeking Alpha

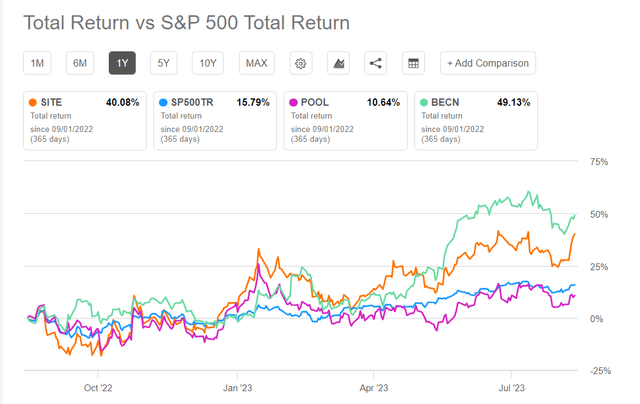

Looking at the fragmented nature of the landscaping end market, SITE aims to grow the small customer base faster than the average. To augment this strategy, it focuses on partner program members significantly. Because the end markets will either decline or see modest growth, it plans to improve margins by lowering inbound freight costs through a better transportation management system. So, the stock outperformed the SPDR S&P 500 Trust ETF (SPY) in the past year.

However, I do not see any favorable impact on the operating margin before 2024. In Q2, the company’s sales decreased. Benign pricing will cause muted revenue growth in 2H 2023. Cash flows, on the other hand, improved handsomely in 1H 2023. The company’s balance sheet is also robust. Given the relative valuation multiples, investors would want to “hold” the stock for a modest medium-term return.

Read the full article here