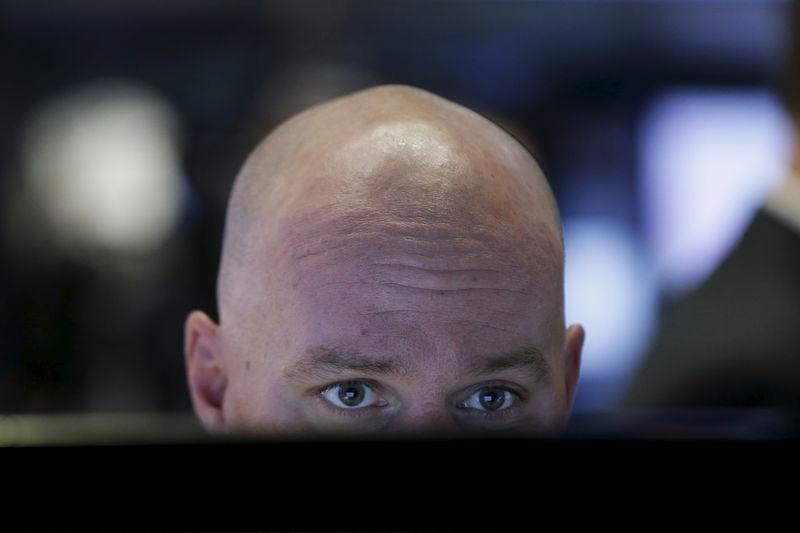

© Reuters. FILE PHOTO: A screen displays the trading information for New York Community Bancorp on the floor at the New York Stock Exchange (NYSE) in New York City, U.S., January 31, 2024. REUTERS/Brendan McDermid/File Photo

(Reuters) -Shares of New York Community Bancorp (NYSE:) dropped nearly 10.6% on Monday, resuming their descent after a one-day reprieve following a downgrade by ratings agency Fitch and a price target cut by brokerage Citigroup.

The bank’s shares had plunged nearly 45% in two days after reporting a surprise fourth-quarter loss due to higher provisions tied to its commercial real estate (CRE) portfolio.

They pared losses on Friday before Fitch downgraded the bank’s credit rating. Citi later lowered the target price on its shares to $7 from $11.

The trading in NYCB’s stock reflects increased levels of uncertainty, Citi analysts wrote in a note. “We don’t see a lot in near-term to change perception and see better risk-reward elsewhere.”

New York Community Bank on Monday confirmed its chief risk officer Nick Munson had left the company after the Financial Times had earlier reported Munson’s departure weeks ahead of the company’s fourth-quarter result.

“We can confirm that Nick Munson left the company in early 2024,” the bank said in an email.

NYCB’s results shone a spotlight on the banking industry’s exposure to the troubled CRE sector, where borrowers are under pressure due to higher interest rates and lower occupancies due to remote work.

Other mid-sized banks have also felt the heat. On Monday, the KBW Regional Banking index fell 1.9% while shares of Valley National Bancorp (NASDAQ:) and BankUnited (NYSE:) dropped 3.6% and 2.4%, respectively.

But analysts have said the issues at NYCB were specific to its balance sheet and were not reflective of other banks.

Investors should be “playing offense” with other U.S. banking stocks as the recent turmoil has created “attractive entry points,” Citi said.

Separately, NYCB kept the quarterly dividend for its preferred stock unchanged on Monday, days after it slashed the payout for its common shares by 70%.

The bank said it would pay a dividend of $15.94 per preferred share. Preferred shareholders are typically entitled to more favorable terms of dividend compared to common shareholders.

NYCB has said it is building capital to deal with stricter regulatory requirements after the purchase of Signature Bank (OTC:) last year pushed its assets above a $100 billion threshold.

Read the full article here