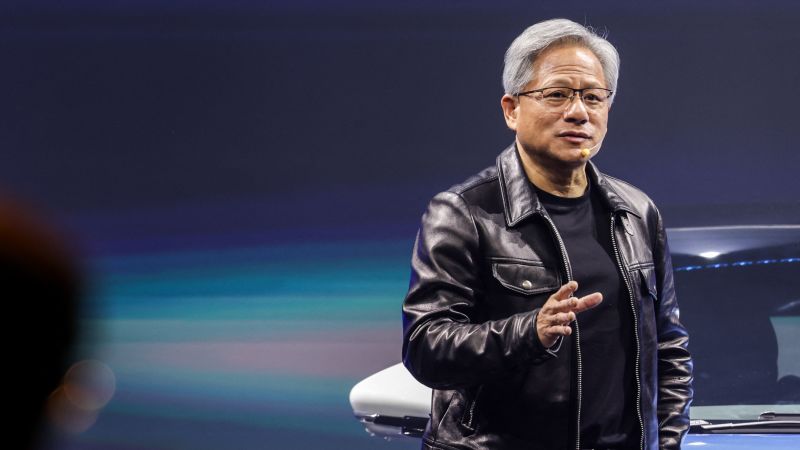

Nvidia CEO Jensen Huang’s wealth saw a major boost on Thursday as the company he cofounded in 1993 surged in value.

Now ranked by Bloomberg as the 21st richest person in the world, Huang expanded his wealth by as much as $8.5 billion on Thursday alone as his company’s stock price bumped up 15% in value during morning trading.

Huang, 61, is now worth an estimated $68.1 billion, passing Charles Koch and rapidly gaining on members of the Walton family, who own Walmart, which has a roughly $471 billion market cap. The list is topped by the Elon Musk, Bernard Arnault and Jeff Bezos.

Huang has been at the helm of Nvidia since its beginning, serving as co-founder, CEO, president and board member. He owns around 3% of the company.

The Taiwanese-born tech leader attended Oregon State University and Stanford University before working at now-competitor chip company LSI Logic and Advanced Micro Devices (AMD) and then launching Nvidia with Chris Malachowsky and Curtis Priem.

Malachowsky remains at Nvidia, while Priem left the company in the early 2000s.

Nvidia, now one of the largest companies on the stock market valued at just under $2 trillion, led gains Thursday after reporting extraordinary earnings growth, fueled by the artificial intelligence boom.

Huang said in a statement on Wednesday evening that generative AI has now “hit the tipping point.”

“Demand is surging worldwide across companies, industries and nations,” he added.

His words led to an explosive morning on Wall Street Thursday, a rapid reversal from earlier in the week when the company logged its worst day since October.

Profits of the chipmaker grew to nearly $12.3 billion in the three months ended January 28 — up from $1.4 billion in the year-ago quarter, a gain of 769% year-over-year and even stronger growth than Wall Street analysts had expected.

That result helped bring the company’s full-year profits up more than 580% from the year earlier.

Other chipmakers benefited from Nvidia’s good news. Shares of AMD (AMD) were 11% higher on Thursday and Microsoft (MSFT) rose 2%.

Nvidia is crucial to the burgeoning AI space. The American chipmaker accounts for around 70% of AI semiconductor sales in the world.

It is unmatched in producing processors that power artificial intelligence systems, including for generative AI, the buzzy new technology that can create text, images and other media.

Nvidia’s growth was highlighted in its earnings, even as Meta, Amazon, IBM and Microsoft have all begun producing some of their own chips, according to Dan Morgan, vice president at Synovus Trust Company.

Sales from the company’s core data center business grew 409% year-over-year to a record $18.4 billion in the fourth quarter, thanks to partnerships with infrastructure giants like Google, Amazon and Cisco.

But the company’s soaring stock price over the past year — shares grew around 230% in 2023 — means Nvidia is now deeply important to the broader market, too.

In a note on Tuesday, Goldman Sachs analysts called Nvidia “the most important stock on planet earth.”

CNN’s Clare Duffy and Nicole Goodkind contributed to this report.

Read the full article here