Co-authored with “Hidden Opportunities.”

In middle school physics, we learned about simple machines, those basic mechanical devices for applying force and getting work done. Think about the wheel and axle, one of the most important inventions in the history of humankind. As simple as it is, we wouldn’t survive without it – automobiles, trains, and nearly all factory equipment wouldn’t exist. We would be moving loads by carrying them or by using sleds or the backs of animals.

Pulleys, wedges, and inclined planes are all examples of simple machines instrumental in our daily lives, simplifying tasks that would otherwise be hard to complete. The engineer in me can’t stop appreciating and talking about simple tools and technologies that make our lives more comfortable. Let us get back on track to discuss simple techniques to brighten your retirement.

Dividends are the simple machines in the financial world, simplifying an otherwise complicated retirement by supplying a regular cash infusion into our accounts. No matter what the market does daily, I know a certain set of dividends will be credited into my account – this feeling is priceless.

They say the first million is the hardest. This is because once a certain level of wealth is attained, the power of compound interest plays a significant role. As investments pay dividends, and when those dividends are reinvested, we accelerate wealth accumulation, making subsequent millions easier (and more automated) to attain.

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” – Albert Einstein.

Like simple machines powering complex machinery, simple dividends coupled with the power of compounding is the secret to my healthy retirement. So, that is enough physics for today; let’s look at two picks to make some money.

Pick #1: RVT – Yield 7.5%

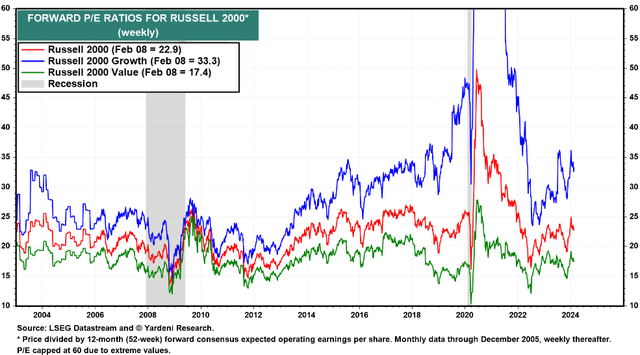

The financial markets ended FY 2023 with value stocks being historically cheaper than any other class of securities. The small-cap value category carried an average price / fair value ratio of 0.84%, implying a 16% discounted pricing, while large gap growth stocks traded at a whopping 15% premium. The divergent recovery from the 2022 bear market is clearly seen in the chart below, with investors overpaying for growth names at a time when our economy is grinding into a recession. Source.

Yardeni Research

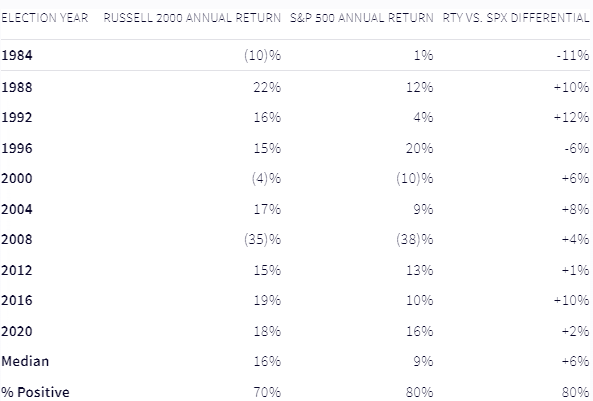

According to a study by Goldman Sachs, in 80% of the election years since 1984, the Russell 2000 has outperformed the S&P 500. Source.

Nasdaq

In addition to being an election year, in 2024, we expect to see a significant change in the Fed’s interest rate policy, and normalizing rates will trigger a valuation reset, fueling small-cap recovery in 2024.

Royce Value Trust (RVT) is a small-cap closed-end fund, or CEF, managed since its inception in 1986 by the same portfolio manager – Chuck Royce. Although Mr. Royce has taken a step back from lead portfolio manager duties since 2022, the Royce funds continue to benefit from his oversight and experience.

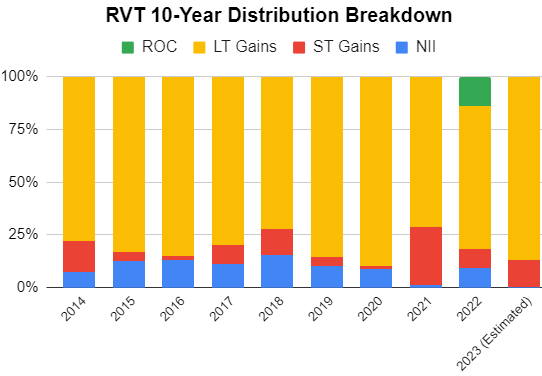

RVT is massively diversified across 486 holdings, a much-needed requirement as small caps tend to be a riskier investment class. The CEF is actively managed, with a 2022 portfolio turnover rate of 60%. This means a holding stays in the portfolio for about 20 months. As such, it doesn’t come as a surprise that a significant portion of RVT’s distributions over the past ten years have been from long-term capital gains.

Author’s Calculations

Industrials and manufacturing companies stand to benefit significantly from government incentives and initiatives to enhance domestic manufacturing capabilities. This segment is the largest holding for RVT, representing ~24% of the CEF’s assets. The next largest sector is financials (~19%), which continues to be deeply discounted following multiple bank failures from 2024 and stands to demonstrate strong recovery with interest rate normalization.

RVT does not utilize leverage in its investment strategy and maintains a variable distribution that is adjusted quarterly based on NAV at the end of the trailing four quarters. This means that the distribution rises and falls with RVT’s NAV, but since the calculation uses an average of the past four quarters, the payment changes are gradual.

RVT’s management fee structure reveals a rare feature among CEFs, indicating a significant incentive for management alignment with shareholder interests:

-

Advisor fees can increase or decrease based on the fund’s performance relative to the S&P 600 SmallCap Index benchmark.

-

The fund managers will forfeit fees for any month when the fund’s performance over a trailing 36-month period is negative.

At a ~11% discount to NAV, RVT presents an excellent bargain to ride the recovery of the small-cap sector. Small caps are well-positioned for a strong recovery in 2024, and RVT is one of the best income-oriented funds to ride this recovery. Driven by a time-tested active management strategy and a management team that eats its own cooking, this CEF pays 7.5% to wait for the big valuation reset.

Pick #2: BTO – Yield 9.1%

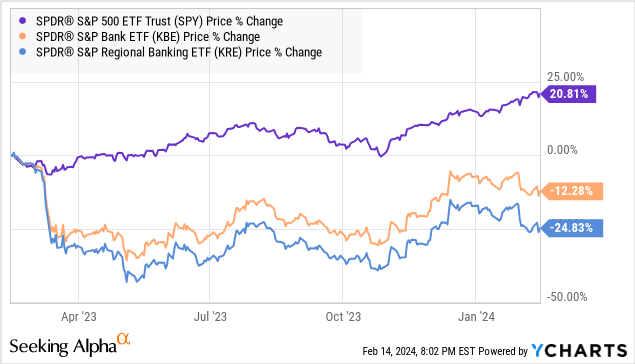

It has been ten and a half months since the FDIC shut down Silicon Valley Bank, making it the third-largest bank failure in the United States. Mr. Market feared banking names, and regional banks got the worst of his emotional spree.

Banks almost became the pariah of the stock market, with analysts of varying reputations and backgrounds attempting to predict the next “shoe that will drop.” But the reality is that the Feds moved quickly and aggressively, and there was no “contagion,” so to speak, in the sector. While banks recovered since their darkest days of 2023, they still remain significantly undervalued.

The terminal interest rate is almost here, and historical market performance shows that banks outperform when rates peak and head downward. This is because as interest rates fall, bond market valuations rise, easing pressure on banks and allowing them to boost their earnings and regulatory capital ratios.

RBC analysts point out two specific scenarios where rate peaks fueled banking sector rallies:

-

1994-95 rate cycle: The Federal Reserve engineered a soft landing after raising interest rates from 3% to 6%. Rate hikes ended in Feb 1995, but stocks bottomed months before and demonstrated a 55% rally in 1995-96.

-

2004-06 rate cycle: The Federal Reserve under Chair Alan Greenspan kept interest rates elevated from mid-2006 to late 2007. Stocks rallied through 2007 but plummeted due to the Global Financial Crisis, mainly due to credit problems.

Credit quality wasn’t an issue in 1994 but became a fatal problem for the financial sector in 2006, resulting in highly contrasting market outcomes.

Credit quality is closely monitored and healthy in today’s market. Banks have been operating cautiously amidst QT, and their loss-absorbing capacity remains historically strong, demonstrating readiness to manage an uncertain macroeconomic and regulatory environment. Average reserve coverage increased for the seventh consecutive quarter to 2.2%, comparing favorably with pre-pandemic levels (1.6% in Q4 2019). Similarly, bank CET1 ratios have been higher vs. historic levels, averaging 11.4% compared with 10.9% at the end of FY 2022 and 10.8% at the end of FY 2019. Credit agency Fitch expects banks to continue to preserve capital given regulatory uncertainty pending the finalization of proposed capital rules. RBC Capital Management estimates that U.S. banks have set provisions enough to handle credit losses and defaults for a scenario where the unemployment rate is 5% (We are at 3.8% per the December 2023 report).

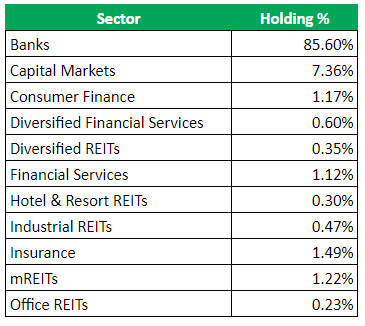

Banks continue to recover from the March 2023 scare, sentimentally and fundamentally. We want to get paid to ride the recovery with the John Hancock Financial Opportunities Fund (BTO) – a CEF with ~95% of its allocations to banks, capital markets, and other financial services companies.

Author’s Calculations

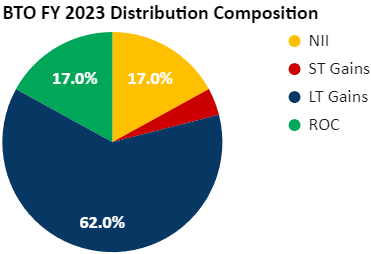

BTO’s distributions in 2023 comprised 62% Long-term Gains, 4% Short-term Gains, 17% net investment income, and 17% return of capital. We expect continued generation of capital gains in 2024 as bank valuations improve.

Author’s Calculations

BTO operates with a ~18% leverage at a modest interest expense of 0.47%. This sets the fund up for boosted returns with the banking sector recovery.

BTO distributes $0.65/share every quarter, reflecting a 9.1% annualized yield. Given the fund’s tenure in the market and demonstrated shareholder returns since inception, the CEF has always traded at healthy premiums (often double-digit) to its Net Asset Value. BTO is now a bargain, trading at par.

In today’s report, we discussed two past rate peaks (followed by cuts), and current banking sector parameters resemble one. Yet, market speculators tend to assume the worst in every scenario and draw parallels to only the problematic times of the past. As income investors, time in the market is money through healthy distributions. BTO’s 9.1% yield provides a great way to ride the banking sector’s recovery.

Conclusion

Little drops of water make the mighty ocean. Retirement is that big ocean that everyone worries and stresses about, but this can be simplified with multiple sources of income. Our Investing Group maintains a model portfolio of +45 securities, targeting an overall yield of +9%. We pride ourselves on this diversification – no single source constitutes more than a single-digit percentage of our portfolio income.

We consider dividends as the building blocks for financial progress and success. Together with the power of compounding, these can help snowball your retirement income, one dollar at a time. Beginning early, investing regularly, reinvesting consistently, and remaining rational in decision-making are the secrets to long-term wealth accumulation.

BTO and RVT are two time-tested CEFs with successful navigation through numerous bear markets and recessions. Their allocation to necessary yet undervalued sectors, current yield levels, and discounted valuation makes them attractive picks to boost our portfolio income. Every complex piece of equipment around us is built with simpler tools. I am simplifying my complex retirement planning with simple and reliable dividends. In sickness and in health, I get my share without any effort. That is the beauty of my Income Method and the unbeatable power of income investing.

Read the full article here