Introduction

CaixaBank (OTCPK:CAIXY) (OTCPK:CIXPF) is the bank with the largest footprint in Spain. While a Banco Santander (SAN) and BBVA (BBVA) have a much higher market cap, those two banks mainly generate their profits in Mexico and South America while CaixaBank still focuses on Spain. Even more so after the completion of the acquisition of Bankia.

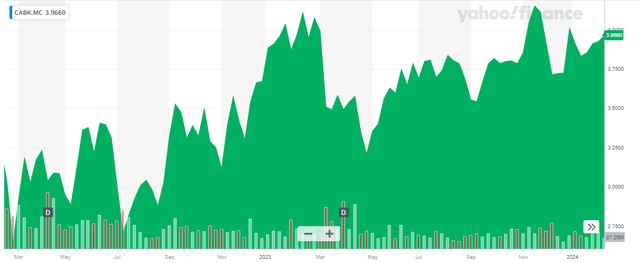

Yahoo Finance

The main listing of CaixaBank is on the Madrid Stock Exchange where the bank is listed with CABK as its ticker symbol. The average daily volume in Madrid is approximately 11.8 million shares to the Spanish listing, which clearly is the most liquid trading venue. At 3.96 EUR per share, the current market capitalization is almost 30B EUR.

All relevant documentation I will be referring to can be found here.

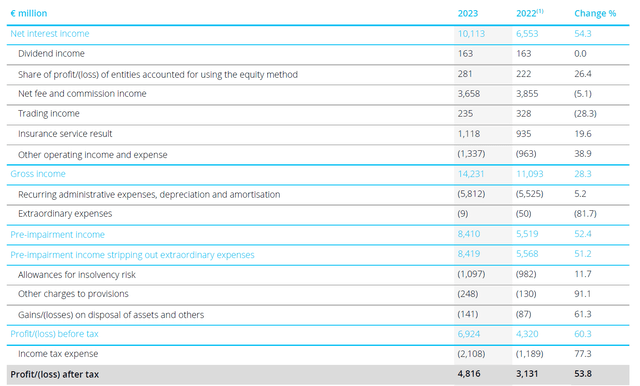

A very strong performance in 2023 results in a surprisingly high dividend

The bank’s reported net income was pretty strong, and definitely much stronger than I had anticipated. The net interest income increased to 10.1B EUR which is an increase of 54% compared to the previous year. Unfortunately, the trading income did decrease by approximately 28% while other operating expenses increased by approximately 39%. When all the dust settled, the total gross income still came in approximately 28% higher than in 2022 and with a result of 14.2B EUR the Spanish bank was well-prepared to cover the higher G&A expenses.

CaixaBank Investor Relations

The pre-loan loss provision and pre-tax income came in at 8.4B EUR which is an increase of 51% compared to 2022 and after setting aside about 1.1B EUR for loan loss provisions and 248M EUR for other provisions, CaixaBank reported a pre-tax profit of 6.9B EUR and a net income of 4.8B EUR. Divided over the current share count of approximately 7.5B shares, the EPS was 0.64 EUR per share. The bank is sticking with its payout ratio of approximately 60% and has declared a 0.39 EUR dividend. This means CaixaBank will retain approximately 25 cents per share, or almost 1.9B EUR, as equity on its balance sheet.

Based on the current share price of just under 4 EUR per share, the dividend yield is now coming in at approximately 10%, subject to the standard Spanish dividend withholding tax of 19%.

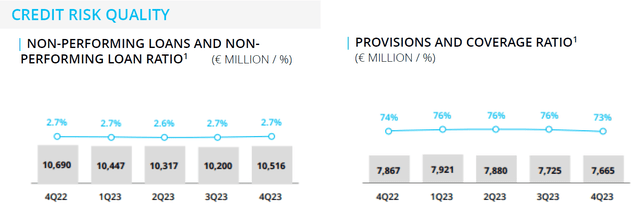

At the end of 2023, the bank’s total amount of non-performing loans was 10.5B EUR which was 2.7% of the loan book. While that sounds high, CaixaBank has also been adding to its loan loss provisions and has kept its coverage ratio relatively stable in the mid-70% range. This is where European banks are quite different from American banks. In Europe, it’s pretty standard to only have provisions to the tune of a certain portion of your non-performing assets while American banks traditionally have loan loss provisions that are higher than the total amount of soured loans.

CaixaBank Investor Relations

As long as the non-performing loan portfolio is well-managed, I don’t have an issue with a coverage ratio of less than 100% as there generally is collateral to cover a portion of the loan size.

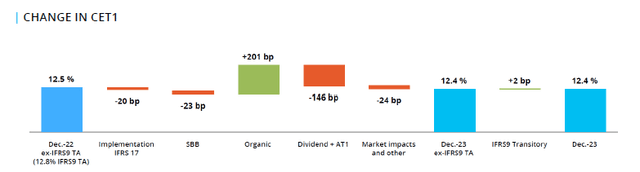

The capital ratio remains strong

It’s always interesting (and important) to keep an eye on the capital ratios of a bank. Looking at CaixaBank’s FY 2023 results, the bank ended the year with a slightly lower CET1 ratio which came in at 12.4% compared to 12.5% at the end of 2022. But as the image below shows, there isn’t really a reason to be too worried: there was a 20 bps hit from the implementation of the new IFRS 17 accounting rules which has an impact on how insurance-related items have to be reported. Excluding the IFRS impact, the CET1 ratio would have increased to 12.6%.

CaixaBank Investor Relations

The impact of the strong earnings result this year is clearly visible in the CET1 evolution. The 2023 profit contributed 201 bps to the capital ratio, but of course the generous dividend proposal has a negative impact on the CET1 evolution as well.

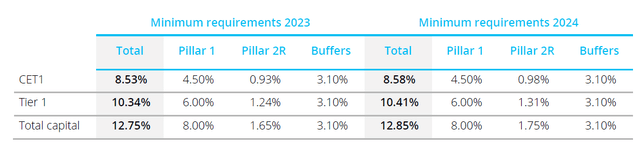

That being said, the 12.4% CET1 ratio still exceeds the minimum required capital ratio by a wide margin. As you can see below, the regulatory minimum for CaixaBank is to end the year with a CET1 ratio of at least 8.58%. I like the odds of seeing the bank exceed this requirement by 400 bps.

CaixaBank Investor Relations

As of the end of 2023, CaixaBank’s total amount of risk-weighted assets on the balance sheet had increased to 228.6B EUR. This means that an excess capital position of 400 bps would equal approximately 9B EUR in excess capital. This represents approximately 1.20 EUR per share. Of course this doesn’t mean the bank will return the ‘excess capital’ to its shareholders, but it is a very useful safety net to have to ensure the bank can get through tougher times without having to resort to capital raises to shore up the balance sheet.

Investment thesis

CaixaBank is currently trading at a small discount to the tangible book value per share, which was established at 4.20 EUR per share as of the end of December (the total book value per share, including intangibles, was 4.93 EUR per share). Meanwhile, the P/E ratio of just over 6x makes the stock pretty appealing: as the capital ratios are relatively strong, the bank has no issue paying a very attractive dividend while it still retains almost 2B EUR per year in earnings to further bolster its capital position and perhaps expand its loan book.

I have a small position in CaixaBank, but it feels like I missed my window of opportunity to add to this position. That being said, I should focus on the future and considering the bank is trading at just 6x earnings, it for sure is still attractive enough for me to add to my position.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here