Loyalty to country ALWAYS. Loyalty to government, when it deserves it.”― Mark Twain.

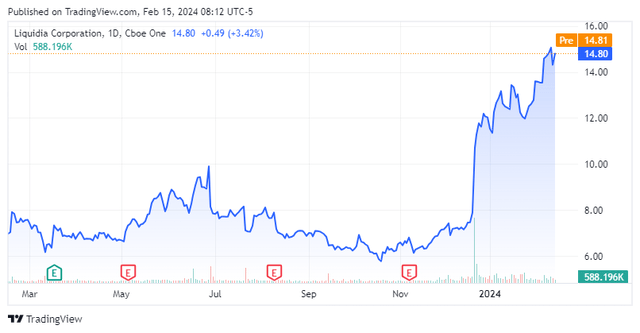

Shares of pulmonary hypertension concern Liquidia Corporation (NASDAQ:LQDA) rallied 36% in one trading session after a U.S. appeals court invalidated the patent of rival United Therapeutics Corporation (UTHR). The decision paves the way for the full approval of its PAH and PH-ILD med Yutrepia, likely in 1H24; however, owing to its protracted court battle with United, additional competition looms. With an original January 24, 2024, PDUFA date for label expansion into PH-ILD and recent insider buying from a former United president and co-CEO, Liquidia merited a deeper dive. An analysis follows below.

Seeking Alpha

Company Overview:

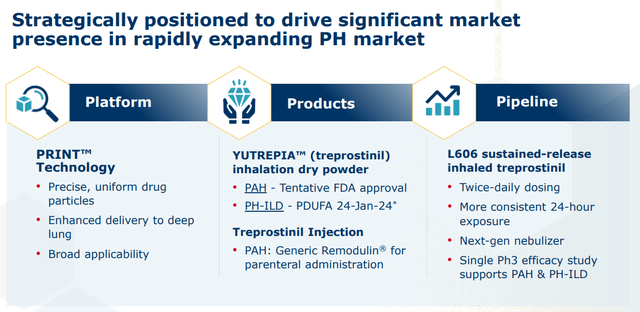

Liquidia Corporation is a Morrisville, North Carolina based commercial-stage biopharmaceutical concern focused on the development of treatments for pulmonary arterial hypertension (PAH) and pulmonary hypertension with interstitial lung disease (PH-ILD). The company’s sole focus is the compound treprostinil, of which it: markets a generic injectable version; has received tentative FDA approval for an inhalable dry powder formulation (Yutrepia); and is advancing a sustained-release inhaled form in a Phase 3 trial. Liquidia was founded in 2004 and went public in 2018, raising net proceeds of $47.3 million at $11 per share. The stock trades at around $15.00 a share, translating to an approximate market cap of $1.1 billion.

January Company Presentation

History of Treprostinil

The compound that currently forms the basis of Liquidia is a manufactured version of prostacyclin, a naturally occurring substance in humans that promotes vasodilation. United Therapeutics first received approval for the compound as injectable Remodulin for the treatment of PAH in 2002. It was later granted a green light for a nebulized version (dubbed Tyvaso) in 2009 and an oral tablet in 2013 (Orenitram). United then expanded its Tyvaso label to include PH-ILD in 2021, making it the first approved med for this indication. United subsequently in-licensed a dry powder inhaler version (Tyvaso DPI) from MannKind, which was approved for both indications in May 2022.

January Company Presentation

After acquiring RareGen in late 2020, Liquidia began marketing a generic version of Remodulin under a 50/50 profit share arrangement with European genetic manufacturer Sandoz (OTCQX:SDZNY). It generated sales of $13.0 million in the first nine months of 2023 (YTD23), up 23% from $10.6 million in YTD22.

January Company Presentation

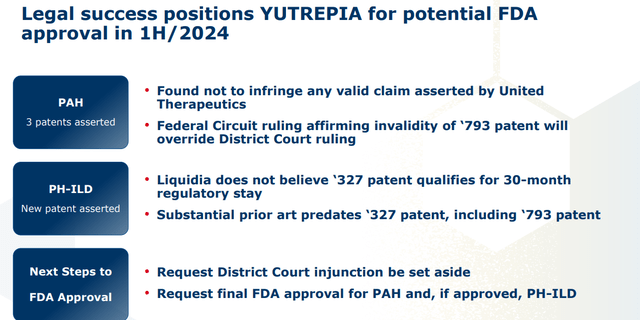

The company also received tentative approval for Yutrepia in the treatment of PAH in November 2021. However, it has been embroiled in multiple lawsuits with United, which have effectively blocked its entry into the marketplace. Without getting too deep into the minutia, Liquidia finally prevailed on December 20, 2023 when a U.S. appeals court invalidated United’s patent ‘793, rendering any patent infringement litigation null and void. This verdict could set the stage for full FDA approval of Yutrepia for both PAH and PH-ILD sometime in the first half of this year. The review period was extended by the FDA late in January of this year. The government agency requested no new information that was needed to make a decision around the application, it should be noted.

January Company Presentation

Liquidia is attempting to expand Yutrepia’s label into the latter indication with an original PDUFA date of January 24, 2024, which was recently extended. Assuming tentative approval, regulatory exclusivity for this indication ends March 2024. For the avoidance of doubt, United is aiming to attain a regulatory stay of 30 months for this indication, citing infringement of another patent. That litigation is ongoing.

Yutrepia

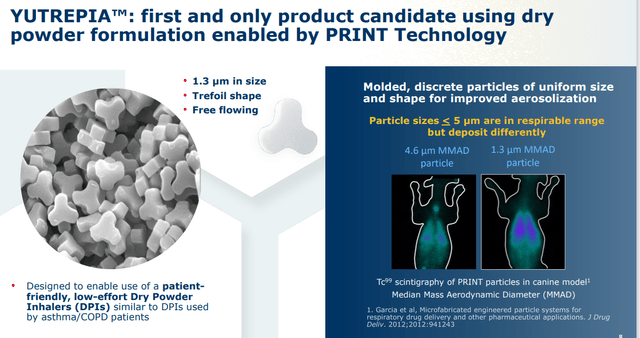

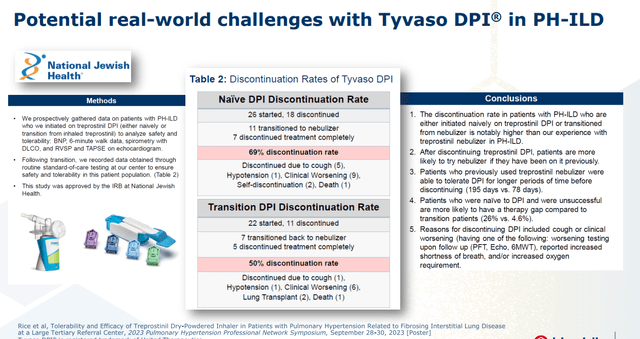

The reasons for United’s vigorous defense of its turf are the amount of revenue it is realizing from its Tyvaso-Remodulin-Orenitram franchise (estimated at $2.1 billion in FY23) and the potential superiority of Liquidia’s delivery system, courtesy of its PRINT particle engineering platform that enables precise production of uniform drug particles. Yutrepia’s small size and homogeneity allows for greater aerosolization and higher dosing with less systemic toxicity. Both are inhaled four times a day, but Tyvaso DPI has been riddled with discontinuation issues due mainly to clinical worsening as not enough treprostinil gets into the lungs. Furthermore, unlike Tyvaso, Liquidia’s med does not require refrigeration.

January Company Presentation

PAH and PH-ILD Marketplace

Although United is a leader in the PAH/PH-ILD space, Johnson & Johnson (JNJ) is poised to generate FY23 revenue of more than $3.7 billion from its PAH franchise, primarily consisting of twice-daily oral prostacyclin pathway med Uptravi and oral endothelin receptor antagonist Opsumit (macitentan). PDE-5 inhibitors, such as tadalafil and sildenafil, are sometimes prescribed for PAH, although there primary use is for erectile dysfunction.

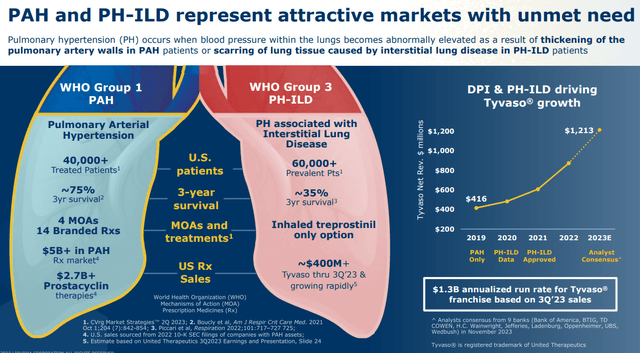

Taking a step back, PAH is elevated blood pressure within the lungs as a result of a thickening of the pulmonary artery walls. In PH-ILD patients, scarring of lung tissue caused by ILD is the high blood pressure culprit. The patient population for these indications is ~85,000 for PAH in the U.S., EU, and Japan with a five-year mortality rate of 43% (25% at three years) and ~135,000 for PH-ILD in the same geographies with a three-year mortality rate of 65%. In 2022, total sales of PAH and PH-ILD meds reached $4.6 billion with $2.7 billion targeting the prostacyclin pathway. When final figures for 2023 are tallied, total revenue from these two indications will be well north of $5.5 billion.

Looming Threats

At the clinical level, a direct threat to Yutrepia is Insmed’s (INSM) prostanoid Treprostinil Palmitil Inhalation Powder (TPIP), which is designed for once-daily dosing as compared to four times a day for the former. Readouts from Phase 2 studies covering both indications are expected in 2024 with a PAH Phase 3 trial slated for 2025.

Outside the prostacyclin pathway, Merck’s (MRK) subcutaneously administered activin signaling inhibitor sotatercept achieved statistical significance (p<0.001) on its primary endpoint (six-minute walk distance) in a 324-patient Phase 3 PAH trial (STELLAR), validating its $11.5 billion acquisition of Acceleron. Furthermore, it demonstrated an 84% reduced risk of time of death or first occurrence of a ‘clinical worsening’ event. This therapy, which targets the proliferation of cells in the pulmonary arterial wall, is expected to make a weighty splash in the PAH market as it may be prescribed prior to prostacyclin pathway meds – assuming approval on or near its March 26, 2024 PDUFA date.

It should also be noted that Liquidia is trying to close the dosing gap versus TPIP by advancing L606, a sustained release version of treprostinil, which is being studied in an open-label Phase 3 trial for: PAH patients who are transitioning from Tyvaso, PAH patients naïve to prostacyclin; or PH-ILD patients who are transitioning from Tyvaso. A registrational placebo-controlled Phase 3 trial for the twice-daily candidate in patients with PH-ILD is anticipated to begin sometime in 2024, which management believes will be good for both indications.

Balance Sheet & Analyst Commentary:

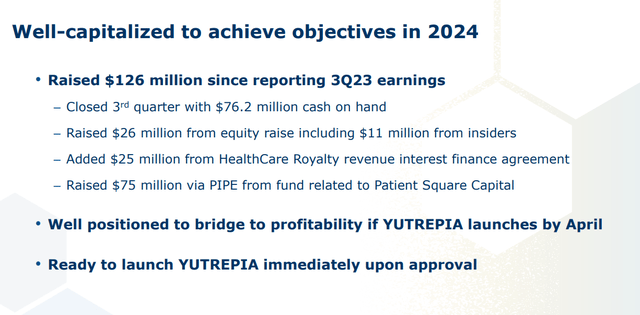

Liquidia conducted a series of financings, one prior to and two after the litigation victory, consisting of $26 million from a secondary (prior), $25 million (for a total of $77.5 million) in revenue interest financing from HealthCare Royalty (at tiered rates potentially varying between 0.36% and 10.28%), and $75 million from a PIPE. Added to the cash of $76.2 million on its books as of September 30, 2023, management had believed it has enough capital to attain profitability if Yutrepia launched by April 2024. The recent extension adds uncertainty to that forecast needless to say.

January Company Presentation

With the exception of one outlier, the Street is positive on Liquidia’s prospects, featuring six buy or outperform ratings against one underperform with a mean price objective of $19.75. That said, filtering down to just the post-litigation commentary, price targets are $3, $15, $28, and $30. The negative outlook comes via Wedbush, who initially downgraded shares of LQDA to underperform in September 2022 as it became clear that the court saga with United would delay Yutrepia’s launch to 1H24. It reiterated its bearish stance after Liquidia’s recent victory, citing United’s head start with its Tyvaso DPI and the impending approval of Merck’s likely disruptive sotatercept.

Sporting an opposite view, CEO Roger Jeffs invested $1 million of his own money on the aforementioned secondary (price at $7.16 a share) on December 14, 2024. He was joined by board member Paul Manning, who invested $8 million. It should be noted that Jeffs was at rival United in many roles for 18 years until 2016, his last positions being President & co-CEO.

Verdict:

Those insider buys were rewarded when shares of LQDA surged 36% to $10.70 in the trading session subsequent to the favorable court ruling. Liquidia’s stock is now up more than 80% since the patent invalidation.

As for the longer-term, there are plenty of moving parts. Yutrepia is superior to Tyvaso DPI and should convert a meaningful number of patients, albeit at a lower price point, probably in the neighborhood of 70% to 75% of Tyvaso DPI, which currently sells for around $135,000 annually. However, with sotatercept’s likely disruptive and imminent approval, Yutrepia’s push into the PAH space may be truncated.

That leaves PH-ILD, into which Yutrepia can have a much larger impact, assuming it achieves two outcomes. First it must receive tentative approval from the FDA for PH-ILD, which should set the stage for full approval, hopefully in the first half of this year. Then, it must skirt any 30-month regulatory stay that United will surely pursue over another patent – in this instance ‘327. Liquidia’s current market cap implies ~$250 – $300 million in peak sales for Yutrepia, which is a meaningful understatement if its label is expanded to PH-ILD and it can launch sometime in the first half of this year.

As such, the recommendation is to stay on the Liquidia Corporation sidelines until Yutrepia is approved for PH-ILD and then keep an eye on United Therapeutics Corporation. This is a story we are likely to follow up on at some point in 2024.

Politics is the art of looking for trouble, finding it whether it exists or not, diagnosing it incorrectly, and applying the wrong remedy.”― Ernest Benn

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here