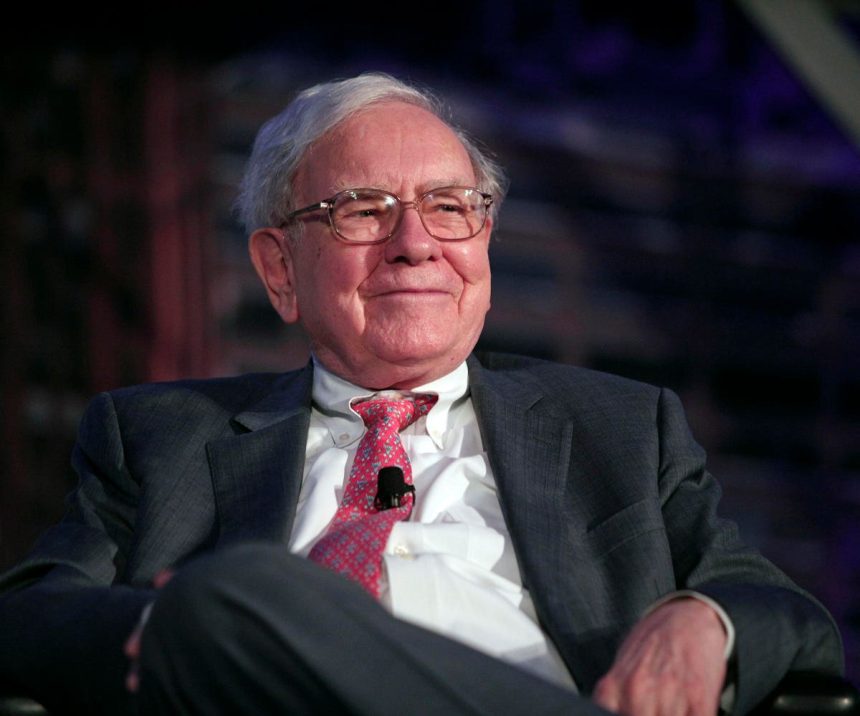

Berkshire Hathaway’s (BRK/A, BRK/B) second-quarter 2023 13F filing revealed three new U.S. homebuilders purchases. This filing gives us a quarterly opportunity to observe what two of the greatest investors, Warren Buffett and Charlie Munger, and their team are doing within Berkshire’s publicly traded equity portfolio. Berkshire purchased shares of D.R. Horton (DHI), NVR

NVR

Since Berkshire’s publicly traded investment portfolio is worth $348 billion, this was a relatively small investment into the home building industry at less than one-quarter of a percent of the total publicly traded stock portfolio. So is Warren Buffett behind the decision to buy these stocks? The size of the holdings is evidence that it was probably Todd Combs or Ted Weschler who pulled the trigger on these buys, but that is only circumstantial evidence. The 13F filing only tells us the position size at the end of the quarter and is released 45 days after the end of the quarter. Berkshire could have continued to build its position after the quarter. Also, all three stocks outperformed the S&P 500 by a wide margin in the second quarter. Buffett is notoriously disciplined about the price of his purchases, so he could have stopped acquiring shares when they were above his limit and thus led to the relatively meager position size.

This analysis looks at the Berkshire homebuilder portfolio across a host of measures, including 12-month forward estimated: price-to-earnings (P/E), price-to-sales (P/S), enterprise value-to-earnings before interest, taxes, depreciation, and amortization (EV/EBITDA), price-to-book (P/B), dividend yield, current debt-to-EBITDA, current free cash flow yield, current operating margin, and long-term earnings-per-share growth consensus estimates.

The Berkshire homebuilder portfolio reflects significantly cheaper valuations across many measures versus the S&P 500. In addition, the Berkshire homebuilders have better profitability and cash flows, hallmarks of Buffett stock purchases. It should be noted that analysts expect earnings to decline, which helps explain the valuation discount. While new home sales have bounced recently, the pace of sales remains well off the highs.

The sharp rise in mortgage rates is likely the primary headwind for new home sales. The average 30-year fixed mortgage has risen from 2.8% in February 2021 to 7.6% last week. The impact has made housing affordability worse than during the housing bubble. One crucial difference from the past is that housing inventories remain historically sparse. The surge of homebuying during the ultra-low mortgage rates surrounding the pandemic makes those homeowners less likely willing or able to sell their homes as the low mortgage payment can’t be replicated at today’s mortgage rates. Please note the recent divergence in direction between existing home sales and new home sales.

Given the inventory situation and U.S. demographics, home building seems less likely to plunge to 2008 levels despite the challenging affordability situation. Some relief on mortgage rates could also be forthcoming if the Federal Reserve begins to cut short-term interest rates next year as expected.

Despite being the most dangerous words in investment management, it might really be different for the homebuilders this time. All three companies continue to produce profits and free cash flow even at lower levels of housing activity. Indeed, earnings compare favorably to past instances at these levels of housing transactions. Focusing on D.R. Horton, the company recently forecasted an improvement in profit margins and home production. In addition, D.R. Horton’s balance sheet looks solid, so it should be able to weather the storm if things deteriorate.

Berkshire’s portfolio managers might have additional insights since the firm controls several housing-related businesses like Clayton Homes, Shaw, Johns Manville, Acme Building Products, Benjamin Moore, and MiTek, which posted lower quarterly and year-to-date earnings in the second quarter. Berkshire noted in the earnings release that the impact of higher interest rates on home construction means that “some of our businesses will experience comparative declines in revenues and earnings over the remainder of 2023.” In addition, Berkshire Hathaway HomeServices (BHHS), the country’s largest residential real estate brokerage firm, posted results showing the slowdown in housing activity remains evident, with a 59.5% decline in second-quarter net earnings versus 2022. Indeed, the purchases probably reflect a view that better news is on the horizon and the future might not be as dire as the expectations of a future earnings decline.

The new purchase of shares in three homebuilders is notable given the challenges evident in the soaring mortgage rates. The cheaper relative valuation and a possibly divergent view of the future fortunes of homebuilders are plausible explanations for the interest in the trio of stocks.

Read the full article here