I upgraded Alexandria Real Estate Equities, Inc. (NYSE:ARE) in September, anticipating more robust support from investors looking to buy the well-battered life sciences REIT. However, that proved to be a month early, as it formed its bottom only in October 2023, bottoming out at the $90 level.

Accordingly, ARE has recovered more than 30% through last week’s highs (price-performance terms), as dip buyers returned aggressively in November, lifting its momentum further. As a result, my ARE buy thesis has turned positive, slightly outperforming the S&P 500 (SPX) in total return terms since then (+3.17%).

I assessed ARE’s bottom in October/November as pivotal, marking a significant reversal in fortune for the leading REITs, particularly for ARE, given its premium valuation and higher growth profile.

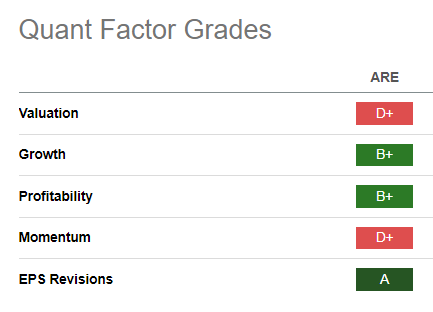

ARE Quant Grades (Seeking Alpha)

As seen above, ARE is assigned a “D+” valuation grade but is rated with a solid “B+” growth grade. Despite that, ARE last traded at a forward FFO per share multiple of 12.7x, well below its 10Y average of 18.7x. Its forward dividend yield of 4.22% is also well above its 10Y average of 3.15%, suggesting it remains materially undervalued relative to its historical averages.

As a result, I gleaned that the opportunity for investors looking to buy its recovery is still early, providing a relatively attractive risk/reward profile. The company’s third-quarter or FQ3 earnings release in late October led to a sell-off, which was ultimately defended robustly.

I can understand why these investors sold in October, as there were signs of more competitive supply headwinds in Alexandria’s market, suggesting it could face increased rental or tenancy pressure moving ahead. Also, I raised concerns about the fungibility of lab and office space in my June article, which could worsen the demand/supply dynamics.

Despite that, Alexandria still boasted robust occupancy, same-store cash NOI growth, and rental rate growth metrics. Moreover, it sees improved occupancy rates toward the end of FY23, “projected to reach about 95% by year-end.” In addition, management accentuated that the fears about the health of the life science industry could have been overstated, given the secular growth opportunities.

Furthermore, management highlighted that 80% of its leasing transactions are attributed to its existing tenant base, corroborating the strength of its rental profile. Moreover, these life science and biopharma tenants are engaged in growth opportunities “driven by emerging-stage companies reaching milestones and needing growth space.” In addition, “large pharmaceutical and biotech companies seeking footprints in life science clusters” also require increased space requirements from Alexandria, underpinning the REIT’s long-term growth opportunities.

Management highlighted that investors are understating the impact of these opportunities, ranging from “massive unmet medical needs, with over 90% of known diseases lacking treatments, driving innovation and industry growth.” Also, increased use of AI/ML would require more lab space, bolstering the “emergence of new therapeutic modalities such as cell, gene, and RNA medicines, [which] is expected to contribute to the growth of the industry.”

Notwithstanding these tailwinds, given its growth premium and relatively unattractive valuation, the market needed to de-rate ARE. Despite the battering, ARE last traded at a forward dividend yield of 4.22%. It’s still lower than the 2Y (US2Y), which fell to a June low of 4.54%. Macroeconomic factors matter as income investors have much more competitive yields to invest in, necessitating the downward de-rating in ARE.

However, with the Fed expected to have reached the end of its rate hike campaign, investors are expected to focus on what’s ahead, even though it’s still too early to assess rate cuts. Despite that, I assessed positive buying sentiments in ARE as it bottomed out resoundingly in October, suggesting the worst is likely over.

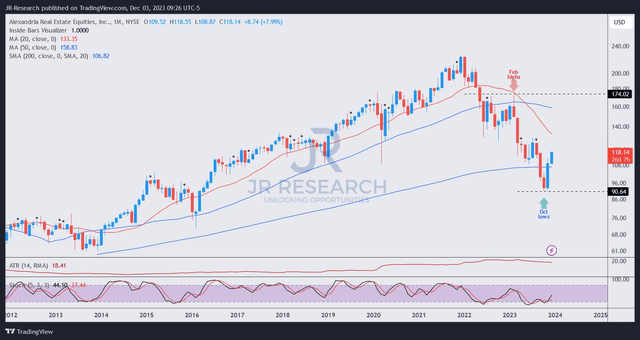

ARE price chart (monthly) (TradingView)

Price action investors should glean an astute bear trap or false downside breakdown (see price action glossary) formed in October 2023 as the last of the “weak hands” capitulated.

The reversal in November and December has recovered all the losses from October so far, as ARE revisited lows last seen in 2016, exceeding a seven-year low.

Notably, the false downside breakdown occurred at a pivotal zone, underpinning ARE’s long-term 200-month moving average (purple line). As a result, significantly improved investor sentiments returned at a crucial moment, underpinning the long-term uptrend bias in ARE.

With that in mind, I’m increasingly confident in ARE’s long-term recovery thesis from these levels, notwithstanding near-term volatility that could follow after its sharp recovery over the past month. While a pullback is anticipated, it should provide a better opportunity for Alexandria investors to add more positions more aggressively.

Rating: Upgraded to Strong Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here