Today’s piece is a long overdue follow up to my original Mesa Air Group, Inc. (NASDAQ:MESA), published back on January 13, 2023.

Seeking Alpha

Although in the short term, MESA shares did have a leg up, moving from the mid $2s to a high-water mark of $3.82, struck on March 9, 2023, it has been all turbulence since then. In fact, since the end of July 2023, Mesa shares have nose dived, moving from about $2 per share to as low of $0.40. Recently, share have rebounded, back into the $0.70s, which is a big percentage move off of $0.40, but again, for investors in Mesa, myself included since early January 2023, it has been ugly.

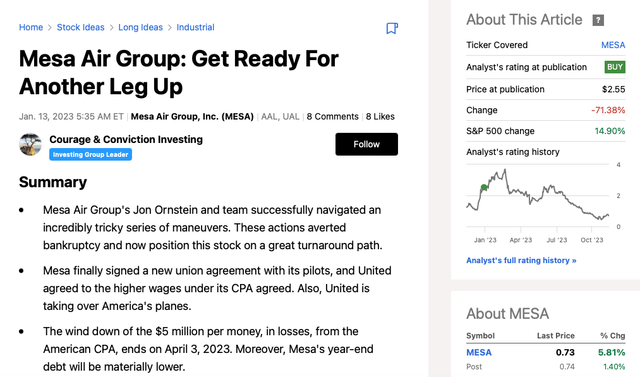

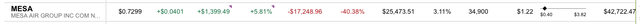

Enclosed below is my Mesa exposure.

Fidelity

Fidelity

Let’s face it, since the second half of 2021, running a portfolio almost entirely made up of small cap value stocks has been extraordinarily difficult. August 1 – early November 2023 has been like surviving the ‘Small Cap Zombie Apocalypse’. Although, and this why I don’t try and mess around with market timing or worry too much about making macro calls (because it is nearly impossible to do it well and even harder to do it consistently well), November 2023 has been amazing and turbo charged my year-to-date returns. That said, and keeping it real, thus far in 2023, and now with one month to go, Mesa Air has been my third largest mistake in terms negatively impacting the 2023 portfolio performance. My other two larger mistakes, in 2023, both of which are now realized losses, is a topic and ground that I will cover in the future piece, in more of a year-end, year in review format, perhaps in early January 2024.

Sorry in advance for the short, but necessary, context and backstory. As for the matter at hand, whether Mesa shares are changing hands at $0.40 per share or $0.73 per share (yesterday’s closing price, which is only a $30 million market capitalization), I would argue this is a ridiculously low market capitalization. Therefore, I’m going to walk readers through why I think Mr. Market is incorrectly pricing in an imminent bankruptcy. Also, I don’t want to rehash too much detail from 2022, as I covered those aspects, in original January 2023 Mesa article. So, just to be clear, the idea is to look forward and explain my thought process and why I continue to own a healthy amount of Mesa shares despite the really bad price action and big drawdown, in Mesa’s stock price, since July 2023.

What Makes Mesa Different

Mesa Air is a regional airliner which, in December 2022, renewed its 5 year CPA (capacity purchase agreement) with best in class and industry titan, United Airlines Holdings, Inc. (UAL). As I covered in the original write up, and reiterate now, United is the linchpin to the entire long Mesa long thesis. Importantly, Mesa has worked well with United for over thirty years and its executive team, CEO, Jon Ornstein, and CFO and COO, Michael Lotz, have a very strong relationship with United. If you read or listen to any Mesa’s past three or four conference calls, the company talks extensively about this relationship. Clearly, United greatly values its relationship with Mesa, as they have reached a lot of win-win small deals, all in the spirit of supporting Mesa during this prolonged and difficult transition period.

To be clear, outside of my Mesa equity bet as well as of owning some Southwest Airlines (LUV) 5 year investment grade bonds, I do very little when it comes to investing in airlines. I was attracted to the Mesa, as a special situation story and setup, because of Jon Ornstein’s passion and leadership and more so because of Mesa’s strong partnership with United Airlines. For context, and for readers that haven’t spent anytime fishing the icy waters, or surfing the boom & bust cycles of airlines stocks, I would argue Scott Kirby, the CEO of United Airlines, is the Jamie Dimon of the industry. Simply put, Scott and his team have their finger on the pulse of the industry, have made both bold and what proved to be prescient investments in growth. He and his team seem to be Wayne Gretzky-esque, whether it be the smart international expansions, moving upstream to the higher end of the market, with premium offerings, and deftly placing massive new Boeing’s (BA) 737 MAX and Airbus A321neos orders well before it was obvious.

Moreover, and speaking of prescient, as United is one of the first major players, within the broader publicly traded airlines sector to report, back on October 18, 2023, which now feels like a lifetime ago, they made some bold statements. Lo and behold, what Scott said during the conference call was spot on, as other peers report a week or two later.

If I was a short seller, and I’m not, Scott more or less suggested the lowest cost players, like JetBlue Airways Corporation (JBLU), Spirit Airlines, Inc. (SAVE), and even once formidable Southwest Airlines Co. (LUV) would post poor Q3 results. Lo and behold, this is exactly what happened.

Given my Mesa investment, I listened to United Q3 FY 2023 conference call and synthesized it that evening.

United’s diverse revenue streams have also allowed us to handle variations in demand and produce solid, absolute, and even better relative results. It’s evident in the numbers. United and one other airline expected to count for 98% of the total industry revenue growth this quarter, and over 90% of the industry’s total pre-tax profitability. Even in a tough industry environment, United’s diverse model is yielding strong, absolute, and even more impressive relative margins.

(United Airlines Q3 FY 2023 Conference Call)

And by the way, in case you’re wondering and not well versed on the sector, Delta Air Lines, Inc. (DAL) is the other profitable airline he was referencing in the quote above.

The entire United Airlines Q3 FY 2023 conference call was illuminating for people that are intellectually curious and that like mosaic theory and trying to connecting dots.

As the conference call was very lengthly and is readily available on Seeking Alpha, as SA does a great job of providing conference call transcripts, in a timely fashion, I’m only going to highlight a few key points.

Specifically, he called for a major shakeout in the domestic industry.

By the way, we also expected and now believe it’ll happen even faster, that the domestic market is going to see a shakeout that leads to an improvement in margins over the medium to long-term. It’s impossible to call the timing exactly, but I guess that we see meaningful industry changes by 2H ‘24. And for what it’s worth, that’s what has happened every single time we’ve been through one of the cycles in my career.

If you’re intrigued then read on.

Why are these low-cost airlines so unprofitable? Why does United have top tier results? And first, I just want to be really clear. United’s domestic network is profitable. So it’s not simply our great global network that’s creating this outcome for us. The first issue, of course, Mike talked about it is cost. Every airline has to manage higher inflationary cost pressures with the lowest cost carriers’ cost structure relative to the legacy carriers are clearly converging. The shrinking cost gap is just a fundamental shift for United and our industry. And I guess, I would rank that number one.

You said it’s impossible to run your airline like it’s 2019. High utilization was a critical ingredient for success of certain models, and that’s simply not possible, where we are today. And also having large labor cost differentials are not possible. Low-cost carriers also tend to operate at a very high gauge already. It will be much more difficult for them to drive cost materially lower with larger gauge planes like United. United has increased domestic gauge more than any airline since 2019, and our plan is to push that even further in the years to come.

Another issue that I think we should talk about is it’s difficult for many to grasp is not every ASM is created equal. It’s easy to mistake often in the middle of really large spreadsheets that everyone uses to evaluate our outlook, right? At United, we proved this point early in 2018 and ‘19 with our growth and revenue performance and we just did it again in Q3.

Market saturation of the low-cost business model in certain regions is creating very low marginal RASMs for some of our competitors. In fact, many of our competitors have marginal revenue percentages that are negative. There are only so many seats Florida, Cancun or Vegas can support in such a short period of time. Also low-cost carriers generally must operate a very large gauge equipment to have low-cost without the connectivity benefit of the hub-and-spoke business model, expansion of the low-cost model into smaller and medium-sized markets with these very large jets lacking connectivity just creates low marginal RASMs.

Market saturation and the mismatch of gauge and other connectivity continues to plague certain business models. Expansion opportunities with this type of business model are not endless in our view, but in response to that shortcoming, many of our domestic competitors have doubled down with plans for even more growth in 2024. 2024 marginal growth in markets will absolutely be no better than 2023. No airline network team would say, let’s add the bad markets in 2023, so we can save the good ones for 2024.

The other factor is the percentage of ASMs that these airlines have in new markets. Very fast growth rates simply create a high percentage of new capacity, which by its nature in the best of times is below average. The fourth quarter — this fourth quarter, United has less than 1% of our ASMs in new markets versus ‘19. This is an absolute difference maker. And capacity growth is designed as a strategy to maintain low cost without revenue accretive markets to add the entire business model can break. And that is what we think is happening right now.

United’s domestic capacity growth has always been about correcting a gauge mismatch created by the overuse of high-cost passenger and friendly single-class regional jets. At United, we have this diversity of revenue streams that provide us long-term stability and earnings that a one-dimensional plan will never achieve. We have a range of products, including array of premium seating options that’s increasingly popular with our travelers.

We fly as much capacity in global markets as we do domestically. We fly to big cities and small. We have a great hub-and-spoke business model. United has significant margin accretive growth, and we’ve proven that time and time again. United’s business model can support dramatically higher gauge and once added, we spill less and less traffic to others. United’s higher gauge will create more and more cost conversions between now and 2027. The complexity of United’s product offering is not a disadvantage. It, in fact, is a structural advantage that generates revenues more than the cost it creates by the complexity and just cannot be replicated.

In the past, United and other legacy carriers that have emerged from the crisis smaller, creating excess planes and other resources for others to grow. This time, that will not happen. This time around, it is not United with the low margins. We will not adjust our plans. United’s focus on global markets has clearly won the day in Q3, and you can see that in the results. Our focus on domestic gauge is absolutely the right one. We’ll no longer spill as much revenue to others as we’ve done in the past. Our focus on basic fares means we’ll be able to be even more competitive.

Again, I apologize for this amount of detail, but I’m only sharing pieces of a fascinating conference call. To translate what United is saying, I would argue he is saying that there is a major, major paradigm shift already in motion. And this paradigm shift was kicked off by the massive pilot union wage increases as well as other rising trends, which should prove stickier and longer lasting. Secondly, United plans to win via gauge. Gauge is flying larger planes with say 175 seats vs. 105 seats. So you can offer fewer flights, so think less pilots, but still have the same number of available seats now that you are adding larger planes into your domestic network. Therefore, pre-pandemic, the mantra and mindset on Wall Street was to favor the low cost, lean and mean, and nimble ULCC players, as on paper and via the ratio comparisons, these companies look like they were better operators, with superior economics. Now, unequivocally, Scott Kirby and his team are saying the industry has changed and United can compete across the entire industry spectrum, from low cost domestics up through luxury and international routes.

To make a long story short, and I grant you this is multi-faceted analysis and somewhat complex to synthesize, my key takeaway is United is the biggest, baddest, and most profitable airline on the block. They have strategically out classed and out muscled many of their domestic peers and they have the bumper profits to show it. Lo and behold, Mesa Air Group is one of United partners, albeit a small one and more of role player, think utility/ back up infielder. That said, based on previous commitments and support offered by United to Mesa, to weather the post COVID / massive pilot shortage / huge pilot wage increase headwinds, I don’t see Mesa going bankrupt, at least not anytime soon.

To quickly recap, Mesa moved away from its former partner, American Airlines Group Inc. (AAL), as American hung Mesa out to dry. American wouldn’t agree to increase its compensation for block hours flown in American’s network even though they, like anyone in the entire industry, were equally facing the dramatic pilot pay increases during the renewal cycles of the pilot union contract negotiations. Yet, United, also a long time partner of Mesa, took a dramatically different view, and agreed to adjust its payment per block hour flown to account for the major and dramatically higher pilot wages. Secondly, and this is well covered by Jon Ornstein, over the past three or four conference calls, United has worked very closely with Mesa on asset sales and the formation of their Aviate program, to help Mesa get back into fight shape. As I’ve said before, United views Mesa as a valued partner and the Aviate program offers the best signpost of this. It is a testament to the farm system role Mesa plays within the framework of United growth ambitions and the way the company operates its hub and spoke network.

Why Mesa Isn’t Going Bankrupt Anytime Soon

As I covered Mesa’s relationship with United, above and in excruciating detail, let me walk readers through the rest of the thesis.

Let’s start with the bear thesis and why the stock is priced for bankruptcy. As of June 30, 2023, Mesa had only $51 million of cash, $124 million of short-term debt, and $442 million of long term debt. The company’s Q2 and Q3 FY 2023 operating cash flow has been ugly, marred by the prolonged transition away from American, operating costs associated with owning 36 surplus aircraft, in excess of the 80 aircraft tied to its CPA with United, as well as a slower ramp in block hour, flown by United, during Q2. Now, the cardinal issue, outside of the high debt load has been a chronic shortage in pilots. In fact, Mesa has a 5 year CPA with United, now 4 year CPA, as nearly one year has elapsed. So, unlike a ULCC, Mesa does’t have to worry about jet fuel prices, airport fees, capacity utilization of flights, booking trends, etc. All Mesa has to worry about is attracting and retaining its pilots, maintaining safe and reliable planes, and its crew associated with running a regional airline with a CPA agreement.

What gives me some comfort, comfort in the relative sense of the word, through the lens of a battle tested small cap contrarian investor are two things.

1) Mesa has a clear path to profitability as they have the 80 planes and now 4 year CPA with United. The only thing holding them back is hiring another 150 pilots, mostly Captain (and not First Officers). And Mesa has been aggressively, strategically, and maniacally focused on this effort (see Exhibits A & B).

2) On the Q3 FY 2023 conference call, at least back in August 2023, Mesa had a firm purchase agreement on 14 of its 36 surplus CRJ-900 aircraft. This was expected to generate $92.3 million of proceeds (including the elimination of $74.3 million of debt collateralized including the elimination of $74.3 million of debt collateralized). In addition, not owning the surplus planes would save $3 million per quarter in interest cost and maintenance expenses (see Exhibits C & D).

Exhibit A

To meet United’s target utilization, we will need approximately 150 more pilots, primarily captains. Once we reach United’s target utilization, which we consistently achieved prior to the pilot shortage, we will generate pretax margins between 7% and 10% in our base business.

Given our current pilot outlook, as well as cooperation and support from United Airlines, we believe we will reach United’s target utilization by the end of fiscal year 2024 (September 30, 2024)

(Mesa’s Q3 FY 2023 Conference Call – August 12, 2023)

Exhibit B

Mesa is addressing our captain and first officer imbalance with our direct-entry captain program in cooperation with United. This effort has been supported by a new requirement in United’s Aviate program that pilots must have 2 years of captain experiences before transitioning to United. In addition, unlike some carriers, Mesa has the ability to require qualified first officers to upgrade to captain.

We also continue to develop our in-house recruiting and training initiatives. In particular, the Mesa Pilot Development Program has worked very well. We now have 10 aircraft at our first location in Inverness, Florida. Currently, we have approximately 2,000 applicants with commercial pilot license who need to build additional hours to reach their 1,500-hour requirement. We have already graduated an initial cadre who have performed very well in training at Mesa.

Given the benefits of Aviate and MPD, in combination with our industry-leading pay scale at the top of the regional industry, we now have approximately 1,900 new hire applicants. While our pilot attrition over the last 6 months has been at pre-pandemic levels, the pacing item has now become the availability of upgradable first officers. A stable pilot base and a healthy pipeline remain essential to the turnaround of our business.

(Mesa’s Q3 FY 2023 Conference Call – August 12, 2023)

Exhibit C

Now let me walk you through some of these items. Of the 36 surplus CRJ-900 aircraft, we have purchase agreements on 14, the disposal of which will result in cost savings of approximately $3 million per quarter. We are also in negotiations to dispose of an additional 15 CRJs, which will deliver cost savings of approximately $2 million per quarter. The remaining 7 surplus CRJ-900s have not been disposed of and hold carrying costs of approximately $2 million per quarter. We also have 12 engines that we are marketing.

(Mesa’s Q3 FY 2023 Conference Call – August 12, 2023)

Exhibit D

We have $26.3 million of scheduled principal and finance lease payments remaining in 2023. And after the repayment of debt associated with asset sales, we expect fiscal year 2023 year-end debt of approximately $490 million.

Notably, we expect our current transactions, involving our 14 surplus CRJs that we currently have agreements on, will reduce our debt levels by $74.3 million and provide another approximately $18 million in cash. Given ongoing uncertainties in the business, we will not provide any more specific fiscal year guidance at this time.

(Mesa’s Q3 FY 2023 Conference Call – August 12, 2023)

Modeling Cash Flows

Mesa is very tricky to model given all of the moving pieces and unknowns, including timing associated with the transition. We know that block hours drive revenue and block hours are a function of Mesa hiring enough Captains (and /or upgrading First Officers, which they are they allowed to as part of their recent amended pilot union contract).

On the Q3 FY 2023 conference they said the following about the cadence of block hours.

Next, I’d like to review our block-hour capabilities. In the June quarter, we flew 45,301 block hours, roughly in line with our estimate of approximately 46,000 that we had provided. Looking forward, we expect that our September quarter block hours is to be roughly the same or slightly higher than the June quarter. Our initial projections for fiscal 2024 are an increase of roughly 4% to 6% per quarter. Our block-hour production is highly dependent on our ability to upgrade first officers, attract direct-entry captain, and is based on our most recent attrition rates.

As of Q3 FY 2023, Mesa had 36 surplus CRJ-900s and 20 spare engines. These are assets that can be utilized to retire the associated collateralized debt and well as reduce the quarterly carry or burn rates, think interest expense and maintenance expenses. As I covered above, as of the August Q3 FY 2023 conference call, they had a purchase and sales agreement on the 14 CRJ-900s. Based on triangulating past plane sales, and we don’t have the luxury of knowing all of the details of the planes being marketed, but I think it is both logical and reasonable to assume a value of $5 million to $6 million, per plane makes sense. This is probably a good proxy for value, again in the absence of having all of the details. The engines could be worth $3 million each, depending on blocks hours and condition. Therefore, it is logical to conclude that Mesa surplus assets, in excess of the 14 CRJ-900s, so the 22 other CRJ-900s and 12 out of the 20 engines are worth upwards of $150 million.

Moreover, as Mesa spelled out on the Q3 FY 2023 conference call, because of the debt and maintenance costs associated with these surplus assets, not only will selling the asset reduce Mesa’s debt, but it materially reduces its ongoing carry costs.

See below:

Now let me walk you through some of these items. Of the 36 surplus CRJ-900 aircraft, we have purchased agreements on 14, the disposal of which will result in cost savings of approximately $3 million per quarter. We are also in negotiations to dispose of an additional 15 CRJs, which will deliver cost savings of approximately $2 million per quarter. The remaining 7 surplus CRJ-900s have not been disposed of and hold carrying costs of approximately $2 million per quarter. We also have 12 [olefin] engines that we are marketing.

The sale of which will result in cost savings of approximately $2 million per quarter. Meanwhile, the disposition of 14 engines to United this past quarter will result in cost savings of approximately $1 million moving forward.

Another important nuances and why Mesa’s debt looks higher is because there were off-balance sheet planes leases that came onto Mesa’s balance sheet subsequent to Mesa’s Q4 FY 2022 conference call.

And as I mentioned in Exhibit A, there is a clear path to pre-tax profitable (Q4 FY 2024 or July 1, 2024 – September 30, 2024) to the tune of high single digit operating margins. So, on a pro-forma basis, if all of the surplus assets are sold, and in a timely fashion, debt could plausibly get down under $400 million, and perhaps to $375 million, depending on the trajectory of Mesa’s block hours and how fast they ramp up.

Given the excruciating amount of detail, I don’t want to risk losing the reader’s attention and therefore I’m going to wrap things up with a Risk Section.

Risks

- The biggest risk is that Mesa didn’t sell the 14 CRJ-900s. If this didn’t happen then an 8-K should have been issued as that would have been a material event.

- Mesa needs to hire 150 new pilots, mostly Captains. This is what it takes to get back to operating profits and flying enough block hours. Mesa’s management team has to make this happen for the company to survive with current equity intact.

- Mesa has a lot of debt. Therefore, the assets sales, of surplus assets, need to happen and the more quickly the better. The debt interest expense is costly and net debt be reduced.

- Mesa’s CFO was hired away. Michael Lotz, who was the long-time CFO and COO got slotted back into the CFO seat.

Putting It All Together

At face value, and based on a $30 million market capitalization, clearly Mr. Market is pricing/ signaling Mesa’s equity is hurdling towards imminent bankruptcy. Let’s face it, outside of short lived points in the boom & bust cycles, airline equities have been a great place for investors to lose a lot of equity capital. Throw in macro fears, higher interest rates, and elevated jet fuel prices and pitching an airline stock, outside of say a UAL or DAL, is a ‘hard pass’ to most small cap value investors, perhaps upwards of 99 out of 100 times, even folks that traverse the most rugged terrain. One look at Mesa’s recent operating cash flow burns and debt pile make it glow radioactive in terms of risks. Just to be clear, I’m saying Mesa is super risky and this idea is super contrarian, bordering on radical.

That said, if you take a step back, Jon Ornstein and Michael Lotz are long time and battle tested airline executives and they have a strong relationship with United, a relationship forged over thirty years of collaboration. To tie back the Jamie Dimon reference, back in the depths of the financial crisis, when a firm was on the precipice of making it, having the right relationships, in banking, was the difference between making it and saving the equity and lower creditors or hitting the rocky coastline. United has proven to be a great partner and Scott Kirby is the Jamie Dimon of airlines. Well, companies are collections of people, and upper brass or the high priests, of companies, are almost always the ultimate decision makers. If you read Scott Kirby’s commentary, on UAL’s Q3 FY 2023 October 2023 conference call, he is point blank telling the ULCCs, he’s coming for them. He’s going to drink their milkshake, Daniel Day-Lewis, There Will Be Blood style!

Therefore, I would argue that Scott Kirby’s word is money good and he and his company value its relationships with its network partners. United values Mesa as its farm team agreement, via Aviate and the important role it plays, in the training and grooming grounds of pilots that have ambitions to fly for a big player, like United. Secondly, and equally as importantly, as long as Mesa sold those 14 excess CRJ-900, Q4 FY 2023 (ending September 30, 2023), they will have the capital to service the near term and current debt. Thirdly, the difference between making money and losing money, as an operating company comes down to increasing flown block hours, as Mesa has a robust pipeline of pilot candidates that just need to accumulate their 1,500 training hours, and prove to be ready to safely fly.

In closing, this is a long over due follow up on Mesa. Unless you traded the 50% pop, between my early January 2023 publication date and early March 2023, the thesis has been quite slow to play out. For all of the reason argued above, I would argue there is an illuminated path out of the thicket of the wilderness. Whether or not Mesa and its management thread the needle, we shall find out.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here