The hatred runs deep

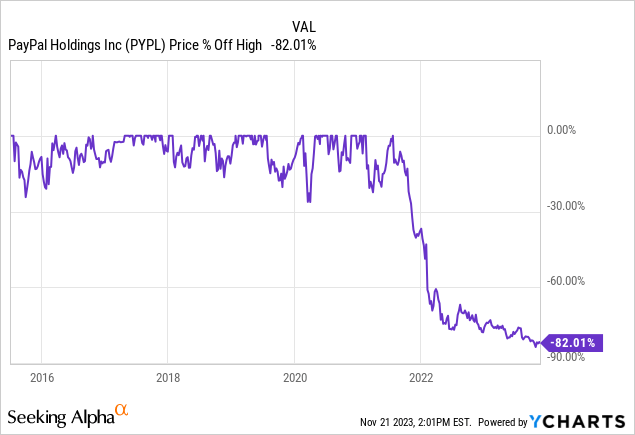

I previously wrote about another fin-tech, a strong buy, clobbered 80% down – Block Inc. (SQ). I also noted that I have started to buy PayPal Holdings Inc. (NASDAQ:PYPL), similarly down nearly 80%, this stock has some fundamental advantages and disadvantages to the Block Inc. pick. Block is growing at faster rates on the top and adjusted non-GAAP bottom lines. PayPal is more mature, has been GAAP profitable for some time, and is returning capital to shareholders through buybacks.

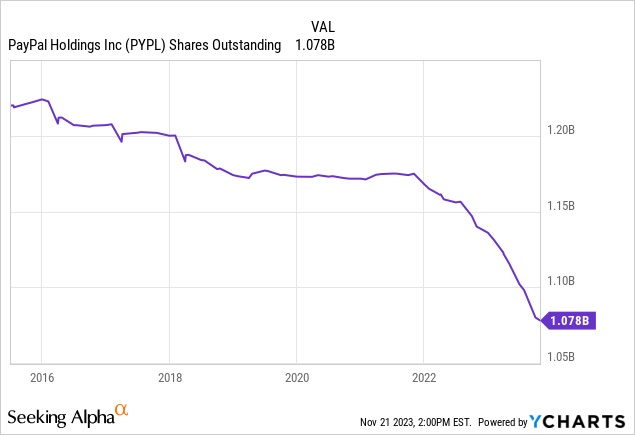

The buybacks are one of the most attractive items to me in this whole thesis. Warren Buffett and others tout that management should buy back shares when it is determined to be trading below intrinsic value. Few managers, when facing an 80% decline in share price, have the gall to do so. With $5.4 Billion in share repurchases on a trailing 12-month basis, new CEO Alex Chriss has my respect if this continues.

If the price stays here for another year and another $5.4 Billion in share buybacks ensue, the shares outstanding could be reduced by nearly 9% with a $61 Billion market cap. This is a stock that I hope stays down for the next 12 months while I accumulate. These are hated stocks, hopefully, the hatred runs deep enough to overlook value.

What they do and revenue exposure

From PayPal’s company profile:

PayPal Holdings, Inc. operates a technology platform that enables digital payments on behalf of merchants and consumers worldwide. The company provides payment solutions under the PayPal, PayPal Credit, Braintree, Venmo, Xoom, PayPal Zettle, Hyperwallet, PayPal Honey, and Paidy names. Its payments platform allows consumers to send and receive payments in approximately 200 markets and in approximately 150 currencies, withdraw funds to their bank accounts in 56 currencies, and hold balances in their PayPal accounts in 25 currencies.

Competition:

- Block Inc.

- Fiserv (FI)

- Fidelity National Information Services (FIS)

- Global Payments (GPN)

Active users PayPal

Statista

We can see by active users within PayPal’s ecosystem that they are steadily climbing, but the breakneck speed which we observed during the “hands off” transaction period of Covid-19, has slowed substantially. The numbers on top and bottom are fine, but in fin-tech, as with many tech-related companies, other metrics related to users and user growth are used to determine success. There has to be a plateau somewhere and that’s where goals switch to monetizing each user at greater and greater levels. This is the stage we are entering.

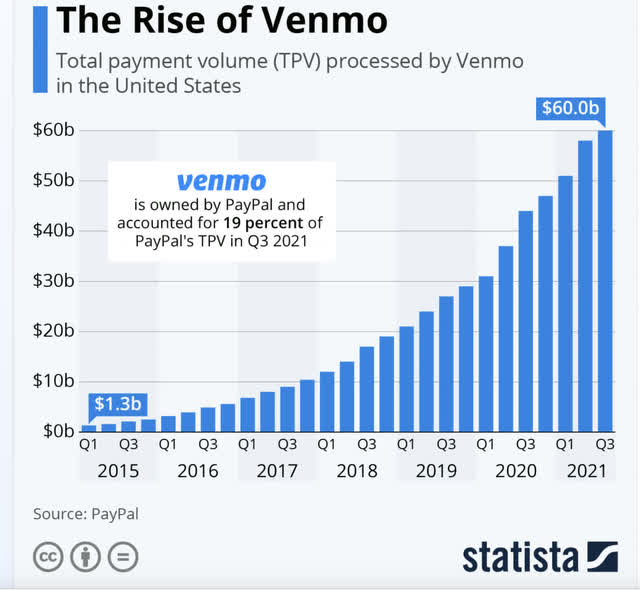

Payment volume Venmo

Statista

Since the acquisition of Braintree circa 2013, the payment checkout integrator plus owner of Venmo, total payment volume has steadily climbed. Venmo was a first mover and has a larger user base than Cash App, at 78 million versus Cash App’s 44 million. Other competition like Apple Pay entering the arena has also put a damper on investor’s perceptions, however, that is generally only used by Apple (AAPL) product users while both Cash App and Venmo are universal across all devices. Venmo is becoming a verb. Verbs are important according to Berkshire Hathaway chief Ted Weschler when recently asked about Uber (UBER) :

Weschler told Gerstner that Uber is a technology company he can understand “because it’s a verb – you Uber.”

“We like verbs in Omaha,” Weschler continued, nodding to Buffett’s hometown where and Berkshire’s headquarters are located. “We get consumer products that people love and that are irreplaceable. And as far as we’re concerned, that’s the attribute that makes Uber most interesting.”

To quote my younger cousins, “Venmo me”.

Most recent quarter revelations

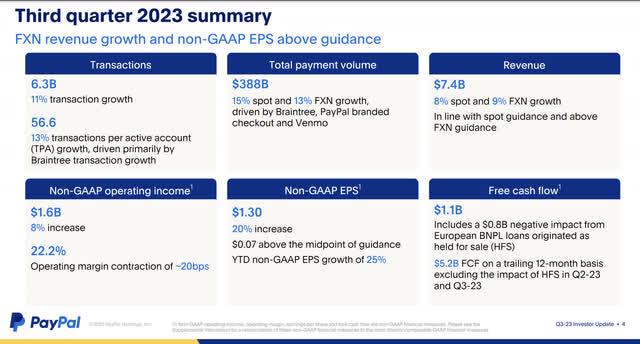

Highlights from Q3:

- Total payment volume (TPV) of $388B, growing 15% at spot and 13% FXN.

- FY-23 non-GAAP EPS now expected to grow ~21% to ~$4.98.

- FY-23 share repurchases expected to reach ~$5B, with ~$4.6B of free cash flow.

PayPal Investor Relations

The results of Q3 are certainly not those of a company that you would expect to trend down to the order of -80%. Yes, PayPal is an older fin-tech brand. Maybe some of the initial feelings of love from the honeymoon of yore are starting to wear off. Be it as it may, this company is still growing in several facets.

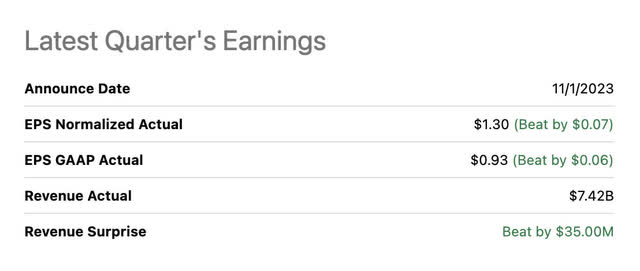

As for just the GAAP per share top and bottom line numbers, we had beats on both.

Seeking Alpha

Anti-bubble for certain

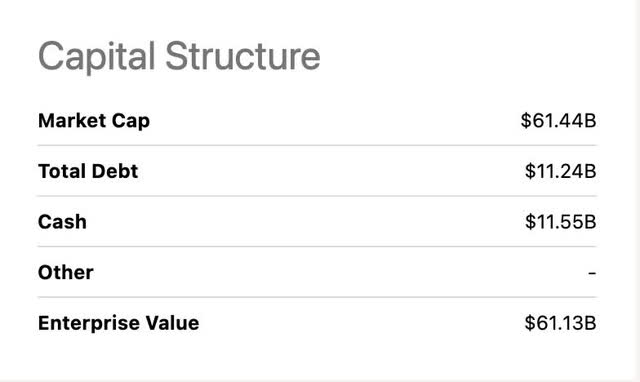

I adore stocks down 50+%. 80+%, still profitable, growing, and with a pristine balance sheet where cash is equivalent to debt? Share buybacks happening at on-sale prices versus dilution? Sign me up.

Growth versus sentiment

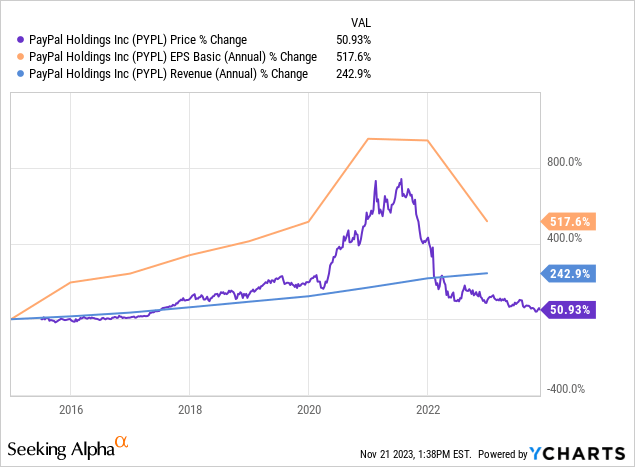

Starting out by comparing the company growth rate in earnings and revenue versus the share price appreciation, we can see the following on a near decade basis:

- 517% EPS growth

- 242.9% revenue growth

- 50.93% share price appreciation

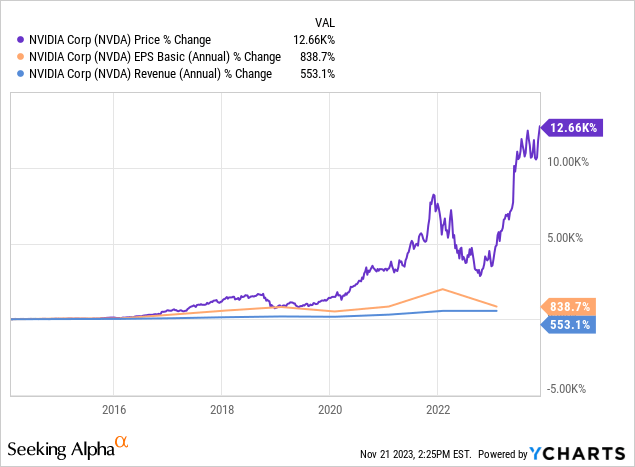

In a perfect world, share price appreciation should follow EPS growth. Again, another case of it did until it didn’t post 2021. This is indicative of value even if EPS has trended downwards. If you want to see the opposite of rationality or a bubble, let’s see what NVIDIA’s (NVDA) chart looks like for this same comparison:

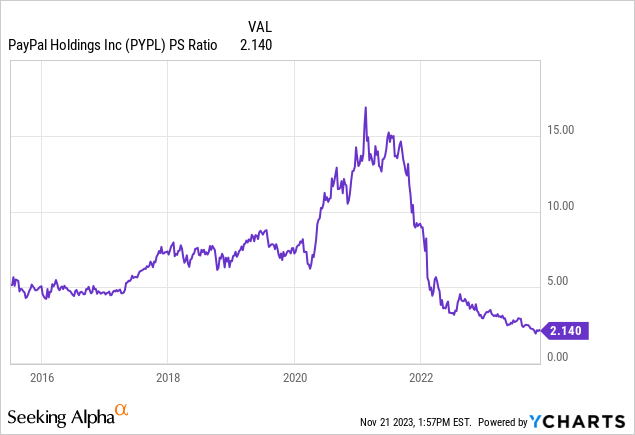

Price to sales ratio

While the price-to-sales ratio is not quite as good as my observation on Block Inc., it’s still rather dandy for GAAP profitable PayPal. The lowest price-to-sales ratio on record. Forward share buybacks will only enhance the cheapness of the stock on this basis as there is expected to be both more sales next year and fewer shares. The math is pretty easy and the valuations should be improving as long as we remain in this $50-$60 range.

Adjusted operating income, growth rates & Valuation

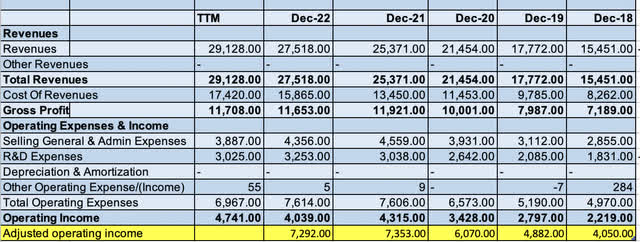

Back to adjusted operating income, a valuable metric used for big R&D spenders that suppress their GAAP income to grow the top line through product improvement.

I like to look at an adjusted operating profit in the same way Nick Sleep and Qais Zakaria from the Nomad Partnership did, by adding back R&D to operating income. This doesn’t work for all sectors, primarily pharmaceuticals, and semiconductors that need R&D constantly to meet the demand of their end users. As for intangible assets and tech companies, it’s highly debatable which portion is necessary and which portion is nearly equivalent to retained earnings.

My own Excel courtesy Seeking Alpha

- 2018 Adjusted operating income backing out R&D- $4.05 Billion

- 2022 Adjusted operating income backing out R&D- $7.292 Billion

- 5 Year adjusted operating income growth rate backing out R&D CAGR- 12.47%

- TTM adjusted operating income- $7.76 Billion

- Divided by 1,078.1 million shares outstanding = $7.2 Adjusted operating income per share.

- $7.2 X 12.47 to find the price at which the PEG ratio is equivalent to 1= $89.82/ share fair price.

A+ balance sheet

Seeking Alpha

Very similar balance sheet to Block Inc., cash is equivalent to debt, thus enterprise value and market cap are virtually equivalent. With EV/Sales being an even more accurate predictor of value and bottoms than price-to-sales, these are the kinds of balance sheets that make others envious. Keep in mind, that this low amount of debt and equivalent cash is all being achieved in the face of big-time share buybacks at very suppressed prices.

What? Buybacks?

PayPal Returned $1.4B to stockholders through share repurchases in Q3-23 and $5.4B on a trailing 12-month basis, reducing weighted average shares by 5% y/y.

Wow, buybacks of this magnitude are just unheard of in burgeoning tech. Yes, PayPal may be more mature than some other new-to-the-scene tech darlings, with 5+ years of profitability, but this is impressive. When you’re down 80+%, please oh please keep pulling the buyback trigger.

Growth prospects

Zettle Point of Sale Solutions

paypal.com

Trusted brands-we have built and strengthened well-recognized and trusted brands, including PayPal, Braintree, Venmo, Xoom, Zettle, and Honey. Our communications and marketing efforts across multiple geographies and demographic groups play an important role in building brand visibility, usage, and overall preference among customers.

Zettle is a big one for me. As I alluded to in my attraction to Block Inc., the total addressable market for point-of-sale cash register replacement is enormous. Each time PayPal integrates a small or medium-sized business into its ecosystem, they have an opportunity to sell them a POS solution if they have a customer-facing business as well. More total payment volume, more fees.

With small and medium banks now being more conservative with their precious capital due to hold to maturity security worries combined with higher costs of capital, PayPal with their “working capital” small business loan solutions can also step in to fill a gap. Short-term business loans can be very profitable if played correctly.

A lot of growth has been attributed to Brain Tree, the e-commerce transaction solution suites that allow small and medium businesses to easily integrate payment prompts into their websites via customizable shopping carts and checkouts. The acquisition of this valuable company back in 2013 continues to pay dividends via both Braintree and Venmo which was originally acquired by Braintree.

Risks

One of the bear cases against PayPal is the increase of point of sale competition within the space. Being able to quickly implement point-of-sale terminals at physical businesses is an ever-expanding market and one where it’s hard to determine who ultimately has the advantage. The crowded nature of the digital payment space is negative against all fin-tech with low barriers to entry. An upcoming recession could hinder their end users in small and medium-size businesses more than larger businesses. So far the consumer has been resilient, but total payment volume needs to keep increasing to continue growth.

Conclusion

This company is cheap. Yes, there is competition from multiple angles that has soured many on the stock and that’s ok. The digital wallet, point of sale transaction, and online digital payment market’s future total addressable market is big enough for many companies to succeed. PayPal and Block Inc. are the cheapest in this group, it’s not a debate on whether they are the best, but they both have an established brand and growth still in the pipeline.

PayPal is particularly compelling due to the previous and future buyback potential and all-time low price-to-sales ratios. This is a stock that I hope flounders while the company deploys capital into buybacks. Strong buy alongside Block Inc., which is also down 80%.

Read the full article here