On November 9, 2023, NCR Voyix Corporation (NYSE: VYX, $16.19, Market Capitalisation: $2.3 billion), a leading enterprise technology provider for retail stores, restaurants, and self-directed banking, reported robust 3Q23 results, with beat vs consensus on both revenue and adjusted EPS. In 3Q23, the company recorded revenues of $2.0 billion, up 2.3% YoY, driven by 5% YoY growth in service revenue (70.1% of total revenue) due to growth in recurring banking services revenue, software maintenance, and other software-related services, partially offset by a decline in hardware maintenance revenue. On the other hand, Product revenue (29.9% of total revenue) decreased 5% YoY due to a decline in ATM, SCO and POS hardware revenues, partially offset by an increase in software license and Bitcoin-related revenues. The company reported an adjusted EBITDA of $404 million in 3Q23, up 6.3% YoY (+5% YoY on a constant currency basis). The adjusted EBITDA margin improved to 20.0% in 3Q23, compared to 19.3% in the prior-year period. In 3Q23, the company reported adjusted EPS of $0.95, down 1.0% YoY compared to $0.96 in 3Q22.

Due to the finalization of certain accounting items relating to the spin-off of NCR Atleos completed on October 16, NCR Voyix filed an extension for the filing of its quarterly report on Form 10-Q for the quarterly period ended September 30, 2023, on November 14.

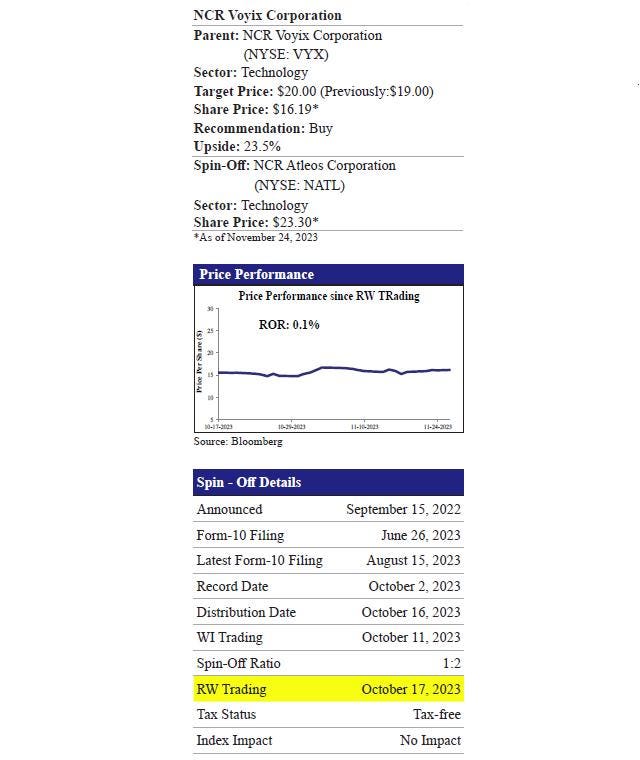

Valuation and Recommendation

We value NCR Voyix (VYX) using the EV/EBITDA valuation methodology. Our intrinsic value of $20.00 (Previously: $19.00) for NCR Voyix is based on a 2024e EV/EBITDA multiple of 9.2x for the digital commerce business (~10% discount to its peer multiple of 10.3x). We maintain our ‘Buy’ rating with an implied upside of 23.5% from the current market price of $16.19 as of 11/24. Risks to our valuation include a slowdown in sales growth due to rising competition, weakness in the economy, slower momentum in key markets, and failure to achieve the cost-saving targets.

Business Highlights and Other 3Q23 Earnings Call Updates

• This year, NCR Voyix was again named the number one global provider of point-of-sale software for Retail and Restaurants by RBR data service. For FY23, the company expects to generate ~$4 billion in revenue, with approximately half of the revenue from recurring revenues.

• During 3Q23, in the company’s Retail segment, Designer Brands implemented self-checkout and signed a contract to convert their point of sale and self-checkout software to subscription across over 2,000 lanes. Moreover, the sales activity in the Digital Banking segment was strong, with 5 new customer deals and 21 Digital Banking renewals. NCR Voyix also continued to experience strong cross-sell and upsell momentum, particularly with the Channel Services Platform (CSP) and Terafina (digital account opening platform).

• Within the Restaurant segment, Uncle Julio’s, a Tex-Mex chain with 44 sites focused on delivering made-from-scratch culinary experiences, became an Aloha Essentials subscription with Payment customers in 3Q23. Overall, the total number of platform sites grew by 388, and payment sites increased by 517. In small- and medium-sized businesses (SMB), the company’s payment attach rate for new customers remains at ~90%, resulting in a 41% increase in payment sites. Furthermore, Papa Murphy’s (NCR Voyix customer for ~15 years) recommitted to the software with a new three-year Aloha Essentials subscription.

• Recently, NCR Voyix hosted the highly successful Accelerate 2023 Digital First Banking Conference in Nashville, Tennessee, with over 900 attendees, including customers, prospects, partners and industry analysts.

3Q23 & 9M23 Results

It should be noted that the results of 3Q23 and 9M23 reflect the legacy NCR business, including NCR Atleos, which was separated as an independent, publicly traded company on 10/16.

3Q23

In 3Q23, the company recorded revenues of $2.0 billion, up 2.3% YoY, driven by 5% YoY growth in service revenue (70.1% of total revenue) due to growth in recurring banking services revenue, software maintenance, and other software-related services, partially offset by a decline in hardware maintenance revenue. On the other hand, Product revenue (29.9% of total revenue) decreased 5% YoY due to a decline in ATM, SCO, and POS hardware revenues, partially offset by an increase in software license and Bitcoin-related revenues. Notably, the company reported Adjusted EBITDA of $404 million in 3Q23, up 6.3% YoY (+5% YoY on a constant currency basis). The adjusted EBITDA margin improved to 20.0% in 3Q23, compared to 19.3% in the prior year period. In 3Q23, the company reported adjusted EPS of $0.95, down 1.0% YoY compared to $0.96 in 3Q22.

9M23

In 9M23, the company recorded revenues of $5.9 billion, up 1.0% YoY, driven by 3% YoY growth in service revenue (70.5% of total revenue) due to growth in recurring banking services revenue, payments processing, software maintenance, and software-related services, partially offset by a decline in hardware maintenance revenue. On the contrary, Product revenue (29.5% of total revenue) decreased 4% YoY due to a decline in ATM, SCO, and POS hardware revenues, partially offset by increased software license and Bitcoin-related revenues. The company reported Adjusted EBITDA of $1.1 billion in 9M23, up 10.6% YoY (+13% YoY on a constant currency basis) despite foreign currency fluctuations having an unfavorable impact of 1% on the revenue. Adjusted EBITDA margin expanded to 18.6% in 9M23, compared to 17.0% in 9M22.

Segmental Information

After the spin-off of NCR Atleos, NCR Voyix now operates in three reportable segments: Retail, Restaurant (formerly reported as Hospitality), and Digital Banking.

Retail Segment

3Q23

For 3Q23, the Retail segment recorded a revenue of $568 million, down 1.2% YoY, primarily due to a decrease in hardware revenue partially offset by increases in software and services revenues. Adjusted EBITDA for the period was $132 million, up 3.1% YoY, with a margin of 23.2%, up by 290 bps. This was primarily due to a favorable software and services revenue mix and improvements in component, labor, and freight costs partially offset by increased employee benefit-related costs.

9M23

For 9M23, the Retail segment recorded a revenue of $1.7 billion, up 0.8% YoY, due to increased software and services revenues partially offset by a decrease in hardware revenue. Adjusted EBITDA for the period was $352 million, up 17.7% YoY, with a margin of 20.8%, up 300 bps. This was primarily due to a favorable software and services revenue mix and improvements in component, labor, and freight costs partially offset by increased employee benefit-related costs.

Restaurant Segment

3Q23

In 3Q23, the Restaurant segment’s revenue remained flat at $238 million compared to the prior-year period. Adjusted EBITDA for the period was $59 million, up 15.7% YoY, with a margin of 24.8%, up by 340 bps, primarily driven by favorable software and services revenue mix, pricing, and cost mitigation actions partially offset by increased employee benefit-related costs.

9M23

For 9M23, the Restaurant segment recorded a revenue of $696 million, up 1.3% YoY, primarily due to increased services and software revenues, including cloud services and payment processing growth partially offset by a decrease in POS hardware. Adjusted EBITDA for the period was $172 million, up 24.6% YoY, with a margin of 24.7%, up by 460 bps primarily driven by favorable software and services revenue mix, pricing, and cost mitigation actions partially offset by increased employee benefit-related costs.

Digital Banking Segment

3Q23

For 3Q23, the Digital Banking segment recorded a revenue of $147 million, up 7.3% YoY due to an increase in recurring cloud services and software maintenance revenues. Adjusted EBITDA for the period was $58 million, down 3.3% YoY, with a margin of 39.5%, down by 430 bps mainly due to investment in selling expenses and R&D expenses and increased employee benefit-related costs.

9M23

For 9M23, the Digital Banking segment recorded a revenue of $423 million, up 4.7% YoY due to increased recurring cloud services and software maintenance revenues. Adjusted EBITDA for the period was $160 million, down 7.0% YoY, with a margin of 37.8%, down by 470 bps due to investment in selling expenses and R&D expenses, and increased employee benefit-related costs.

Valuation

EV/EBITDA Valuation: Post-spin-off, NCR Voyix focuses on digital commerce business, continuing to operate its Retail, Hospitality, and Digital Banking businesses. We assign a 2024e EV/ EBITDA multiple of 9.2x to VYX’s digital commerce business. The ~10% discount to its peer multiple of 10.3x factors in VYX’s relatively slower top-line growth and higher debt level. We have estimated FY24e adjusted EBITDA of $705 million, with Net Debt of $3.0 billion (including unfunded pension liabilities). We have also considered a conglomerate discount of 20%. Consequently, we arrive at an intrinsic value of $20.00 (Previously: $19.00) for NCR Voyix.

During the investor day held on 9/5, the company introduced FY27 financial targets. NCR Voyix expects total revenue growth at a 4%-6% CAGR during FY23-FY27. Notably, the company aims for recurring revenue of 65% with 9%-11% CAGR during FY23-FY27. The company anticipates an Adj. EBITDA growth at a 10%-12% CAGR during FY23-FY27 with Adj. EBITDA margin expansion of 400 – 500 bps to 21%-22%, and free cash flow conversion rate of 40%-45% in FY27.

Company Description

NCR Voyix Corporation

NCR Voyix Corporation (NYSE: VYX), formerly NCR Corporation, is a leader in transforming, connecting, and running technology platforms for self-directed banking, stores, and restaurants. NCR Voyix operates a digital commerce business comprising Retail, Restaurant, and Digital Banking businesses. Digital Banking solution helps financial institutions implement their digital platform for various transactions. The Retail segment offers software-defined solutions to customers in the retail industry. The Restaurant segment offers technology solutions, such as table-service, quick-service, and fast-casual restaurants of all sizes to the hospitality sector. Following the separation, NCR Voyix is expected to be a growth business positioned to leverage NCR’s software-led model to continue transforming, connecting, and running global retail, Hospitality, and digital banking businesses. NCR Voyix recorded a total revenue of ~$3.7 billion in FY22

Read the full article here