People are naturally curious as to how they compare to others, and wondering how you compare to someone else financially is no different. While understanding where you fall within the national average when it comes to your net worth is useful information, keep in mind that it has no bearing on your value as a person. It’s just helpful information so that you can plan for your future and ensure that you have enough resources going forward. When we refer to net worth, that means the sum of your assets minus your liabilities.

This study comes from data from the Federal Reserve and compiled in 2022 by the Survey of Consumer Finances. It’s useful to note that there’s a difference between the average or mean (the number you get by dividing the sum of a set of values by the number of values in the set), and the median which means the middle point between a set of data.

As a frame of reference, the highest level of average net worth in households in 2022 was $1,059,470 while the median was $192,700.

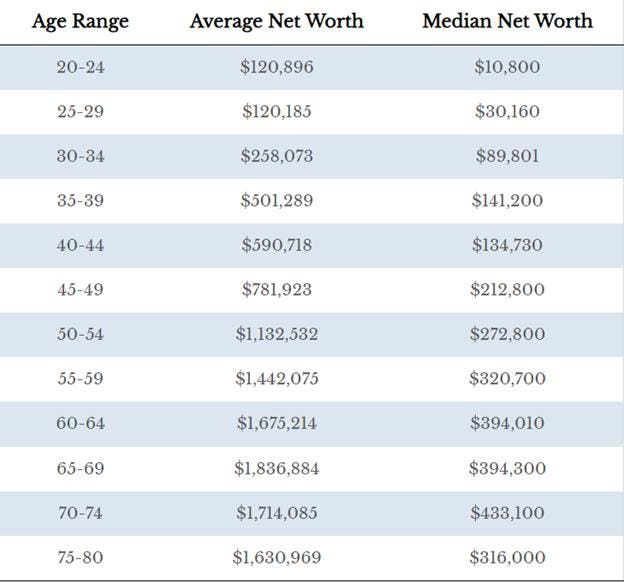

This chart from the 2022 Survey of Consumer Finances helps us to visualize the average and median net worths within various age ranges.

Your Net Worth By Age

As you can see within your 20s, the average net worth hardly moves at $120,000. This can be a skewed group, with a large concentration of the population with very little net worth while a small group has a large amount from wealth parents or family. The better data point here is the median net worth, which tells the more accurate story – that by the end of your 20s, you’re likely only seeing a net worth around $30,000.

By your 30s there is a jump both in the average and median net worth – a 100% increase in the average and a 60% increase in the median. In this group, you’re hitting your stride with your earning and saving potential and you may not have children to be spending on at this point. Adding in a home may also up the net worth figures here.

Into your 40s the median net worth may actually decrease, in part because there is additional spending with family expenses. There is a pick up in the back end of the decade likely due to additional earning potential as careers progress.

By your 50s the average net worth hits the seven digit mark – you likely have a home, a 401k, and additional investment accounts that may have benefited from years of compounding interest. Into your 60s we see more of the same, likely due to interest continuing to compound even when someone retires and begins living off of their assets.

One we get into the 70s we start to see a net worth dip which makes sense, as you’re using your assets to live off of for several years (most likely) at this point.

Again, while it’s useful to know where you stack up against the national average, don’t feel awful if you’re pulling up behind average. In that same breath, don’t bury your head in the sand when it comes to your finances. It’s better to have a good understanding of where you are so that you can plan ahead for what you need.

Read the full article here