This article was co-produced with Kody Kester.

—————————————————————————

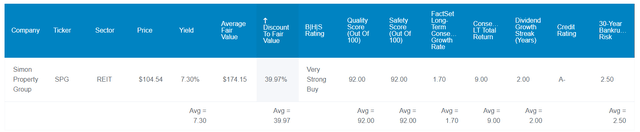

Verizon Communications Inc. (NYSE:VZ) and its slowly growing, well-covered 8% dividend yield could fit well within an income portfolio.

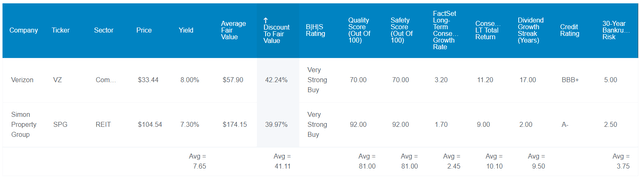

But with about three dozen other 7% and up yielders in our master list of 500+ stocks, there are plenty of other options.

Simon Property Group, Inc. (SPG) is one name I like.

It trades 36% below fair value, respectively.

The two stocks could have a 13% annual total return potential over the next ten years.

On average, adults make well over 100 informed choices each day, ranging from what they will eat to what they will wear. As you’d expect from a capitalist society such as ours, our lives are filled with endless choices as consumers. Are you buying brand names or generic foods at your supermarket? The option is yours. An Apple or Android phone? Again, that’s your prerogative in a free market. I could go on, but you get the point.

One thing that we may only sometimes think about is that behind all these choices that we make each day, there are the companies who make it all possible. Most of us and our subscribers are predominantly dividend-focused investors.

Fortunately, there are also hundreds to thousands of dividend stocks in the investment universe in which we could choose to invest. That means regardless of your risk tolerance and investment objectives, there are plenty of investment options out there suitable for you or me.

Verizon Communications Inc. could be such a pick for investors. Let’s dive into why Verizon could be a great pick for some investors and discuss two high-yielding substitutes for those not eager to buy the stock.

Verizon Is A Steadily Growing Business Priced At A Dirt-Cheap Valuation

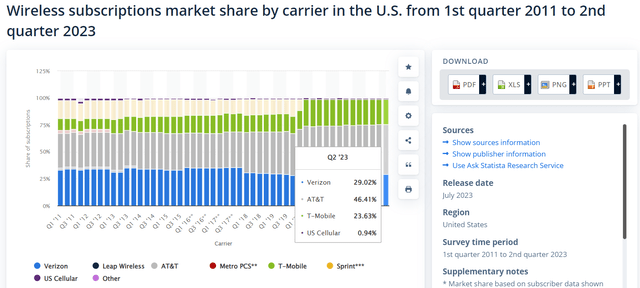

Statista

Boasting over 114 million wireless retail connections and nearly 9 million broadband connections as of June 30, Verizon is a major player in the telecom industry. The company’s 29% market share is second only to AT&T (T) at 46% and moderately ahead of T-Mobile US’s (TMUS) 24% share. For another competitor to rival any of these big three networks, it would take at least tens of billions of dollars of network spending, billions more in marketing, and years. The massive barriers to entry in a slowly growing market are why the telecom industry is widely considered to be an oligopoly.

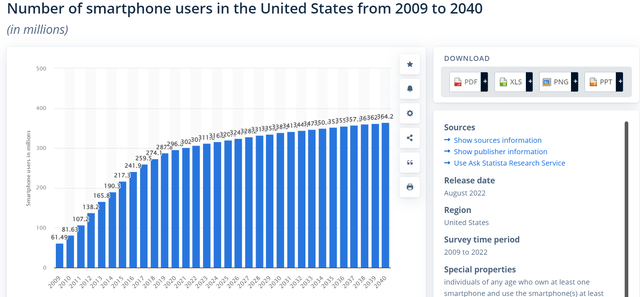

Statista

As the U.S. grows in population and smartphone adoption edges higher, demand for wireless plans should slowly grow over time. As long as Verizon’s market share remains unchanged and prices gradually rise, the company’s earnings should also increase. These reasons explain why FactSet Research expects Verizon’s earnings to expand by 3.2% annually over the long haul.

A risk that has emerged in recent months came with the news that around 200,000 miles of underground lead cables will have to be removed by the likes of Verizon and AT&T. Still, Morningstar estimates annual removal costs to be around $500 million by 2027, that’s arguably a drop in the bucket for a large-cap telecom.

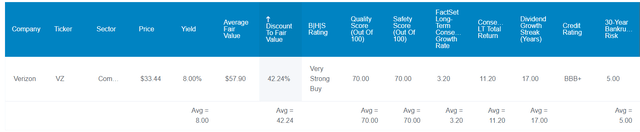

DK Zen Research Terminal

Regardless, Verizon’s 8% dividend yield is well-covered by its 56% EPS payout ratio. Based on the $18 billion that management expects in free cash flow in 2023, the company will have approximately $7 billion in excess free cash flow after paying its dividend.

This could further improve Verizon’s healthy balance sheet. Despite its large debt load in absolute terms, the company’s 0.5 debt-to-capital ratio already leaves breathing room relative to the 0.6 that rating agencies prefer from telecoms. That is why Verizon’s debt is currently rated BBB+ by S&P on a stable outlook.

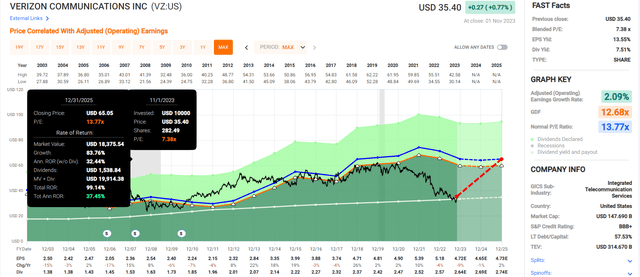

Concerning valuation, the company is trading near its cheapest levels of this century. Verizon’s $35 share price (as of November 1, 2023) is priced 39% below its historical fair value (measured by an average of dividend yield, P/E ratio, and so forth) of $57.90 a share.

Here’s what the stock’s total return potential could look like in the next 10 years if Verizon grows as predicted and returns to fair value:

-

7.5% yield + 3.2% annual earnings growth + 5.1% annual valuation multiple reversion = 15.8% annual total return potential or a 334% cumulative total return versus the 10% annual total return prospects of the S&P 500 (SP500) or a 160% cumulative total return.

FAST Graphs, FactSet

Simon Property Group: The Leading Class A Mall REIT

Simon Property Group

Perhaps you already have too much exposure to telecoms or you’re just not compelled to own Verizon for whatever reason. If that’s the case, Simon Property Group may pique your interest.

The REIT owns interests in over 200 major malls throughout the U.S., Asia, and Europe. These aren’t your typical empty malls that are dying a painful death due to not adapting to e-commerce. No, Simon saw the writing on the wall long ago that a supermajority of consumers would come to prefer experiences over material possessions. This is why in recent years, the company has invested $9 billion in developing and redeveloping malls of the future.

Whether you want to shop or create memorable experiences with loved ones, Simon has you covered. The company’s properties include premier shopping, entertainment, mixed-use destinations, and dining.

Fortunately, Simon also has the resources to keep attracting consumers to its properties and positioning its tenants for success. The company’s A-credit rating is the highest among real estate investment trusts, or REITs, which leaves it with access to capital that comes at a lower cost than what its investments can deliver.

DK Research Terminal

Simon’s generous 6.8% dividend yield is also sustainable. That’s because the company’s payout ratio of 63% is well below the 75% rating agencies view as safe from retail REITs.

Overall, Simon is the best house in an otherwise bad neighborhood. FactSet Research believes the company can grow at a modest rate of 1.7% annually over the long run.

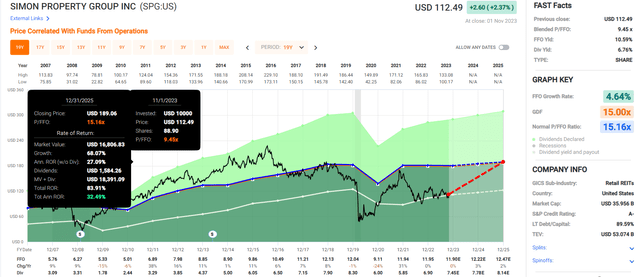

Perhaps the most attractive characteristic of Simon is its appealing valuation. The stock’s $111 share price is 36% less than its $174 historical fair value.

These factors could set the company up for the following total returns through 2033:

-

6.8% yield + 1.7% annual growth + 4.6% annual valuation multiple expansion = 13.1% annual total returns or a 242% cumulative total return.

FAST Graphs, FactSet

Summary: Either Of These 2 Businesses Could Make For Intelligent Investments

Dividend Kings Zen Research Terminal

Successful investing is built around hedging your bets across a diversified portfolio. Investors seeking high yields would do well to consider these three decent to superb-quality businesses.

Together, these stocks average a 7.7% dividend yield, are expected to grow at 3.4% annually, and have a 7.2% annual valuation multiple upside. This 18.2% average annual total return potential could deliver a 432% cumulative total return to investors over the next ten years, leaving the 10% and 164% figures of the S&P 500 in the dust.

Read the full article here