What to expect from October Nonfarm Payrolls Report?

Well, it’s that time of the month gain. The nonfarm payrolls report is almost upon us. And this number is coming right on the heels of a Fed meeting, so in terms of the relevance for the Fed’s future actions, it is likely pretty minimal unless it deviates from expectation significantly. This could happen. Remember, the September report came in sweltering last month. The specifics of that report are below:

- Nonfarm payrolls increased by 336,000, with Hospitality & Leisure and Government showing the most significant gains.

- Bars and restaurants comprised the majority of gains in Hospitality and leisure.

- The unemployment rate stayed unchanged at 3.8%.

- There was no impact on payrolls from the UAW strikes in the last report.

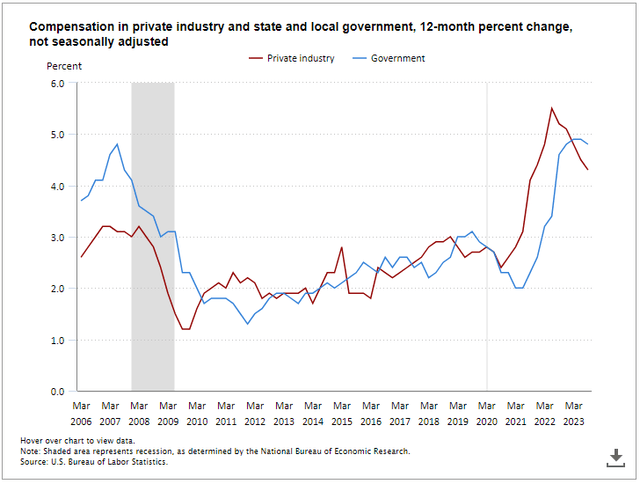

- Wage gains slowed from an annual pace of 4.3% to 4.2%, likely reflecting that many jobs added last month were in lower-paying industries.

So, the proverbial jury will be watching to see whether this was a seasonal hiccup or whether persistent strength in the labor market is problematic for the seemingly waning battle against inflation. It’s important to remember the last report did not show that upward wage pressure was threatening to re-ignite inflation. One exciting thing to watch in this report will be the effects of the recent UAW strike and other union activity.

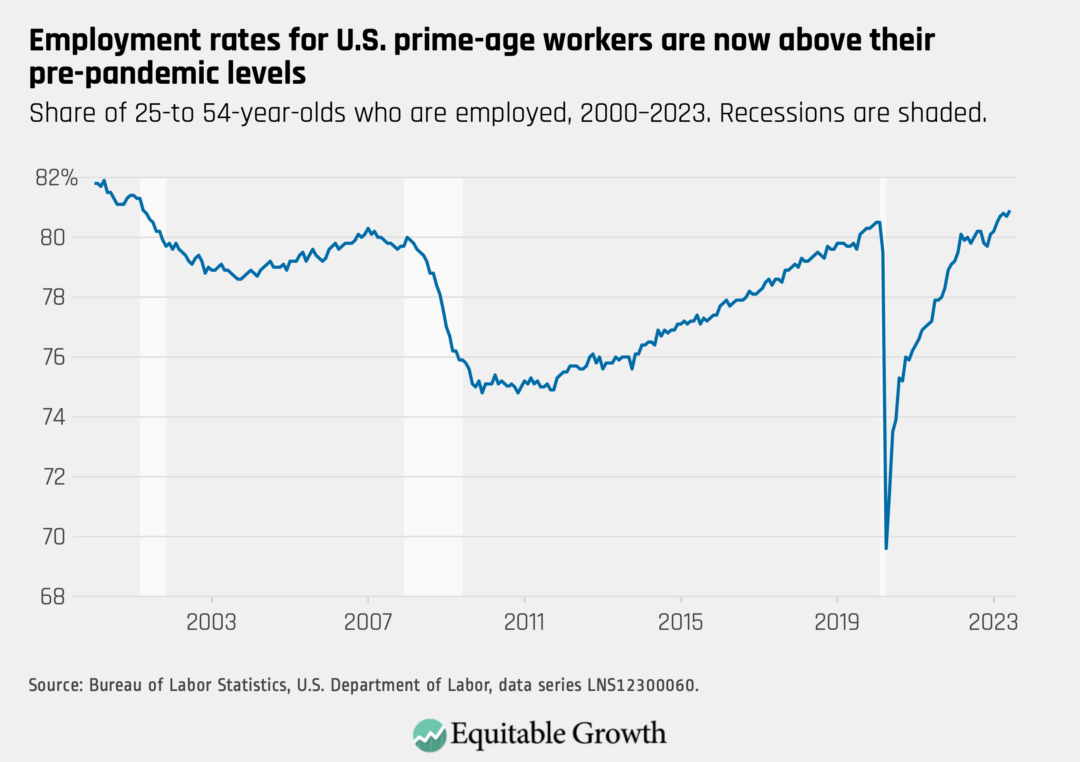

Mostly, though, the labor market, more than any statistic, is where we will see whether there is a soft landing or not. But the unemployment rate edging up and monthly nonfarm payrolls coming convincingly below 150,000 for an extended period are probably necessary to verify this is happening. One positive is that participation has been moving in the right direction. This helps pacify the hawks on the FOMC and strengthens the hands of the Doves, stealthy as they may be these days.

BLS, Center for Equitable Growth

In any event, the projections for tomorrow’s nonfarm payrolls are 170,000 jobs added and the unemployment rate to stay steady at 3.8%. This is a report where “bad news is good news,” potentially. What I mean by this is that if fewer jobs were added than anticipated, this would help the Fed’s hand in not having to raise the Federal Funds rate again. Of course, this should be taken with a grain of salt. If the news is too bad, like, say, less than 75,000 jobs, then the market always reserves the right to freak out.

That’s an important distinction. But the report is doubtful to be a concerning miss to the downside in my estimation. Still, there are building reasons in the data across the economy to suspect the jobs report could show some late-cycle economic weakness and potentially make it more like 140,000 to 150,000, given the alleviation of seasonal tailwinds and slowing down elsewhere across the economy. I predict we get a slightly softer number, and the market will build on the rally that has begun this week. The following data suggests that the jobs number might be softer than the consensus or helps the bullish setup:

- ISM Manufacturing showed weakness below expectations. This was at the lowest level since July.

- The quarterly treasury plan was more dovish than many of the bond market debt scolds would have thought. This helped bonds rally.

- The Fed’s preferred measure of inflation, the Personal Consumption Expenditure, came in primarily in line and shows deceleration in the core.

- The ADP Private Sector Jobs report came in light at 113,000, which was lower than the expected 130,000 added jobs.

- The BLS metro-level data shows more aggregate slowing at the local level than the other way around. The unemployment rate was higher in most surveyed metro areas than a year ago.

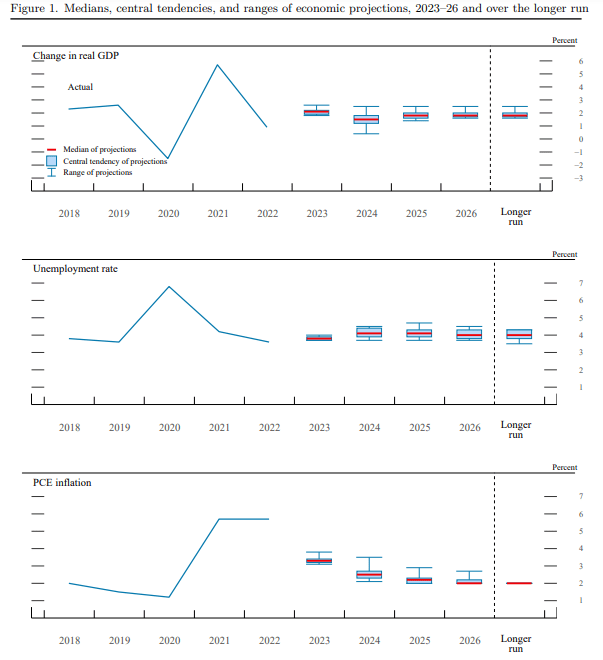

The Fed’s current projections don’t have the unemployment rate getting above the high four handle in the next three years. But it would probably be welcome to see the unemployment rate tick up a basis point unexpectedly. The dots show that unemployment is steadily and tamely rising while inflation declines. I know this will be a bit controversial to say, but based on the data, a soft landing seems to be already occurring. So, it’s important to remember that the soft landing is underway, and the FOMC members largely agree with this assessment.

Federal Reserve: September Dot Plot

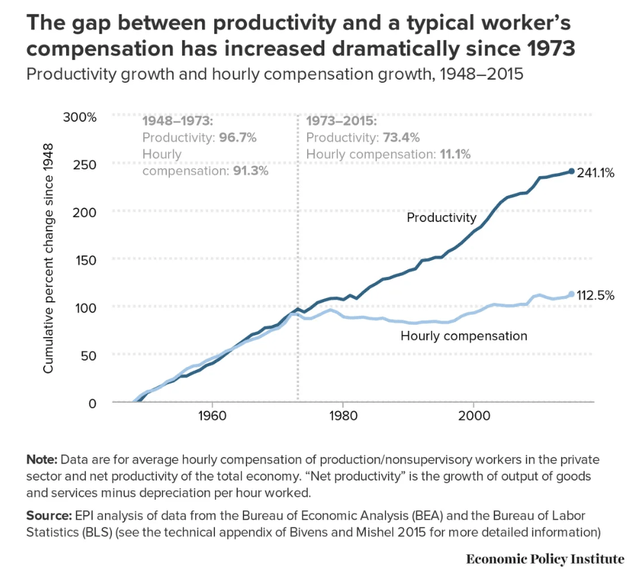

At the same time, I’ve written extensively on why labor unions aren’t anywhere near their role in the 1970s economy in terms of being able to exert price. There are several different ways to show this. Still, one key measure from the Economic Policy Institute shows how productivity gains have far exceeded wage gains to the decided benefit of management. The last three years have been very positive in the labor market because there have been real gains among the bottom quintiles. Hopefully, a labor market dislocation won’t reverse that achievement.

Economic Policy Institute

So, it will be attractive to what extent unions and their resurgence will affect the jobs market. I’m afraid I have to disagree with many of the doomsaying in the area, suggesting that labor interests will suddenly re-assert themselves in an economy that has seen the decline for half a century. Many had expected late-cycle weakness to start showing up in the labor market in the last report. Still, I think the unusual strength of consumption driven by the wealthiest quintile in these areas allowed for an extra pop of seasonal strength.

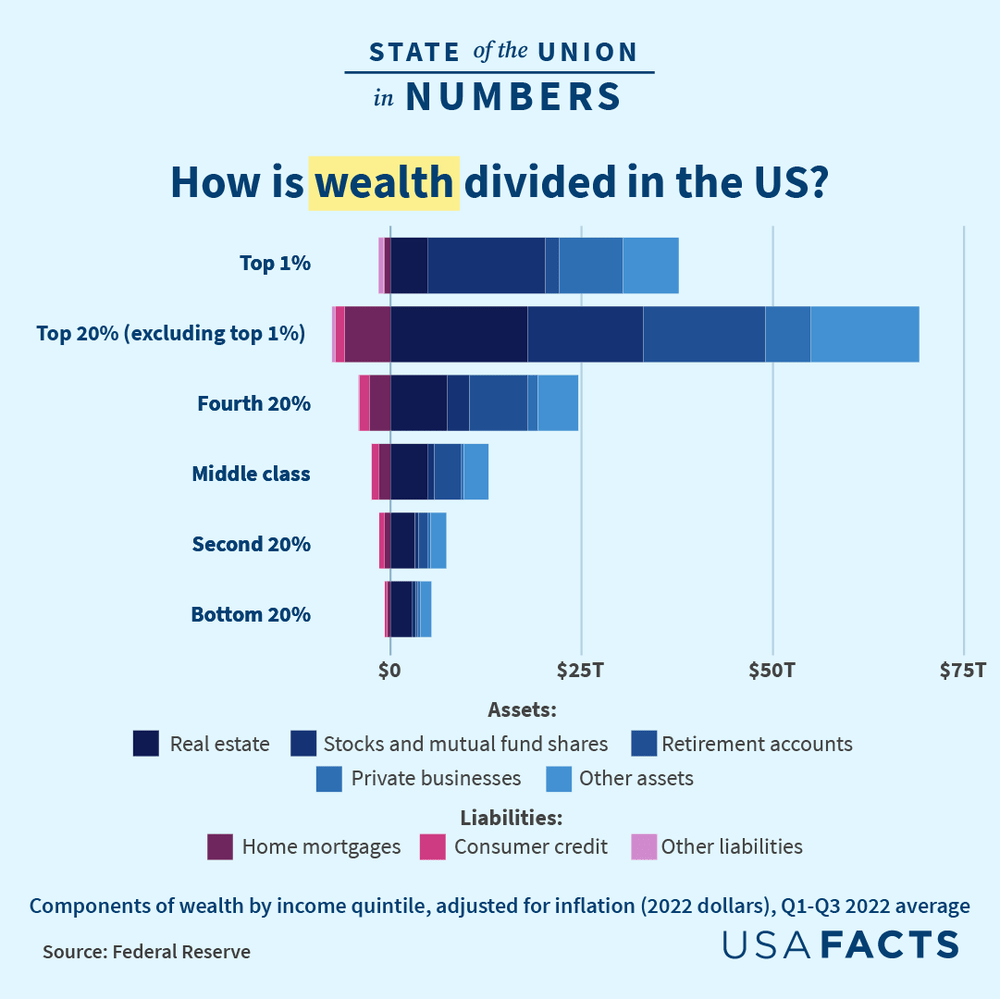

Federal Reserve

As I mentioned in my article after the September CPI report, the remaining sticky areas of inflation are caused by asymmetric per capita consumption of the wealthiest quintile versus the bottom four quintiles. One of the key areas that has become different in our economy versus when the Fed inflation in the 1970s and 1980s is that the wealthiest income quintile is far more crucial to total consumption given the vastly greater amount of wealth they control compared with the past.

Just think of it this way. How many houses does a person in the top 1% buy versus what an average person can afford? And the behavior of wealthy consumers appears to be making housing inaccessible for many in the bottom quintiles. However, for the jobs report, the consumption of hotel rooms, airplane tickets, and food away from home is more crucial for jobs. These will be important to watch since they drove strength last time, along with government jobs.

But here, the concentration of wealth is not all bad. Because wealthy consumers can keep spending, and that demand leads to labor demand, there is more of a countervailing current in the economy than there has been in previous recessions. So, the following labor report will validate the evidence suggesting a soft landing is underway.

Risks and Where I Could Be Wrong

While there has been some data supporting that tomorrow’s job numbers could be light, one fly in the ointment is today’s JOLTS reading. This number came in above expectation. The job openings ticked up from 1.49 per worker to 1.50. This is in the wrong direction, and it’s important to remember that there has to be some weakness in the labor market for the Fed not to hike. For a soft landing to occur and for the Fed to have comfort, this number has to go down faster than layoffs and firings go up.

BLS

Otherwise, the fear is that the generally favorable position of workers will lead to upward wage pressure as employers compete for scarce workers. What was also worrying is that layoffs went in the wrong direction, too, and hit their lowest level in July. This could bode ill for the report tomorrow. There are plenty of other risks. A conflict is heating up in the Middle East, and the elevated threat of terrorism could hurt the economy and dampen already sour sentiment even further. The following risks are stalking markets for the rest of the year.

- Geopolitical risks in Ukraine, the Middle East, and Taiwan

- Credit event (Junk bond spreads rising).

- Political Risk and Fiscal Situation.

- Commercial Real Estate.

- Reignition of the banking crisis.

- The lag effect of high rates/Fed policy error.

Tomorrow’s jobs report will be an essential indicator of the strength from last month’s GDP reading, whether it was a last pop before the anticipated slowing or whether there is problematic heat in the economy. I suspect the labor market will begin slowing roughly in line with the Fed’s September SEP projections, and I think tomorrow’s nonfarm payrolls report could be the first sign. However, the strength in the last report could be repeated. If this is the case, I suspect the market will sell off.

Conclusion

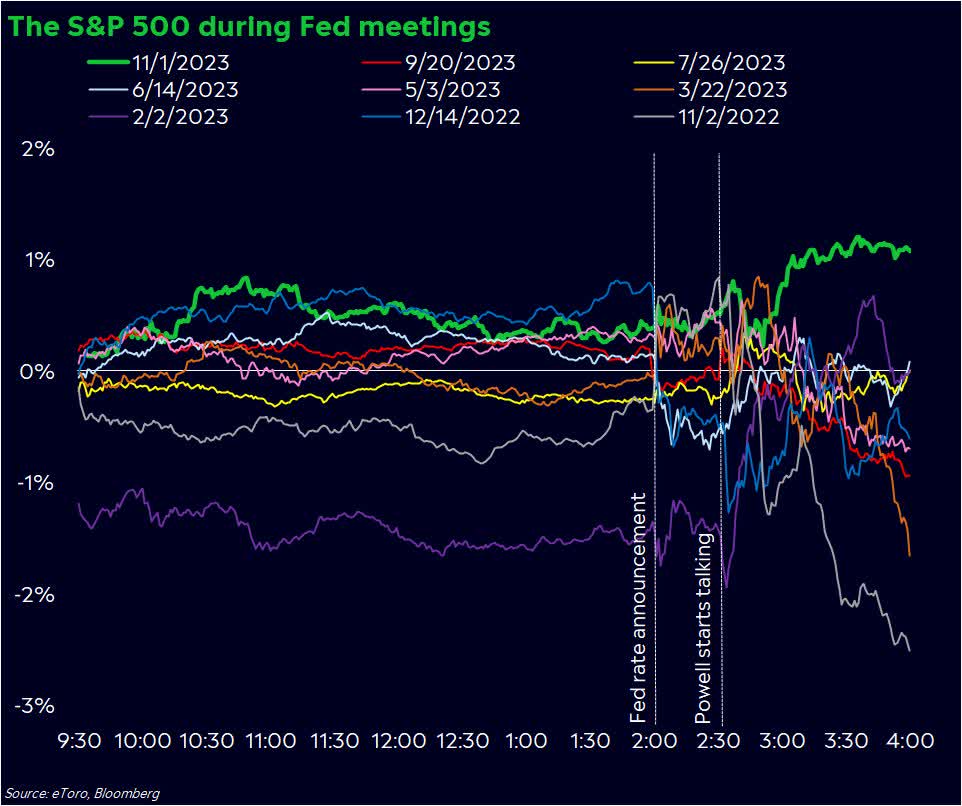

The Fed’s meeting on November 1st showed an FOMC that didn’t feel an urgent need to hike. In Powell’s speech at the Economic Club of New York, he also mentioned that the evidence suggests that economic policy is still tight. But, as I mentioned in my piece previewing the Fed meeting, the reaction function of the market to the Fed is changing. One of the things that is different about the modern Fed from the Fed of Volcker’s time is that the market leads the Fed’s actions instead of responding to them. When you think about what this means, no matter what Powell says at any further meetings, I assure you it will continue language conveying a fierce dedication to not letting inflation return because it has to because of how these expectations now work.

eToro

But something is starting to feel different. As you can see above, this was the most buoyant market reaction to a Fed day in quite some time. I suspect the nonfarm payroll numbers will come a bit softer than expected and build on the gains we have already enjoyed this week. We have three seasonal tailwinds as well.

EquityClock.com

- Gasoline prices tend to be lower in the last two months of the year.

- Stocks tend to be higher in the last two months of the year.

- Volatility tends to decline seasonally in the last two months of the year.

I think the convergence of these three seasonal factors from a strong earnings season should produce a year-end rally so long as unanticipated shocks from the critical situation in the Middle East don’t derail a return to favorable market conditions. Overall, the balance between supply and demand in the labor market should ultimately be helped by increasing visibility and normalizing COVID-19 supply chain anomalies and demand patterns. Recent economic projections suggest that a slowdown could show up in the October nonfarm payrolls report.

While it’s always good for there to be more jobs, some unexpected weakness will be a welcome development for a market where increasingly bad sentiment and fear of inflation’s return are in stark contrast with increasingly positive data. This suggests increasingly that a significant labor market dislocation similar to what was seen in recent recessions won’t be necessary to ensure price stability.

Read the full article here