Healthpeak Properties, Inc. (NYSE:PEAK) and Physicians Realty Trust (NYSE:DOC) announced early on Monday, 30 October 2023, a “merger of equals.”

I wrote an article Physicians Realty Trust: a Case for M&A on 31 July 2023 suggesting that DOC was the best candidate acquisition candidate among the public real estate investment trusts, or REITs, in the medical office building (“MOB”) space, and that a deal within the year should not be a surprise. It provides useful background to this transaction.

Investment Thesis

The proposed merger of DOC and PEAK is on reflection a reasonable deal, and a positive for both DOC and PEAK shareholders.

DOC was at best static, and their best path forward was to be acquired by a larger REIT.

PEAK increases their outpatient medical office space by 65%, which offers G&A efficiencies and at least the potential of a degree of “moaty” local market share advantages.

Critically, the acquisition currency is currently depressed PEAK shares, which offers considerable upside to patient current DOC shareholders.

For investors who want exposure to medical office buildings, PEAK is a more attractive option today than last week.

Healthpeak Properties/Physicians Realty Deal

In practical terms, this is an acquisition, with $16 billion enterprise value PEAK buying $4.6 billion DOC.

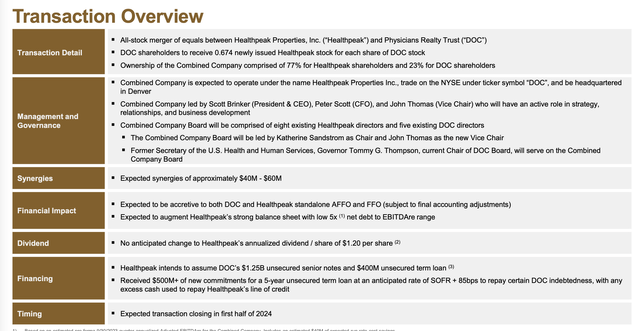

PEAK provided their analysis of the transaction in an investor presentation here, including the overview below. The full investor presentation is worth review.

PEAK + DOC Merger Overview (PEAK investor Presentation)

Key points to my eye for most investors:

- all-stock deal

- each share of DOC stock converted to 0.674 share of PEAK stock

- Healthpeak Properties to be the surviving name, to trade under DOC symbol

- current PEAK dividend of $1.20 per share expected to continue

- expect synergies of $40-60 million per year

- expect deal to close in first half of 2024.

PEAK will add 16 million SF of medical office space to their existing 24 million, yielding a footprint roughly comparable to Heathcare Realty Trust (HR), formally the dominant REIT in that space.

Initial reaction to the deal has been less than enthusiastic. DOC stock closed down six cents (0.5%) and PEAK stock closed down 44 cents (2.7%), both at lows, although slightly above intraday lows. At midday Tuesday, both were trading down about 2.5%. Initial comments from DOC shareholders were very negative.

The Downside

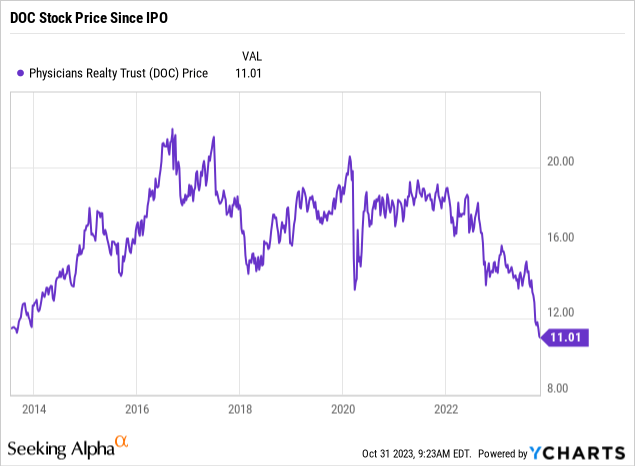

The focus of distress was not the acquisition per se, but the price. Under these terms, DOC is being acquired at an all-time low price. DOC IPO’d in July 2013, and the share price history is shown below.

The 32% CPI increase over that period (per Bureau of Labor Statistics calculator) makes the price appear even less attractive.

In addition, DOC investors will see a reduction in dividend payments. DOC currently pays a $0.92 annual dividend. With the 0.674 share conversion rate, each current DOC share will earn 0.674 x $1.20 = $0.81 post-merger, a 12% reduction.

The Upside

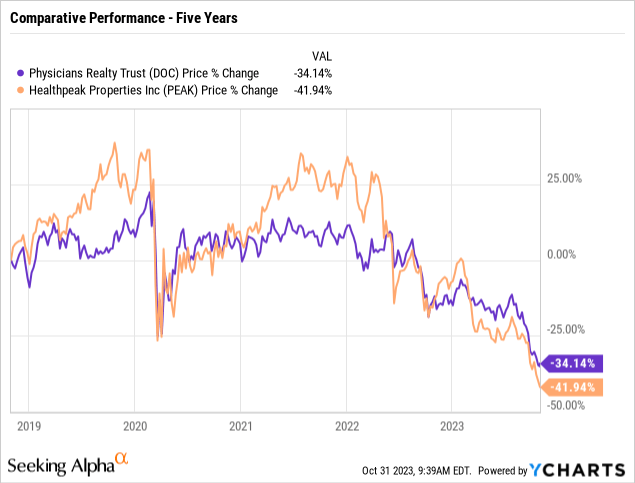

The REITs in the MOB space have had a difficult time over the past few years, with returns struggling to match inflation. I discussed the MOB space and the challenges involved in some detail in a September 2022 article here.

All of the REITs are professionally managed, with portfolios curated over a decade or more. None have any secret sauce.

In the absence of easy options, there appear to be three ways to improve results: lower G&A burden with increased scale, increase revenue via increased local market share (what HR terms clustering), and get really good at development/re-development, which should provide returns above purchase. In short, get big or go home.

This deal offers significant increase in scale, which is required to pursue the first two elements.

The should be a material reduction in aggregate expenses, primarily G&A. I discussed that at some length in the DOC M&A article noted above. In brief, 2022 G&A was 8% of revenue for DOC and 6% for PEAK.

Per Seeking Alpha, there are 547 million PEAK shares and 238 million DOC shares outstanding. Post merger, there will be 547 + 0.674x 236 = 547 + 159 = 706 million PEAK shares.

The $60 million in projected savings would amount to about 8.5 cents per share. In the context of PEAK’s estimated 2023 FFO of ~ $1.77, it’s about a 5% increase.

In addition, the larger size of the resulting firm should at least marginally lower debt costs.

Is the Downside Real?

The PEAK shares, which are the currency being offered here, are also depressed, arguably even more so than DOC.

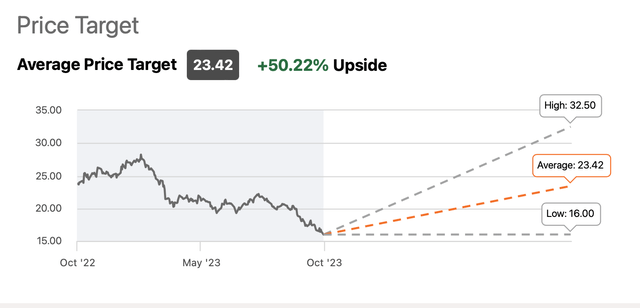

Seeking Alpha’s Wall Street price target suggests a 50% upside to a fair value around $23, with a range from $16 to $32.

PEAK Price Target – Wall Street Analysts (Seeking Alpha)

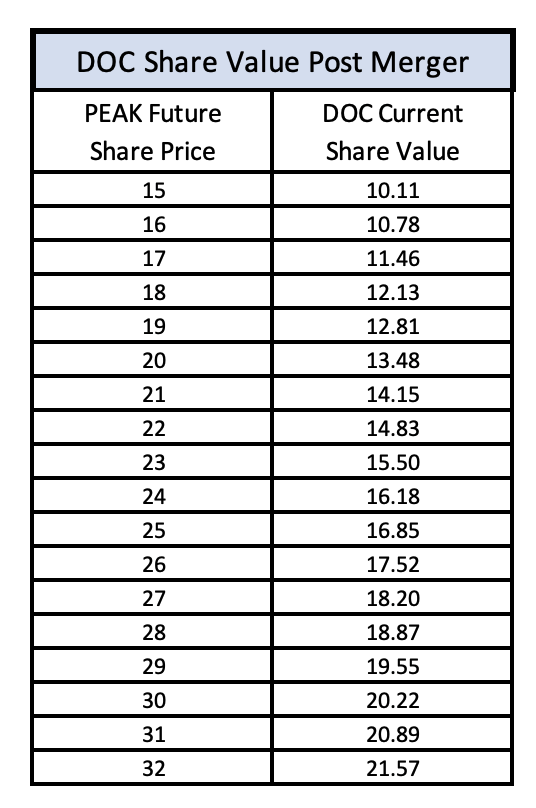

That suggests a potential post-merger value from a current DOC share – after conversion to 0.674 PEAK shares – of about $16, with a range of $10.78 to $21.60. The table below displays the value of one DOC share today after the merger for a range of post-merger PEAK prices.

DOC Share Value Post Merger (Author)

I find it unlikely that – absent the merger – DOC shares would have performed better than PEAK shares going forward. For an investor willing to willing to give credence to the Wall Street fair value estimates, either DOC or PEAK shares may be considered attractive today, with perhaps little to choose between them.

As far the dividend, it should be significantly more secure going forward, and the post merger company offers, in my view, a better chance of future dividend growth.

Investor Takeaway

The combined PEAK + DOC entity should be stronger than either current DOC or current PEAK standing alone. For investors who want a position in medical office buildings, PEAK seems a reasonable choice.

The PEAK position in laboratory buildings may be viewed as another advantage. I would not be surprised to see the continuing care portfolio viewed as a distraction and sold.

The DOC to PEAK merger exchange ratio appears on reflection to be reasonable, and investor actions may be more influenced by whether shares are held in taxable or non-taxable accounts, etc. than the exchange ratio.

I would rate DOC and PEAK both a BUY at current prices, for investors who want to hold a MOB REIT.

Personally, I own share in HR, PEAK, DOC, VTR, and GMRE. I bought a small slice of PEAK on the day the merger was announced, and after writing this article, plan to buy another, perhaps larger slice, which would make a full position.

I will probably sell my DOC shares before the merger closes, largely because I hold them with another broker and don’t want a holding split between brokers. I’d probably keep them otherwise.

Read the full article here