In the aftermath of the 2020 volatility spike, Flow Traders (OTCPK:FLTLF) was often hailed as insurance against declining markets. Over the last years, markets have not been declining but still volatility traded at, historically, elevated levels. This year volatility dropped and even though Flow has returned value in terms of dividend, the declining stock price more than offset these gains.

The catch is that insurance generally costs money whereas during the last decade, on the back of unprecedented central bank stimulus, shareholders have been conditioned to make profit instantly. This contradiction has led investors to divest from the stock, a classic example of buying high and selling low.

Akin to options, Flow is a company to buy when volatility is subdued. Besides low volatility, rising interest rates have affected the earnings, sending the stock even lower. This has created the option to purchase this stock at a sub-20 price in a sub-20 volatility environment.

3Q23 results

The results presented on the 26th of October showed a continuation of the lacklustre situation as presented in the second quarter of this year. Given the level of volatility and general reduction in Global Exchange Value Traded, as per data provided by the company, this result is not unexpected.

Highlights from the trading update can be summarized as follows:

- Flow Traders’ ETP Value Traded declined 18% year over year

- Normalized fixed operating expenses of €46.7 million

- Full year Normalized Fixed Operating Expenses expected to remain in the range of 175-185 million

- Normalized basic EPS of €0.22

- Execution of the €15 million share buyback program to be resumed

In spite of the general market environment being slow and operating expenses increasing further, the earnings per share did improve compared to the previous quarter.

Elevated value traded

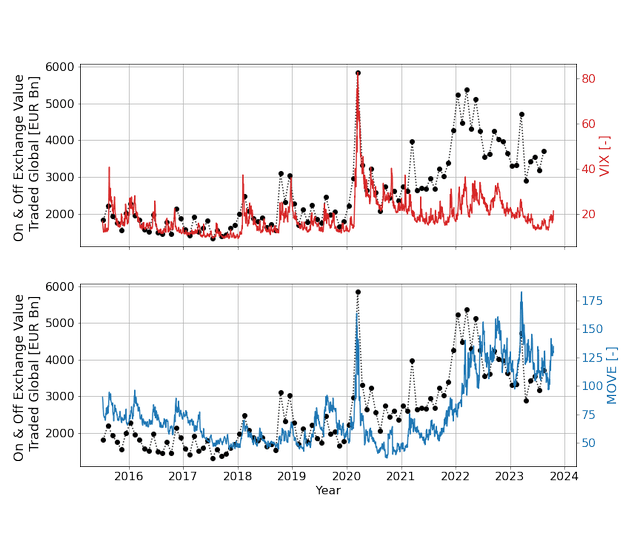

The current performance of Flow has been attributed to a slow market and low volatility which has eroded earnings and subsequently the stock price. If the Exchange Value Traded [EVT] reported by the company is assessed, it becomes clear that the current situation is nothing out of the extraordinary, see figure 1.

Figure 1 – Exchange Value Traded versus VIX and MOVE (flowtraders.com, seekingalpha.com, yahoo.finance.com; chart by author)

In fact, the current levels of EVT and VIX are not low at all if the period prior 2020 is taken into consideration. Value traded has shown growth over time and, even at these seemingly slow times, is a multiple of the numbers booked in the previous decade. The current level of EVT is no match for the numbers booked in the first half of 2022, but on the other hand value traded is much higher than in 2021 for example.

Similarly, the current volatility may be perceived as low, but in aggregate there is a distinction to be made pre- and post-2020. In this respect, the one thing that may be extraordinary is the elevated level of volatility that persisted from 2020 all the way to the beginning of this year. After all, prior 2020 the company had mainly been operating in a sub-20 volatility environment.

Summarizing, the market is somewhat slower and the VIX signals a less nervous market, but this does not explain the subdued performance of Flow and covers only half of the story.

Rates, rates, rates…

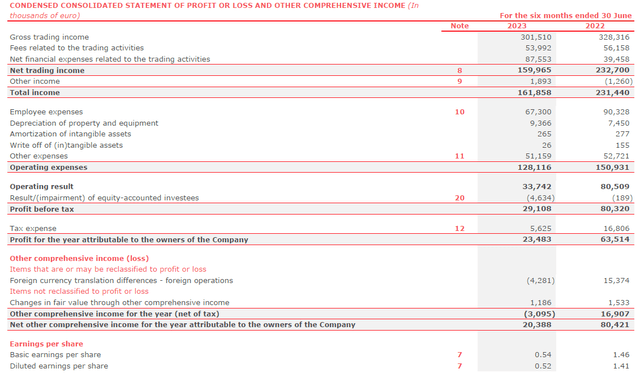

The other half of the story becomes clear when the income statement, accompanying the 1H23 results, is considered. Unfortunately an update of these results was not available at the 3Q23 update, but the point to be made will not change.

The data in Figure 2 shows gross trading income was down 8% in 1H23 compared to last year. Given the perceived slowness in the market, as demonstrated in Figure 1, this result is palatable. Less so is the line item financial expenses related to trading activities, which more than doubled.

Figure 2 – Consolidated income statement, 1H23 report (flowtraders.com)

Digging a bit deeper into these expenses it turns out they mainly ‘relate to interest expense on the credit facilities with the prime brokers calculated on the drawn amount during the year.‘ In other words, the central bank actions in the form of rate hikes also affect the bottom line of Flow Traders.

A second observation from the income statement is the effect of foreign currency translation differences. The difference of almost €20 million between this and last year works its way into the earnings per share. With approximately 44 million shares outstanding, the FX effect alone already affects EPS by 45 cents.

The 3Q23 trading update unfortunately provides no specific data on these items, but especially the interest rate expenses will remain substantial as rates have not been lowered.

Perfect storm

Flow traders stock has taken a beating this year on the back of poor performance. It seems a combination of factors is suppressing the results, namely:

- Currency headwinds

- Interest rate headwinds

- Reduced volatility

- Reduced trading volume

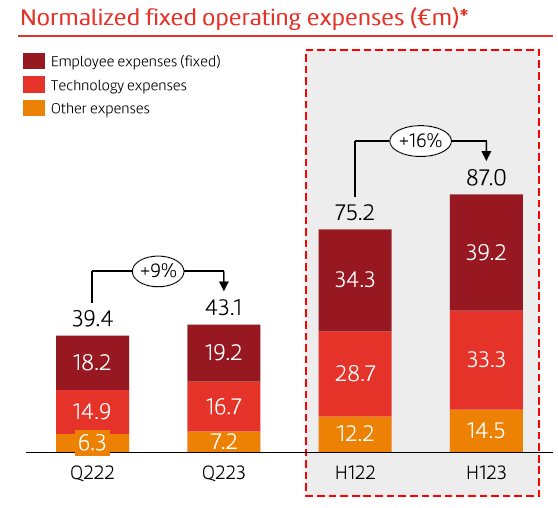

On top of these external factors, Flow Trades continues to work on its ambitious growth plan, which means expenses are rising, see figure 3. In addition to this figure the 3Q23 normalized fixed operating expenses amounted to €46.7 million, a continuation of the trend.

The upside is management still expects normalized fixed operating expenses to remain in line with previous guidance of €175-185 million. The downside however is that these expenses still need to be covered in a macro environment that is weighing on both the income and costs.

Figure 3 – Operating expenses, 1H23 results presentation (flowtraders.com)

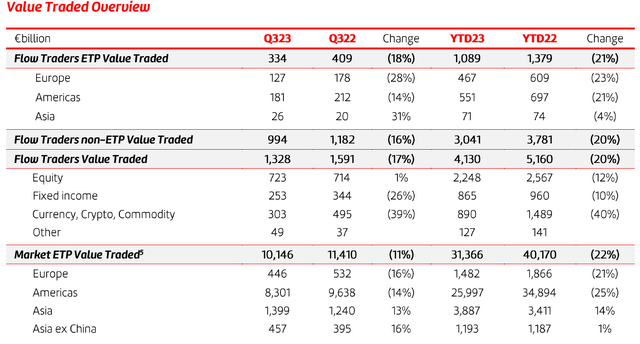

As noted in my previous coverage, the growth efforts in e.g. the bond and crypto markets have not materialized to the extent that these can compete with the equity section of the company. Figure 4 shows Flow’s total value traded declined by 20%, in line with the market, but section Currency, Crypto and Commodities reduced 40% compared to last year.

Figure 4 – Value traded overview, 3Q23 trading update (flowtraders.com)

These are big numbers that imply equity remains the secure base and the other businesses still require more time to mature. In itself this need not be a problem, but the unfortunate situation occurs that the investments are now executed in a time of deteriorating performance. On the upside it must be mentioned a combined value of €1.2Bn was traded in the Fixed Income and CCC segment whereas this was non-existent several years ago.

More options

Broadly speaking insurance will cost you money until a foreseen, yet unexpected event materializes. While typically insurance is taken to protect oneself against negative events, there is no hopeful expectation such an event will materialize. Similarly, when one buys insurance, potentially in the form of options, to protect ones portfolio against a decline in the stock market, the cost of the option is discarded as no one expects to make money on this insurance. It is a ‘just in case’ cost people are generally willing to incur.

On the contrary, when a position in Flow is opened, equity is added to the portfolio and the logic expectation is that the price will appreciate and the dividend keeps flowing. It may even be so that investors will hope for an event that will make volatility spike, only to prove the merit of the investment in Flow Traders. The effect is thus the opposite of insurance, the investor welcomes the adverse event the insurance was bought for in the first place.

Similarly, with Flow being a market maker, benefitting from a combination of volume and volatility, the stock behaves in a contrarian manner. This year earnings dwindled as volatility was low, in stock markets that is. Lower earnings logically lead to lower distributions which has put pressure on the stock.

Instead of considering the company as equity or insurance, a more correct analogy can be made to options. The similarity between Flow Traders and options is that both are relatively cheap to purchase when volatility is low. When volatility is high however, options are typically more expensive and the same holds for Flow as earnings are higher. Similarly, the sale of options will command a higher premium in a highly volatile environment. When earnings for Flow are higher, due to increased volatility, the selling price will be higher as well.

The difference however is that a position in options will expire, unless these are rolled over, whereas a position in Flow will remain unless the company ceases to exist. While it’s not worthwhile to dwell on options for too long, the point is case is that the value of both products is closely tied to volatility. But, as high volatility does not equal a good investment in this company, it was argued before the focus should be put on the dividend rather than the volatility.

Time over timing

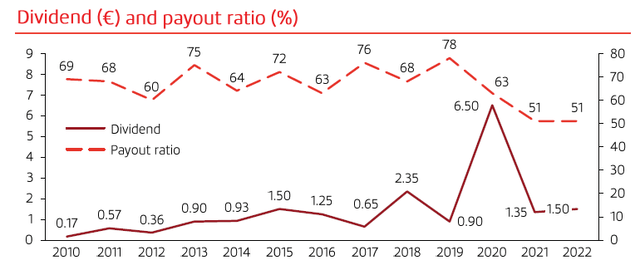

The 2023 interim dividend was set at €0.30 based on €0.80 (normalized) earnings per share for the first half of this year. While the third quarter results give little confidence the final dividend will be much higher, it is worth noting the historic dividend has had its ups and downs, but overall displays and upward trend as demonstrated in figure 5.

Figure 5 – Flow Traders dividend history, 1H23 results presentation (flowtraders.com)

Yes, the company will need to grow value traded and get a grip on interest expenses, but then again it appears the company is in a perfect storm. Concerning rates, it can’t be said for sure no more hikes will be done, or for how long the rates will remain at the current elevated levels. That said, odds are rising that rates will be lowered rather than increased further. In these adverse conditions, recent performance shows the company still earns money, even though it may be a small amount.

Flow is a growth story that will not appreciate materially in terms of stock price any time soon in absence of big volatility spikes. Instead, the goal is to grow Net Trading Income [NTI] to a level of €1Bn. While this goal may be a few years out, the growth trajectory has been plotted and action is underway while management keeps an eye on costs.

Personally I have been waiting for sub-20 volatility levels to scoop up this stock at a sub-20 price. With this target achieved, next up will be the wait for the NTI to increase over time. Volatility spikes are a bonus, but not part of my base case.

Conclusion

Flow traders stock has taken a beating this year on the back of poor performance. A combination of factors is suppressing the results of which interest costs form the bulk. As chances are rates will come down rather than increase further, this may create room for to lift earnings. Over time, earnings will further be supported by the goal achieve €1Bn in trading income.

It is extremely difficult to buy a stock that has depreciated in value like Flow has. However, realizing that Flow has more similarities to options rather than equity, the case is made that a low volatile environment presents a better buy moment for this stock than times of high volatility. Therefore, the best conclusion with regard to this stock may be that Flow is not the stock for you if you are not comfortable trading options.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here