Along with other regional banks that have released Q3 2023 earnings, Fulton Financial also benefited from a positive market reaction: up about 4% post-market. There are still many regional banks missing from the earnings call, but this quarterly earnings season is off to a good start for the banking sector. It would seem that the pessimism of the beginning of the year is behind us, but beware of underestimating some lingering problems.

Q3 2023 highlights

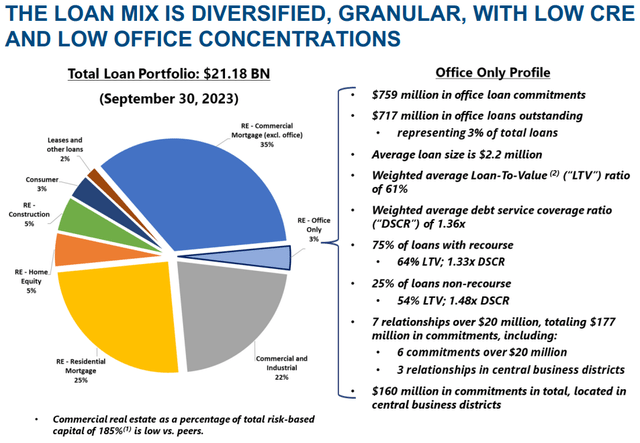

Fulton Financial’s (NASDAQ:FULT) loan portfolio remains diversified and gradual, as well as not too dependent on commercial loans. In fact, the CRE loans concentration ratio is 185%, quite low when compared to peers: some even exceed the 300% threshold limit.

Fulton Financial Corporation Q3 2023

The average size of a loan issued by this bank is $2.20 million, and the average LTV is only 61 percent. In the event of a major collapse in the housing market, Fulton Financial has an LTV such that it can absorb much of any damage since the value of the collateral far exceeds the amount lent. In addition, exposure to office loans has been kept very low, only 3% of total loans.

In general, Fulton Financial’s loan portfolio appears less risky than those of peers since there is not a strong prevalence of commercial loans, particularly toward non-owner-occupied loans. In any case, having a portfolio with moderate risk does not result in the same yield.

Fulton Financial Corporation Q3 2023

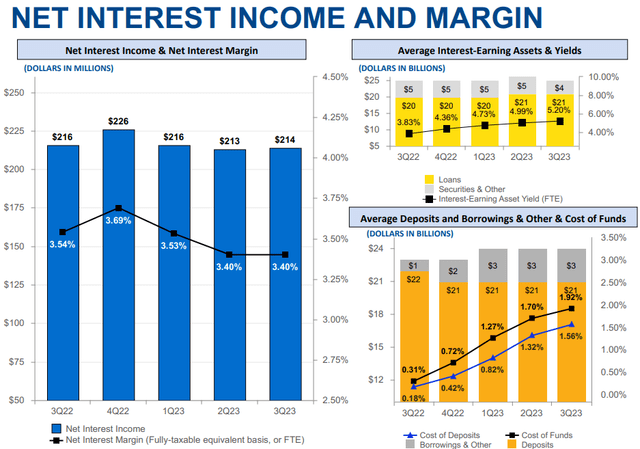

As we can see from this image, the interest-earning asset yield is increasing every quarter and has reached 5.20 percent: yet, net interest income has remained almost unchanged since the beginning of the year. The reason is due to a major increase in the cost of funds, up 22 basis points from the previous quarter.

The increase in yield on assets could not overcome the increase in the cost of funds, and as a result, Fulton Financial’s growth stalled. Anyway, the market was discounting a more negative scenario than expected, in fact both EPS and revenue for Q3 2023 beat estimates, by $0.02 and $10.01 million respectively.

In other words, the market was too pessimistic about the banking sector’s performance in the second half of 2023 and is now upwardly revising the valuations of the banks that suffered most from the SVB crisis. In particular, I expect that regional banks – including Fulton Financial – will recover some ground in the coming weeks.

Returning to the previous theme, the increase in the cost of funds has been significant. In fact, while for peers (banks with assets between $5-$49 billion) that cost was 1.77%, for Fulton Financial it was 1.92%. However, in the coming weeks many regional banks will release their quarterly results and the average for peers may rise. In addition, even though funds cost more, the net interest margin in Q3 2023 was 3.40%, higher than the peer average of 3.26%.

Finally, FY2023 guidance was revised upward for net interest income: from the previous range of $830-$840 million, to the current $845-$855 million. In the previous quarter, management had taken a far too conservative approach.

Focus on deposits

Fulton Financial Corporation Q3 2023

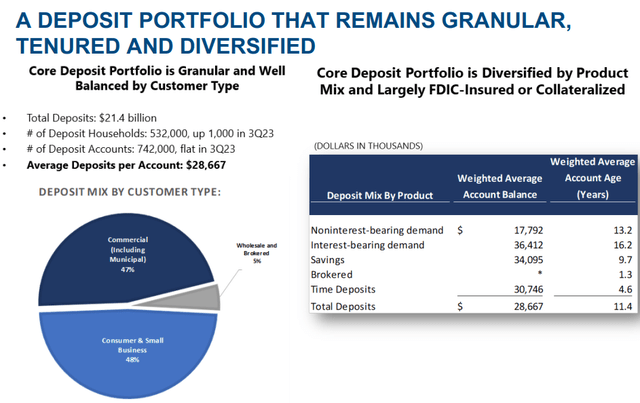

Deposits remain granular and diverse, as well as quite stable given the weighted average of account years. There are many dated clients and the average deposit today stands at $28,667. All good news, but the main concern is not the amount of deposits, but their cost.

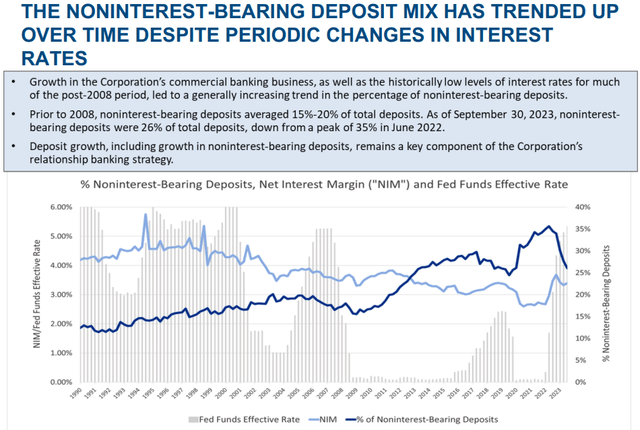

Fulton Financial Corporation Q3 2023

As we can see from this chart, non-interest-bearing deposits relative to total deposits are in steep decline: from a high of 35 percent in June 2022, they are now on 26%. This is a major 9% drop for what is the main source of funding for banks since it is free. In any case, this liquidity has not been lost, but simply replaced with interest-bearing deposits and time deposits. Since this trend began the net interest margin has experienced a gradual decline that only in the last quarter seems to have stopped. After all, the market is no longer discounting any rise in the Fed Funds Rate, and the cost of deposits may have reached a point where it is unlikely to rise further. There is a silver lining to all this, however: the reduction in non-interest-bearing deposits at Fulton Financial appears to be cyclical.

In fact, this typically occurred when the Fed was adopting tight monetary policy, but once it ceased, the growth of non-interest-bearing deposits was stronger than before. Over the long run, the latter continues to be in a bullish trend.

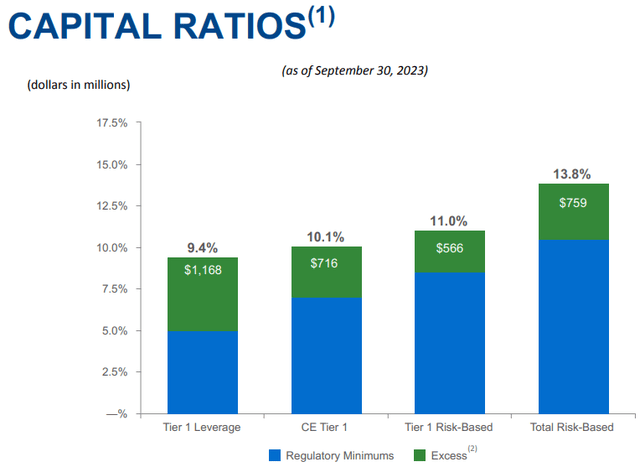

Capital requirements under stress

Since banks have the ability to influence a country’s economic growth in the event of failure, it is essential that they are constantly monitored by supervisors. Given their importance, they must necessarily meet capital requirements imposed by the Basel Committee.

Fulton Financial Corporation Q3 2023

In the case of Fulton Financial all the main requirements are met, however if we adjust them for unrealized losses in the securities portfolio the picture looks different.

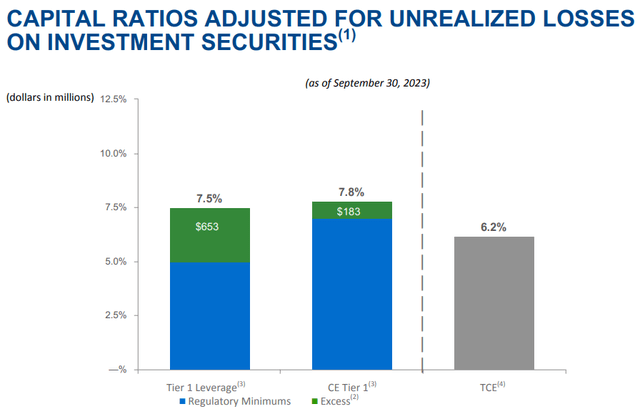

Fulton Financial Corporation Q3 2023

CET1 drops from 10.10% to 7.80%, while Tier 1 leverage drops from 9.40% to 7.50%. This is a significant reduction and brings capital requirements to just above the minimum threshold, especially for CET1.

The large write-downs that fixed-rate and high duration securities have obtained are weighing on Fulton Financial’s balance sheet, which, by the way, has limited room to maneuver to resolve the issue. Selling these securities would mean realizing a major loss, so the best option seems to be to wait for their maturity with the hope that the Fed will reduce interest rates in 2024. In any case, should the bank need liquidity, this would become a tangible problem.

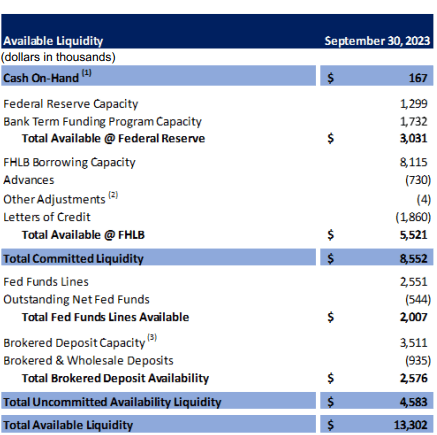

Fulton Financial Corporation Q3 2023

For the time being, the liquidity available to cover unexpected events is sufficient to avert this scenario, but the issue needs to be monitored in the coming months.

Conclusion

Overall, I believe Fulton Financial’s Q3 2023 was modest, as NIM stayed stable and the problems with non-interest-bearing deposits and unrealized losses remain. The reason the market reacted positively to this quarterly report is because expectations were so low that even a modest quarter would have been positive. In fact, regional banks have lost a lot of ground this year and could ride the wake of this period to return to pre-banking crisis levels.

Despite this glimmer of hope, it should be remembered that the overall picture still remains tumultuous and the Fed Funds Rate is still quite high. Mortgage demand will have to be evaluated in the coming months since the fixed rate is at 8%, as well as the willingness of companies to refinance at much higher rates than in previous years.

Read the full article here