Main Thesis & Background

The purpose of this article is to evaluate the PIMCO Municipal Income Fund II (NYSE:PML) as an investment option at its current market price. This fund’s objective is to invest at least 90% of its net assets in municipal bonds whose interest is exempt from regular federal income taxes and the fund invests at least 80% of its net assets in bonds that at the time of investment are investment grade quality – bonds that are unrated but of similar quality.

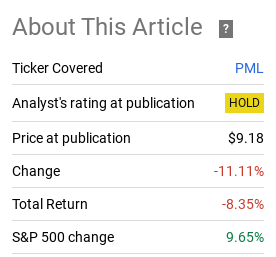

Back in Q1, I took a look at all the leveraged PIMCO national muni CEFs and saw limited value. The inverted yield curve and weak income metrics were macro-headwinds – despite a generally bullish outlook for munis overall. This led me to suggest caution with respect to PML (and other funds) and that cautionary message has certainly been vindicated over the last seven months:

Fund Performance (Seeking Alpha)

In fairness, I probably should have been more bearish, but I don’t like the idea of outright selling income-oriented vehicles unless there is a very strong and compelling reason. I saw a few positives for PML, so the steepness of this loss has surprised even myself.

With this sharp drop over time, I thought it could be worthwhile to take another look at this CEF. Unfortunately, after review, I can’t walk away with a buy case despite what appears to be some underlying value. Therefore, I am maintaining the “hold” rating for PML – and I will explain why in detail below.

What Are The Good Points? Discount To NAV Has Emerged

To begin, I am going to touch on a couple of positives. This is important because I had initially considered a “sell” rating on this security, but there are a few attributes that make me reluctant to do so. The first aspect in particular is the fund’s valuation. Back in February, when I last suggested my followers avoid this fund, PML sat with a 4% premium. Today – it has a discount to NAV in excess of 2%:

| Fund | Current Valuation |

| PML | (2.4%) |

| PIMCO Municipal Income Fund (PMF) | (2.4%) |

| PIMCO Municipal Income Fund III (PMX) | (9.1%) |

Source: PIMCO

Now, this does not automatically mean anything by itself. Some funds trade at very high (sometimes ridiculously high) premiums for years, while others see extensive discounts persist. So it is just one piece of the puzzle. But to see a premium price narrow to a neat discount is an attribute one should not ignore.

The problem with buying on this fact alone is that it doesn’t really tell the whole story. PML could easily see its discount widen – so that right there is something to consider. But we also should acknowledge that PIMCO has two other national muni CEFs: PMF and PMX. These are two very similar funds, and one – PMX – has a very cheap price by comparison right now. So if one was considering any of these options, it seems clear to me that buying PMX over the others would be the right call. That naturally supports my neutral rating on PML by extension.

Munis Remain Well Supported

The next thing to consider is that muni bonds remain well-supported on average. This is a critical point because many investors are starting to think interest rates have peaked (or are near peaking) and the time is ripe to start locking in long-term bond yields. This includes treasuries, corporate bonds, and, of course, munis.

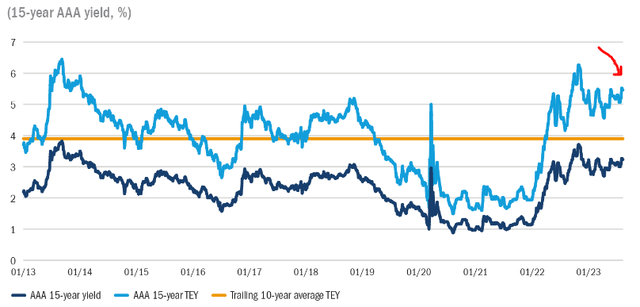

This extends to the muni sector because just like those other areas, current yields are historically high at the moment. On a tax-adjusted basis, yields on IG-rated munis are well above what investors are normally getting:

Current Yield (Tax-adjusted, Triple A-rated) (FactSet)

But the yield is not the whole story. A higher yield – just like valuation – needs to be put in context. A yield that gets too high (whether in isolation or in relative terms) could be the market’s signal telling you to stay away because the risk is elevated.

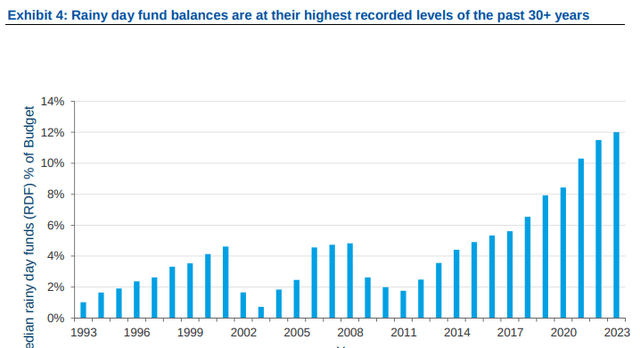

But with munis this is not the case. On average, state, and local government debt is as supported now as ever. This is due to consistent tax collections and excess, leftover federal cash from Covid-relief efforts. The net result is that “rainy day” funds (government reserves) are as high as ever:

Rainy Day Funds (National Average) (Federal Reserve)

For this reason, I am not too worried about the credit quality of the underlying securities in PML. I personally am a muni bull right now. But to play this space, I would advocate my followers to buy individual issues from their broker – most likely from their state of residence. Or, for a more diversified play, buy a non-leveraged ETF until the yield curve normalizes (more on that below).

Leveraged Plays Are Simply Not Working In This Environment

At this point, one has to wonder why PML is struggling. With a discount to NAV and strength in the underlying holdings, this seems like a “sure thing”. Yet, the fund is down into correction territory and could be headed lower. What gives?

The answer lies in the strategy of the fund and the broader macro-environment. As a leveraged CEF, it has been hammered by rising interest rates and an inverted yield curve. This is something I have been discussing at length in my articles over the past year and a half. Simply put, leveraged funds are seeing an uptick in borrowing expenses as short-term rates rise, but are having challenges finding higher income streams to reinvest that borrowed cash into at the longer-end of the curve.

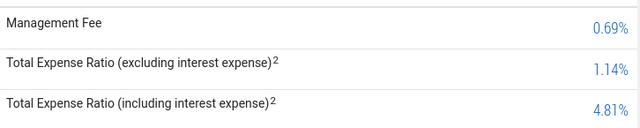

To see how this impacts PML, let us start with expenses. Leveraged CEFs are normally a pricier way to play the market because one has to pay for both active management and borrowing costs. But the costs are often worth it because the cost of that leverage is less than what fund managers can reinvest that borrowed money into. The difference in yield trickles back into the fund and allows these CEFs to pump out above-average income streams.

The problem now is that fund managers are not cutting back on their management fees and borrowing costs are elevated. This results in investors paying out nearly five percent for the “privilege” of owning this fund:

PML’s Expenses (PIMCO)

This should make it clear why the leverage is not really benefiting investors. It is difficult to find munis yielding 5% on the open market, so the borrowing costs and management expenses are actually eating away at returns – not enhancing them.

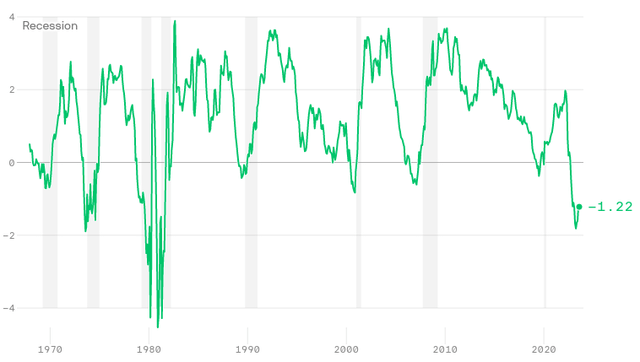

The bad news is also that the yield curve remains steeply inverted. It is going to take some time for that to change. So the short-term outlook for PML suggests that more of the same is the most probable scenario:

Treasury Yield Curve (3-month vs. 10-year) (S&P Global)

The bottom line here is that investors are not doing themselves much of a favor by utilizing these types of CEFs. PML is by no means the only rabbit in this hole. Until the macro-environment normalizes – either because the Fed starts cutting short-term rates or investors stop pricing in a recession (which is weighing on long-term rates) then the prospects for PML will continue to be mediocre at best.

Income Cut Looks Likely

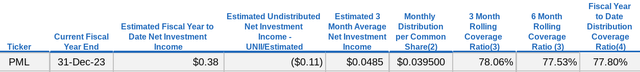

Expanding on the prior paragraph, it is not much of a stretch to suggest that an income cut is going to happen for PML. This is because the income metrics are well under 100%, and have been there for most of 2023. This simply means the fund is not earning enough in income to adequately cover its distribution – which logically means that distribution may have to come down:

UNII Report (PIMCO)

To put this in perspective, the coverage ratios have been fairly consistent since my last review – but they are quite poor. So that isn’t a good thing. Being under the 80% mark has meant that PML is dipping into other avenues to cover that payout, resulting in a negative UNII balance of almost 3 months’ worth of distributions. This ($.11) figure is up from just one cent back in February. So – the trend is not your friend here.

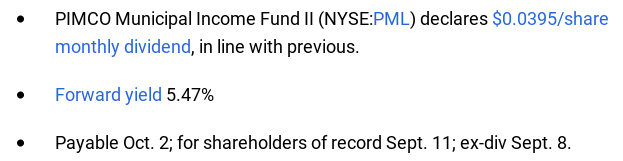

The conclusion I draw is that PML is going to have to cut. This will probably occur in January because that is when PIMCO likes to get the bad news out of the way. This means investors have some time to prepare, which is a positive thing. Further, PML’s yield (based on the most recent payout) is 5.5%:

Current Yield (PML) (Seeking Alpha)

Once we factor in tax exemptions, this yield can climb substantially for high-income earners. What I take away from that is that PML can survive an income cut. Normally I would be bearish if I think an income cut is coming (like I was with respect to PIMCO California Municipal Income Fund (PCQ)) that dropped over 40% after an income cut).

But this isn’t the same situation. For starters, PML has a discount, while PCQ had a massive premium before it cut its distribution. Further, PCQ is a California-focused debt fund, meaning its potential buyer pool is more limited than a national option like PML. That can make the moves more exaggerated if there are fewer buyers and/or sellers. This backdrop should give some insight into why I still feel “hold” is the more appropriate rating.

Bottom line

PML has been on a downward spiral, and I’m afraid the forward outlook isn’t much better. A strong credit backdrop for munis as a whole and a discount to NAV could help limit the future pain. But an impending income cut and a punishing environment for leveraged CEFs means that it is hard to get bullish here. As a result, I continue to advocate to my followers that they approach these types of products cautiously and will maintain my “hold” rating on PML going into the fourth quarter.

Read the full article here