Chip design company Arm Holdings (NASDAQ:ARM) completed its Initial Public Offering last week which resulted in a significant 25% valuation gain on the first day of trading. However, the company is trading at an inflated valuation and achieves a market cap of $62B although Arm virtually produced no top line growth in the last fiscal year. Considering that Arm is trading at a significant premium to other chip companies, I believe the risk profile is highly skewed to the downside and investors buying into the Arm IPO today are at risk of massively overpaying for the firm’s revenue potential. As a result, I rate Arm a strong sell and believe shares are going to experience significant selling pressure in the near term!

Successful initial IPO, but lack of top line growth is a concern

Softbank-owned Arm announced the pricing of its initial public offering of 95,500,000 American depositary shares (+ overallotment option of 7M shares) on September 13, 2023. Shares of the chip design company were priced at the upper end of the proposed range and came to market at $51 on Thursday. Shares immediately soared 25% over the IPO price on its first day of trading on Thursday, but dropped 4% on Friday.

Arm is a key player in the chip industry and provides crucial CPU architecture that customers are using around the world. At its core, Arm licenses a portfolio of products to customers and generates recurring licensing revenues. Nvidia (NVDA) originally planned to buy Arm in 2020 for $40B but the deal fell through due to regulatory concerns. Softbank remains a major shareholder of Arm going forward and owns nearly 90% of the chip design firm.

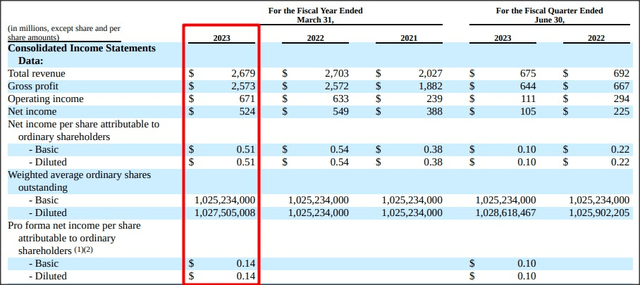

According to Arm’s registration statement, the company is solidly profitable, but has seen practically no top line growth in FY 2023… which is the year that ended on March 31, 2023. While Arm remains fundamentally profitable on an operating and net income basis, the lack of attractive top line growth is what is concerning.

Arm generated $2,679M in revenues in FY 2023, showing a 1% decline year over year. Arm’s margins, however, look decent as the company achieved reasonable net profit margins of 20%, 20% and 19% in FY 2023, FY 2022 and FY 2021. Although Arm has been running a profitable chip design enterprise for many years, the lack of meaningful top line growth is a concern that I believe investors will have to face sooner rather than later. Ultimately, companies like AMD (AMD) and Nvidia offer investors much better growth prospects in terms of revenues and earnings per-share which I believe will force investors to reevaluate Arm’s value proposition following the massive first day valuation gain.

Source: Arm Holdings

Share overhang a potential issue for buyers in the future

Softbank still owns nearly 90% of the company’s outstanding shares, meaning there is a considerable share overhang that could ultimately depress Arm’s valuation. If Softbank decides to sell more shares to the public in the future (which it very well might), investors are likely to face a considerable amount of selling pressure and a potentially lower valuation factor.

Arm now more expensive than Nvidia

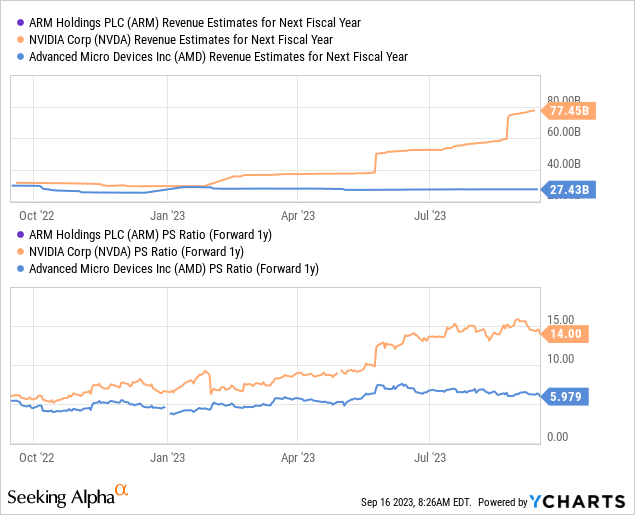

Arm is highly valued with a market cap of approximately $62B. Assuming $2.7B in revenues for FY 2024 (assuming no material top line growth), shares of Arm are valued at a huge (and indefensible) forward P/S ratio of 23X. Nvidia and AMD, both of which are not necessarily considered cheap either, trade at much lower revenue valuation factors: Nvidia trades at a forward P/S ratio of 14X and AMD at 6X.

However, both companies offer investors significantly better revenue upside: Nvidia is expected to grow its top line 43% next year while AMD is still projected to deliver 20% revenue growth in its upcoming fiscal year. In other words, both Nvidia and AMD offer investors stronger revenue growth potential while trading at cheaper valuation factors.

The entire chip sector is currently overvalued which exposes investors to severe downside risks, in my opinion. I recently reviewed my work on Nvidia and lowered my May rating from sell to strong sell because I see Nvidia’s valuation, despite its impressive revenue trajectory, as hugely inflated which translates to an unattractive risk profile for investors. In May, I warned about exuberance related to the AI hype and recommended AMD to be sold: Don’t Kid Yourself, This Is The Time To Sell. With Arm now even more expensive than Nvidia, the previously highest-valued chip stock, I believe investors are going to see continual valuation pressure, especially if Arm doesn’t execute well in terms of top line growth following its Initial Public Offering.

Risks with Arm Holdings

The obvious risk with Arm is that the current IPO hype will fizzle out sooner rather than later, in my opinion, and the multiplier factor the chip design company is trading at could seriously compress as a result. Additionally, Softbank still owns the overwhelming majority of shares. If the company decides to throw these shares on the market and increase the supply going forward, Arm’s valuation is most likely going to suffer severe headwinds.

Final thoughts

Arm’s Initial Public Offering has been successful as the chip design company delivered a 25% gain on the trading… but that does not mean that Arm makes a good value proposition. The lack of top line growth is, in my opinion, what makes the current market valuation of $62B unsustainable and I don’t see how this premium valuation, especially with respect to Nvidia, could be justified. The share overhang creates an additional problem for shareholders down the road. I believe, therefore, that investors are overpaying for the revenue potential of Arm. As a result, I am rating shares of Arm a strong sell.

Read the full article here