By Mobeen Tahir and Christopher Gannatti, CFA

The Jetsons, a beloved animated series from the 1960s, captured the imagination of audiences with its futuristic vision of a world filled with flying cars, robotic helpers and space-age technology.

One of the most iconic elements of the show was the flying car, which symbolized humanity’s enduring fascination with the idea of taking to the skies.

The Jetsons’ flying car represented the ultimate realization of the dream of living in a world where we could effortlessly soar above traffic and congestion, experiencing a new dimension of mobility and adventure.

While we may not yet have flying cars in the way the show envisioned, Joby Aviation’s (JOBY) electric vertical take-off and landing (eVTOL) aircraft is quickly taking us to a place where we might be able to keep up with the Jetsons.

Joby’s eVTOL

The eVTOL is an aircraft that looks like a cross between a drone and a helicopter. According to Joby Aviation, it is a faster, cleaner and smarter way to carry people through their lives.

As an aerial ridesharing service, the aircraft will transport passengers from downtown New York City to JFK Airport in just seven minutes, in contrast to a car, which can take up to 49 minutes, assuming optimal conditions and no traffic.1

The eVTOL offers numerous additional benefits as well. Its vertical take-off and landing capability enables it to access urban locations more easily. Powered by electric motors running on lithium-ion batteries, like an electric vehicle, it produces zero operating emissions and flies quietly.

It is also fast and can achieve a maximum speed of 200 miles per hour. And, as Joby Aviation states, it can accommodate one pilot and up to four passengers, making the experience of flying in it more akin to getting into an SUV than boarding a plane.

Your Flying Taxi Has Arrived

In June of this year, Joby Aviation received a Special Airworthiness Certificate from the U.S. Federal Aviation Administration (FAA) for the first production prototype built at its Pilot Production Line in Marina, California, marking a significant milestone.

This certificate allows the company to begin flight testing its first production prototype. This aircraft is expected to become the first-ever eVTOL delivered to a customer when it moves to Edwards Air Force Base in 2024 as part of a U.S. Air Force contract.

Joby, with substantial support from strategic partner Toyota (TM), is progressing toward FAA certification and large-scale production. This achievement represents a major step in their journey toward sustainable aviation, with plans to begin commercial passenger operations in 2025 and a recent partnership with Delta Air Lines (DAL) to offer emissions-free travel.2

For the average person, the cost of riding in an eVTOL versus calling an Uber (UBER) will also be an important factor when deciding whether taking to the skies is feasible.

In 2021, Joby founder and CEO JoeBen Bevirt told The Washington Post that the company hopes to begin services at an average price of around $3 per mile – comparable to a taxi or Uber – and eventually move to below $1 per mile.

Decarbonizing Aviation

At WisdomTree, we believe that eVTOLs represent a crucial component in the exciting array of technologies contributing to aviation decarbonization. Larger aircraft are increasingly turning to sustainable jet fuel to significantly reduce emissions while maintaining their reliance on internal combustion engines.

Hydrogen is also emerging as a viable future aviation fuel, with Airbus (OTCPK:EADSF) planning to test a hydrogen engine in an A380 as early as 2026. Battery-powered flight is expected to make smaller planes airborne.

The success of Joby Aviation and other companies involved in eVTOL development will likely inspire additional companies seeking to electrify their aircraft.

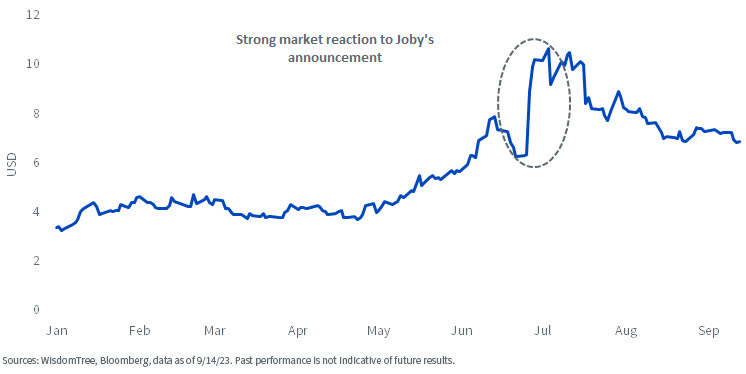

Share Price for Joby Aviation Year-to-Date

We view the electrification of aviation as an exciting subsector within the battery value chain. Emerging technologies, especially those that capture the public’s imagination, can go through hype cycles.

In June this year, when Joby Aviation announced that it had received the FAA’s permit to fly its prototype, its share price immediately surged. Naturally, the share price has since stabilized but continues to show robust year-to-date growth.

In a year dominated by headlines about Nvidia (NVDA) and artificial intelligence, Joby Aviation’s 107% year-to-date return (as of September 14, 2023) might have flown under the radar. Nevertheless, it underscores the potential of emerging players in the technology world.

Joby has yet to deliver its eVTOLs to customers and, understandably, has not yet achieved positive earnings. All that lies ahead. For now, it’s time to fasten your seatbelts.

The Way Forward for Investors

The WisdomTree Battery Value Chain and Innovation Fund (WBAT) gives investors a diversified exposure to the battery value chain. The strategy identifies 37 subsectors across raw materials, manufacturing, enablers and emerging technologies.

Aeronautical is one of the subsectors within the category of emerging technologies within which Joby Aviation is classified. As of September 14, 2023, Joby Aviation is the top holding in WBAT.

By diversifying across multiple frontiers of potential growth, the strategy stands to benefit if any of the innovations in the world of batteries become the next big thing.

1 Source: Joby Aviation, September 2023.

2 Joby Aviation’s press release on June 28, 2023.

3 As of September 19, 2023, WBAT held in 3.75% in Joby Aviation.

Important Risks Related to this Article

For current Fund holdings, please click here. Holdings are subject to risk and change.

There are risks associated with investing, including the possible loss of principal. The Fund invests in equity securities of exchange-listed companies globally involved in the investment themes of Battery and Energy Storage Solutions (“BESS”) and Innovation. The value chain of BESS companies is divided into four categories: Raw Materials, Manufacturing, Enablers and Emerging Technologies. Innovation companies are those that introduce a new, creative or different technologically enabled product or service in seeking to potentially change an industry landscape, as well as companies that service those innovative technologies. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit. The Fund does not attempt to outperform its Index or take defensive positions in declining markets, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Mobeen Tahir, Associate Director, Research

Mobeen is a member of WisdomTree’s research team where he focuses on a wide range of asset classes to offer strategic and tactical insights to our clients on global markets and investment products. Before joining WisdomTree in December 2018, Mobeen worked at Willis Towers Watson as an investment consultant advising institutional clients as well as their in-house fund business on asset allocation and portfolio construction with his research focus being equity and multi-asset smart beta. Mobeen has a BSc (Hons) in Accounting and Financial Management from Loughborough University and an MSc in Accounting and Finance from the London School of Economics and Political Science. He is also a CFA Charterholder.

Christopher Gannatti, CFA, Global Head of Research

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here