Investment Thesis

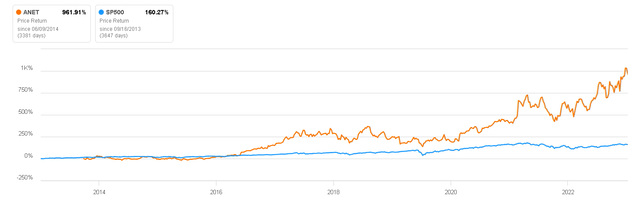

Arista Networks, Inc. (NYSE:ANET) is a company that has consistently outperformed the index. Over the last decade, it has delivered impressive returns to its shareholders, which is not surprising given the quality and resilience of its business model.

In this comprehensive article, we will delve into the pivotal role that Arista plays in the major macroeconomic trends of today, including the realms of artificial intelligence (AI), cloud computing, and data centers. These are areas at the forefront of technological advancement, and understanding Arista’s position within them will provide valuable insights into what awaits the company in the next decade.

Arista’s ability to adapt and thrive in these ever-evolving landscapes is a testament to its innovative approach and dedication to meeting the demands of an increasingly interconnected world. By exploring its strategies and contributions in these critical sectors, we can gain a deeper appreciation of Arista’s potential to continue delivering strong returns to its shareholders while shaping the future of networking technology.

Price Return vs S&P500 (Seeking Alpha)

Business Overview

Arista Networks is a multinational computer networking company that specializes in providing software-driven cloud networking solutions. The company is known for its high-performance data center switches and networking products that are designed to meet the demands of modern data centers and cloud computing environments.

Arista’s products are often used by large data center operators, cloud service providers, and enterprises to build scalable and efficient network infrastructures. The company is well-regarded for its innovative approach to networking, including its use of open standards and software-defined networking (SDN) principles to deliver high-speed and low-latency networking solutions.

If we were to envision networks as a city with roads and data as the cars that traverse this network, Arista switches would resemble traffic lights controlling the flow of data along the roadways. Routers would act as GPS systems guiding the “drivers” (the data), and Software Defined Networking ((SDN)) would serve as a control center overseeing and managing the conditions of the traffic lights and traffic in general.

Using this analogy, we can grasp the vital role Arista’s products play in the implementation of any network. Considering the significant increase in demand for AI, cloud computing, and digitalization, Arista finds itself in an excellent position for the coming years.

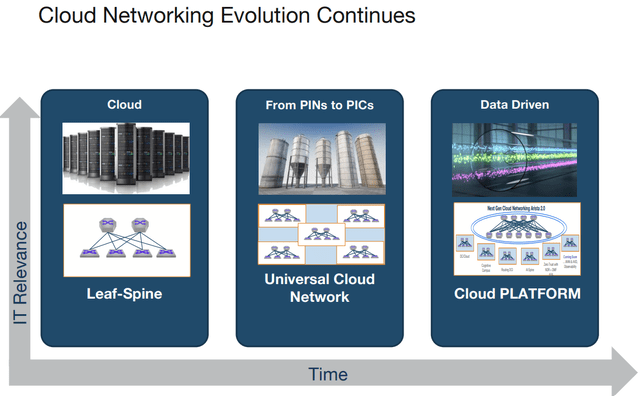

Arista Networks

Industry Overview

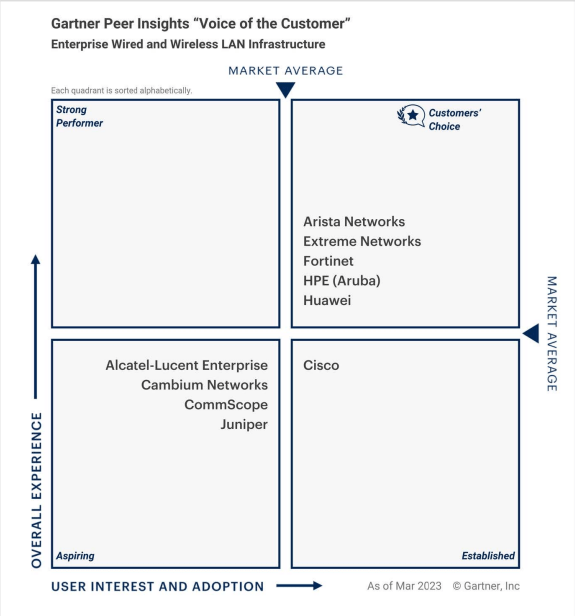

Arista’s products compete with the networks of other big businesses, such as Cisco (CSCO), Dell (DELL), Juniper (JNPR) or Huawei. In a Gartner study on Enterprise Wired and Wireless LAN Infrastructure, Arista appeared in the Customer’s Choice quadrant, indicating that it is one of the best options in terms of user interest in purchasing its products and the overall experience as a customer.

Arista Networks

Having a strong position in user experience is of paramount importance in this type of product category. Companies typically compete based on reputation rather than price because customers prioritize network reliability. Given the substantial investment involved, customers expect the highest quality from the products they choose.

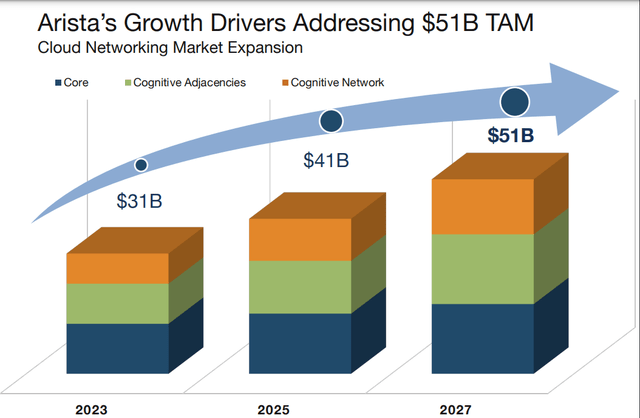

Various studies estimate that the data center and cloud computing market can grow around 13% in the United States and almost 20% globally, due to the rapid growth that Asia is experiencing. This widespread growth in the sector will provide tailwinds for Arista to grow in the coming years, because the company already has 10% of its revenue in Asia Pacific and could continue with an expansion in that geographic region that is experiencing so much growth.

Total Addressable Market (Arista Networks)

Key Ratios

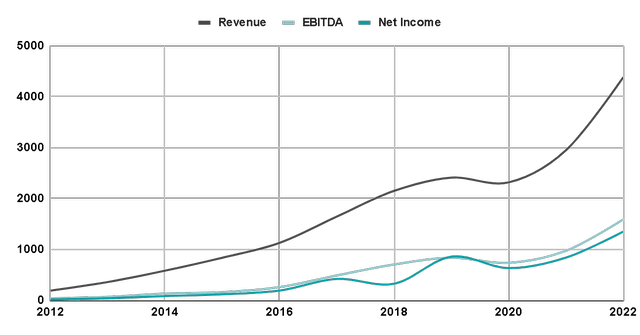

The company’s sales have shown impressive annual growth of 26% over the last decade, while EBITDA has increased by 38% annually. This growth reflects improved cost management and, consequently, higher margins.

Author’s Representation

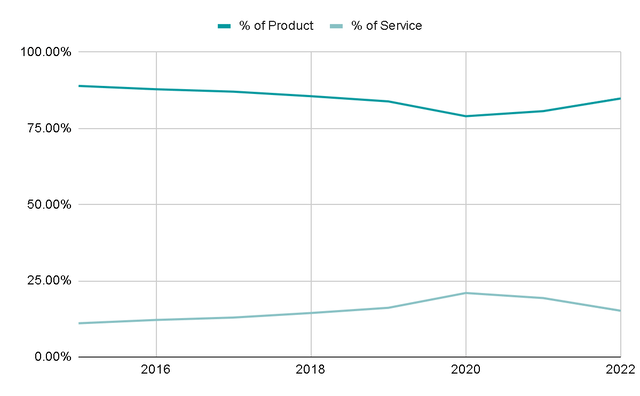

A key factor contributing to margin expansion is the increased proportion of sales derived from Services. In 2015, these services accounted for 10% of sales, and currently, they make up 20% (with the exception of FY2022, where they represented 15% of sales). These cloud-related services often focus on optimizing network performance, enhancing security, and improving cloud-based infrastructure management.

Author’s Representation

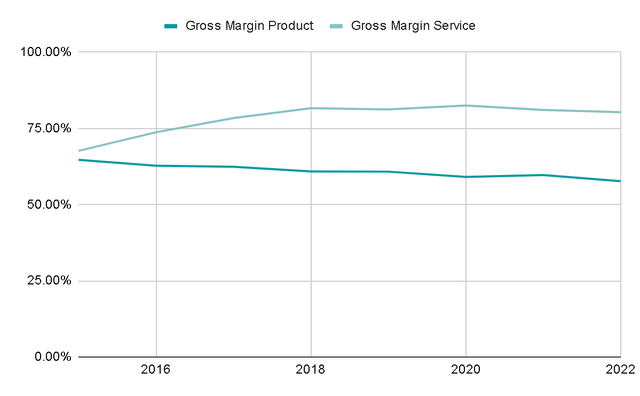

The significance of these services lies in their higher gross margins, which typically hover around 80%. In contrast, the gross margin for products, specifically hardware, tends to remain at approximately 60%. While recent trends do not suggest that hardware margins will increase significantly in the near future, the superior margins associated with services underscore their importance for the company’s profitability.

Author’s Representation

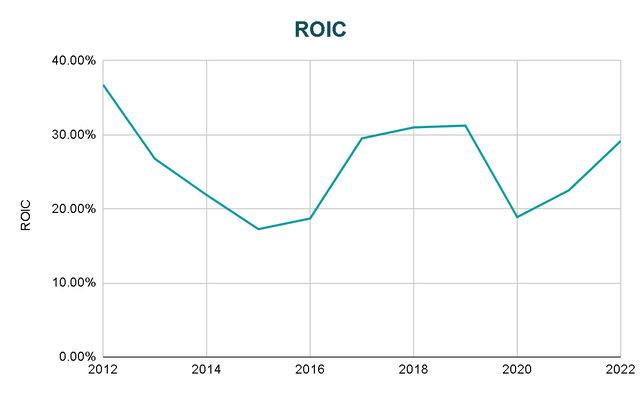

This growth has been accompanied by an average Return on Invested Capital (ROIC) of 25%, which is excellent and significantly higher than the market average. This indicates that the company is highly efficient in its use of capital for investment. This efficiency is particularly positive, considering that the company still has a long path ahead for reinvesting in the business. If it manages to sustain these rates, it will continue to create significant value.

Author’s Representation

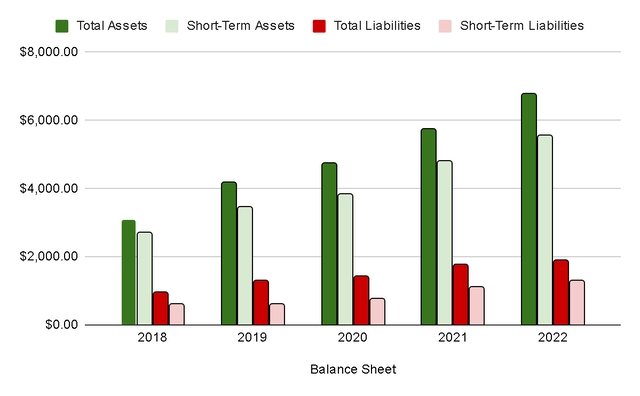

In terms of debt, the company maintains a robust and healthy balance sheet. Typically, its assets exceed its liabilities by three to four times, mirroring the ratio of short-term assets to liabilities. Consequently, in an environment of rising interest rates, the company is well-positioned, and debt is not expected to pose a significant concern.

Author’s Representation

Valuation

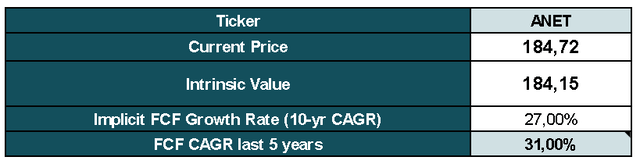

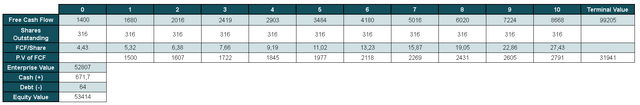

For the valuation, I will do a Reverse DCF to know the growth that the market expects based on the data that we already know. These data are the following:

- Outstanding Shares: 316M

- Cash as of FY2022: $617M

- Total Debt: $64M

- Free Cash Flow FY2022: $1300M.

I’m aware that the company reported a Free Cash Flow (FCF) of $450 million in 2022, which represents a margin of 10%. However, I believe it’s prudent to normalize this figure by considering the average margins it has maintained in recent years, which would yield a margin of 32%. It’s worth noting that the margin in FY2022 was affected by a significant increase in inventories, resulting in the decline.

Based on this data, the company would need to achieve an annual FCF growth rate of 27% to achieve a 15% Compound Annual Growth Rate (CAGR) return on our investment. This growth rate appears quite demanding, and I believe a more realistic expectation for FCF growth over the next decade could fall between 15% and 20%. Under this scenario, we might anticipate a return ranging from 10% to 12% from current prices. While not unfavorable, it’s important to note that there isn’t a substantial safety margin built into these projections.

Author’s Representation Author’s Representation

Risks

Customer Concentration: In the last three years, just over 10% of revenue comes from Meta and Microsoft alone. Losing these two customers would mean losing 10% of sales. This is dangerous because being such large clients, it is evident that all hardware suppliers want to work with them, even if this means lowering prices to gain the volume that these two giants provide you.

Technological Disruption: Rapid technological advancements or shifts in industry trends could render Arista’s existing products or solutions obsolete, necessitating significant investments in research and development if it doesn’t want to disappear, and even then, there is no guarantee that Arista will still have the best technology in five years or so.

Economic Downturns: Economic recessions or downturns could lead to reduced IT spending by customers, impacting Arista’s revenue and profitability. This is something that we have seen in many players in the digital transformation area, although in the case of Arista it seems that their products and services are of more critical use and for this year FY2023 they expect to grow 30%, which is excellent considering the macroeconomic situation.

Final Thoughts

Arista Networks undeniably stands as a high-quality business strategically positioned in a sector that is set to experience substantial demand in the years to come. With its cutting-edge solutions, it remains the go-to choice for clients aiming to optimize their networks, showcasing a strong competitive advantage.

However, it’s important to weigh the scales with care. Despite Arista Networks, Inc.’s remarkable business profile, the current valuation doesn’t seem to have a margin of safety. This, in my view, is the sole drawback I currently perceive. While Arista’s long-term growth potential and the sector’s promising outlook are evident, the current market price doesn’t present an attractive entry point.

Ideally, I would be more inclined to consider a buy rating if Arista Networks, Inc. stock were priced around $120 USD. At that level, the potential return on investment would become significantly more appealing. It underscores the significance of valuation in assessing investment opportunities, even for businesses as fundamentally strong as Arista Networks.

Read the full article here