Investment Thesis

The Wendy’s Company’s (NASDAQ:WEN) revenue growth should benefit from the carryover impact of price increases and favorable pricing gaps with peers, which should lead to market share gains as consumers trade down. In addition, increasing promotional and value offerings, and increased advertisements to boost the ongoing strength in the breakfast and late-night dayparts should also support the top line. In the long term, international footprint expansion should help the company’s sales growth.

The company’s margin prospects are also good, benefiting from the carryover impact of past pricing increases, moderating inflation, productivity gains, and sales leverage. The good growth prospects coupled with attractive valuation and a compelling dividend yield make Wendy’s an attractive buy.

Revenue Analysis and Outlook

In my previous article, I talked about the company’s good growth prospects ahead, benefiting from strength in its digital channel, growing breakfast and lunch daypart, and new unit development. The company has reported its earnings for its second quarter of 2023 since then and similar dynamics were seen. However, the stock price has corrected due to a broader correction in the restaurant sector over the past few months, which has made the stock’s valuation even more attractive than before.

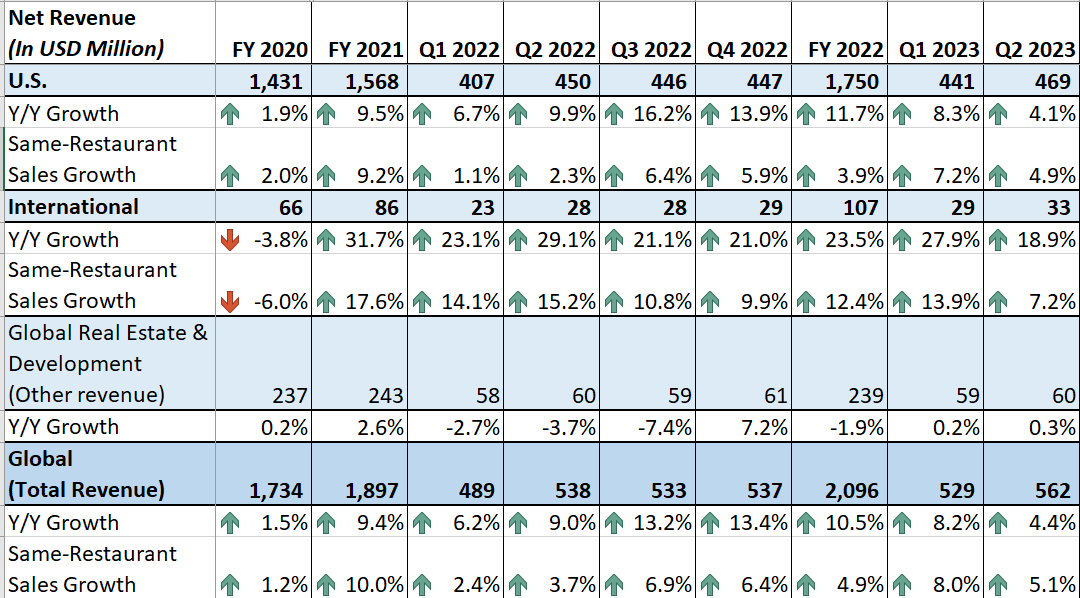

In the second quarter of 2023, the company continued its streak of delivering positive same-restaurant sales (SRS) growth as it benefited from price increases and a positive mix, partially offset by a slight decline in customer counts. The good demand in the breakfast and late night daypart also helped in increasing sales. This resulted in a 4.4% YoY increase in net sales to $562 million. On a same-restaurant sales basis, revenue increased by 5.1% YoY, reflecting a 4.9% YoY SRS growth in the U.S. and 7.29% YoY SRS growth internationally.

WEN’s Historical Sales (Company Data, GS Analytics Research)

Looking forward, the company should be able to continue delivering revenue growth benefiting from price increases, good demand at the breakfast and late night daypart, increase in promotional and value offerings, and footprint expansion.

Over the past year, the company’s SRS growth has benefited from price increases, which WEN took to offset inflationary pressure. The company further took pricing increases in the second quarter of 2023. This additional price increase and the carryover impact from the previous price increases should continue to support the company’s SRS growth.

Although the company implemented price hikes amid rising inflation, these increases have remained lower than those of its competitors, some of which have raised prices significantly, even by double digits. This pricing gap has been advantageous for the company’s sales growth because it has made Wendy’s products more affordable to price-sensitive consumers. In an inflationary environment, consumers often seek more budget-friendly alternatives, and by keeping prices relatively lower, the company should be well-positioned to attract such customers. So, I believe that this pricing strategy of raising prices below that of competitors should drive increased demand and higher customer traffic for the company moving forward.

In addition, the company has also increased its promotional and value offerings, which is also resulting in good customer traction for its food service. For instance, WEN ran its Buy 1, Get 1 for $1 promotion in July which according to management, performed well and attracted customers and should aid sales growth in the third quarter. The company has a good promotional line-up in the coming quarters to support the topline.

Moreover, while near-term headwinds from lower consumer spending in an inflationary environment are a concern to the overall restaurant industry, management has not seen any impact of challenging macroeconomic conditions on customer demand yet and expects customer demand to remain sustained moving forward as well. On the Q2 2023, earnings call, CEO Todd Penegor commented,

The consumers continue to face a lot of pressures as a result of the several macroeconomic factors, but we believe we’re really well positioned to compete in this environment. QSR continues to be the place to be. We saw some trade-down from mid-scale casual last year into our brand. Those customers have stuck with us. You’re seeing higher-income cohorts start to shift into QSR, which is good for our brand.

And we do know the lower income cohort as inflation starts to moderate in the back half with all the gross income improvements they had real income will start to improve, which could be a nice tailwind for our business.”

So I believe pricing below peers, and increased promotional value offerings should continue to benefit the company through customer trade-downs and support sales growth.

The company’s value offering “$3 croissant” has also helped it drive customer demand to the breakfast daypart and resulted in a mid-single-digit sales growth in breakfast daypart versus the prior year. The breakfast daypart has been growing consistently over the last several quarters thanks to increased mobility post-pandemic, increased promotional and value offerings, consistent menu innovations, and the launch of the breakfast menu in new markets. Additionally, the company is also seeing growing demand in its late-night daypart. This is due to a growing customer preference for late-night snacking and again due to the company’s value offers. This led to a double-digit sales growth in the late night daypart in Q2 2023 both on a sequential as well as year-over-year basis and helped the company gain incremental market share.

The company now plans to accelerate advertising and marketing initiatives to increase brand awareness among customers for both breakfast and the late-night daypart. However, as compared to the breakfast daypart, the company is planning to focus advertising initiatives more on the late-night daypart and looking forward to spreading the message that its restaurants are open till midnight or later than that with compelling food offerings. This increased advertising and growing demand at breakfast and late-night dayparts should continue to drive incremental market share for the company moving forward and help overall sales growth.

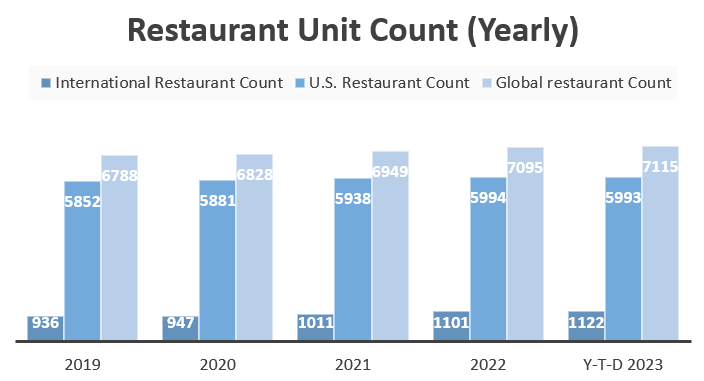

Lastly, as I mentioned in my previous article, the company is focused on expanding its footprint for long-term growth. The company further opened 41 net new restaurant units including net unit growth in Canada, the U.K., India, and the Philippines in Q2 2023, bringing its total restaurant count to 7,115. The company aims to open restaurants both in the U.S. and internationally in the coming years and increase its global market share.

WEN’s Historical Restaurant Unit Count (Company Data, GS Analytics Research)

The company currently plans to open 2% to 3% net new units in 2024 and accelerate it to 3% to 4% net new units in 2025, with 70% of the growth coming from international expansion.

To achieve this goal, the company has a promising lineup of upcoming restaurant launches. In the second quarter, the company got into a new master franchise deal with Flynn Restaurant Group to establish 200 Wendy’s restaurants in Australia. Flynn Restaurant Group stands as the world’s largest restaurant franchise operator and manages nearly 200 Wendy’s restaurants in the U.S. Additionally, the company is solidifying its presence in Canada, which represents its largest international market, contributing to 50% of total international sales, by committing to new restaurant development. So, I anticipate that the expansion of the international footprint should make a good contribution to sales growth in the coming years.

Hence I remain optimistic about Wendy’s sales growth prospects ahead.

Margin Analysis and Outlook

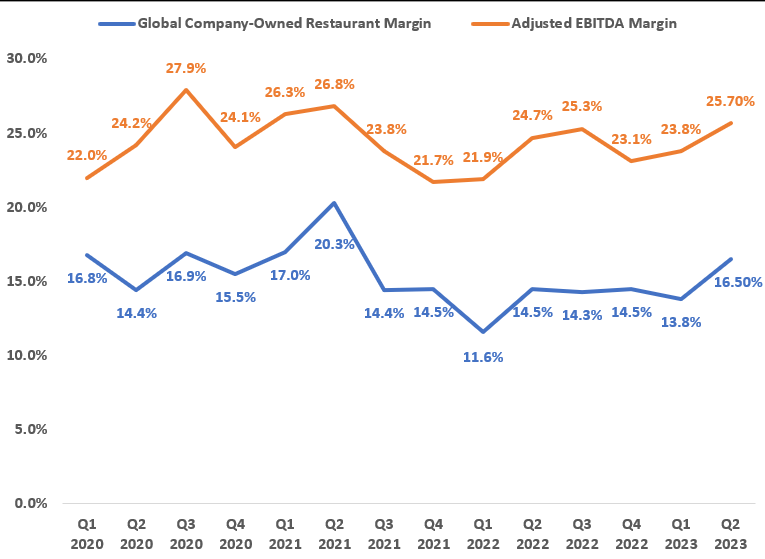

In the second quarter of 2023, the company’s margin continued to face inflationary headwinds from commodity and labor inflation. However, the company was able to offset these headwinds through price increases. In addition, productivity gains also helped the company in delivering margin growth. This resulted in a 200 bps YoY increase in global company-owned restaurant margins to 16.5% and a 100 bps YoY increase in adjusted EBITDA margin to 25.7%.

WEN’s Historical Global Company-Owned Restaurant Margin and Adjusted EBITDA Margin (Company Data, GS Analytics Research)

Looking forward, I expect WEN to continue expanding its margins. The company’s margin growth should benefit from the carryover impact of price increases taken in the last few quarters. Furthermore, the company is also seeing sequential as well as year-over-year moderation in inflation. In the first quarter, the company incurred commodity and labor wage inflation of 7% YoY and 5% YoY respectively, which moderated to 2% YoY and 4% YoY respectively in the second quarter. I expect inflation to be further moderate moving forward. So, this should be less of a drag on margins and the carryover price increases should be able to fully offset it.

Moreover, the company is also seeing improved labor productivity with the help of its initiatives to enhance restaurant operations. In my previous article, I mentioned that the company is leveraging advanced AI tools to drive efficiencies and enhance labor productivity with the help of its partnership with Alphabet (GOOG) (GOOGL) in implementing AI-powered tools. These advanced technological tools are resulting in saving time by improving service speed and a ~10% reduction in operational costs. The company is also rolling out new machinery in its kitchens to lower cooking times. For example, the company’s new Double-sided Grill (DSG) rollout has led to reduced cook times for hamburgers and improved labor productivity. Moreover, the company continues to decrease labor turnover and is experiencing increasing labor productivity which should help in margin growth.

Lastly, the company is also seeing new margin opportunities from its late-night daypart. The late-night daypart is accretive to margins as it is able to generate incremental sales without adding significant fixed costs. This is increasing its sales leverage and should help in expanding margins further as the late-night daypart continues delivering increasing sales. Hence, I remain optimistic about the company’s margin growth prospects ahead.

Valuation and Conclusion

Wendy’s is currently trading at 20.43x based on the FY23 consensus EPS estimate of $0.98 and 17.95x based on the FY24 consensus EPS estimate of $1.12, which is below its historical 5-year average P/E (FWD) of 29.89x and at a relative discount versus its biggest peer McDonald’s (MCD) which is trading at 24.01x FY23 P/E and 22.35x FY24 P/E. The company should see good growth benefiting from price increases, increases in advertising and promotional initiatives, market share gains with the strength in breakfast and late-night daypart, and global footprint expansion. In addition to the attractive valuation and encouraging growth prospects, the company also has an excellent forward dividend yield of 4.97%. Hence, I continue to have a buy rating on the stock.

Read the full article here