I last wrote about Bank of America (NYSE:BAC) in 2017 when it was trading for around $24. You can read that article here. Since then BAC has risen to over $49 before falling to its recent price of just over $29 dollars. The past might not repeat but certainly sometimes it rhymes. I believe that BAC is in a similar situation to 2017 and current buyers could receive future capital gains and dividend increases that should be advantageous to their portfolio’s returns.

BAC has struggled this year mainly due to concerns regarding the recent banking crisis, raising rates and paper losses. I won’t cover these issues because I believe they have been well covered and are mostly understood. I will say that I believe these concerns mask the progress and growth that BAC has made over the last decade and appear to be temporary in nature. Bank of America should continue to grow its client base, expand its online presence, and grow its earnings. The dividend should continue to grow and recent weakness makes BAC a strong buy for dividend growth investors.

Seeking Alpha

Recent Highlights from Barclays Global Financial Services Conference

Dean Athanasia President of Regional Banking BAC

-

“I cover 100 markets — about 100 markets in the U.S. I have all the people in those markets that are covering them from consumer, small business, business banking and commercial banking, which runs up the clients all the way up to $2 billion.”

-

“So having it all in one group and focused on working together, we’ve delivered over $5 million client referrals in those markets and the job of all those people is to deepen it, market by market by market.”

-

“Consumer Banking, the biggest opportunity for us right now, two-fold, one, we introduced ourselves and we have nine new markets that we’re in.”

-

“In the commercial side, we’ve added over — acquired over 1,100 new clients this year so that machine is going.”

-

“On the credit side, they’re still paying off their credit cards. And I know what the last group said here, but for our group, in our specific client base, they are paying off at a higher rate than they ever have before.”

-

“So, I would say, slow angling down, getting to more normalized period out into the first quarter of 2024.”

-

“We’re taking share across the spectrum from some of the smaller banks, mid-tier banks, and upper banks, so it’s pretty consistent across the board.”

-

“The combination of those two things allow us to beat some of the local banks and the regional banks, helps us compete with our peers, the bigger banks and they help us to ward off the fintechs and keep them away from our client base.”

Dean highlights the extensive reach of Bank of America’s operations, covering various market segments, from consumers to businesses, including small and large enterprises. This broad market presence is a critical asset for the bank. His comments also emphasize the importance of cross-functional collaboration within the bank to provide clients with comprehensive financial solutions. The $5 million client referrals highlight the success of this approach. Bank of America is actively expanding its market presence, entering nine new markets. This expansion strategy aims to capture new customers and deepen relationships with existing clients.

A highlight that stood out to me was Dean’s mention of acquiring over 1,100 new clients highlights the bank’s success in growing its commercial banking segment, indicating a strong client acquisition engine. This acquisition should continue as BAC continues to take share from smaller regional banks and grow its digital presence. Bank of America’s clients are actively managing their credit card debt, which is being paid off at a higher rate. This indicates the financial health of its consumer base. The outlook suggests that consumer spending will gradually return to pre-pandemic levels by early 2024, driven by continued job opportunities and cash inflow.

Bank of America’s competitive strategy involves gaining market share across various banking segments, from smaller to larger institutions. This demonstrates the bank’s ability to compete effectively.

Strengths of BAC Currently

Worldwide Presence: Bank of America’s global presence in over 35 countries, in addition to the U.S., provides the bank with a diversified revenue stream and access to international markets, contributing to its strength in the financial industry.

Consistency in Growth: Despite challenges like the COVID-19 pandemic, Bank of America has maintained a consistent upward trend in its performance. This consistent growth rate has built trust among both customers and investors, reflecting the bank’s resilience.

Service & Innovation: The bank’s commitment to innovation and its wide range of client-centric services set it apart in the financial industry. Being recognized as the “Most Inventive Bank in North America” by Fortune magazine in 2020 underscores its innovative prowess.

Strong Brand Recognition: Bank of America’s reputable brand name is a significant strength. Its long history and financial stability have contributed to the establishment of trust and loyalty among its customers.

Diversified Business Model: The bank’s diversified business model spans various financial sectors, including consumer banking, wealth management, corporate and investment banking, and global markets. This diversification mitigates risks and creates multiple revenue streams, enhancing its stability.

Large Customer Base: Serving a wide range of customers, from individual consumers to large corporations and institutional investors, Bank of America enjoys a substantial customer base. This provides a stable income source and opportunities for cross-selling products and services.

Extensive Branch and ATM Network: Bank of America’s extensive network of branches and ATMs across the U.S. ensures convenient access for customers and maintains a robust physical presence in the market.

Digital Innovation: The bank’s substantial investment in digital technology and innovation has resulted in user-friendly and efficient digital banking services. With a growing number of digital users and innovative features, Bank of America stays competitive in the digital banking space.

Strong Capital Position: Bank of America’s solid capital base and strong balance sheet position it well to withstand economic fluctuations and meet regulatory capital requirements as shown below.

Seeking Alpha

Seeking Alpha

Weaknesses

Lawsuits & Controversies: Bank of America has a history of legal challenges and controversies. Notably, it paid a substantial settlement of approximately $16.65 billion in 2014 for failing to disclose mortgage-related costs. Lawsuits related to consumer claims and mishandled transactions in 2009, as well as the failure to secure unemployment assistance accounts in 2021, have further added to the bank’s legal troubles. These legal battles can be costly, damaging to the bank’s reputation, and hinder its overall growth.

Low Income in Nations Outside the U.S.: Despite its presence in 150 countries worldwide, Bank of America generates approximately 90% of its revenue from operations within the United States. This heavy reliance on the U.S. market leaves the bank vulnerable to economic fluctuations and regulatory changes in the country, potentially limiting its growth opportunities on a global scale.

High-Interest Rates: Bank of America has faced criticism for charging high-interest rates that some consider unjustifiably high. This perception of high rates can deter potential customers and impact the bank’s growth potential.

Exposure to Litigation and Regulatory Risks: The bank’s status as a major financial institution exposes it to various legal and regulatory requirements. Past legal disputes and regulatory actions have resulted in significant financial penalties, settlements, and reputational damage. The bank’s $1.2 billion in penalties and settlements in 2022 highlights this ongoing risk.

Dependence on the U.S. Market: Despite its international presence, Bank of America’s substantial revenue is generated from the U.S. market. This dependence on a single market makes the bank susceptible to changes in the U.S. economic landscape and regulatory environment, potentially limiting its ability to diversify and grow in other regions.

Competition: Bank of America faces fierce competition from a wide range of financial institutions, including traditional banks, credit unions, fintech companies, and non-banking financial service providers. This competitive landscape can exert pressure on the bank’s market share, profitability, and customer retention efforts.

Vulnerability to Low-Interest Rates: Extended periods of low-interest rates can negatively impact Bank of America’s net interest income by compressing the spread between its lending and deposit rates. This can lead to reduced profitability and hinder the bank’s capacity to expand its loan portfolio.

Cybersecurity Risks: Bank of America’s significant digital presence exposes it to cybersecurity risks, including data breaches, hacking, and cyberattacks. Such incidents can result in substantial financial losses, damage to its reputation, and regulatory scrutiny, posing a significant threat to the bank’s operations.

The Dividend

Seeking Alpha

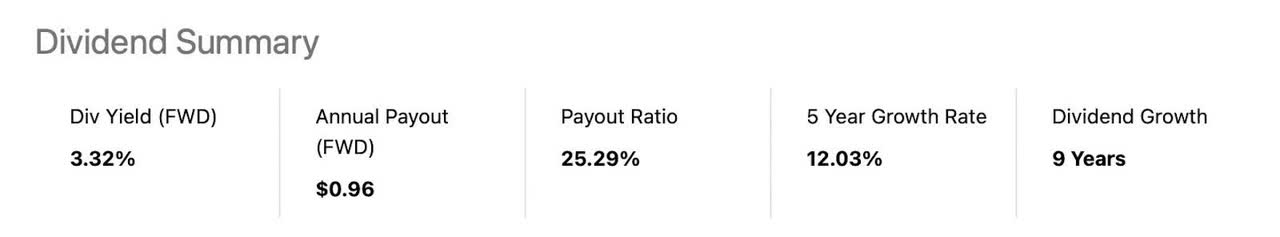

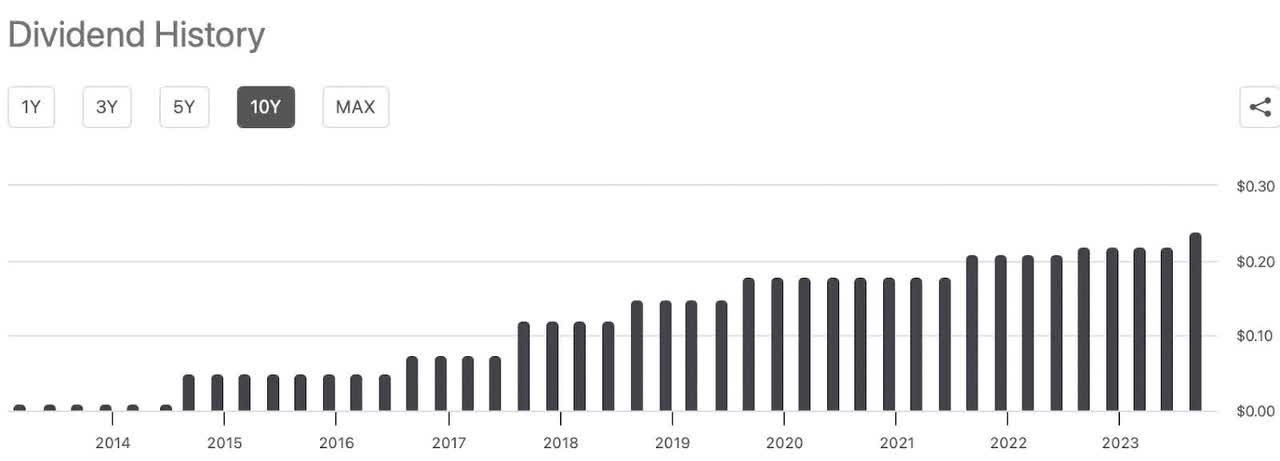

BAC currently has a low payout ratio of 25.29%. This should allow them to continue to raise their dividend at a consistent pace and could even see an increase in the growth rate of the dividend if their growth plans stated above end up coming to fruition.

Seeking Alpha

Dividend growth investors should look at the 10 year history of dividend increases and see that future increases are likely given its low payout ratio. Instead of chasing high yield stocks that can’t cover their dividend, investors should consider BAC as a potential steady source of future income. I believe the dividend is safe and that it will continue to grow at double digit rates over the next 5 years.

Final Thoughts

Bank of America (BAC) has faced challenges in the current year. However, these challenges are viewed as temporary, masking the substantial progress and growth the bank has achieved over the past decade. Despite these concerns, there are several compelling reasons to consider Bank of America as a strong investment, especially for dividend growth investors.

Recent insights from Dean Athanasia, President of Regional Banking at BAC, shed light on the bank’s extensive reach and strategies for growth. Bank of America’s strengths lie in its worldwide presence, consistency in growth, commitment to innovation and service, strong brand recognition, diversified business model, large customer base, extensive branch and ATM network, digital innovation, and robust capital position.

One noteworthy aspect is Bank of America’s ability to acquire over 1,100 new clients in its commercial banking segment, indicating a strong client acquisition engine. Moreover, the bank’s clients are actively managing their credit card debt, reflecting their financial health and suggesting a gradual return to pre-pandemic spending levels by early 2024.

Bank of America’s global presence in over 35 countries, its consistency in growth even during challenging times, and its innovative approach set it apart in the financial industry. Its strong brand recognition and diversified business model provide stability, while a large customer base and extensive physical and digital presence offer opportunities for further growth.

The weaknesses of Bank of America include a history of lawsuits and controversies, heavy dependence on the U.S. market, perceived high-interest rates, exposure to litigation and regulatory risks, competition, vulnerability to low-interest rates, and cybersecurity risks. Addressing these weaknesses effectively is crucial for sustained growth and success. I personally believe an over reliance on U.S. consumers could be a headwind if the U.S. experiences a recession and could delay stock appreciation if it occurs.

Regarding dividends, Bank of America currently maintains a low payout ratio of 25.29%, indicating room for continued dividend growth. The bank’s history of dividend increases over the past decade suggests a commitment to rewarding shareholders. Dividend growth investors may find Bank of America appealing, as it is likely to continue raising dividends at a consistent pace, potentially even accelerating its dividend growth rate if its growth plans materialize.

For these reasons, I currently rate BAC a strong buy and will be looking to dollar cost average into a position in the near future. As always please do your own due diligence before buying any positions and as always good luck investing. If you liked this article please like, share and subscribe. Thanks for reading.

Read the full article here