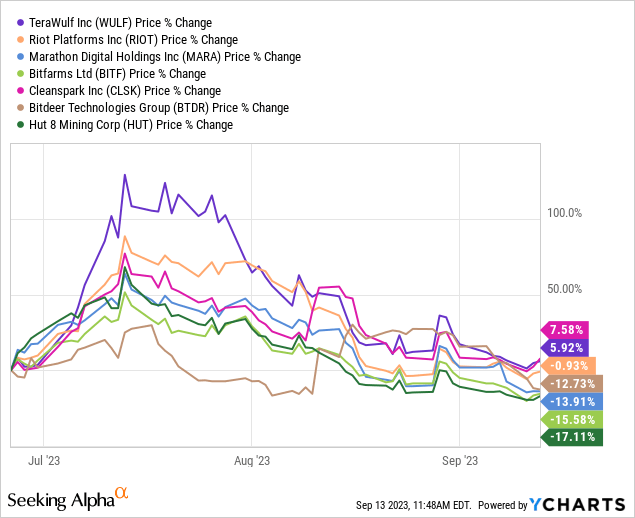

When I last covered TeraWulf (NASDAQ:WULF) for Seeking Alpha in late-June, the stock was trading at $1.73 per share. In the time since, WULF shareholders have taken the full round trip from $1.73 up to $4.04 and back to down to $1.70.

It’s been an absolutely wild ride to say the least and at times this summer WULF was the best performing miner in the public markets. With another quarter of performance to assess and a fast approaching halving event coming in early 2024, I think it’s a good time to check in on the fundamental setup for WULF to close out the year.

Q2 Earnings

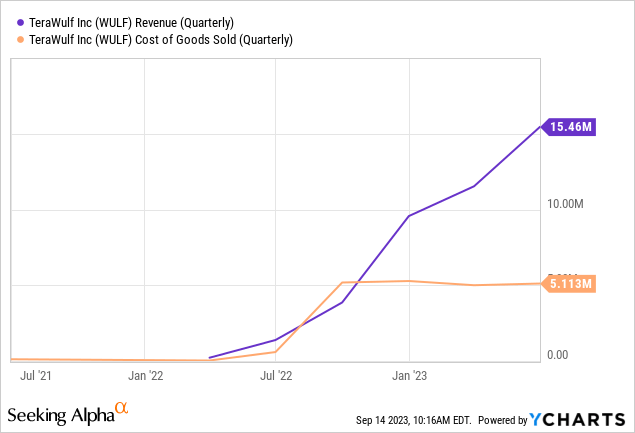

In the three months ended June 2023, TeraWulf reported 35% sequential increase in revenue from $11.5 million in Q1 to $15.5 million in Q2. The company accomplished this with just a small $100k increase in cost of revenue and improved gross profit margin from 57% in Q1 to 67% in Q2.

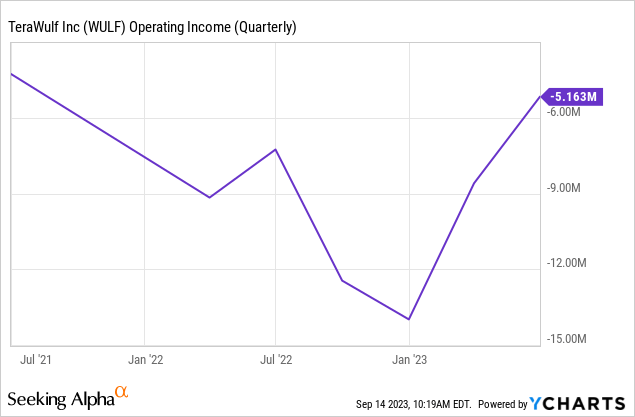

From an opex standpoint, there was a small 3% increase in total operating expenses and the company decreased its operating loss for the second consecutive quarter:

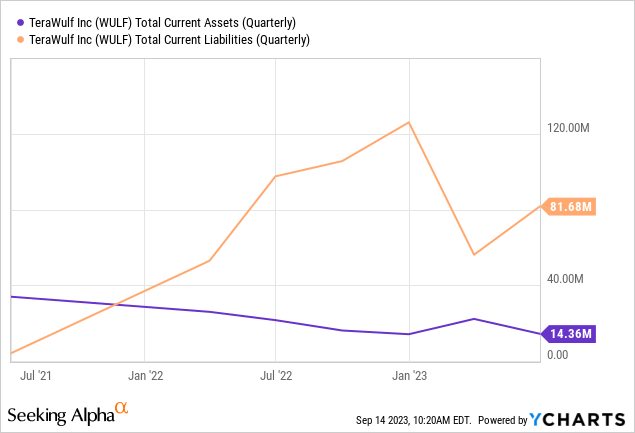

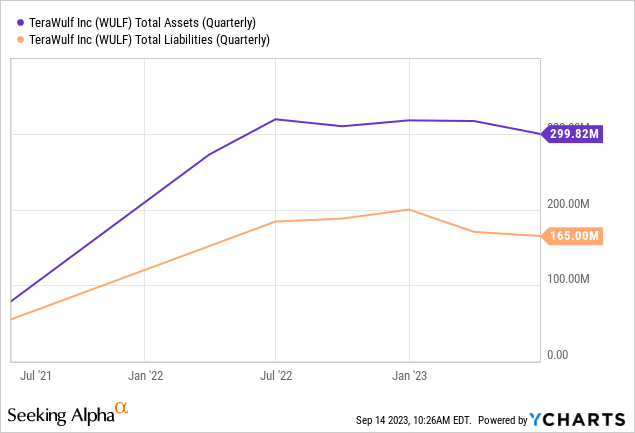

Looking at the balance sheet, cash levels were noticeably lower from $17.0 million at the end of Q1 to just $8.2 million at the end of Q2. Total current liabilities actually increased from $56.1 million to $81.7 million sequentially:

However, total liabilities did decline from $170.5 million to $165 million quarter over quarter as the company continues to work toward paying down its debt.

Since the company is now running at 5.5 EH/s with plans to scale to 7.9 EH/s by the end of the year, TeraWulf is strongly positioned among the second tier miners by total capacity.

Profitability in Sight?

When combining the company’s cost of revenue with the total opex, we can get a feel for how quickly the company could become profitable given its low energy pricing and flee efficiency:

| Q3-22 | Q4-22 | Q1-23 | Q2-23 | TTM | |

|---|---|---|---|---|---|

| Cost of Revenues | $5,200,000 | $5,300,000 | $5,000,000 | $5,100,000 | $20,600,000 |

| Total Opex | $12,100,000 | $17,700,000 | $15,800,000 | $16,200,000 | $61,800,000 |

| BTC Mined | 117 | 387 | 533 | 909 | 1,946 |

| Breakeven Price | $147,863 | $59,432 | $39,024 | $23,432 | $42,343 |

Source: TeraWulf Filings

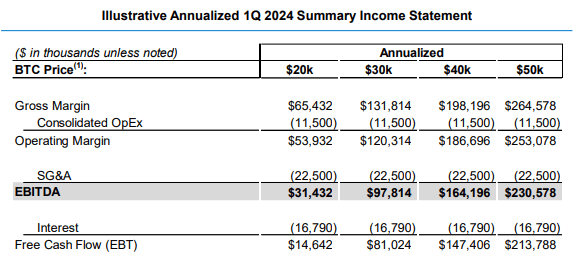

In the table above, the company’s breakeven price sans interest is roughly $23.5k – which is among the lowest prices that can be observed in the public mining space. Importantly, the breakeven figure has decline each of the last three quarters. Of course, this calculation doesn’t include the company’s debt payment obligations. I attempted to estimate that in my last TeraWulf article. In the company’s latest investor deck, TeraWulf provided an internal calculation that shows $97.8 million in annualized EBITDA at a $30k BTC price:

TeraWulf

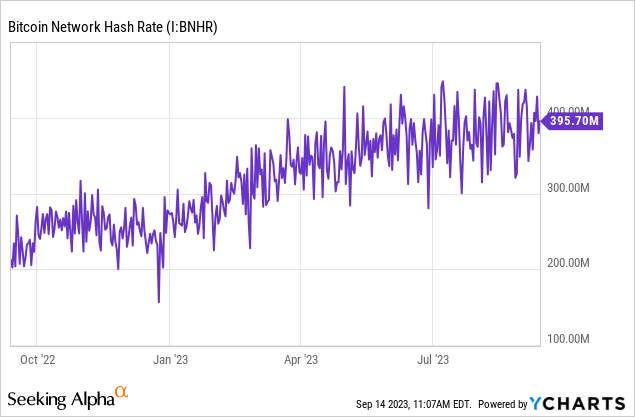

These calculations assume both 7.9 EH/s active capacity and a network hash rate of 400 which is right around where global hash rate has been for the last 5 months:

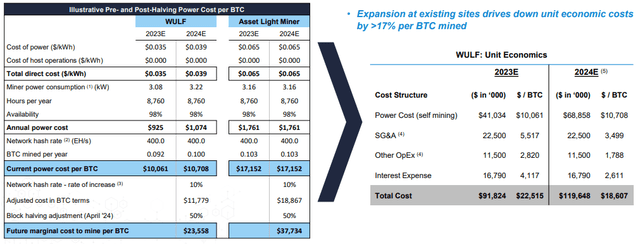

Interestingly, TeraWulf estimates a 10% increase in global hash rate post-halving and still projects the company’s marginal cost to be under $24k per coin following the block reward halving:

TeraWulf

WULF is theoretically set up far better than many of the company’s higher cost peers in the public equity market. Particularly the ones with asset light models. But something else that I think might be worth considering is the possibility that global hash rate doesn’t actually go up much further following the halving. At current BTC prices, many of these companies aren’t going to come close to breakeven following the halving and we could ultimately see machines from weaker miners turned off entirely if the BTC price doesn’t re-rate higher.

In that event, it’s possible TeraWulf’s share of the block reward could actually increase given the company’s unit economics. While that’s purely speculative on my part, I don’t think it can be entirely ruled out if BTC’s price remains where it is. Of course, if BTC’s price does increase following the halving as it has historically, the unit economics of TeraWulf’s operation could improve even with the smaller block reward.

Risks

In my last WULF article, I noted TeraWulf’s high SG&A as a percentage of revenue compared to peers. While still somewhat high at 67% in Q2 compared to a few of the company’s peers, TeraWulf was able to bring that expense down sequentially to $9.7 million in Q2. TeraWulf’s reduction in SG&A as a percentage of revenue was more attributable to the increase in revenue than the reduction in SG&A expense itself.

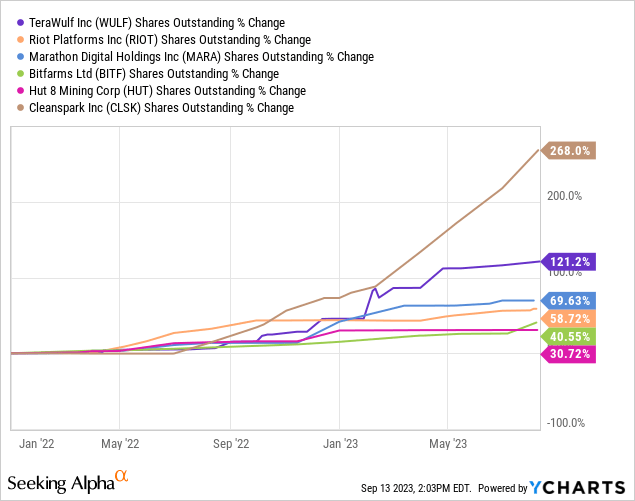

Like seemingly every public Bitcoin (BTC-USD) miner, dilution is a risk for TeraWulf and that risk might be more significant if TeraWulf’s debt and past actions are any indication. Of the mining equities sampled above, only CleanSpark (CLSK) has diluted shareholders to a larger degree purely from a shares outstanding perspective. However, on the last quarterly call, TeraWulf leadership was adamant that the company will not be diluting unless it is accretive. CFO Patrick Fleury said this near the end of the Q&A session:

you will never, ever, ever see us issue, you know, hundreds of millions of dollars on the ATM in a quarter.

The company’s CEO Paul Prager mentioned numerous times that insiders hold a substantial portion of WULF shares and he purchased an additional 50,000 at $1.90 in mid-August.

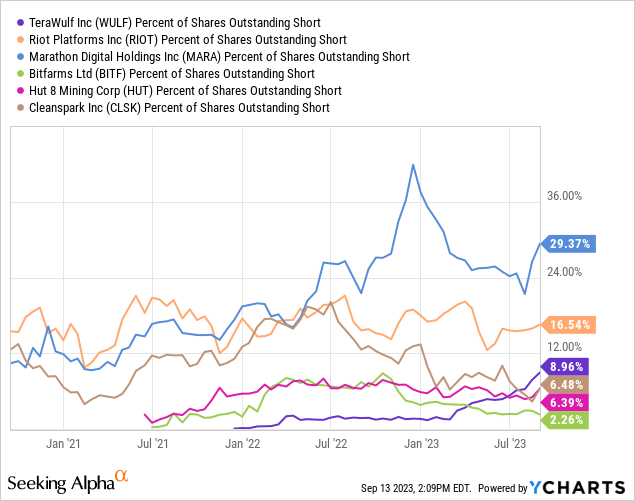

One final risk to potentially consider is the growing short position in WULF shares. While still well below what would likely be viewed as the tier 1 public miners, TeraWulf’s short percentage of shares outstanding has been edging higher than tier 2 peers in recent weeks and months.

Investor Takeaways

In the public Bitcoin mining space, there are roughly 2 dozen companies to choose from. Each of these entities is facing a significant macro headwind next year as the April block reward halving will virtually cut miner revenue in half overnight if the price of BTC and global hash rate both stay constant. In my view, and I think this view is shared broadly throughout the industry, the halving is likely going to put the weak dogs out of their misery. Given what I view as strong execution of a corporate strategy and a focus on mining efficiency, I believe TeraWulf is positioned well to be one of the survivors post-halving.

I’ve taken a small introductory position in WULF shares at an average share price of $1.72. WULF is now one of five public miner equities that I’m exposed to and I anticipate holding WULF through the halving. I’ll reiterate what I’ve said in countless SA articles; the safest way to benefit from an increase in the price of Bitcoin is to just hold BTC directly. However, for those with a high risk tolerance who want additional upside to gains in BTC pricing, miners like TeraWulf in an brokerage account may offer that upside.

Read the full article here