Introduction

Carvana’s (NYSE:CVNA) latest quarter was its best quarter ever. Nonetheless, the company is still highly unprofitable and debt-laden. Carvana was a darling of the zero-interest rate era, which caused the stock to soar to a high of $380. Unfortunately, it is unlikely for this meme stock to turn its business around.

In our opinion, the company is valued as a growth company with exponential growth ahead of itself, while it is making strategic decisions that resemble that of a maturing company like Coca-Cola (KO). As such, we believe the company won’t be able to survive in the long run and we rate the stock as a strong sell.

In this article, we will do a deep-dive on CVNA as a company, the risks, the debt situation, what the market makers expect, short squeeze potential, and much more.

CVNA Investor Presentation

Carvana From Market Darling to In The Gutter and Back?

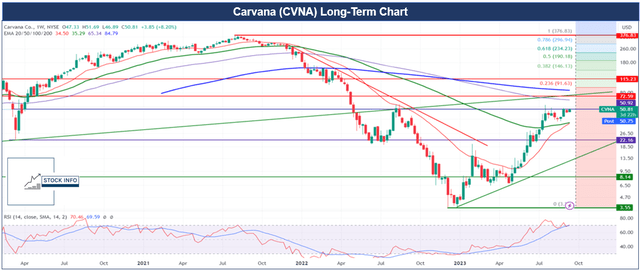

Carvana stock had an incredible run of close to 1600% from its COVID-19 bottom at $22.16 back in March of 2020 till its all-time high at $372.01 in August of 2021. Since then the stock crashed to its all-time low at $3.55 in December of 2022 and is now up over 1300% since then with a current price of over $50 per share. Needless to say, the volatility in this stock has been real, and as such the stock remains in the attention of traders.

Carvana underwent a remarkable transformation over the last 3 years going from a market darling to a company many thought would fail and rebounding with astonishing resilience. We believe this rollercoaster journey shows that price is able to drive sentiment. In addition, CVNA already is and will be an excellent case study for investors in the future.

Carvana was once regarded as a disruptor set to revolutionize the way people buy cars. The company faced adversity when the COVID-19 pandemic disrupted its operations, but the situation quickly turned around when the Fed started its quantitative easing policy and stimulus packages started flowing around. Needless to say, the market soared and the rest is history.

CVNA swiftly adjusted its business model during this period and doubled down on digital and contactless delivery. This not only helped the company survive, the company absolutely thrived. Unfortunately, the times of stimulus packages and zero interest rate environments came to an end and Carvana started to struggle.

Will the company survive? Let’s dive deeper into this interesting story.

Does This Business Model Have a Chance To Succeed?

Carvana’s business model is focused on e-commerce, where customers purchase used cars entirely online, without a test drive. While this eliminates the need for customers to visit physical dealerships, it brings other issues with it for Carvana. As Carvana boasts a wide selection of used cars this means they need a significant inventory.

Where does Carvana get all these vehicles from you might ask? They source their vehicles from a variety of sources including dealerships, auctions, and also trade-ins. All the cars undergo a thorough inspection and reconditioning process prior to resale, according to the company.

While CVNA is focused on complete transparency by providing customers with virtual tours and imaging of both interior and exterior and by providing clear pricing transparency inclusive of fees and taxes, we are not sure if this business model has what it takes to succeed.

As history has shown, businesses like CVNA, such as Zillow (Z) and Opendoor (OPEN) had issues with this buying and selling at whatever price in order to move inventory. Unfortunately, prices don’t go up forever and used car prices went especially bonkers. As they say, “what goes up, must come down.” This caused CVNA to sit with a bunch of pretty overvalued cars while the price of used cars was slowly declining. Due to the nature of its business CVNA, got into a rough spot as it now had an inventory of cars which were bought for more than their current market value.

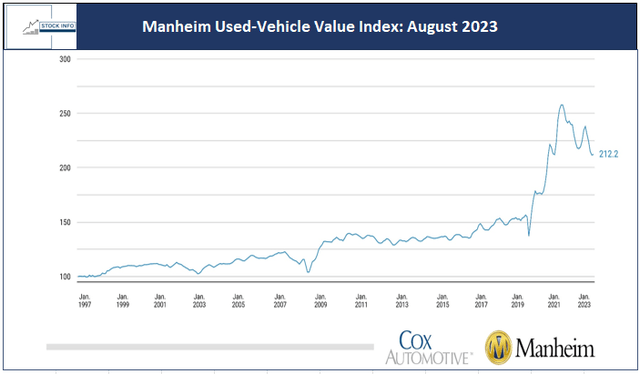

As can be seen in the chart below, used-vehicle prices are trending down and there really aren’t any signs of improvement as the macro-economic outlook remains rough. The index is still down 7.7% compared to only a year ago.

Stock Info with Manheim

A key issue is that CVNA has spent a significant amount of investor capital to drive growth. Despite those expenditures, the company has never been able to show consistent profitability or generate a positive cash flow. In the end it should be quite simple, no? It all comes down to buying and reselling cars. There is probably at least one small business in your own state that is able to accomplish this while being profitable.

One should ask themself if the core issue might just be that the business model of Carvana just doesn’t work? To explore this question, let’s consider a business like CarMax (KMX) who is also a big time player but is still focused on the physical aspect of things. While KMX had a rough time as well, the company is cash flow positive and is in a better shape financially. So what’s different?

While CVNA’s marketing towards shareholders looks excellent and the company positions itself as a hyper-growth company, we believe one should be careful at the current market capitalization.

CVNA Investor Presentation

Growth, Financials, and Debt Situation

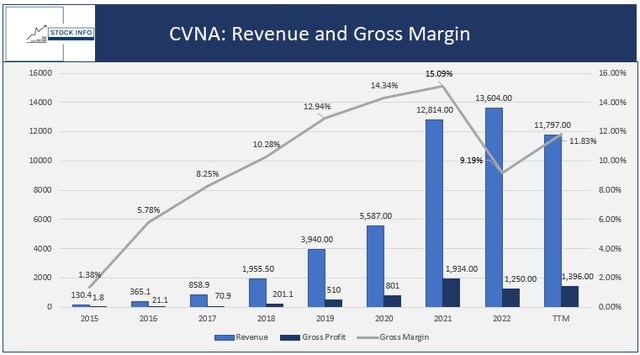

As can be seen in the chart below, CVNA has indeed been able to grow its revenues in explosive fashion, with the revenue soaring from $5.587B to $12.814B in 2021. Nonetheless, growth has been lackluster and even non-existent since then.

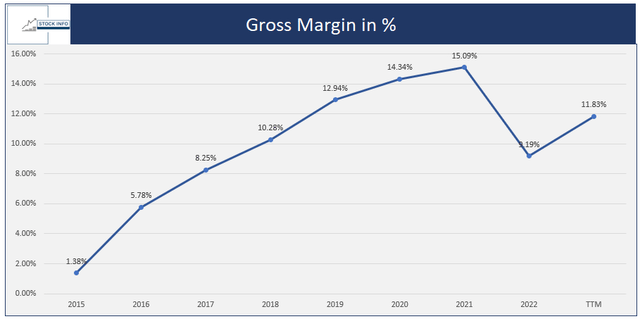

Gross margins plummeted from an already low 15% (for its valuation) in 2021 to 11.83% over a trailing twelve-month period, ending on 7/19/2023. It has to be noted that gross profit is increasing while revenue is lower. This is due to the fact that management is finally cutting back on SG&A costs, as they affect the amount of revenue that remains as profit. For example, the company slashed its advertising expenses from $131M to $57M when comparing Q2 2022 to Q2 2023.

In addition, it is clear that the company is scaling down its operations to keep operating costs under control. Nonetheless, this cutting down on advertising expenses will hurt the growth this company is valued on. Which is what the investors liked about it in the first place.

Stock info

The company decided to focus on the adjusted EBITDA. While adjusted EBITDA certainly isn’t one of the first metrics I would look at personally, it is something that has to be discussed here as the company rallied on the news that CVNA was going to be profitable in Q2.

So what caused this adjusted EBITDA profitability you might ask? CVNA accomplished this by a massive reduction in net loss. The net loss went from $439M to $105M. A very impressive accomplishment from the management team you might say, considering revenue dropped significantly.

When we take a closer look there were many factors that helped CVNA to report lower SG&A expenses compared to last year. Some of the major contributors to this reduction were:

Reducing headcount by over 4,000 employees since May 2022, which caused an overall drop in compensation benefits. Integrating properties while reducing the number of employees that now need to work in these offices. Last but not least, the company made a substantial reduction in the marketing budget, which was obviously one of the key factors that drove this exponential growth in 2020-2021.

While the reduction in headcount is a good move in my opinion, as it will more than likely improve operating margins in the future (which are currently still negative), as we indicated above, reducing advertising spending will impact the company’s growth, which was the whole selling point to investors.

The waning consumer interest, coupled with a notable reduction in advertising expenditure, is beginning to manifest its impact. Retail unit sales have dwindled by a substantial 35%, and the monthly unique visitors to CVNA’s website have seen a steep decline of 38%. Furthermore, the inventory has been significantly downsized by 52%. These unmistakable signs point to Carvana’s aggressive scaling-down efforts. However, from our perspective, it remains highly unlikely that Carvana will achieve GAAP profitability in the near future.

Valuation

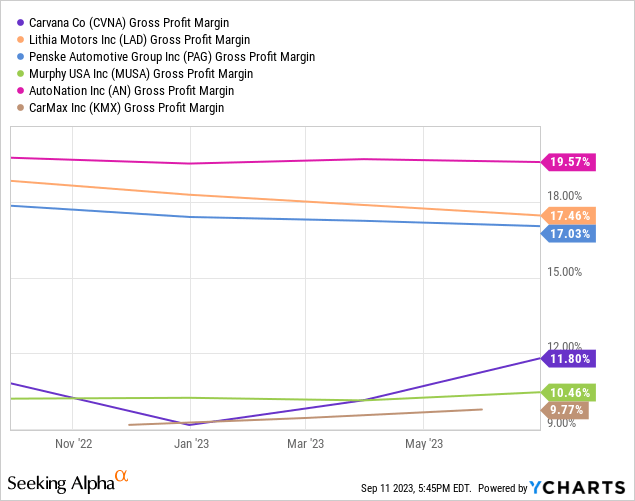

The issue with Carvana is that it is valued like a hyper-growth company, yet growth is clearly slowing down and there are no signs of GAAP profitability anytime soon. In addition, most hyper-growth companies are tech companies with high gross margins.

Meanwhile, CVNA has gross margins between 10% to 15%, indicating that for each $100 the company invests in its business it generates an additional $10 in operating profit.

Stock Info

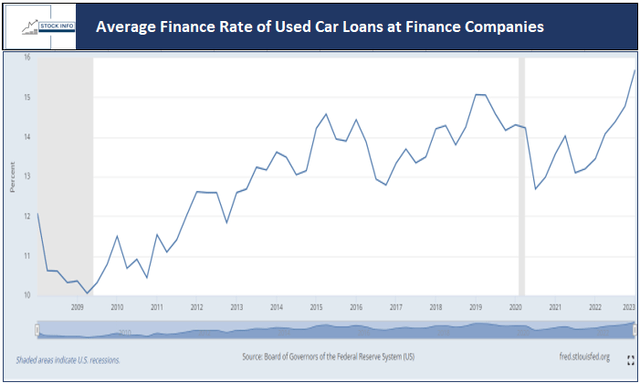

In addition, the average monthly payment for new vehicles financed hit an all-time high of $730 in August. This means that the average American buying a new car now spends more than 10% of what they earn every month to pay for their car. This is an increase of 28% in three years.

The trend for financing used cars is similar as can be seen in the chart below. In my opinion, the situation is not looking too good when we take into consideration that the economy certainly isn’t in the best spot.

Stock info with FRED

Peer Comparison

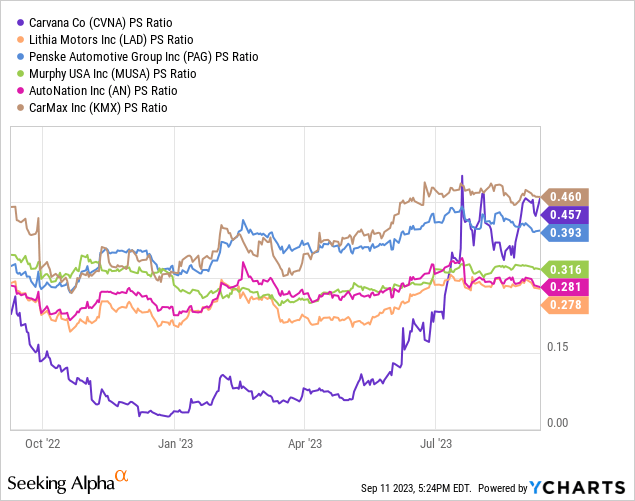

Let’s see how CVNA holds up compared to its peers in the industry, such as KMX. First, let’s take a quick look at the Price-to-sales ratios. This should be favorable for a growth company like CVNA. Nonetheless, we can see that CVNA is the second most expensive stock based on PS Ratio, only beaten by KMX.

Ycharts

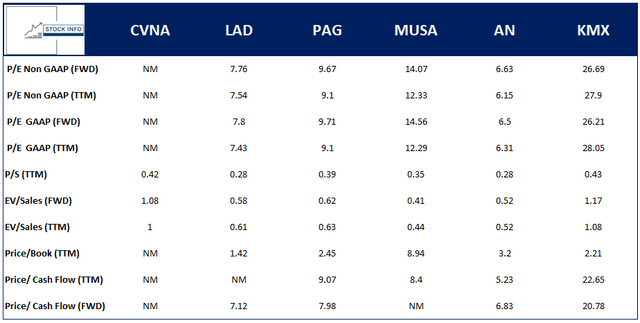

When we take a look at the table below we can notice some more interesting discrepancies. As can be seen, all other companies in the list are profitable and even on EV/sales CVNA is the second most expensive compared to its most notable competitor KMX. In addition, you can see that all of the others are priced like value companies. Agreed, KMX is priced more expensively, but still this company is in a far better position than CVNA and is still able to grow nicely.

While we agree that KMX is the one we should really focus on, it is clear that the sector as a whole can be considered as a value sector.

Stock Info with Seeking Alpha

In addition, the hyper-growth company CVNA has a fairly low gross margin when we compare the business to these value companies. As can be seen in the chart below, the company has the third-lowest gross margin.

Ycharts

Debt Situation

Furthermore, one thing that needs to be addressed is the debt situation. The headlines looked awesome:

Reduced debt by $1.2B. Eliminated 83% of Y25 and Y27 note maturities. Reduced interest expense by over $400M per year for 2 years.

It almost looked like CVNA was out of the woods, but don’t be mistaken; when Apollo is doing the debt restructuring you can be sure you need to be careful with how it looks on first sight. The current debt is $5.66B, and even with the reduced debt it is still an incredibly high amount. Furthermore, the $430M per year interest payments aren’t gone, they are simply added back to the principal.

Nonetheless, there has been plenty written on this and if you still aren’t convinced that CVNA isn’t the best investment opportunity out there at the current price I would advise you to look deeper into this situation as well.

Furthermore, CVNA is still a cash-burning machine, with over $5B in cash burned since 2020. Even now, the company is still cash flow negative with a negative free cash flow of $595M over a trailing twelve-month period and a negative FCF of $1.836B in 2022. Needless to say, CVNA is still burning cash like crazy and it doesn’t look like that will improve anytime soon.

While the company has a 24.52% 5Y revenue CAGR, the -6.6% FCF/Yield is simply concerning. The company is losing money fast, and again it doesn’t look like it will improve drastically anytime soon.

Market Makers Expectations and Short Squeeze Potential?

According to the latest data from Seeking Alpha, the short interest is currently 46.19%. This is incredibly high. Nonetheless, people need to realize that short interest isn’t the only thing one should focus on. Sure, CVNA has a high short interest. Could the stock see a short squeeze? Yes, it definitely can.

But, a short squeeze is often short-lived and in the long-term, these exponential moves aren’t sustainable. Good examples are both AMC (AMC) and GameStop (GME). While the movement in itself would be applaudable, it often isn’t the best way to invest your money in the long run.

Currently, the market maker expected move (MMEM) is $23.47 for the January 19’24 strike. This means that the market makers currently expect CVNA to be trading somewhere between $27.28 and $74.22 per share on the 19th of January.

If you believe the stock will see a significant move below or above one of these zones it might be interesting for you to buy this straddle and capitalize on the extreme volatility. On the contrary, if you believe Carvana stock will trade between $27.28 and $74.22 per share on the 19th of January it could be interesting for you to sell this short straddle.

The key takeaway of this is that the market makers clearly expect a lot of volatility in the stock, which can also be seen in the Implied volatility, which currently still sits at over 100% for January 19th.

As such, the risks to our thesis are simply that the company is able to use the meme stock status for a while and will be able to continue trading at an elevated valuation, which would give them the option to further dilute their shareholders.

In addition, another risk would be the company turning profitable, while this is highly unlikely, it is a risk that should be addressed.

Technical Analysis

When we look at CVNA’s chart, we first notice that CVNA is currently in a strong uptrend ever since the all-time low at $3.55 back in December of 2022. The stock has made a rally of over 1300% since then. Important to notice is that the RSI is currently in overbought territory on the weekly, which is something we haven’t seen since the ATH back in 2021.

Nonetheless, the stock is currently at an interesting resistance level, the $50.92 to $58 zone has proven to be a tough resistance level, which is where the stock struggled breaking through in the past, and has been pushing hard again over the last few weeks.

If the stock is able to push through, the $72.59 level isn’t out of the question. In addition, the stock is currently trading above its 20 and 50 weekly EMA’s indicating that the stock has strong momentum with the 20 EMA now close to breaking above the 50 EMA as well, which could further fuel the rally.

The most important support levels currently are the 2 previously mentioned EMA’s, which are currently laying around $34.50 and $35.29 respectively. If both of these would be broken one should look out for the $22.16 level for further support. In addition, the green trendline support, which has formed since the lows is an important trendline to keep in mind.

Stock Info with Tradingview

Conclusion

In conclusion, Carvana has experienced a remarkable and tumultuous journey in the stock market. While it had a meteoric rise during the era of low interest rates, it now faces significant challenges.

Despite impressive revenue growth, the company’s profitability remains elusive, and it carries a substantial debt burden. The business model, centered on e-commerce for used cars, has its share of challenges, particularly in a market with declining used vehicle prices.

Carvana’s recent cost-cutting measures have impacted its growth prospects, which were once a major attraction for investors. In addition, we are not convinced that the current management team is able to turn the business around. Furthermore, shareholders haven’t been treated very well in recent years due to strong dilution.

Additionally, the stock’s valuation as a high-growth company seems disconnected from its financial realities. Debt reduction efforts, while positive, haven’t eliminated the substantial debt load.

Ultimately, the market’s expectations for Carvana are marked by extreme volatility, but a sustainable turnaround appears uncertain. Given these factors, we believe the stock is currently a strong sell.

Read the full article here