On our last coverage of Enviva Inc. (NYSE:EVA), we discussed the difficulties the company had in convincing us of the bull case. Particularly notable was a lack of economic profits and a closed off equity market. Sometimes after a lot of analysis, you come to the conclusion that it is not ok to buy a company, even though it has fallen 85%. That was the case here and our decision to stay on the sidelines paid off.

We look at the key developments since that report and tell you what exactly Enviva needs to do to convince the capital markets that it deserves a higher price.

Q2 2023

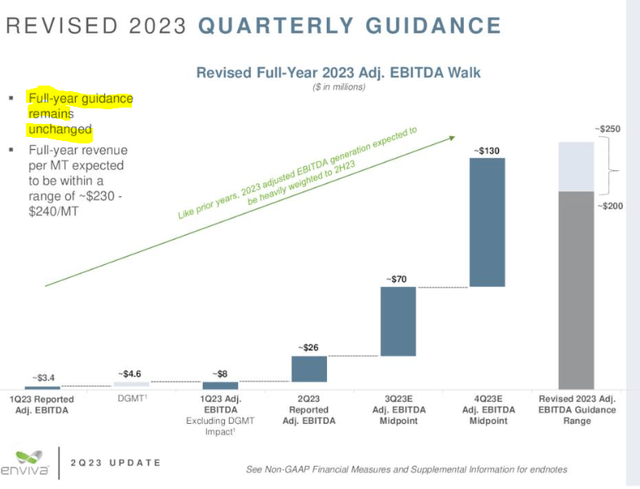

After a series of guidance cuts, Enviva did actually hold the line on their 2023 numbers. There was some shuffling of the quarterly numbers, but the overall 2023 guidance was kept firm.

Enviva Q2-2023 Presentation

But those were all the Non-GAAP numbers (note that it is adjusted EBITDA, not EBITDA above). With this company, it pays to look at the financial statements directly (10-Q link). When you do that, a few things become clear.

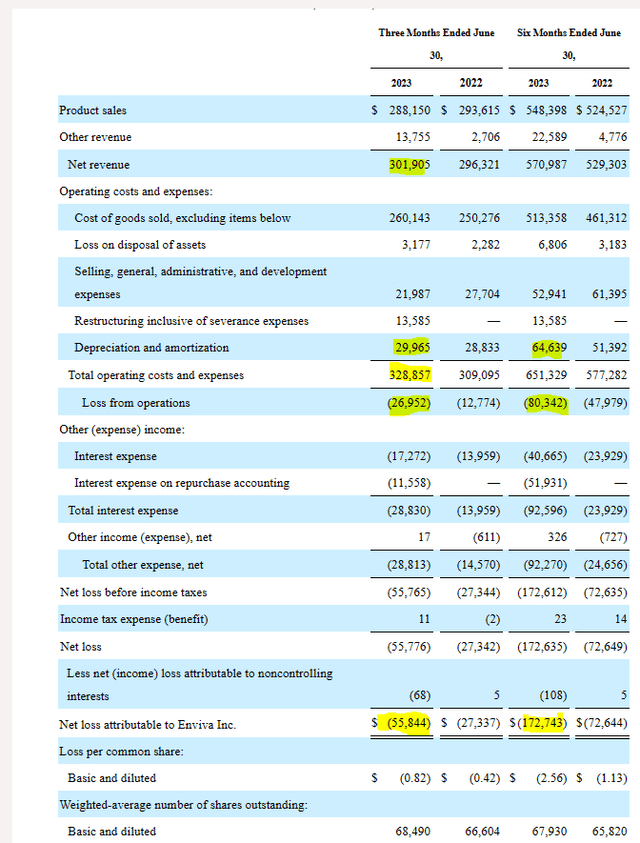

The first being that despite net revenue coming in higher this quarter, the company is still nowhere in the postal code of GAAP profitability.

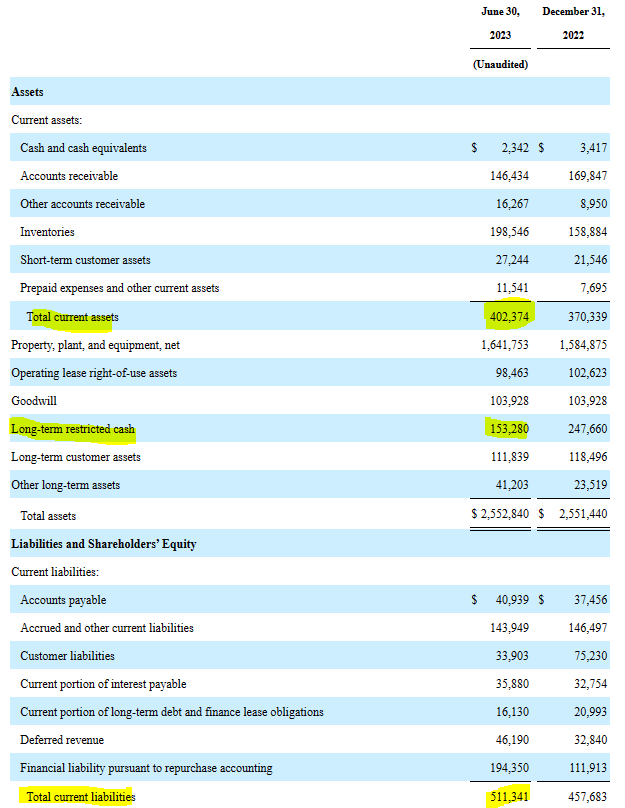

Enviva Q2-2023 10-Q

What we want investors to note is that this is not a real estate investment trust, or REIT, and ignoring depreciation on a capital intensive industry is going to be a costly error. Likely the people who bought this in the 70s and 80s (share price, not decades), found out the hard way. But even today, if you gave them the benefit of the doubt and added back depreciation to the net loss, Enviva is not even close to being profitable. For the first half of 2023, net loss as $172.74 million and depreciation was just $64.6 million. So the core model produces at $110 million loss, even if you ignore the depreciation. That is the crux of the problem. You can waive your hands around all you want and point to short sellers and negative reports, but when the business model cannot even produce a profit ignoring depreciation, you have a problem.

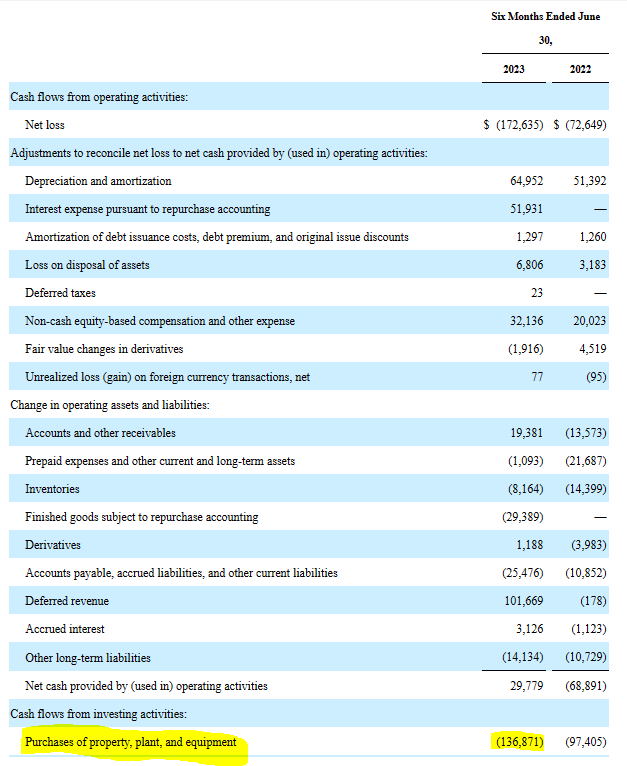

Capital Expenditures Remain High

Enviva spent at a $273 million annualized run rate for the first half of this year.

Enviva Q2-2023 10-Q

Thankfully, the company stopped its dividends and that has allowed some extra room to spend. But even after that consideration, there is not a lot of leeway on the balance sheet. Working capital plus restricted cash is around $553 million, and that lines up closely with current liabilities as well.

Enviva Q2-2023 10-Q

Outlook

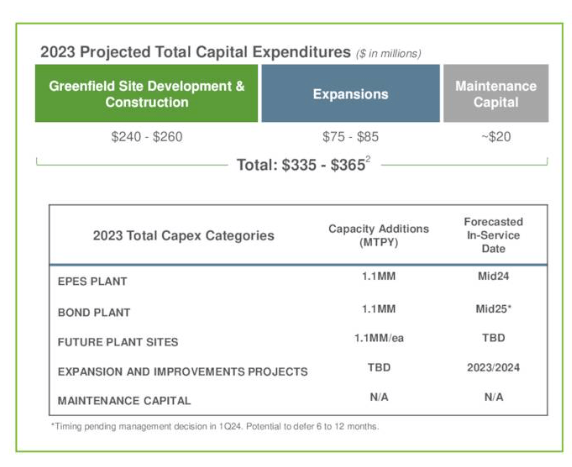

The $273 million of annualized capex that we pointed to, actually understates what Enviva plans to spend in 2023.

Enviva Q2-2023 Presentation

At $350 million, the capex will be close to 60% of the current market cap of the company. One of the key bull-bear differentiators is how much do you buy into the logic that maintenance capex is only $20 million out of that. Bears have long argued that it’s a lot more.

From our point of view, as shown earlier in this piece, we added back the entire depreciation and assumed maintenance capex was actually zero. Even despite that, Enviva has no profits today. Of course, not everyone has our generosity. So what Enviva needs to do here is show that they can create some degree of economic profits. If they double their EBITDA by 2026 and they double their operating loss, you can be sure it will be game over for the company. Their green dream will turn pink.

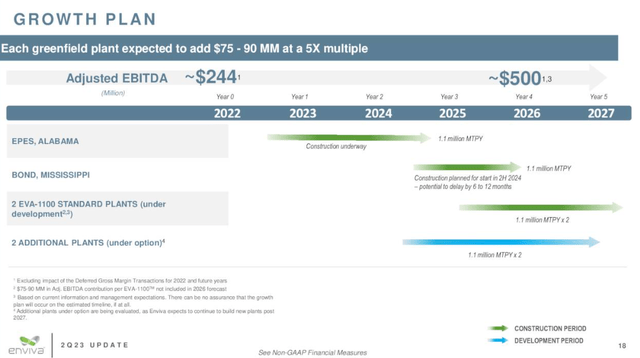

Enviva Q2-2023 Presentation

They have a huge debt stack with maturities in 2026 and a term loan in 2027. The current yield to maturity on those 2026 notes is close to 17%, so you can bet that will be a problem refinancing. Their term loan is at SOFR plus 4%, so that is costing them a lot more than the 2026 notes today. The latter have a coupon of just 6.5%.

Verdict

Enviva has to show investors the money. Some degree of traditional cash flow and free cash flow that convinces the market of the viability of the model. As it stands, through all this complexity, Enviva is still hemorrhaging cash. Now, those capital projects are committed to and they will continue regardless. But as soon as it has a window, it needs to demonstrate that the core model produces cash, unlike what Blue Orca has alleged. The new CFO has his job cut out for him.

Assuming we can see some improvements in the core profits over the next 4-6 quarters, Enviva can survive. We continue to stay out of the stock as we just don’t see anything remotely attractive about the model. For those into this, we would still suggest the bonds as the best relative play here.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here