Shopify’s stock (NYSE:SHOP) has benefited from a substantial valuation re-rate this year. It has restored trading at double-digit valuation multiples, in line with the broader software peer group and its historical performance, after Shopify announced plans to divest from the logistics business. While Shopify’s ambitions to integrate logistics and fulfilment into its ecosystem was a good idea, the combination of tightening economic conditions and a macro-driven pullback in consumption created an adverse backdrop for execution.

However, the company’s Q2 outperformance and solid guidance for Q3 shows Shopify is swiftly leaving logistics in the past and turning a new page. While macroeconomic uncertainties remain a near-term risk, especially in retail where Shopify has significant exposure, the company is restoring its portfolio of idiosyncratic value proposition. Returning bullish themes include sustainable margin expansion through operating leverage, TAM expansion, and increasing “merchant stickiness”. We believe these three factors will strengthen Shopify’s moat as the prime ecosystem for hybrid online-offline businesses, which is value accretive to the stock.

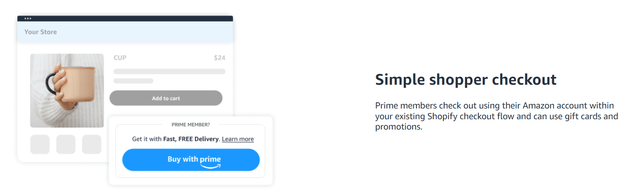

Shifting From Losses to Operating Leverage

Shopify’s efforts in righting the course was a rather quick one. The logistics divestiture was a painful, but needed move. Wrapping up the mess cost $1.3 billion in impairment, and another $165 million in pulled-forward stock-based compensation, but the ensuing return to operating leverage and profitable growth expansion is likely to drive a greater pay-out. And this appears to resonate with investors, as observed via the stock’s resilient climb this year.

Shopify’s successful turnaround and improving operating leverage has been bolstered by strong merchant adoption rates. This is evidenced through consistent GMV expansion across the flurry of new features introduced in recent quarters after Shopify sharpened its focus on its roots of providing critical e-commerce software solutions.

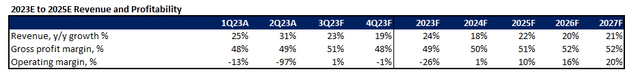

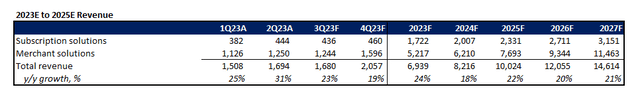

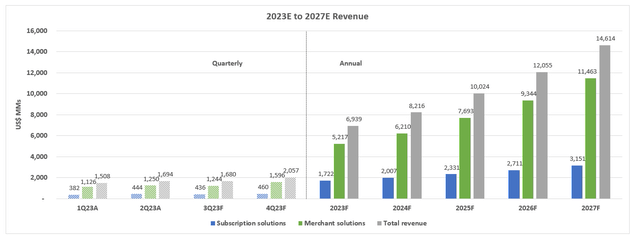

Specifically, operating leverage is observed through management’s flat opex guidance for Q3 – Shopify’s first full quarter post divestiture of Deliverr – which was rather quick in our opinion, underscoring optimized operating efficiency. We estimate opex growth to lag Shopify’s revenue prospects going forward, as its higher-margin e-commerce software solutions continue to scale.

Author

Author

Our forecast is in line with management’s guide for top-line expansion in the low-20% range (or mid-20% range normalized for Deliverr) and sequentially flat opex dollar spend. This reflects post-Deliverr and headcount reduction cost-savings being reinvested into new growth areas as management intends, while also achieving operating leverage. With incremental consideration of impending 2H23 headwinds on consumption – particularly on the resumption of student loan repayments, rising gasoline prices, softening labour market, and rising loan delinquencies – Shopify’s anticipated realization of operating leverage corroborates durability, underscoring a sustained trajectory of profitable growth ahead.

Multiple Outlets for TAM Expansions

Complementing Shopify’s realization of operating leverage is solid adoption of its expansive portfolio of mission-critical e-commerce solutions, spanning Capital, Markets, Installments, and Payments, among others. And more recently, POS and B2B solutions have gained momentum in supporting the growing transition from an offline to hybrid business model, integrating multi-channel store-fronts to facilitate a seamless experience on both the front- and back-ends for shoppers and merchants. A particular highlight from Shopify’s recent earnings is the accelerating expansion of POS adoption and, inadvertently, offline GMV:

In Q2, offline GMV increased 23% year-over-year as we won larger multi-location merchants across the 14 countries where Shopify point-of-sale operates today… Among Shopify point-of-sale retailers with more than 20 locations, their Q2 GMV grew over 120% year-on-year, with more than 70% of their GMV coming through Shopify Payments, demonstrating our ability to monetize as we move upmarket.

Source: Shopify 2Q23 Earnings Call Transcript

We view this as a critical outlet for enhancing Shopify’s capture of e-commerce opportunities. More than 80% of commerce remains offline today, with “trillions of offline retail dollars moving online over the much longer-term”, highlighting the value of Shopify’s growing importance in facilitating the transition for merchants.

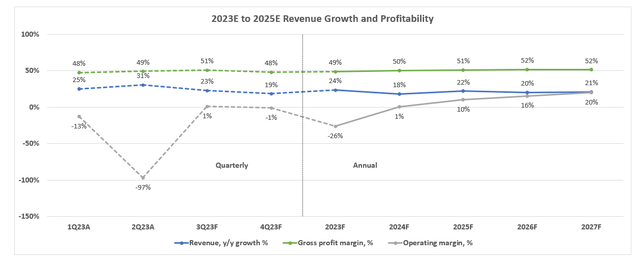

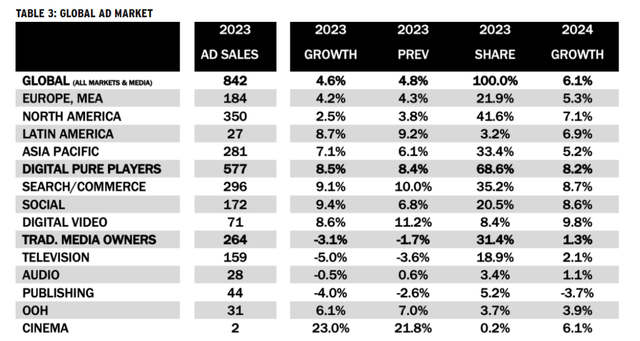

In addition to POS, Shopify Audiences is another emerging TAM driver for Shopify. The recently introduced Shopify Audiences for Plus plan merchants allows Shopify to realize value from its increasing trove of first-party data, while also enabling participation in secular digital advertising tailwinds. Despite the advertising industry’s inherently macro-sensitive nature, digital formats are expected to stay resiliently “counter cyclical”. Market currently forecasts y/y growth of 8.5% on global digital ad spending in 2023, outperforming the broader advertising industry’s anticipated expansion at 4.6%. Much of digital advertising’s resilience will be driven by retail media formats such as Shopify Audiences placements, with relevant demand expected to expand by 12% y/y in 2023.

MAGNA Global

Shopify’s upcoming launch of its AI suite for merchants – Shopify Magic – as well as integration of the Sidekick commerce-specific chatbot are expected to further reinforce its market share gains. Taken together, continued product innovation will not only differentiate Shopify’s value proposition and reinforce merchant adoption, but also enable the company’s access to a greater TAM. We view robust Plus plan adoption at Shopify in recent quarters as evidence of this tailwind. Recall that the Plus plan differs from Shopify’s lower-priced subscriptions by offering a greater variety of functionalities and support to merchants. This includes full-service coverage spanning multi-location and multi-channel integration, online storefront development solutions, checkout and payments, data analytics, and advertising through Audiences, catering primarily to larger and faster-growing merchants. Plus also carries a higher subscription rate that is “several times” higher than the Advanced plan that precedes it.

Plus has consistently contributed close to a third of Shopify’s MRR in recent quarters. The higher-priced plan’s increasing share of sales mix suggests an increasingly effective land-and-expand strategy at Shopify in our opinion, which reinforces its moat. Shopify’s extensive list of subscription plans aims at catering to the needs of all merchants across all stages of business, with an intension to grow with them. And Plus’ increasing share mix indicates that Shopify has been effectively mitigating churn risks by adequately addressing the rapidly changing needs of its growing merchants, while also reinforcing its value proposition to prospective large merchants through product innovation. This is corroborated by Shopify’s growing list of large-brand wins across a diverse set of industries in recent quarters, ranging from consumer packaged goods giant Nestle (OTCPK:NSRGY) (OTCPK:NSRGF) to baked goods manufacturer Mrs. Fields (OTC:FMBRF) (OTCPK:FMBRY).

Meanwhile, product innovation also allows Shopify to better capitalize through non-Plus plans and merchant solution sales by enabling cross- and up-selling opportunities. Taken together, we see Shopify as well-positioned to bolster its market share gains as continued product innovation enables TAM expansion. This is likely to further improve its current product attach rate of more than 3%, and enable greater revenue growth over the longer-term.

Author

Author

Author

Shopify_-_Forecasted_Financial_Information.pdf

Increasing “Merchant Stickiness”

Although Shopify has gotten rid of its logistics ambitions, its market share gain prospects have not gotten any weaker. Lower than expected churn following its recent round of subscription price increases is solid proof increasing stickiness to its ecosystem.

Recall that Shopify has increased monthly subscription rates across the board by almost a third in late April. While existing merchants had the option to switch from a monthly to annual plan to extend their lower rate prior to the new price increase, management had observed a lower-than-expected volume of switches. Existing merchants had “largely remained on monthly plans versus moving to annual”, while most also remained on the platform. While Shopify does not separately disclose data pertaining to its merchant count, recent market data estimates an 8% y/y growth, or 3% sequential decline, corroborating that the price increases implemented earlier this year were a net benefit for the company.

In fact, Plus subscribers grew by 58% q/q (+180% y/y) in Q2, accelerating from the 53% q/q increase observed in Q1. We believe the recent price increases might have also incentivized some of Shopify’s better-performing merchants to up-tier from lower-priced plans to Plus for better value-for-money economics. Continued product innovation, which bolsters Plus plan features as discussed in the earlier section, has likely reinforced Shopify’s market share retention as the anticipated impact from recent subscription price increases stabilizes, despite the uncertain macroeconomic backdrop.

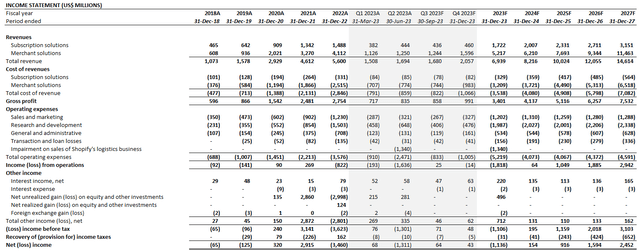

More importantly, we see Shopify’s recently updated arrangement with Amazon (AMZN) on Buy With Prime integration as a key validation to the former’s strengthening e-commerce moat. While most investors are primarily excited about incremental GMV penetration for Shopify through Buy With Prime (considering 200+ million Amazon Prime members worldwide), the latest tailwind comes from a detail in the updated payments arrangement.

Specifically, Shopify merchants looking to integrate Buy With Prime into their online storefronts can now do so by having related transactions processed through Shopify Payments as well.

amazon.com

Prior to the latest update, Shopify merchants that have integrated Buy With Prime had to process related transactions through Amazon Checkout – not only does this mean Shopify loses out on their share of related purchases, but also implies inconvenience for Shopify merchants given the broken link in payments to the broader Shopify ecosystem. The inconvenience has likely been a barrier of Buy With Prime adoption amongst Shopify merchants. Despite a 25% increase in conversion rates on average with Buy With Prime integration, Shopify merchants had been reluctant to adopt Amazon’s fulfilment network. Market data estimates that less than 0.1% of Shopify’s merchants had integrated Buy With Prime prior to the updated payments arrangement which was announced on August 30 and will be coming online soon. This single piece of data alone underscores increasing strength to Shopify’s moat, as it validates the value proposition of its ecosystem to merchants as the transition to multi-channel commerce continues.

What we have now in coordination with Amazon, they obviously released the app in our ecosystem, and that allows a merchant to basically have this in a very seamless way, the ability to offer Buy with Prime to their customers. Some merchants want it, some merchants won’t want to do it. For those that do, obviously, that now flow — it all flows through the Shopify admin. And obviously, we’re getting all the payments revenue from that. And so from a merchant’s perspective, you have 100% in terms of the data, the view of the business, which is flowing through the Shopify admin, the dashboard, the single pane of glass, whatever, however you want to describe it. And so as you think about analytics, as you think about knowing your customers, as you think about where everything is shipping that’s all on one dashboard, which is not what you had before…

Obviously, we were working on the Amazon partnership for a while. I mean Harley had mentioned it on a bunch of quarterly calls. It’s good to have it nailed down…there’s always been a certain type of merchant that’s leaned a little bit more to kind of the Shopify view of the world versus the Amazon view of the world. One of the things that Amazon does really well for you as a marketplace, if you’re a merchant selling in the marketplace, it gives you a lot of scale immediately. But that comes at certain costs and certain things as it relates to data and some other things, which are kind of well documented from a Shopify merchant perspective, you have all the data, you keep all the data, you know everything that you’re shipping and where it’s going. That’s one of the things that our partnership with Amazon now does.

So it can be shipped through Buy with Prime, but it’s obviously still going through the Amazon — or through the Shopify dashboard, and so we have a full view of what’s happening. I don’t think it fundamentally changes in any way, shape or form. The question that a merchant is going to have is do I want to offer Buy with Prime, do I not? And so far, the response has been good.

Source: Shopify, Goldman Sachs 2023 Communacopia & Technology Conference

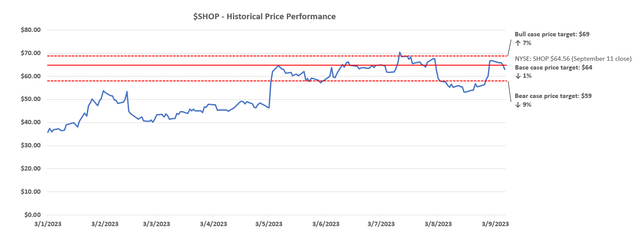

Valuation Considerations

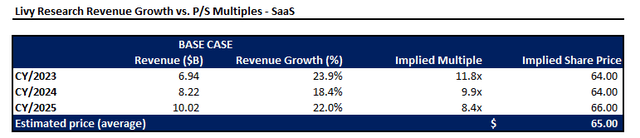

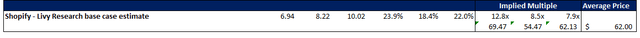

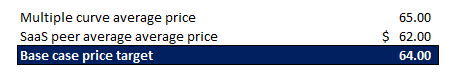

Considering Shopify’s projected cash flows in conjunction with its fundamental prospects discussed in the foregoing analysis, we believe the low $60-level would make a compelling risk-reward set-up for partaking in the stock’s longer-term upside potential. While we have set $64 as the base case PT for the next 12 months considering Shopify’s near-term progress in scaling its recently announced offerings and the currently volatile market climate, we believe the stock has the potential for further upside when cyclical tailwinds return and Shopify’s strengthening moat drives incremental cash flow realization. We believe there is potential for Shopify to hit its downside price amid broader market volatility in the near-term as sector valuations adjust to tightening financial conditions and the elevated rate environment. But instead of being bearish on the name from current levels, we see any potential pullback in the low-$60 range as a reasonable entry to partake in longer-term gains.

Author

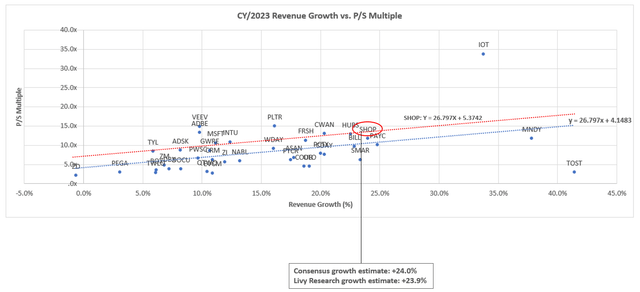

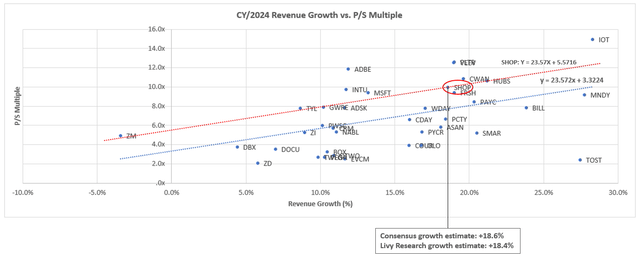

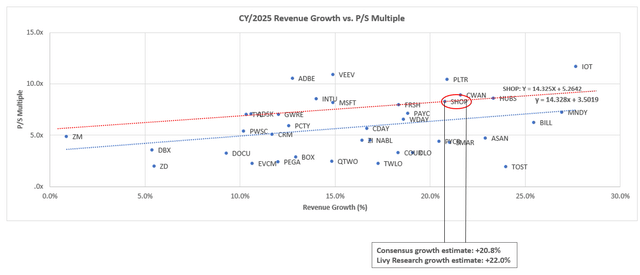

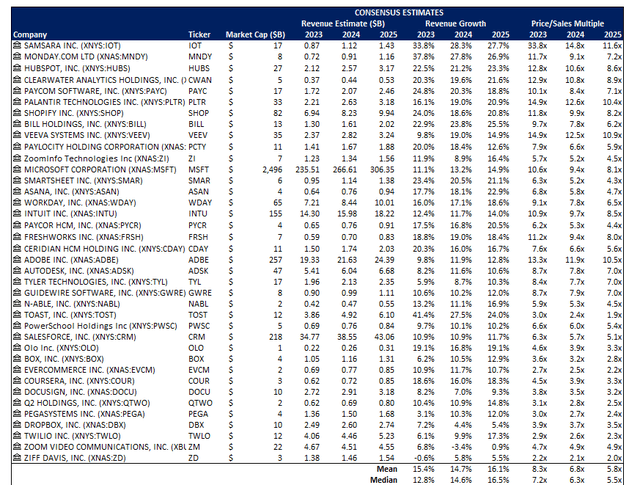

Our base case price target of $64 for the stock considers both Shopify’s valuation multiple curve (dotted red line) relative to the broader SaaS peer group (dotted blue line), as well as its growth prospects relative to the peer group average.

Data from Seeking Alpha

Data from Seeking Alpha

Data from Seeking Alpha

Author

Data from Seeking Alpha

Author

Author

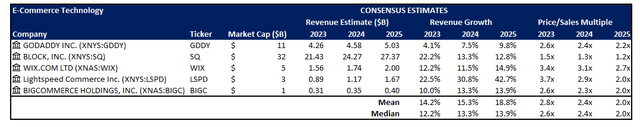

We believe market currently values the stock in line with higher-growth and higher-margin SaaS names in the double-digit multiple range, instead of the e-commerce technologies peer group that trades at the single-digit multiple range due to their lower growth and profitability profile.

Data from Seeking Alpha

This is in line with Shopify’s valuation re-rating lower last year due to its untimely venture into the capital-intensive fulfilment and logistics business amid a deteriorating economy and tightening financial conditions, which has since recovered to the double-digit multiple range after letting go of Deliverr.

Risks to Consider

As mentioned in the earlier section, Shopify’s fundamental prospects are inherently sensitive to persistent macroeconomic uncertainties, given its significant exposure to the retail segment. And the second half of 2023 is not without its headwinds, despite improving inflation and signs of a softening labour market pointing to a potential economic “soft landing”.

- Resuming student loan repayment: Recent research shows that student loan repayments resuming in October could potentially diminish monthly disposable income by as much as $9 billion on a monthly basis, or $100 billion on an annualized basis. This represents about 8% of average monthly non-store retailer spending (i.e. e-commerce spending) over the last seven months, which is a material sum, enough to raise concerns over the impending impact on Shopify. To better put into perspective, Shopify GMV totaled $55 billion in the second quarter. This represented 16% of U.S. Q2 e-commerce sales (or 13% based on $44 billion online GMV), highlighting its significant exposure to retail industry impacts. Meanwhile, more than half of student loan borrowers have expressed a need to “choose between making their loan payment or covering necessities, like rent and groceries” when the pandemic-era moratorium ends, highlighting incremental risks to impending back-to-school and year-end seasonality tailwinds.

- Rising gasoline prices: Energy costs have increased over the summer due to the tightening physical market, as observed through decreasing stockpiles that have been exacerbated by a supply cut from leading producers in OPEC+. This risks reversing the recent progress seen in taming inflation, with markets now forecasting a 0.6% m/m increase in August CPI – the biggest monthly jump since June 2022 when inflation peaked. Consumers will likely continue to feel the pinch of inflation on their wallets, reducing budgets for discretionary spending which accounts for the bulk of e-commerce purchases facilitated by Shopify’s merchants.

- Rising loan delinquency: Credit card delinquencies are gradually surpassing pre-pandemic levels at more than 7% during the second quarter. This highlights rising pressure on consumer savings and spending power, despite improving inflationary headwinds. In addition to impact on spending, rising loan delinquencies could also impact the extent of which Shopify can monetize from its Capital offering to merchants. Shopify Capital had been a key growth area for the business this year.

- Higher for longer rates: With the Fed fixed on taming inflation, risks of a rebound in prices and still largely resilient labour market could potentially cause policymakers to keep rates “higher for longer”. This is in line with elevated Treasury yields in recent months, which bodes unfavourably for the valuation of growth companies like Shopify given the discounted appeal of their future cash flows.

Taken together, the impending risk factors could impact both of Shopify’s fundamental and valuation performance. However, we view second half seasonality as a potential compensatory factor the macro headwinds facing Shopify’s fundamental prospects. The company also exhibits idiosyncratic tailwinds given its new revenue opportunities bolstered through product innovation, improving operating leverage, as well as increasing merchant stickiness.

We also believe increasing take-rates on the Plus plan and POS could potentially drive Shopify to better capitalize on resilient online spending. U.S. non-store spending has grown at a 1% average rate in the first seven months of 2023, while broader U.S. retail sales have expanded by 0.47% per month on average over the same period. This continues to underscore merchants’ increasing urgency in shifting to a hybrid business model to better optimize operating costs and exposure to consumer demand in an uncertain economy, which could be an incremental tailwind to Shopify’s strengthening moat.

Final Thoughts

The combination of durable operating leverage, expanding TAM, and increasing ecosystem stickiness is expected to further strengthen Shopify’s moat in the long-run. Despite the recent decision to divest from its capital-intensive logistics business, integration of related services to its ecosystem through third-party partnerships is expected to bring the same value proposition to customers without compromising on Shopify’s fundamental performance. This is further corroborated by Shopify’s resilient growth amid a challenging consumer spending environment, highlighting its idiosyncratic strengths. Taken together, we expect the stock to remain a long-term gainer from current levels

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here