Investment Thesis

Fiserv, Inc. (NYSE:FI) is a fintech business providing tools and services that empower businesses to operate in the financial landscape. Its prospects are not the most exciting, with around 8% to 10% CAGR expected going forward into 2024.

But what it lacks in terms of top line excitement it makes up for with the fact that looking out to 2024, I believe that Fiserv is going to print around $4.5 billion in free cash flow. This puts this stock priced at 16x next year’s free cash flow, a multiple that is low and alluring enough to make up for its lack of growth excitement.

But this investment thesis has one blemish. Fiserv carries a significant amount of debt. However, nonetheless, I am bullish on this stock.

Fiserv’s Near-Term Prospects

Fiserv is a global provider of payments and financial services technology solutions.

They cater to a diverse clientele that includes merchants, banks, credit unions, and other financial institutions worldwide. Fiserv’s value proposition lies in account processing, digital banking solutions, card issuer processing, and network services. They also operate in areas like payments, e-commerce, merchant acquiring, and the development of the Clover cloud-based point-of-sale and business management platform.

Fiserv has a broad range of products and services in the financial and payment technology ecosystem. Their diverse range of solutions, including the Acceptance segment for merchant solutions, Fintech segment for financial institutions, and Payments segment for digital payment processing.

Fiserv’s distribution channels, including direct sales teams and alliances with financial institutions, allow them to cater to clients in growing their businesses.

To get a further understanding of Fiserv’s different businesses, allow me to elaborate.

Fiserv’s Merchant Acceptance focuses on services related to merchants and businesses that accept payments, both physical and digital. It includes solutions for point-of-sale systems and payment processing. This vertical includes Clover, a SaaS operating system for small and medium-sized businesses helping businesses manage their payments and operations.

Its smallest business is its Fintech business, servicing technology solutions to financial institutions, including banks and credit unions, as well as account processing clients. This operation is embedded in finance, where businesses outside the traditional financial sector integrate banking and payment services into their offerings.

And its last business unit is its Payments and Network. This operation focuses on various payment-related services and networks, including debit networks like STAR and Accel and services like Zelle.

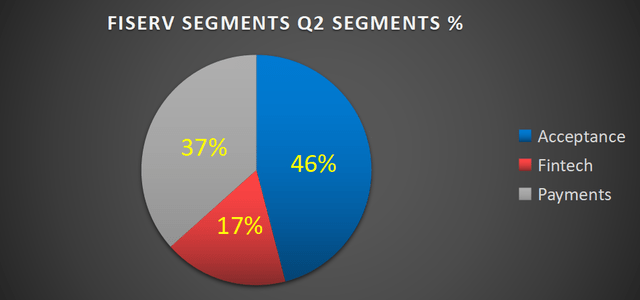

For clarity, we see this graphically displayed.

FI segments, approximate figures, not including adjustments

As you can see above, its biggest segment is its Acceptance segment, responsible for payment processing.

Revenue Growth Rates Have Matured

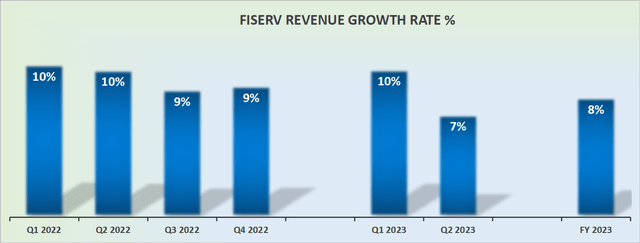

FI revenue growth rates

Fiserv has recently sold some businesses which have impacted its total revenue growth rate figures. However, Fiserv reminded investors during the call that this business has posted nine consecutive double-digit revenue growth rate quarters.

In other words, this is one of those businesses that has for the most part matured, with the advantage of having matured being that it is able to turn its focus away from any eagerness to grow market shares, cut back on excess operational spend, and truly focus on growing its free cash flows. With that framework, let’s now turn to discuss its free cash flows.

FI Stock Valuation — Priced at 19x Free Cash Flow

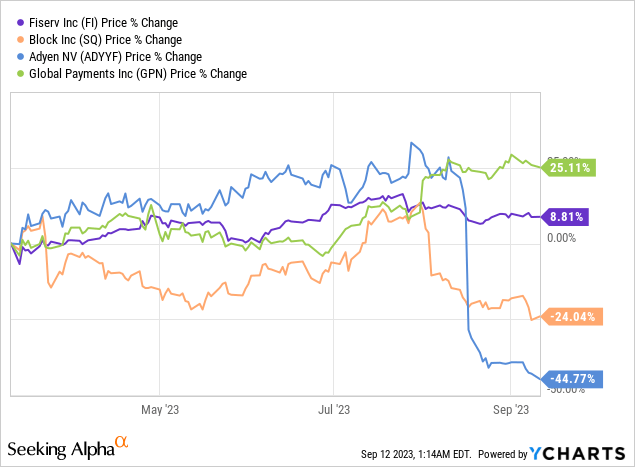

The payments and fintech sector has been through a turbulent time in 2023 and hasn’t participated as much as other areas of the market, particularly sectors with exposure to AI.

The theme that has concerned investors is whether, with so much competition, these businesses can remain as profitable as they aspire to be.

For my part, I believe that Fiserv in 2023 has demonstrated that its highly distributed operations have allowed it to remain stable even as many of its peers have reported lackluster results.

Fiserv is priced at 19x this year’s free cash flow. I don’t believe this is a rich valuation. What’s more, looking out to 2024, it’s likely that this multiple could fall closer to 16x forward free cash flow.

On the other hand, Fiserv carries a significant amount of debt that will get in the way of allowing Fiserv to continue returning capital to shareholders via buybacks at a pace in line with the $2.5 billion Fiserv returned to shareholders in H1 2023.

On yet the third hand, Fiserv recently refinanced its European notes at 4.5% rates. This means that creditors appear more than eager to accept Fiserv’s paper.

The Bottom Line

I have a bullish outlook on Fiserv, Inc. While its growth prospects may not be the most exhilarating, with an expected 8% to 10% CAGR into 2024, the real gem lies in its potential to generate approximately $4.5 billion in free cash flow by 2024. This positions the stock at an enticing 16x next year’s free cash flow, a valuation I find quite attractive despite its moderate growth.

Fiserv operates globally, offering a diverse range of financial and payment technology solutions, serving merchants, banks, credit unions, and financial institutions. Its broad product portfolio, including the Merchant Acceptance, Fintech, and Payments segments, allows it to cater to a wide range of clients and grow its businesses. Though Fiserv, Inc. carries significant debt, I see its potential for cash flow generation as a strong reason to be bullish on FI stock.

Read the full article here