It is finally time to upgrade DocuSign, Inc. (NASDAQ:DOCU) to a buy. The e-signature company has seen some stabilization in growth rates, though management continues to warn that there may be further pressure on account of the tough macro environment. Nonetheless, after a period of significant underperformance, DOCU is trading at compelling valuations that can work out even if growth continues to decelerate. The company has a net cash balance sheet and is aggressively repurchasing stock.

DOCU might not be the same growth story it once was, but it doesn’t have to be – DOCU is a deep value opportunity in the tech sector. I rate the stock a buy on account of the valuation but note the looming risk from its greatest competitor.

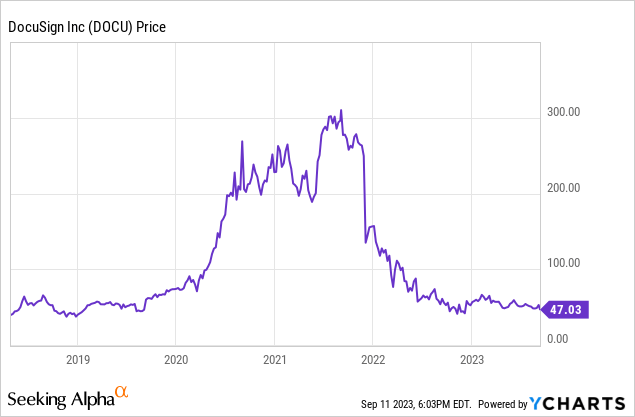

DOCU Stock Price

Even after a big rally in the tech sector, DOCU still trades over 80% lower than all-time highs. I don’t see the stock getting anywhere close to that target any time soon, but the beat down is enough.

I last covered DOCU in March where I explained why I was downgrading the stock from buy to hold due to the breakdown in the growth story. There remains some issues with the growth thesis here, but after underperforming the broader market by 25%, the valuation has become more compelling.

DOCU Stock Key Metrics

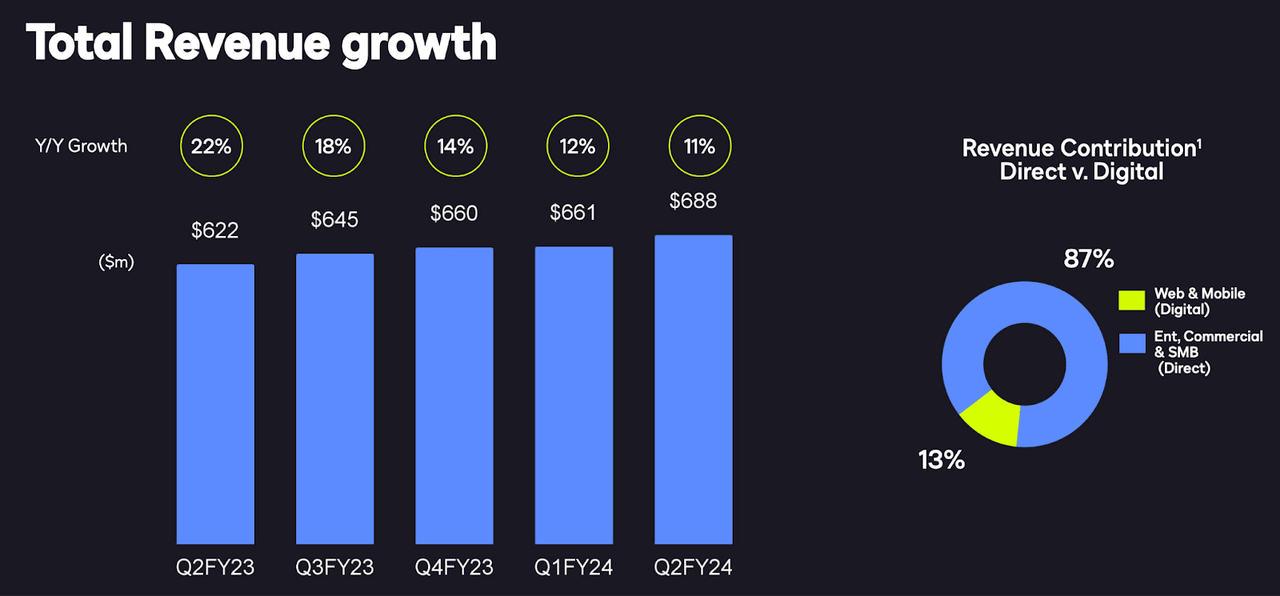

In its most recent quarter, DOCU delivered a surprise revenue beat, with revenues growing 11% YoY to $688 million, ahead of guidance for $679 in revenue.

FY24 Q2 Presentation

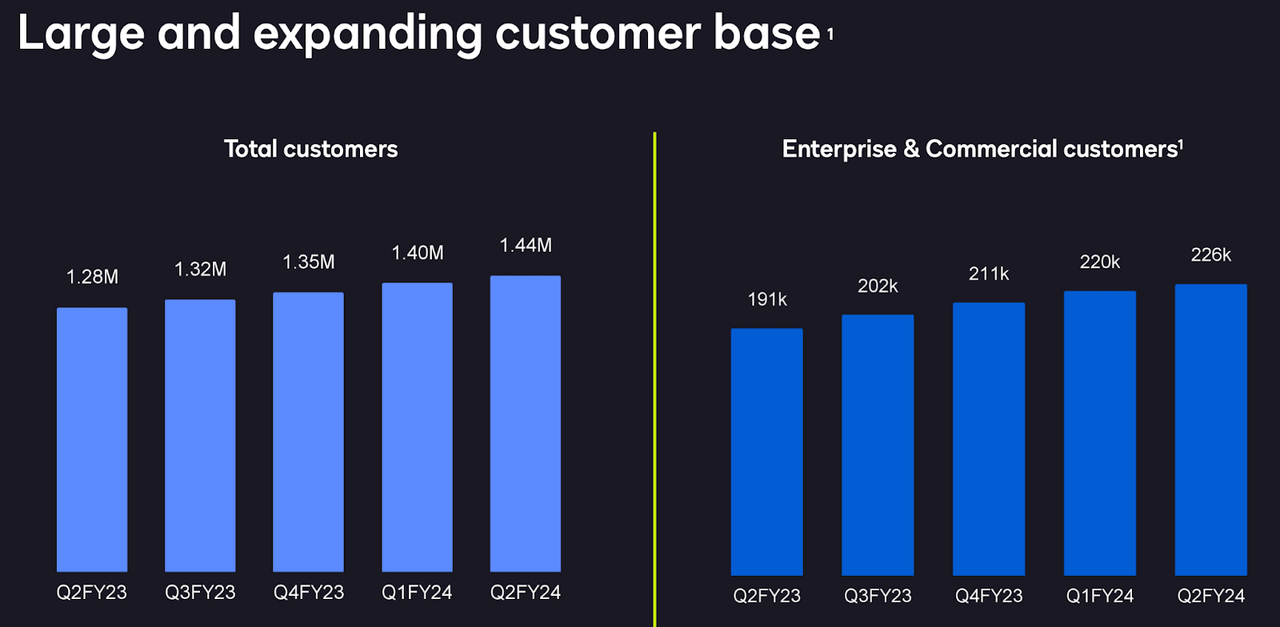

International revenue was even faster at 17% YoY growth and represented 26% of total revenue. This tough macro environment has seen tech companies across the board see difficulty in adding new customers. DOCU has been able to sustain some customer growth nonetheless.

FY24 Q2 Presentation

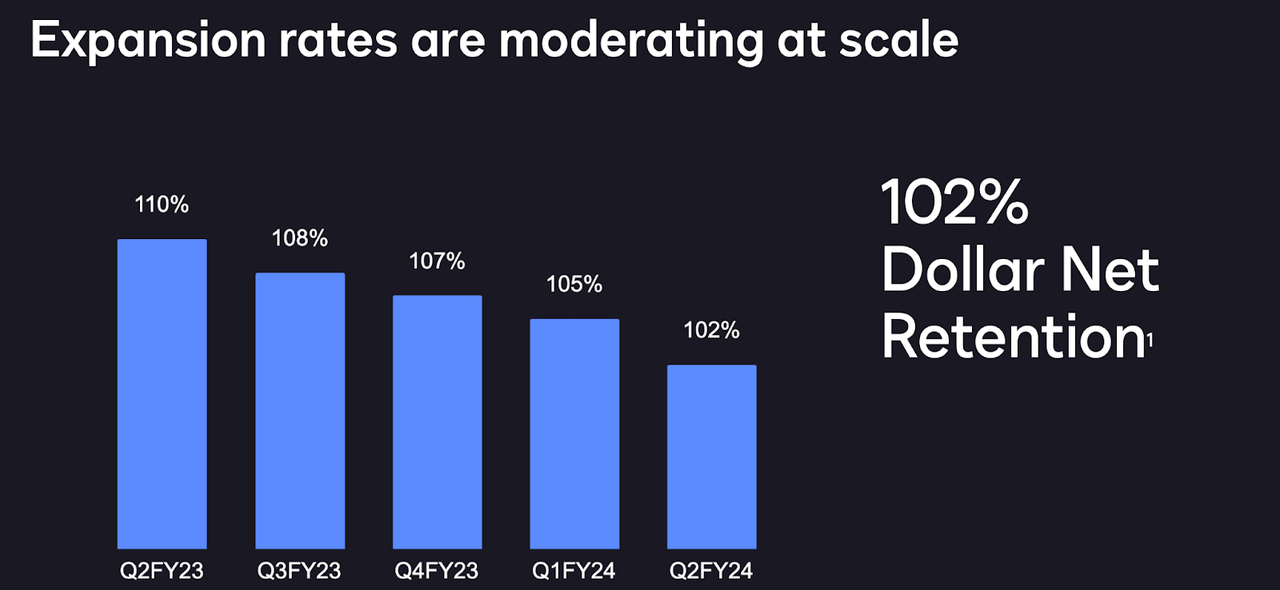

E-signatures have turned out to be more cyclical than expected, as DOCU has seen its dollar net retention rate continue to compress, hovering at 102% in this past quarter. Similar to the “cloud optimization” reported by other cloud companies, DOCU has seen customers show greater scrutiny in usage of the product.

FY24 Q2 Presentation

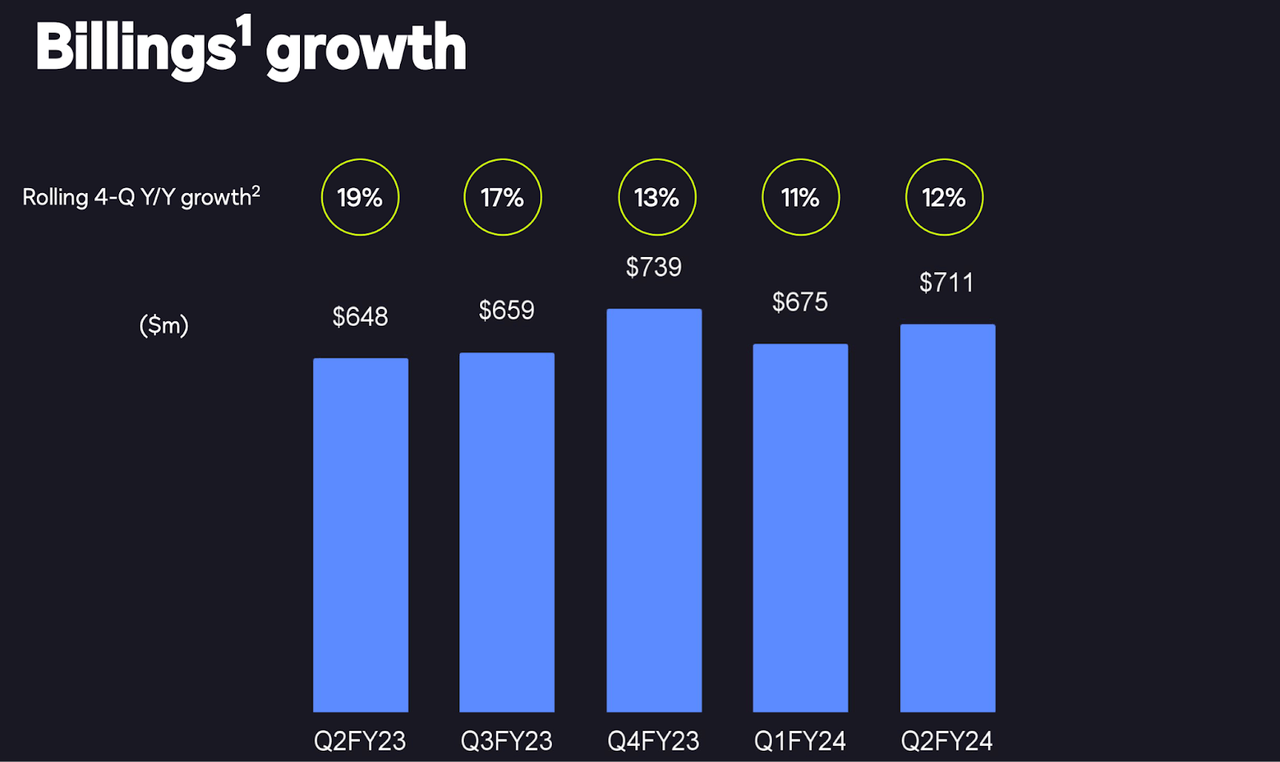

It was promising to see billings growth rise sequentially to 12%, marking an end to the incessant bleeding.

FY24 Q2 Presentation

That may spur some optimism that the worst is behind us, but on the conference call management stated that the billings’ strength was primarily due to a greater amount of “on time renewals,” while reiterating that the near term outlook remains challenged.

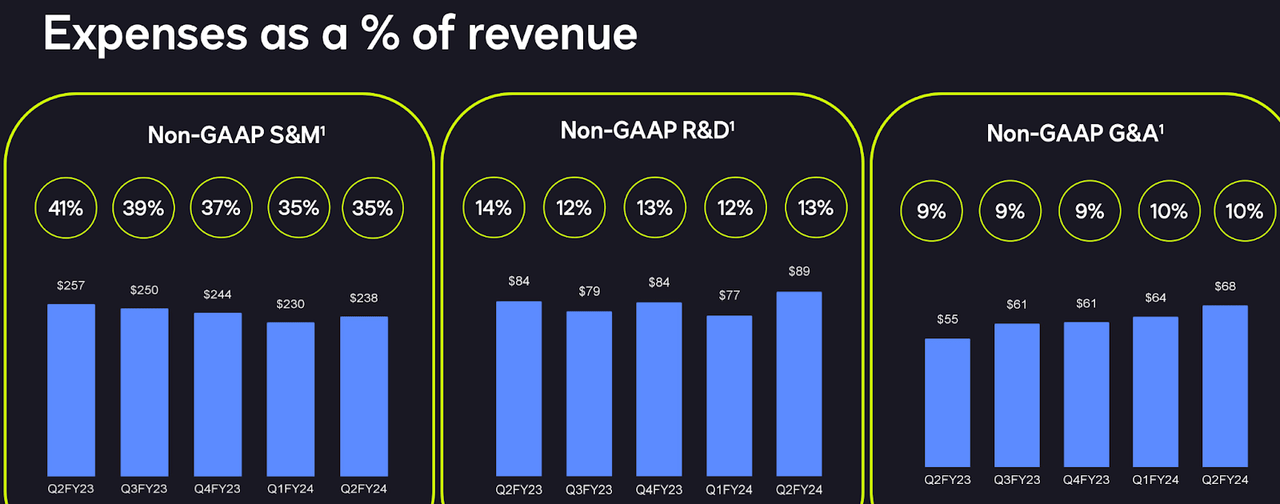

Like many tech peers, DOCU has sought to offset decelerating top-line growth with expanding bottom-line margins. DOCU showed solid operating leverage, especially in sales and marketing.

FY24 Q2 Presentation

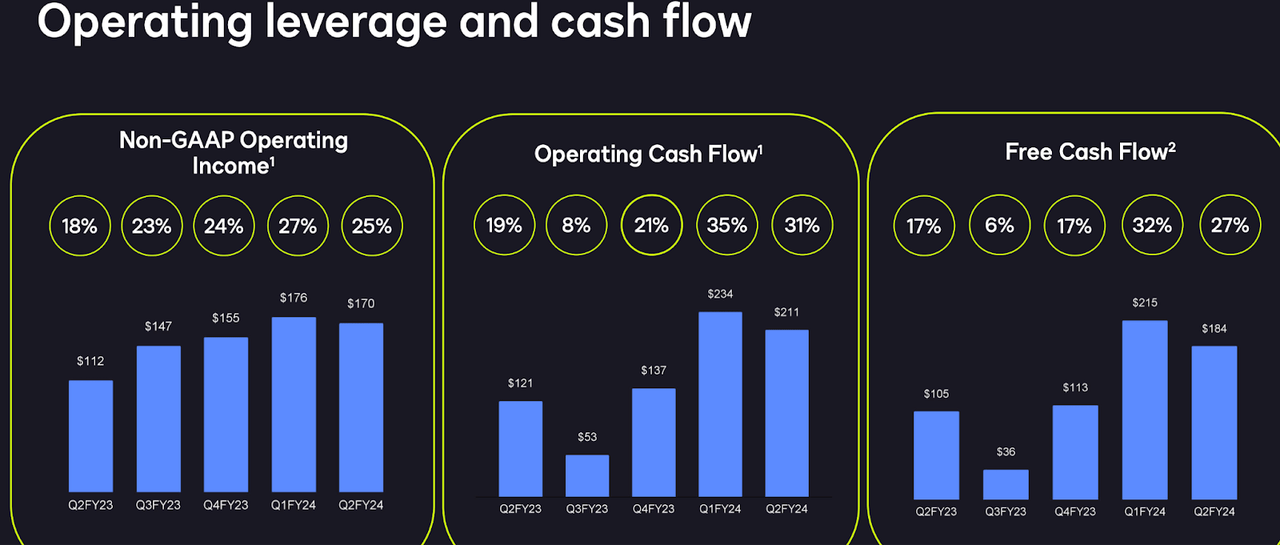

DOCU was able to show impressive margin expansion, with non-GAAP operating margins expanding 700 bps. DOCU generated a 27% free cash flow margin, surpassing the operating margin due to pre-paid revenues.

FY24 Q2 Presentation

DOCU ended the quarter with $1.5 billion in cash versus $725 million in debt (convertible notes). The company repurchased $30 million worth of stock in the quarter, while also increasing its share repurchase authorization by $300 million to a total aggregate amount of $500 million. I expect the company to take on net debt over the long term, and the cheap stock offers an easy target for the excess capital.

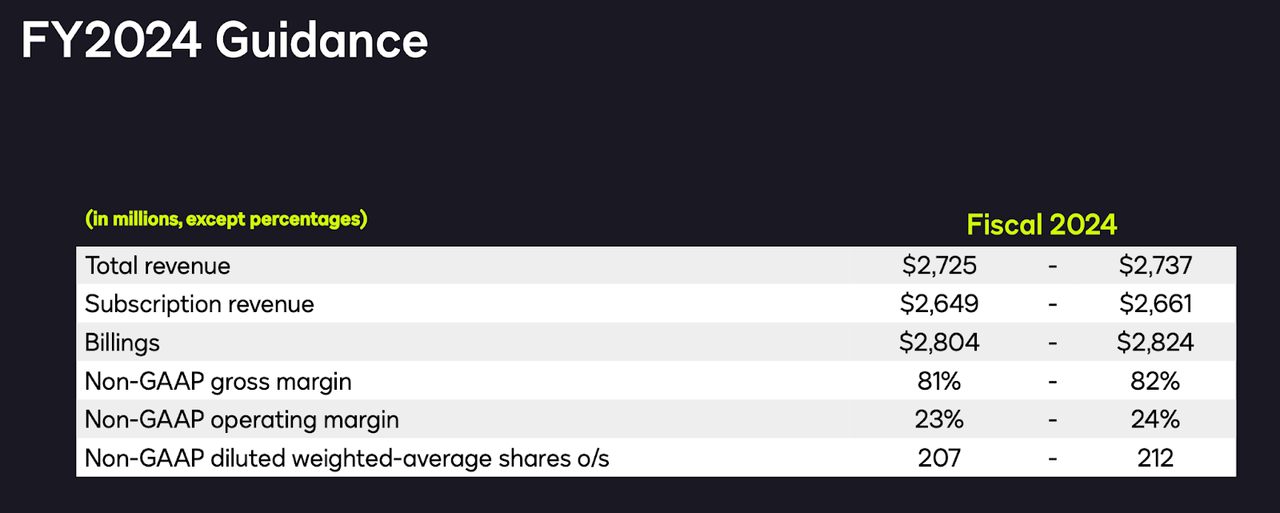

Looking ahead, management expects the third quarter to see up to 7% YoY revenue growth to $691 million, with the non-GAAP operating margin dipping sequentially to 23%. Management raised full-year guidance to $2.737 billion (up from $2.725 billion), but that implies just 5.6% YoY growth in the fourth quarter.

FY24 Q2 Presentation

Management outlined plans to add a wallet feature that “will enable frequent users to save their profile, driving improved efficiency and convenience.” That functionality and value proposition sounds similar to the checkout feature of PayPal (PYPL), though I suspect that users may find it less relevant. Signing your name seems less of a hassle than entering your billing information, and I’d think that users would typically want to read through contracts anyway.

Management expects the dollar net retention rate to continue trending downwards in the third quarter, which seems to imply a negative net dollar retention rate at some point in the near future, if we have not already reached such a point. Management continues to expect a re-acceleration in growth rates at some point, perhaps due to an improving macro outlook, but notes that they still “have work to do ahead” of any such progress.

Is DOCU Stock A Buy, Sell, or Hold?

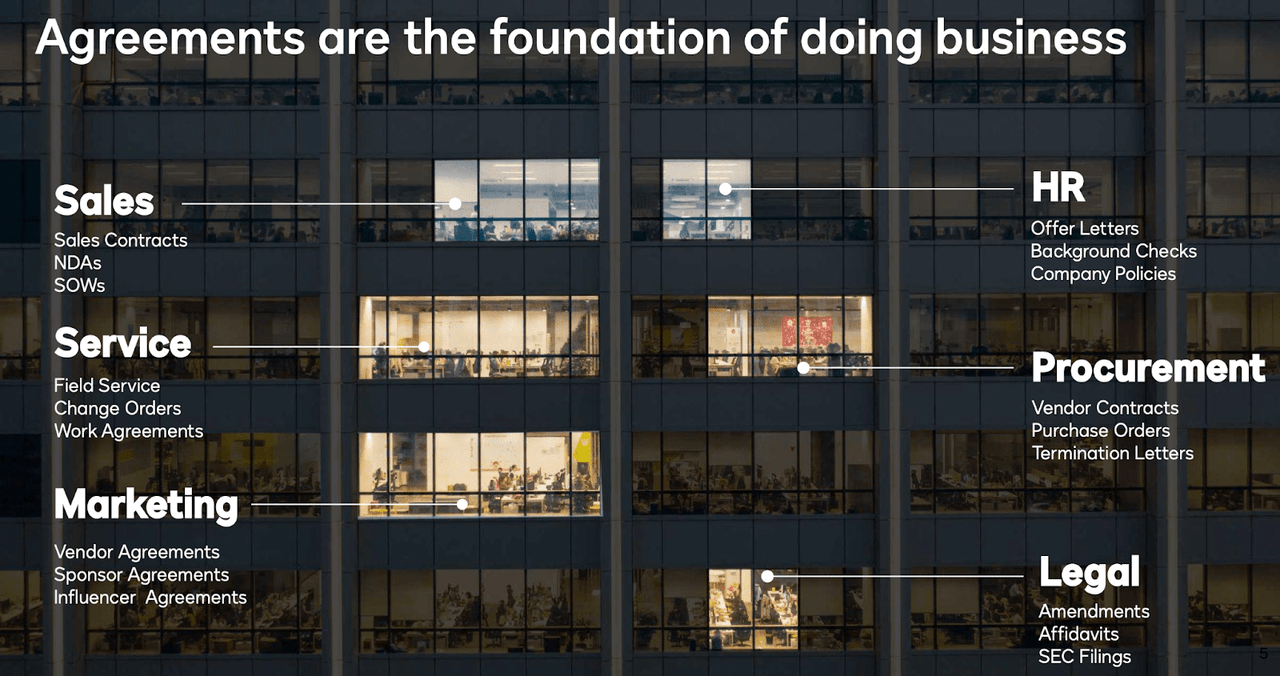

DOCU is helping to advance the digital age by bringing agreements away from paper handling toward e-signature processing. Agreements go far beyond lease contracts and form the foundation of doing business.

FY24 Q2 Presentation

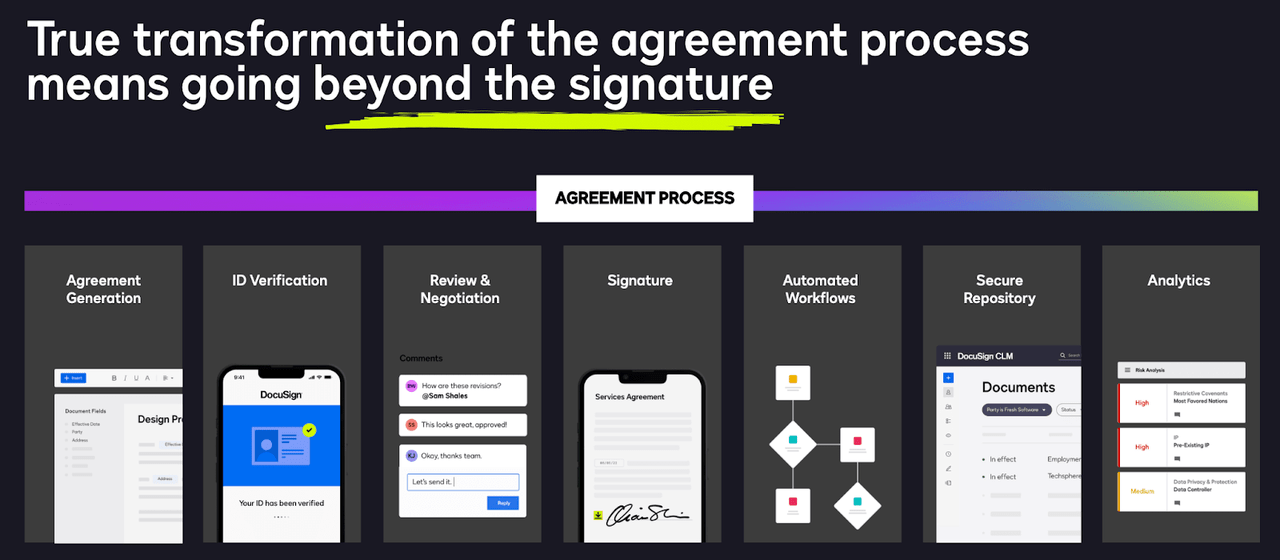

DOCU offers an end-to-end platform to manage the entire e-signature process.

FY24 Q2 Presentation

I’d go as far as saying that DocuSign has almost become a verb, but that clearly hasn’t helped prevent growth from decelerating as it has.

While the growth story appears pressured, the stock is trading cheaply, recently trading hands at under 4x sales.

Seeking Alpha

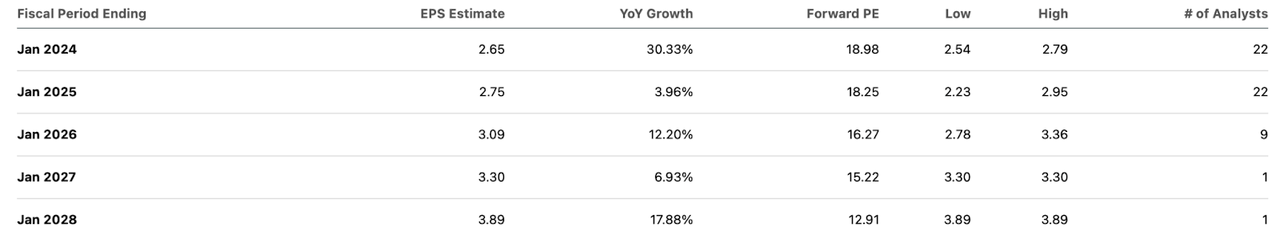

On a non-GAAP basis, the stock is trading at under 20x earnings and operating leverage is expected to help earnings grow solidly over the coming years.

Seeking Alpha

Based on 30% long term net margins, DOCU is trading at an implied valuation of around 12.3x long term earnings. I’d argue that such a valuation is too cheap given that the company can likely sustain at least mid-single-digit revenue growth over the next decade, and still maintains a net cash balance sheet. I can see the stock trading up to around 15x earnings, implying over 20% potential upside.

What are the key risks? Competition, especially from Adobe (ADBE) is arguably the biggest risk. ADBE has been a serious competitor in the e-signature space, seeking to add e-signature functionality to its already popular PDF document product offering. This creates the possibility that even if the macro picture improves, DOCU may still see struggling top-line growth due to the strong competitor in ADBE (among others). I believe that this market is big enough to support the growth ambitions of both companies, and note that these two stocks trade at opposite ends of the valuation spectrum. Another risk on a similar note is that e-signatures may be viewed as a commoditized market. That is clearly being reflected in the stock valuation, but may negatively impact the company’s growth rate and unit-level margins moving forward. Finally, it is unclear how generative AI may impact the company. Will it enable it to bolster its product offerings? Or will it help to empower the competition?

DocuSign, Inc. isn’t a slam dunk, but the valuation is cheap enough to warrant an upgrade. I rate the stock a buy due to the low valuation, net cash balance sheet, and aggressive share repurchase program.

Read the full article here