Main Thesis & Background

The purpose of this article is to evaluate the state of the global marketplace, with a focus on why the US has been out-performing and drawing investor interest from around the globe. This is a central theme for why I keep a US-dominate positioning in my equity portfolio over time and why I see that as the right move going forward. There is always merit to diversifying, of course, and I do hold some non-US exposure, but as this review will cover, global investors are continuing to pile in to US-related equities and bonds at the expense of foreign holdings.

In this review I will examine why the US has had such a great year (in terms of market performance) and why global investors continue to put their funds state-side with growing enthusiasm. While we have plenty of problems to contend with at home, this is not unique to America. Many problems are global problems and it seems investors are willing to bet that the US is going to handle them in a relatively better way than other corners of the world. I will take readers through how the market has been adapting to this reality, and what it might mean for portfolio positioning as we approach the all-important fourth quarter.

Foreign Investors Are Rotating Out Of Their Own Countries

One of the key themes in the second half of the year so far has been a shift to US equities by non-US investors. This has been due to a number of reasons. One, the US has been able to avoid a recession thus far. Two, the labor market has been extremely resilient. Three, US corporates are registering relatively strong earnings at a time when firms from many other countries – especially in Europe and emerging markets – are starting to struggle.

All of these factors are keeping investors confident that the US is the place to be – and will be for a while. No place is this more evident than China. It seems like not a day goes by when we don’t get a headline warning of the precarious economic state of affairs there. Whether it is debt issues, government intervention, or geo-political concerns, China appears fraught with risk.

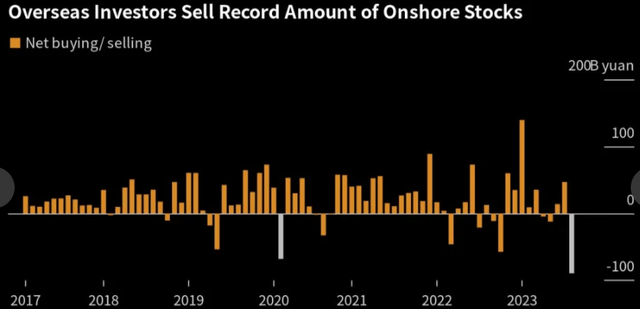

Importantly, this is a view shared by many Chinese investors. In the short-term, there has been a wave of selling (after months of net buying) of Chinese equities by Chinese shareholders:

Foreign (Non-US) Selling of Chinese Shares (Bloomberg)

This begs the question – where is this new found cash going? In many cases, it is finding its way to US markets.

Of course, this is just one example, but it amplifies the point I am making in this article. Non-US investment dollars are starting to find their way to US markets at an accelerating pace. While this may have contrarian thinkers concerned, it is hard to argue with this trend for the time being. This looks like a momentum play to me – and one readers should probably be taking advantage of.

**The majority of my portfolio is long large-cap US stocks. I achieve this through a passive approach in a number of funds, some with a dividend focus. I would recommend the complete list of my holdings in this respect: Vanguard S&P 500 ETF (VOO), Invesco QQQ (QQQ), SPDR Dow Jones Industrial Average ETF Trust (DIA), Invesco S&P 500 Equal Weight ETF (RSP), iShares Core Dividend Growth ETF (DGRO), Schwab U.S. Dividend Equity ETF (SCHD), SPDR S&P Dividend ETF (SDY).

Debt Management Not An Immediate Concern

My next topic may be more relevant for debt markets, but it impacts equity valuations all the same. This has to do with debt management – how proactive companies are in managing their debt loads and how able they are to handle the “higher for longer rate environment.” This is critical because, as interest rates have risen, this means interest expenses are also rising. That can mean less capital to invest back in the business, lower levels of profits, and/or a more clouded outlook for shareholders. But, as with everything, higher interest rates do not exist in a vacuum. They have to be taken in to account against a host of other factors.

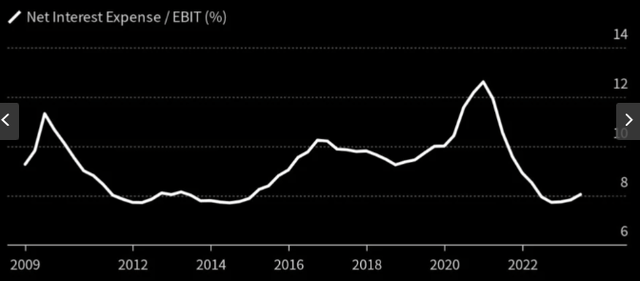

The good news is these other factors suggest corporate America is actually in a pretty good place despite higher borrowing costs. When we look at large-cap US companies, interest expenses are actually near their lowest levels in over a decade. This suggests there is plenty of “wiggle room” for corporations to handle their current and upcoming interest payments:

Earnings to Cover Debt Expense (Corporate America) (Yahoo Finance)

What this suggests is that corporations have prepared for higher rates by both raising prices (and therefore profits) and by locking in longer term debt at lower levels. Those are two explanations for why interest expenses have only risen modestly, on average, while interest rates have shot markedly higher.

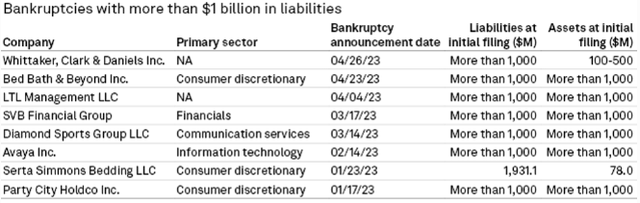

I would manage expectations here by saying this is an average figures. Investors need to be well aware that some companies are struggling with debt burdens and that will continue to be the case. Bankruptcies have been on the rise in 2022 and 2023, especially among junk-rated issuers. Here is a list of some of the biggest names to fall victim to this trend year-to-date:

Largest Bankruptcies (By Dollar Amount) in 2023 (S&P Global)

The conclusion I would draw here is we still need to be selective in how we approach both debt markets and equity markets. Despite positive averages in profits and debt figures, there are a lot of trouble spots out there. So when you are picking stocks, individual debt issues, or even the funds that hold them, be sure you aren’t holding a time bomb. Critically analyze the holdings in each fund or any individual ticker you are interested in.

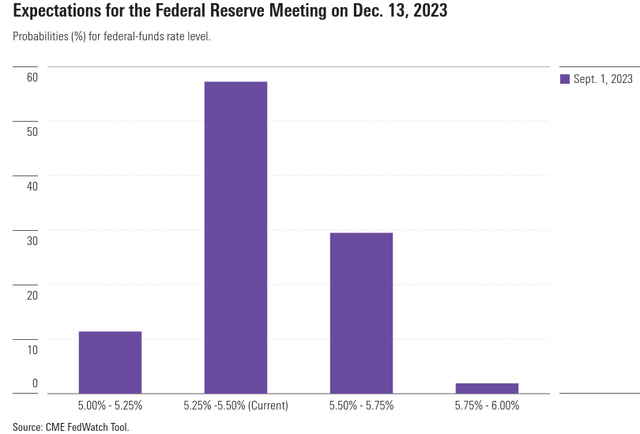

This is generally good advice for any climate, but rates are likely to remain elevated for the rest of the year. So it is not a problem that is going to go away for any company that is skating on thin ice. If they are struggling now, they will continue to struggle for the remainder of the year based on interest rate forecasts at present:

CME FedWatch Tool (CME Group)

The reality is that higher rates have not rattled equity markets like some feared. While bond markets have been hit pretty hard over the past 18 months, higher rates are starting to make new positions look quite attractive on a risk adjusted basis. As long as I avoid the riskiest corners of the market, I think the above discussion highlights that American corporates are quite resilient on the earnings and expenses front.

**I have debt exposure through a number of individual muni issues, the BlackRock Floating Rate Income Trust Fund (BGT), and the PIMCO Dynamic Income Opportunities Fund (PDO).

The Labor Market Shines

Moving the discussion to the labor backdrop, we arrive at another reason why investors – global and domestic – continue to be confident in US markets. While there have been plenty of layoff headlines and the unemployment rate actually ticked up in August, if we look past some of that noise we see a generally strong underlying environment.

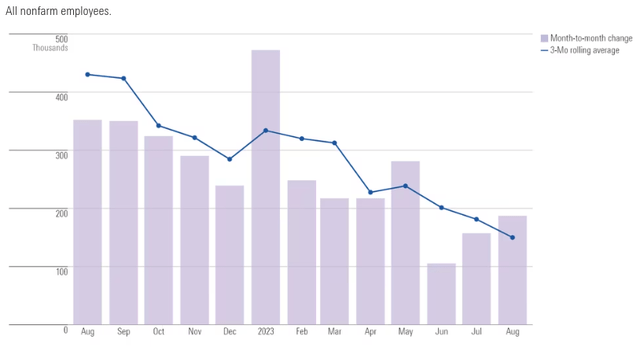

The reason is that unemployment ticked higher because the labor force is expanding. That is a great sign and is helping to even out the prior mismatch between job openings and job seekers, which had previously been at extremely high levels. The fact is that over the past year, the US has added jobs every single month. This particular supports consumer-oriented sectors and other cyclical areas that are reliant on spending:

Monthly Payroll Change (US) (Bureau of Labor Statistics)

The outcome from this is the US economy remains on relatively solid footing. When people have jobs, they have money to spend and are confident enough to do so. It really is that simple. This has helped to buffer the impact of higher borrowing costs on the American consumer and is a central reason for why there has been an avoidance of a recession so far this year.

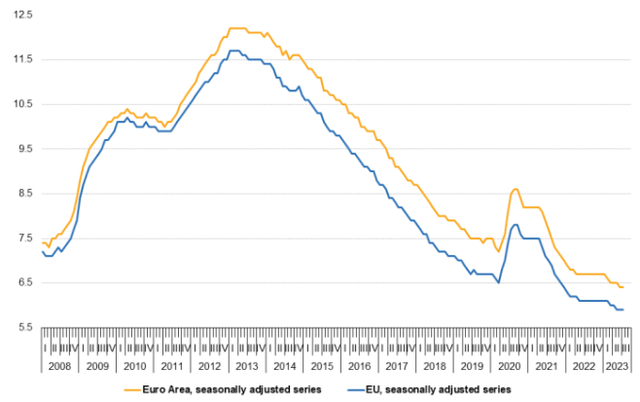

I would imagine investors around the world are looking at this and using it for support on why they may be rotating out of home assets and in to US corporates. I say this because despite US unemployment moving up to 3.8% in August, this still easily bests other developed areas like the EU-zone:

EU-Zone Unemployment Rates (Eurostat)

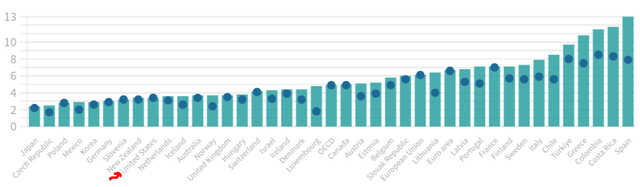

The relative story here is what I am trying to get across. The US labor force is strong on the surface but also in comparison to comparable economic zones. While the US doesn’t have the “lowest” unemployment among all OECD nations, it stands above most of the pack – especially of economies and trading blocs of similar size:

Unemployment Rates By Country (Blue Dot Represents 20-Year Low) (OECD)

Again, while not the only metric to consider by any means, it is a supporting one for US-based investment. I take this as a reason to remain confident (and therefore long) my US-based positions going forward.

The US Winning The Inflation Game By Comparison

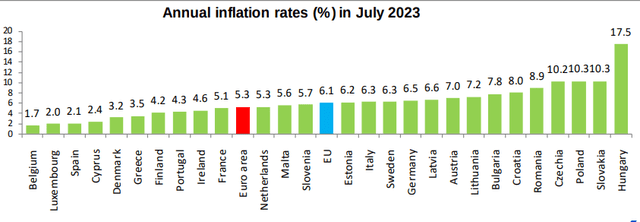

Another key metric to evaluate when considering buying US stocks or other developed nation’s stocks is inflation. This has been the thorn in the side of most stock markets – both equities and bonds – for the better part of a year. Fortunately, in the US this issues has turned on its head a bit, with inflation starting to slow and the outlook for a Fed “pause” becoming closer to a reality.

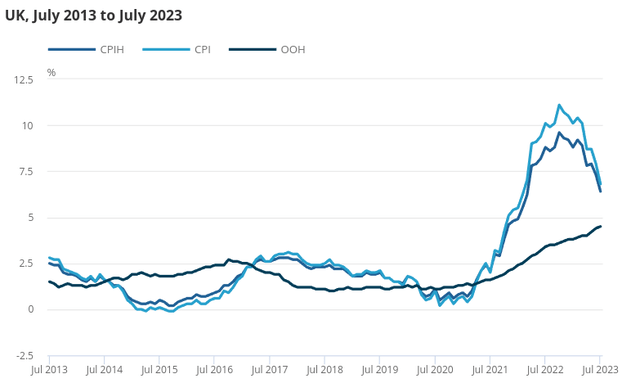

This matters to global investors because inflation, when it is too high, can pressure the forward outlook for equities (and therefore valuations) and also decimate the underlying value of fixed-income bonds. The fortunate case is that the US is bucking the global trend here is as well. Similar to employment numbers, America has seen inflation decline at a quicker pace compared to its UK and European counterparts:

EU Inflation (Eurostate) UK Inflation Figures (Office for National Statistics (UK))

The good news is these areas are seeing inflation states come down (on average). But the broader conclusion is US inflation has come down faster and that, in isolation, also makes the US look more attractive from an investment perspective.

Opportunities Beyond Equities

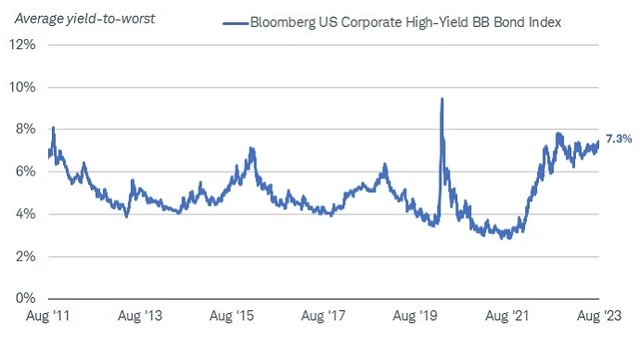

Expanding on the inflation discussion above, a key area I would consider as a result of this is the high-yield bond arena. This is a spot that should be approached with care. It has elevated risks and is not appropriate for everyone. In my view it requires more selectivity and active management – so carefully consider if this is something you want in your portfolio. If the answer is yes, however, then it is clear to me there is opportunity at these levels based on current income streams:

BB-rated Bonds – Current Yield (Average) (Charles Schwab)

On a historical basis it is clear that bonds rated just below investment grade are offering an attractive level of income. While higher yields weren’t necessarily a winning play over the past year as inflation was eating away at the overall return, that dynamic has shifted a bit. With inflation coming down, but non-IG rated debt still offering a high absolute yield, this looks attractive.

**Readers could capitalize on this through buying individual issues from BB-rated companies and/or finding funds that are long this particular debt. Popular ETFs that I would consider now are ones such as the SPDR Bloomberg High Yield Bond ETF (JNK). I would continue to approach leveraged CEFs cautiously (with the exception of floating rate CEFs) because the inverted yield curve remains a substantial headwind.

How Would The Bears Counter?

Through this article I have discussed some favorables aspects of the US markets and why they may be preferable to non-US alternatives. I stand by this assessment and will remain US-heavy going forward for the foreseeable future.

However, that does not mean this is an automatic “buy” assessment. Readers should carefully weigh their own portfolio allocations to see if taking on additional risk via US stocks or bonds makes sense here. This would be dependent on how much exposure one has already, cash levels, and if their overall outlook is similar to mine (being bullish). Further, there are concerns about the risk-reward proposition at this juncture. It is not secret that US markets have had a great 2023 and that could give some pause on whether or not continuing to buy or hold makes sense at the moment.

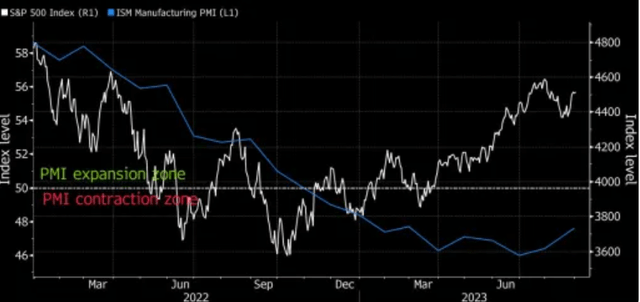

For some bearish supporting data, we don’t have to look too far. For example, the stock market is getting increasingly disconnected from economic realities. True, the economy has proved more resilient this year than many expected when the year began. So that justifies a good portion of the move. But we should also realize that beating weak expectations is not the same as beating strong expectations. What I mean is that economic metrics like the PMI may have been “better than expected” – but are they really good? The PMI has actually been in contraction territory for a while, yet the S&P 500 has marched higher on a consistent basis all the same:

S&P 500 Index Level vs PMI (Bloomberg)

This is just one aspect to consider but it is an important one. It shows that if economic conditions (both in the US and globally) don’t improve, valuations don’t have a lot of room to move higher. The FOMO and euphoric investment sentiment can linger in the face of weak economic data for a long time – but not forever. If we don’t see modest improvement in leading indicators like the PMI going forward, the risk to equities could be pronounced.

Bottom-Line

The US has proved its a mecca of resiliency for another year (so far) in 2023. This comes at a time when a rebound was very welcome after 2022’s dismal performance and as some nations (i.e. China) continue to see equity losses recently. The growing momentum of foreign investment in to the US is a sign that more gains could continue or, at the very least, that the US is set to out-perform.

There are inherent risks to buying in now to be fair. Markets are not cheap and the Fed seems committed to a “higher for longer” stance with respect to interest rates. This was proved to be a challenging reality, but large-cap US stocks appear ready to weather that storm. This tells me that while being an outright bull on a buying spree may not be the most advised path at this moment, holding on to long-only positions in US stocks and bonds has a lot of merits. I don’t see a need right now to sell-off positions to more outside our borders. The US has momentum, underlying corporate strength, and a split Congress that should limit government actions in the year ahead. All of these signs suggest the US is poised to keep on beating the rest of the world.

Read the full article here