Prudential plc (NYSE:PUK) has reported a strong financial performance recently and its strategic update confirms its good growth prospects over the next few years.

As I’ve covered in previous articles, Prudential is one of the insurance companies in Europe with better long-term growth prospects, due to its high exposure to Asia. Given that the company has recently updated its financial performance and provided a new strategy for the coming years, I think it’s now a good time to revisit its investment case to see if it remains an interesting growth play within the European insurance sector.

Business Overview

Prudential is a European insurance company based in the U.K., but after several years of business restructuring, its business is now only exposed to Asia and Africa. This gives it a unique profile compared to other European insurance companies, and much better growth prospects over the long term given that insurance is a mature industry in developed economies, but its penetration across emerging markets is much lower.

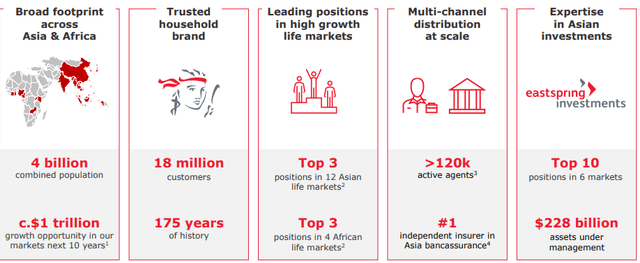

Its operations are nowadays focused on the Life and Pensions segments across high-growth markets, including China, Singapore, or Indonesia. These regions have a combined population of about four billion and insurance penetration is somewhat low, providing good growth prospects ahead. It currently has about 18 million customers, and top three positions across several markets, being in a good position to benefit from positive growth market tailwinds for many years.

Company profile (Prudential)

While the European insurance sector has relatively muted growth prospects over the long term, Prudential decided to shift its business to high-growth markets, being exposed to several secular growth trends, including aging population and the rise of the middle-class across Asia. This makes it quite unique among European insurance companies, thus its closest competitor right now can be considered to be AIA Group (OTCPK:AAGIY), which is an insurance company that is also highly exposed to Asian countries.

Strategy Update

Prudential has a very good growth history, as the company’s business was already significantly exposed to growth markets before its pivot to Asia, a trend that Prudential aims to maintain over the next few years. This should be relatively easy to achieve considering that Prudential is exposed to countries with higher economic growth prospects, favorable demographics, relatively low levels of insurance penetration, and a growing customer base.

Despite this positive background, Prudential’s operational performance has not been impressive in recent months, as the demerger process has been to some extent a distraction on its strategic priorities and failure to adapt its business to changing dynamics has led to market share losses in some markets.

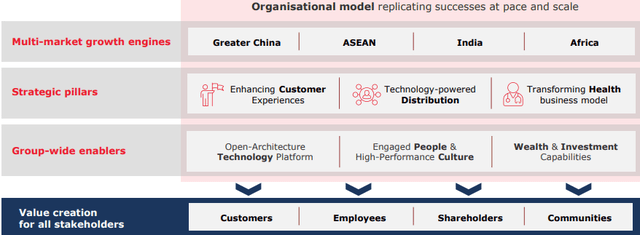

Acknowledging this situation, Prudential aims to improve its customer service in the coming years, also using technology and data to improve its service. It also wants to standardize processes to achieve economies of scale across the group, which should help to improve profitability over the long term.

Growth strategy (Prudential)

To measure its success, Prudential aims to improve Net Promotion Score (NPS), which measures a customer’s loyalty to a company, from mid-quartile presently to top quartile, and improve customer retention rate from 89% in 2022, to 90-95% by 2027. In its distribution channels, the company wants to improve agents’ productivity and increase customer penetration across its banking partners, which should be important growth sources over the coming years.

Regarding its main financial targets, Prudential is targeting new business profit annual growth of between 15-20% from 2022-27, and double-digit embedded value per share growth during the same period. This seems to be achievable considering the company’s positive growth track record and significant exposure to high-growth markets.

Recent Earnings

Regarding Prudential’s recent financial performance, the company has released a couple of weeks ago its first half 2023 results, which maintained a positive operating trend.

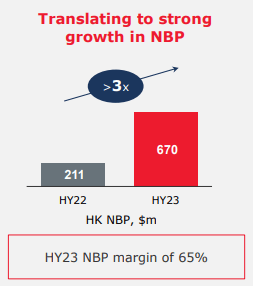

Its value of new business profit (NBP) amounted to $1.5 billion, an increase of 39% YoY, supported by strong results in the life segment and an increase of 3% in assets under management compared to the end of 2022 at its asset management unit. In Hong Kong, one of its most important markets, new business profit increased significantly to $670 million in H1 2023, due to new products and strong growth in active agents, being the main responsible for Prudential NBP’s growth.

HK growth (Prudential)

In Mainland China, while sales through agents increased in the first semester, in the banking channel the company decided to move its offering to higher quality long term pay products, which led to a decline of 40% in APE sales. This resulted in a decline of 16% in NBP during the semester, to some $171 million. Other markets performed better, with Prudential reporting double-digit NBP growth in Taiwan, Malaysia, India, and Indonesia, while on the other hand Singapore and Vietnam reported lower NBP due to different product mix and some economic headwinds.

Due to this strong operating performance, Prudential’s IFRS operating profit amounted to about $1.5 billion in H1 2023, an increase of 6% YoY. Going forward, the company is quite confident that it can achieve its growth targets, both through gaining new customers and higher engagement within its existing customer base, by leveraging its service capabilities.

Regarding its capitalization, Prudential is well capitalized given that its coverage ratio was 295% at the end of June, a decline of 7 percentage points compared to the end of 2022. This ratio is comfortably above the regulator’s requirement, which means that Prudential does not need to retain much profits in the coming years, leading to a strong surplus capital position.

As the company wants to have at least a coverage ratio of 150%, this means Prudential’s surplus capital is about $8 billion, which it can use to return capital to shareholders.

While most recently it has returned cash to shareholders through dividends, if the company is not able to pursue meaningful acquisitions over the medium to long term, it may decide to perform share buybacks given that it has plenty of room to operate with a lower coverage ratio.

This also means that its dividend is sustainable and well-supported by the company’s strong balance sheet, even though at its current share price it only yields about 1.75%, which is not particularly attractive considering other alternatives. Therefore, Prudential’s investment case is not geared to income, a profile that is not expected to change in the medium term, given that its target is to grow its annual dividend by 7-9% in 2023 and 2024.

Conclusion

Prudential has reported a positive operating performance in recent months, and its strategic update provided a sound message regarding the company’s growth prospects ahead. After being hit by COVID-related restrictions in Hong Kong and China during 2022, its business is now returning to normal, boding well for earnings growth in the coming quarters. Regarding its valuation, Prudential is trading at 1.8x book value, at a discount to its historical average of around 2.2x over the past five years; thus it remains an interesting growth play within the European insurance sector.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here